what more information is needed? the image is attached with the relevant information and what is required is at the bottom?

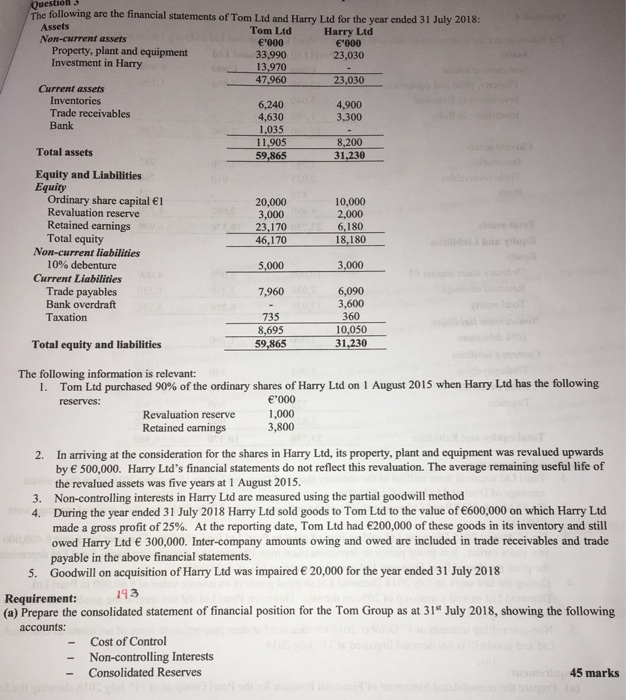

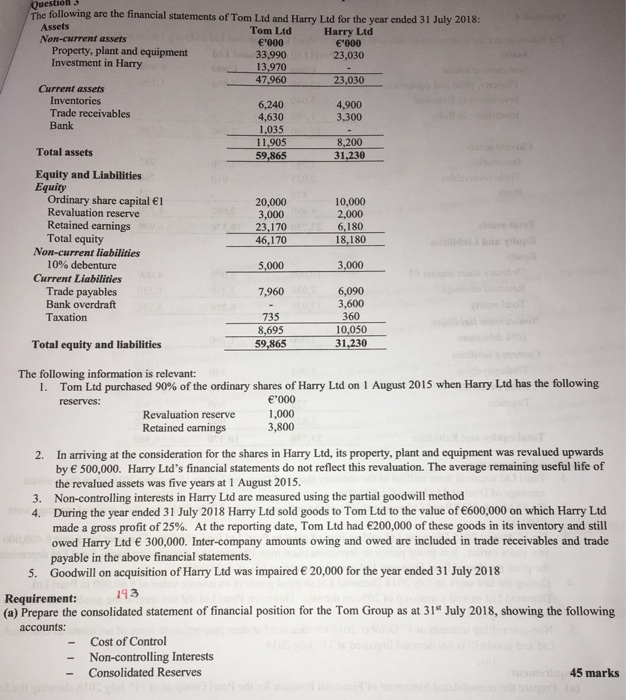

Question 3 The following are the financial statements of Tom Ltd and Harry Ltd for the year ended 31 July 2018: Assets Tom Ltd Non-current assets Harry Ltd '000 '000 Property, plant and equipment 33,990 23,030 Investment in Harry 13,970 47,960 23,030 Current assets Inventories 6,240 4,900 Trade receivables 4,630 3,300 Bank 1,035 11,905 8,200 Total assets 59,865 31,230 Equity and Liabilities Equity Ordinary share capital 1 20,000 10,000 Revaluation reserve 3,000 2.000 Retained earings 23,170 6,180 Total equity 46,170 18,180 Non-current liabilities 10% debenture 5,000 3,000 Current Liabilities Trade payables 7,960 6,090 Bank overdraft 3,600 Taxation 735 360 8,695 10,050 Total equity and liabilities 59,865 31,230 The following information is relevant: 1. Tom Ltd purchased 90% of the ordinary shares of Harry Ltd on 1 August 2015 when Harry Ltd has the following reserves: '000 Revaluation reserve 1,000 Retained earnings 3,800 2. In arriving at the consideration for the shares in Harry Ltd, its property, plant and equipment was revalued upwards by 500,000. Harry Ltd's financial statements do not reflect this revaluation. The average remaining useful life of the revalued assets was five years at 1 August 2015. 3. Non-controlling interests in Harry Ltd are measured using the partial goodwill method 4. During the year ended 31 July 2018 Harry Ltd sold goods to Tom Ltd to the value of 600,000 on which Harry Ltd made a gross profit of 25%. At the reporting date, Tom Ltd had 200,000 of these goods in its inventory and still owed Harry Ltd 300,000. Inter-company amounts owing and owed are included in trade receivables and trade payable in the above financial statements. 5. Goodwill on acquisition of Harry Ltd was impaired 20,000 for the year ended 31 July 2018 Requirement: 143 (a) Prepare the consolidated statement of financial position for the Tom Group as at 31* July 2018, showing the following accounts: Cost of Control Non-controlling Interests Consolidated Reserves 45 marks Question 3 The following are the financial statements of Tom Ltd and Harry Ltd for the year ended 31 July 2018: Assets Tom Ltd Non-current assets Harry Ltd '000 '000 Property, plant and equipment 33,990 23,030 Investment in Harry 13,970 47,960 23,030 Current assets Inventories 6,240 4,900 Trade receivables 4,630 3,300 Bank 1,035 11,905 8,200 Total assets 59,865 31,230 Equity and Liabilities Equity Ordinary share capital 1 20,000 10,000 Revaluation reserve 3,000 2.000 Retained earings 23,170 6,180 Total equity 46,170 18,180 Non-current liabilities 10% debenture 5,000 3,000 Current Liabilities Trade payables 7,960 6,090 Bank overdraft 3,600 Taxation 735 360 8,695 10,050 Total equity and liabilities 59,865 31,230 The following information is relevant: 1. Tom Ltd purchased 90% of the ordinary shares of Harry Ltd on 1 August 2015 when Harry Ltd has the following reserves: '000 Revaluation reserve 1,000 Retained earnings 3,800 2. In arriving at the consideration for the shares in Harry Ltd, its property, plant and equipment was revalued upwards by 500,000. Harry Ltd's financial statements do not reflect this revaluation. The average remaining useful life of the revalued assets was five years at 1 August 2015. 3. Non-controlling interests in Harry Ltd are measured using the partial goodwill method 4. During the year ended 31 July 2018 Harry Ltd sold goods to Tom Ltd to the value of 600,000 on which Harry Ltd made a gross profit of 25%. At the reporting date, Tom Ltd had 200,000 of these goods in its inventory and still owed Harry Ltd 300,000. Inter-company amounts owing and owed are included in trade receivables and trade payable in the above financial statements. 5. Goodwill on acquisition of Harry Ltd was impaired 20,000 for the year ended 31 July 2018 Requirement: 143 (a) Prepare the consolidated statement of financial position for the Tom Group as at 31* July 2018, showing the following accounts: Cost of Control Non-controlling Interests Consolidated Reserves 45 marks