Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What more information do you need? This is all I have as well. Check my word The Robinson Corporation has $42 million of bonds outstanding

What more information do you need? This is all I have as well.

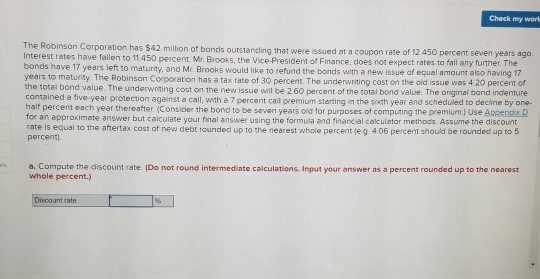

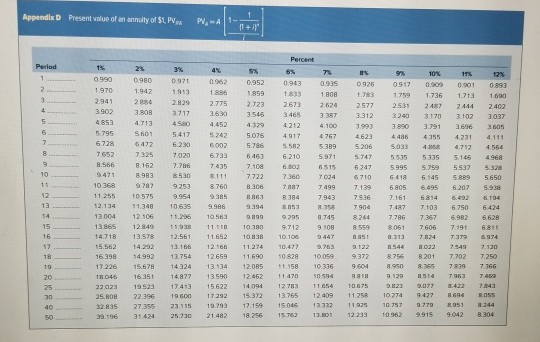

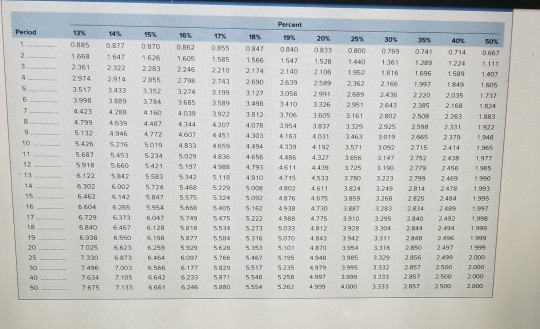

Check my word The Robinson Corporation has $42 million of bonds outstanding that were issued at a coupon rate of 12.450 percent seven years ago Interest rates have fallen to 11 450 percent Mr Brooks, the Vice-President of Finance does not expect rates to fall any further The bonds have 17 years left to maturity, and Mr. Brooks would like to refund the bonds with a new issue of equal amount also having 17 years to maturity. The Robinson Corporation has a tax rate of 30 percent The underwriting cost on the old issue was 420 percent of the total bond value. The underwriting cost on the new issue will be 260 percent of the total bond value. The original bond Indenture contained a five-year protection against a call with a 7 percent cal premium starting in the exth year and scheduled to decline by one hat percent each year thereafter. Consider the bond to be seven years old for purposes of computing the premium.) Use Appendix D for an approximate answer but calculate your final answer using the formula and financial calculator methods. Assume the discount rate is equal to the aftertax cost of new debt rounded up to the nearest whole percent leg. 4.06 percent should be rounded up to 5 percent a. Compute the discount rate (Do not found intermediate calculations. Input your answer as a percent rounded up to the nearest whole percent.) Discount rate s Appendix D Present value of an annuity of S1, P P 7 8 0990 1.970 0903 1833 2673 3465 4.212 4017 0935 180 2624 390) 4853 5.795 6728 7,652 15h 1808 4767 2% 3% 0.980 0.97 0962 0.952 1942 1913 1859 2884 28.9 2.723 3717 4713 4580 4.452 4329 5601 5.417 5.075 6.002 5.796 6.463 8.162 7.786 7435 7.108 8.983 8.50 11 7722 0779253 8760 306 10.575 994 35 36 11.348 10.635 9.996 9,394 12 106 1.206 10 3 199 12 845 11. 11 13.578 12.561 11652 1083 14.202 1 3166 12.16 11.274 14.992 13.754 12659 11.690 15.678 14.324 13.34 12.065 16:35 1487713500 12 462 1952 1741315622 14094 2296 9600 17.292 15.372 27.355 23115 793 17.159 3142425.0 21.48218.256 % 9 10% 11% 0.026 0917 0.00 0801 0893 1.783 174 1736 1713 1690 2577 2531 2487 2444 3.312 3240 1170 3102 1037 3.993 3.890 3.791 3606 3605 4623 4486 4355 4.231 4111 5.206 5033 4 4 .712 4564 5.741 5535 5335 5.145 496 6747 59955759 5537 178 70641 6145 59 5650 719 605 6.495 6.207 5.9 7536 7161 6814 7904 7487 703 6750 6.424 821 7 786 7 357 97 5628 5.971 6515 704 T499 7.943 11.255 12.134 13004 13865 14.718 15.562 16198 17226 1046 22.023 25.08 235 156 6.210 620 71 in B 384 153 9.295 9712 10.106 10.477 10.828 57.158 470 2.7 3.765 15.045 1576) 74 8.745 9100 9.447 2.763 10.059 10.336 10 594 1.654 2409 13.332 20 311 22 544 9.372 8 .756 9.60418.950 724 022 B 201 83 73 7549 7.702 7879 7.250 10675 1 258 11 12.233 9.8239077 10 274 47 10 0362 315 3.42 743 64 BOSS 95 24 104 104 14% 15% 16% 17% 19% 20% 25% 30% 40% So 0.85 0.8770870 0.362 08550.847 0140 O R DO 07600 741 0714 0667 1668 1647 1626 1605 155 1566 1547 1.528 1.460 161 1.289 1224 111 2.361 222 223 2246 2.210 2174 2140 2.106 1952 1816 1696 159 1607 2974 2.914 2.855 2.790 2.743 2690 2.639 25 2 .162 2166 907 78491605 3.517 343333523274 3.1993127 1058 2091 2.436 2202035 737 3.998 389 3784 3.685 3589 3.498 3410 3.326 2951 26412115 2168 1824 4.423 42084.160 4.039 39223.812 1705 16053161 2002 2.26) 1883 4.799 461 4.487 4344 42024.078 3.954 1329 2925 2.50 331 1922 5.132 4.946 472 4607 4451 4.303 4163 031 3.463 3019 2065 2179 948 4659 4494 4.339 4 192 2.571 3092 2715 2.414 1.955 5.687 54535.234 5.029 4836461 4.486 4.3273656 147 1 4 38 1977 5918 5.660 5421 5.197 4.965 4793 4.611 4.439 3.725 3.100 2.779 2.456 95 6.122 584255831425.1184.910 4.715 45337503223 2.799 2469 990 6.302 6.002 .724 5468 5.20 500 402 4.611 3824 3.249 2.814 2.478 1993 6.462 6.142 347 5.575 5.324 5.092 476 4675 385932682825 2.484 1995 6604 5.255 5954 5. 6 4 05 5.162 493 4730 3.7 3.283 2834 2.499 997 6.729 633 047 5749 5.475 5.222 498 4.775 3910 3.295 2840 2.492 58406 467 612 5 554 21 01 292 301 244 2494999 5.9 50 51 1877 52177 5584 5.316 5070 4.341 342 3311242496999 5 523 525 529 562 111 1101 4 4 35 28 2497 19 6.0 576 5.467 5.135 4 10 39 2 456 2499 2000 7.003 7.490 0 .17 529 5517 5.235 4979 3 1 1122057 2000 2500 7634 7105 5642 5233 57 58 535 490 1 333 2857 2500 2000 3322 246 2 ST 7675 5554 200 7.133 200 666 Check my work b. Calculate the present value of total outflows. Do not round intermediate calculations and round your answer to 2 decimal places.) PV of total outflows c. Calculate the present value of total inflows. (Do not round intermediate calculations and round your answer to 2 decimal places.) PV of total indows d. Calculate the net present value (Negative amount should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places.) Net present value Check my word The Robinson Corporation has $42 million of bonds outstanding that were issued at a coupon rate of 12.450 percent seven years ago Interest rates have fallen to 11 450 percent Mr Brooks, the Vice-President of Finance does not expect rates to fall any further The bonds have 17 years left to maturity, and Mr. Brooks would like to refund the bonds with a new issue of equal amount also having 17 years to maturity. The Robinson Corporation has a tax rate of 30 percent The underwriting cost on the old issue was 420 percent of the total bond value. The underwriting cost on the new issue will be 260 percent of the total bond value. The original bond Indenture contained a five-year protection against a call with a 7 percent cal premium starting in the exth year and scheduled to decline by one hat percent each year thereafter. Consider the bond to be seven years old for purposes of computing the premium.) Use Appendix D for an approximate answer but calculate your final answer using the formula and financial calculator methods. Assume the discount rate is equal to the aftertax cost of new debt rounded up to the nearest whole percent leg. 4.06 percent should be rounded up to 5 percent a. Compute the discount rate (Do not found intermediate calculations. Input your answer as a percent rounded up to the nearest whole percent.) Discount rate s Appendix D Present value of an annuity of S1, P P 7 8 0990 1.970 0903 1833 2673 3465 4.212 4017 0935 180 2624 390) 4853 5.795 6728 7,652 15h 1808 4767 2% 3% 0.980 0.97 0962 0.952 1942 1913 1859 2884 28.9 2.723 3717 4713 4580 4.452 4329 5601 5.417 5.075 6.002 5.796 6.463 8.162 7.786 7435 7.108 8.983 8.50 11 7722 0779253 8760 306 10.575 994 35 36 11.348 10.635 9.996 9,394 12 106 1.206 10 3 199 12 845 11. 11 13.578 12.561 11652 1083 14.202 1 3166 12.16 11.274 14.992 13.754 12659 11.690 15.678 14.324 13.34 12.065 16:35 1487713500 12 462 1952 1741315622 14094 2296 9600 17.292 15.372 27.355 23115 793 17.159 3142425.0 21.48218.256 % 9 10% 11% 0.026 0917 0.00 0801 0893 1.783 174 1736 1713 1690 2577 2531 2487 2444 3.312 3240 1170 3102 1037 3.993 3.890 3.791 3606 3605 4623 4486 4355 4.231 4111 5.206 5033 4 4 .712 4564 5.741 5535 5335 5.145 496 6747 59955759 5537 178 70641 6145 59 5650 719 605 6.495 6.207 5.9 7536 7161 6814 7904 7487 703 6750 6.424 821 7 786 7 357 97 5628 5.971 6515 704 T499 7.943 11.255 12.134 13004 13865 14.718 15.562 16198 17226 1046 22.023 25.08 235 156 6.210 620 71 in B 384 153 9.295 9712 10.106 10.477 10.828 57.158 470 2.7 3.765 15.045 1576) 74 8.745 9100 9.447 2.763 10.059 10.336 10 594 1.654 2409 13.332 20 311 22 544 9.372 8 .756 9.60418.950 724 022 B 201 83 73 7549 7.702 7879 7.250 10675 1 258 11 12.233 9.8239077 10 274 47 10 0362 315 3.42 743 64 BOSS 95 24 104 104 14% 15% 16% 17% 19% 20% 25% 30% 40% So 0.85 0.8770870 0.362 08550.847 0140 O R DO 07600 741 0714 0667 1668 1647 1626 1605 155 1566 1547 1.528 1.460 161 1.289 1224 111 2.361 222 223 2246 2.210 2174 2140 2.106 1952 1816 1696 159 1607 2974 2.914 2.855 2.790 2.743 2690 2.639 25 2 .162 2166 907 78491605 3.517 343333523274 3.1993127 1058 2091 2.436 2202035 737 3.998 389 3784 3.685 3589 3.498 3410 3.326 2951 26412115 2168 1824 4.423 42084.160 4.039 39223.812 1705 16053161 2002 2.26) 1883 4.799 461 4.487 4344 42024.078 3.954 1329 2925 2.50 331 1922 5.132 4.946 472 4607 4451 4.303 4163 031 3.463 3019 2065 2179 948 4659 4494 4.339 4 192 2.571 3092 2715 2.414 1.955 5.687 54535.234 5.029 4836461 4.486 4.3273656 147 1 4 38 1977 5918 5.660 5421 5.197 4.965 4793 4.611 4.439 3.725 3.100 2.779 2.456 95 6.122 584255831425.1184.910 4.715 45337503223 2.799 2469 990 6.302 6.002 .724 5468 5.20 500 402 4.611 3824 3.249 2.814 2.478 1993 6.462 6.142 347 5.575 5.324 5.092 476 4675 385932682825 2.484 1995 6604 5.255 5954 5. 6 4 05 5.162 493 4730 3.7 3.283 2834 2.499 997 6.729 633 047 5749 5.475 5.222 498 4.775 3910 3.295 2840 2.492 58406 467 612 5 554 21 01 292 301 244 2494999 5.9 50 51 1877 52177 5584 5.316 5070 4.341 342 3311242496999 5 523 525 529 562 111 1101 4 4 35 28 2497 19 6.0 576 5.467 5.135 4 10 39 2 456 2499 2000 7.003 7.490 0 .17 529 5517 5.235 4979 3 1 1122057 2000 2500 7634 7105 5642 5233 57 58 535 490 1 333 2857 2500 2000 3322 246 2 ST 7675 5554 200 7.133 200 666 Check my work b. Calculate the present value of total outflows. Do not round intermediate calculations and round your answer to 2 decimal places.) PV of total outflows c. Calculate the present value of total inflows. (Do not round intermediate calculations and round your answer to 2 decimal places.) PV of total indows d. Calculate the net present value (Negative amount should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places.) Net present valueStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started