Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What portion of total assets does your companys property, plant, and equipment make up? (Hint: the total of Net PPE divided by total assets). Make

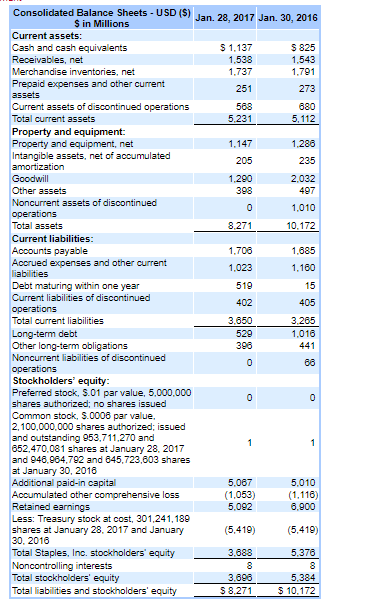

- What portion of total assets does your companys property, plant, and equipment make up? (Hint: the total of Net PPE divided by total assets). Make sure you show the calculation and take your time to pull the correct numbers from the balance sheet or the note.

- What method does your company use to compute depreciation?

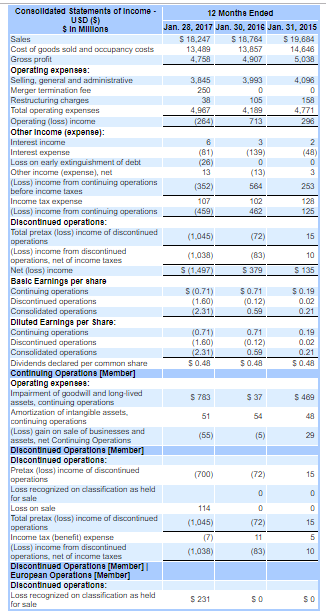

- How much depreciation expense was reported for the year? Where did you get this amount? Caution: I do not want accumulated depreciation

- What is the net book value of all your companys PP&E? Show your calculation.

- What is the fixed asset turnover ratio for your company? Use the following calculation.Fixed Asset Turnover = Total Revenues / Average Net Fixed AssetsAverage Fixed Assets = (Beginning Year Net FA + End of Year Net FA) / Show your numbers and label the amounts

- . Is the ratio good or bad? Explain.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started