Question

What monthly payments (made at the end of the month) would a bank demand if you were to borrow $50 000, to be repaid over

What monthly payments (made at the end of the month) would a bank demand if you were to borrow $50 000, to be repaid over 3 years, if the interest that is charged is 16% compounded quarterly? What would be your remaining debt at the end of 2 years of these payments? How many years will it take you to pay off a mortgage of $100 000 if you are making monthly payments of $1434.71 and the rate of interest you are being charged is 12.3040% compounded semiannually?

What monthly payments (made at the end of the month) would a bank demand if you were to borrow $50 000, to be repaid over 3 years, if the interest that is charged is 16% compounded quarterly? What would be your remaining debt at the end of 2 years of these payments? How many years will it take you to pay off a mortgage of $100 000 if you are making monthly payments of $1434.71 and the rate of interest you are being charged is 12.3040% compounded semiannually?

**Only use the formulas I provide*****

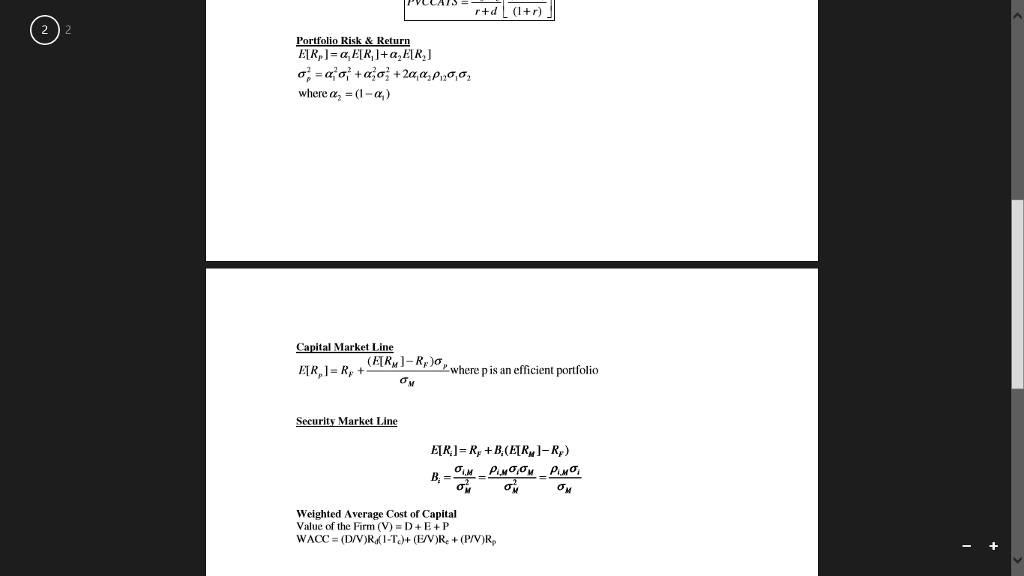

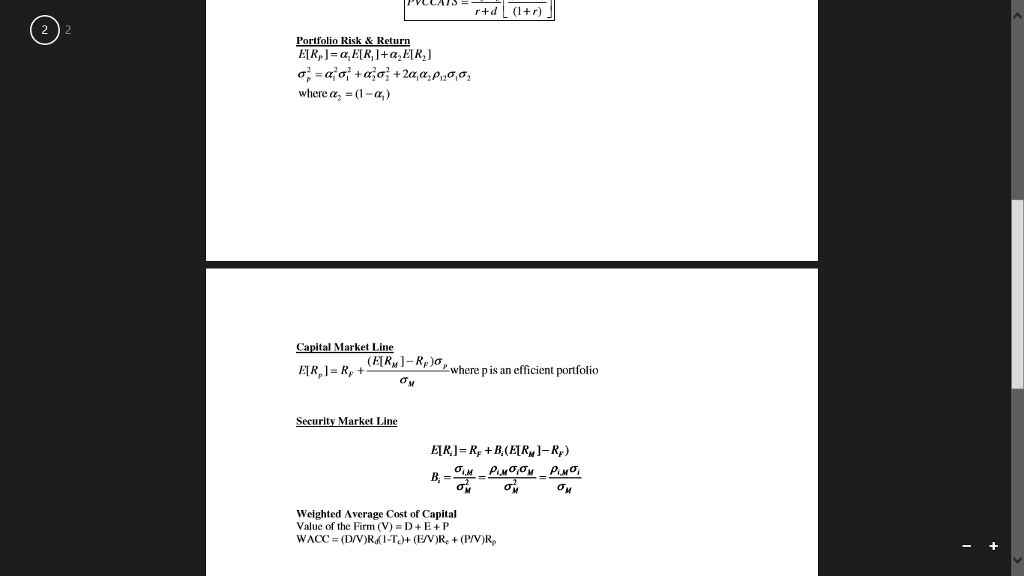

FORMULAS Future Values (r = quoted annual rate, t = number of years, m = number of compounding per year.) Compound Interest: FV = PV(1 + r)t Compounding more than once a year: FV = PV(1 + r/m)tm Effective Annual Rate of Interest:: r = (1 + r/m)m - 1 Annuities (A = constant periodic cash flow) Future Value of an Ordinary Annuity: () )1(1 , tr t CFVIFA r r FVAC = + = Future Value of an Annuity Due: )(1)(1 )1(1 FVArr r r FVADC t =++ + = Present Value of an Ordinary Annuity: () )(11 , tr t CPVIFA r r PVAC = + = Present Value of an Annuity Due: () )(1)(1 )(11 1, tr t CPVIFAC PVArr r r PVADC =+ =++ + = Other Formulas Perpetuity (without growth): r C PV = Growing Perpetuity (Ct = C1 (1 + g)t- 1): rg C PV = 1 Dividends Growing at rate g: rg D P s = 10 PVCCATS With Half Year Rule + + + = )(1 ).5(10 r r rd CdT PVCCATS c Portfolio Risk & Return )(1where 2 [][][] 21 122121 2 2 2 2 2 1 2 1 2 2211 = ++= += p P ER ERER Capital Market Line efficient portfolioan p is where ])([ [] M FpM pF RRE RRE =+ Security Market Line Weighted Average Cost of Capital Value of the Firm (V) = D + E + P WACC = (D/V)Rd(1-Tc)+ (E/V)Re + (P/V)Rp

Portf olio Risk & Return ELR a EUR J+ a EUR,J a G where a, (1-a) Capital Market Line EUR RF)o where pis an efficient portfolio Security Market ne Ry) Weighted Average Cost of Capital Value of the Firm (V) D+E+P WACC Portf olio Risk & Return ELR a EUR J+ a EUR,J a G where a, (1-a) Capital Market Line EUR RF)o where pis an efficient portfolio Security Market ne Ry) Weighted Average Cost of Capital Value of the Firm (V) D+E+P WACCStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started