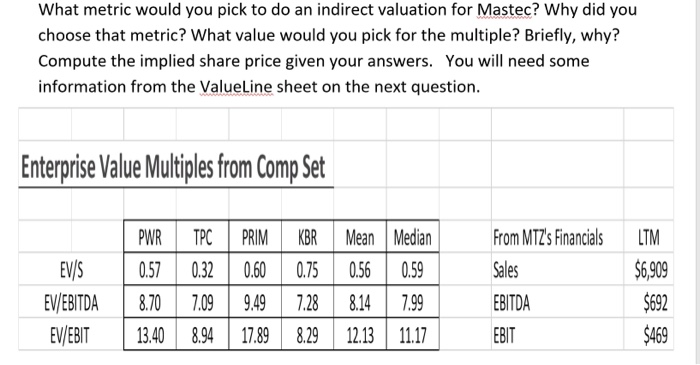

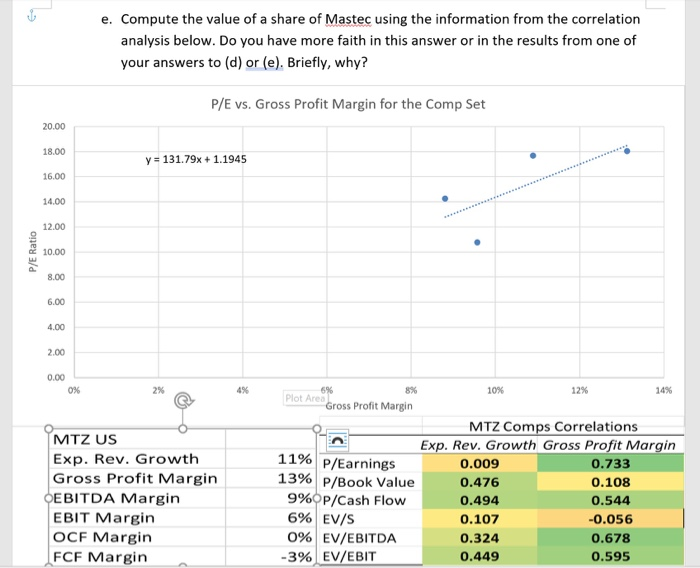

What metric would you pick to do an indirect valuation for Mastec? Why did you choose that metric? What value would you pick for the multiple? Briefly, why? Compute the implied share price given your answers. You will need some information from the ValueLine sheet on the next question. Enterprise Value Multiples from Comp Set LTM $6,909 EV/S EV/EBITDA EV/EBIT PWR 0.57 8.70 13.40 TPC 0.32 7.09 8.94 PRIM 0.60 9.49 17.89 KBR 0.75 7.28 8.29 Mean Median 0.56 0.59 8.147.99 12.13 11.17 From MTZ's Financials Sales EBITDA EBIT $692 $469 e. Compute the value of a share of Mastec using the information from the correlation analysis below. Do you have more faith in this answer or in the results from one of your answers to (d) or (e). Briefly, why? P/E vs. Gross Profit Margin for the Comp Set 20.00 18.00 y = 131.79x + 1.1945 P/E Ratio 2.00 0.00 Q MTZ US Exp. Rev. Growth Gross Profit Margin OEBITDA Margin EBIT Margin OCF Margin FCF Margin 6% 10% 12% 14% Plot Area Gross Profit Margin MTZ Comps Correlations Exp. Rev. Growth Gross Profit Margin 11% P/Earnings 0.009 0.733 13% P/Book Value 0.476 0.108 9% P/Cash Flow 0.494 0.544 6% EV/S 0.107 -0.056 0% EV/EBITDA 0.324 0.678 -3% EV/EBIT 0.449 0.595 What metric would you pick to do an indirect valuation for Mastec? Why did you choose that metric? What value would you pick for the multiple? Briefly, why? Compute the implied share price given your answers. You will need some information from the ValueLine sheet on the next question. Enterprise Value Multiples from Comp Set LTM $6,909 EV/S EV/EBITDA EV/EBIT PWR 0.57 8.70 13.40 TPC 0.32 7.09 8.94 PRIM 0.60 9.49 17.89 KBR 0.75 7.28 8.29 Mean Median 0.56 0.59 8.147.99 12.13 11.17 From MTZ's Financials Sales EBITDA EBIT $692 $469 e. Compute the value of a share of Mastec using the information from the correlation analysis below. Do you have more faith in this answer or in the results from one of your answers to (d) or (e). Briefly, why? P/E vs. Gross Profit Margin for the Comp Set 20.00 18.00 y = 131.79x + 1.1945 P/E Ratio 2.00 0.00 Q MTZ US Exp. Rev. Growth Gross Profit Margin OEBITDA Margin EBIT Margin OCF Margin FCF Margin 6% 10% 12% 14% Plot Area Gross Profit Margin MTZ Comps Correlations Exp. Rev. Growth Gross Profit Margin 11% P/Earnings 0.009 0.733 13% P/Book Value 0.476 0.108 9% P/Cash Flow 0.494 0.544 6% EV/S 0.107 -0.056 0% EV/EBITDA 0.324 0.678 -3% EV/EBIT 0.449 0.595