What quantitative analysis needs to be done (what numbers need to be calculated)?

Explain calculations and their results.

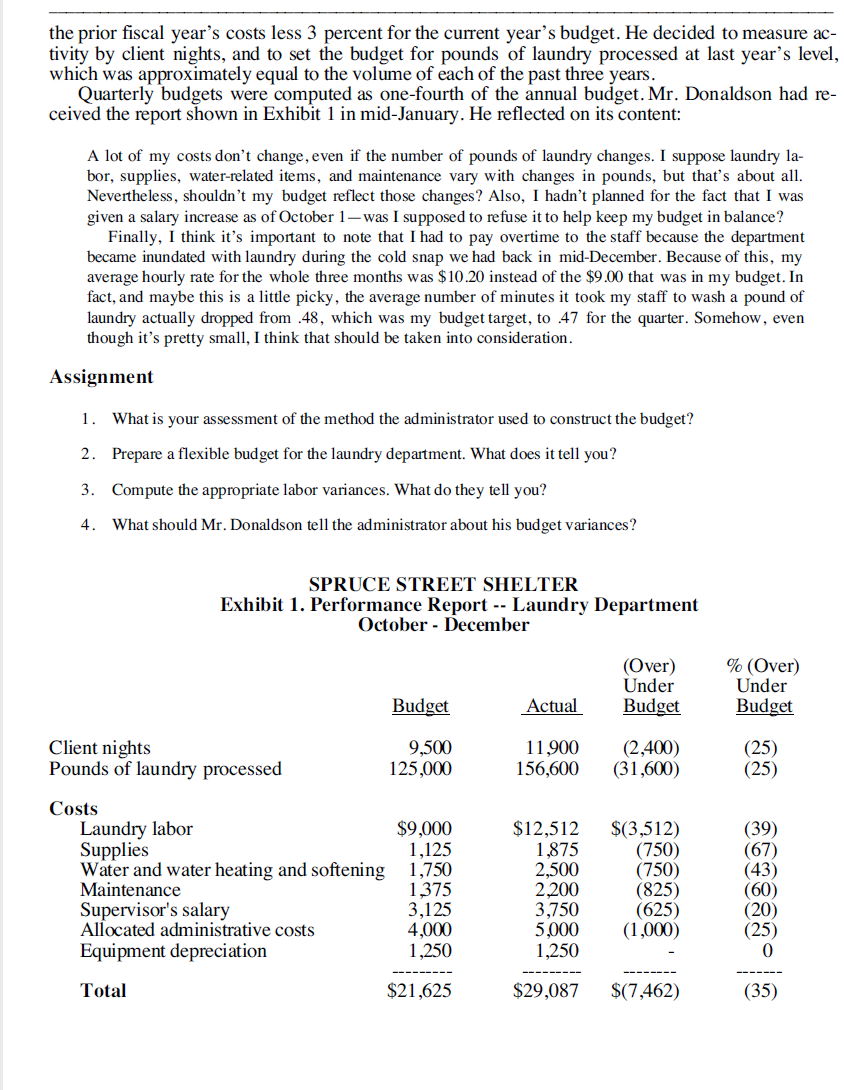

Spruce Street Shelter Sam Donaldson, the laundry supervisor of the Spruce Sueet Shelter, stared at the memo that had just reached his desk: The shelter has adopteda responsibility accounting system. From now on you will receive quarterly re- ports comparing the costs of operating your department with budgeted costs. The reports will highlight the cifferences (variances) so that you can zero in on the departure from budgeted costs. (This is called management by exception.) Responsibility accounting means you are accountable for keeping the costs in your department within the budget. The variances from the budget will help you identify which costs are out of line, and the sizes of the variances will indicate the most important ones. Your first such report ac- companies this announcement. [Exhibit 1] As this report indicates, your costs are signicantly above budget for the quarter. You need to pay par- ticular attention to labor, supplies, and maintenance. Please get back to me by the end of this week with a plan for making the needed reductions. Mr. Donaldson knew he needed a plan, yet midwinter was the busiest time of the year at the shelter, and the laundry was piling up faster than his staff could wash it. BACKGROUND Spruce Street Shelter was located in the heart of a large metropolitan area in the north-central United States. FOunded in the late 18005, it had been serving the homeless ever since, providing hot meals, shelter, and companionship. Situated on a busy urban thoroughfare, it was a haven of last re- sort for many of the city's indigent, and \"home\" for many others. As might be expected, the de- mand for its services was especially high in the winter, when temperatures frequently dropped to below freezing, and life \"on the street\" became unbearable. The shelter provided three services. Its most significant activity was the HotMeal Program, where it served hundreds of meals a day. A meal of hot soup and a sandwich was available to any one who arrived between the hours of noon and 2pm and 5pm to 7pm. Its second program was its Overnight Hostel, where it had 150 beds that were available on a rst~come, rst-served basis. The linen was changed daily, and fresh tOwels were always available, so that the shelter's clients c0uld look forward to \"clean sheets and a hot shower.\" Finally, it had a counseling program,in which a staff of three full-time social workers assisted clients to cope with the difculties that had brought them to the shelter, and in establishing themselves in a more selfsufcient lifestyle. SYSTEM CHANGES In March, the shelter had hired a new administrator to imIIOve its business activities. A busi ness school graduate with prior experience in manufacturing and service companies in the [livate sector, one of his rst steps had been to introduce what he called \"responsibility accounting.\" He had instituted a new budgeting system, along with the provision of quarterly cost reports to the shelter's department heads. (Previously, cost data had been presented to department heads only in frequently.) The annual budget for the current scal year had been constructed by the new administrator, based on an analysis of the prior three years' costs. The analysis showed that all costs increased each year, with more rapid increases between the second and third year. He considered establishing the budget at an average of the prior three years' costs hoping that the installation of the system would reduce costs to this level. However, in view of the rapidly increasing prices, he fmally chose the prior scal year's costs less 3 percent for the current year's budget. He decided to measure ac- tivity by client nights, and to set the budget for pounds of laundry processed at last year's level, which was approximately equal to the volume of each of the past three years. Quarterly budgets were computed as one-fourth of the annual budget. Mr. Donaldson had re- ceived the report shown in Exhibit 1 in midJanuary. He reected on its content: A lot of my costs don't change, even if the number of pounds of laundry changes. I suppose laundry la- bor, supplies, water-related items, and maintenance vary with changes in pounds, but that's about all. Nevertheless, shouldn't my budget reect those changes? Also, I hadn't planned for the fact that I was given a salary increase as of October lwas I supposed to rerse it to help keep my budget in balance? Finally, I think it's important to note that I had to pay overtime to the staff because the department became inundated with laundry during the cold snap wehad back in mid-December. Because of this, my average hourly rate forthe whole three months was $10 20 instead of the $9.0) that was in my budget. In fact, and maybe this is a little picky, the average number of minutes it took my staff to wash a pound of laundry actually dropped from .48, which was my budget target, to .4? for the quarter. Somehow, even though it's pretty small, I think that should be taken into consideration. Assignment 1 . Whatis your assessment of the method the administrator used to construct the budget? 2 . Prepare a exible budget for the laundry department. What does it tell you? 3. Compute the appropriate labor variances. What do they tell you? 4. What should Mr. Donaldson tell the administrator about his budget variances? SPRUCE STREET SHELTER Exhibit 1. Performance Report -- Laundry Department October - December (0 ver) % (Over) Under Under Budget Actual Budget Budget Client nights 9,500 1 1 ,900 (2,411)) (25) Pounds of laundry processed 125,000 156,600 (31 ,600) (25) Costs Laundry labor $9,000 $12,512 $(3,512) (39) Supplies 1 ,125 1,875 (1350) (6?) Water and water heating and softening 1,750 2,500 (750) (43) Maintenance 1 ,375 2,200 (825) (60) Supervisor's salary 3,125 3,?50 (625) (20) Allocated administrative costs 4,0(I) 5,000 (1 ,0(I}) (25) Equipment depreciation 1 ,250 1,250 0 Total $21,625 $39,085 $5,462) (35)