Question

What recommendations would you make for this company moving forward based on these ratios and the following information? 2016 Ratio Values 2015 Ratio Values Current

What recommendations would you make for this company moving forward based on these ratios and the following information?

|

| 2016 Ratio Values | 2015 Ratio Values |

| Current Ratio | 2.3 | 0.5 |

| Quick Ratio | 1.4 | 0.4 |

| Debt-to-Assets Ratio | 0.9 | 0.9 |

| Times-Interest-Earned Ratio | 4.3 | n/a |

| Net Profit Margin Pct. | 1.7 | 3.8 |

| Return on Equity Pct. | 28.8 | 68.4 |

| Account Receivable Turnover | 10.6 | 22.0 |

| Inventory Turnover | 5.2 | 24.1 |

Discontinued Operation: On October 1, 2015, TECHNOGYM made and announced a decision to sell its West Coast operations (considered a component according to the GAAP definition) to an unaffiliated company. On December 31, 2016, the West Coast division was sold, and the actual result of the sale was a $125,200 loss. The journal entries related to the sale were recorded already, along with all other normal 2016 adjusting entries.

Revenue Recognition: TECHNOGYM has a division that builds university fitness centers. At the end of 2016, there was one building project in process, the $45,000,000 Western Sky University project (WSU), which was started in June 2015. Throughout 2016, routine transaction entries were to record construction costs, billings, and collections. During 2016 there were substantial additional cost increases, resulting in a 2016 year-end total cost estimate of $45,500,000 for the job.

Accounts Receivable: TECHNOGYM uses the Accounts Receivable approach to estimate bad debts, based on an A/R aging schedule.

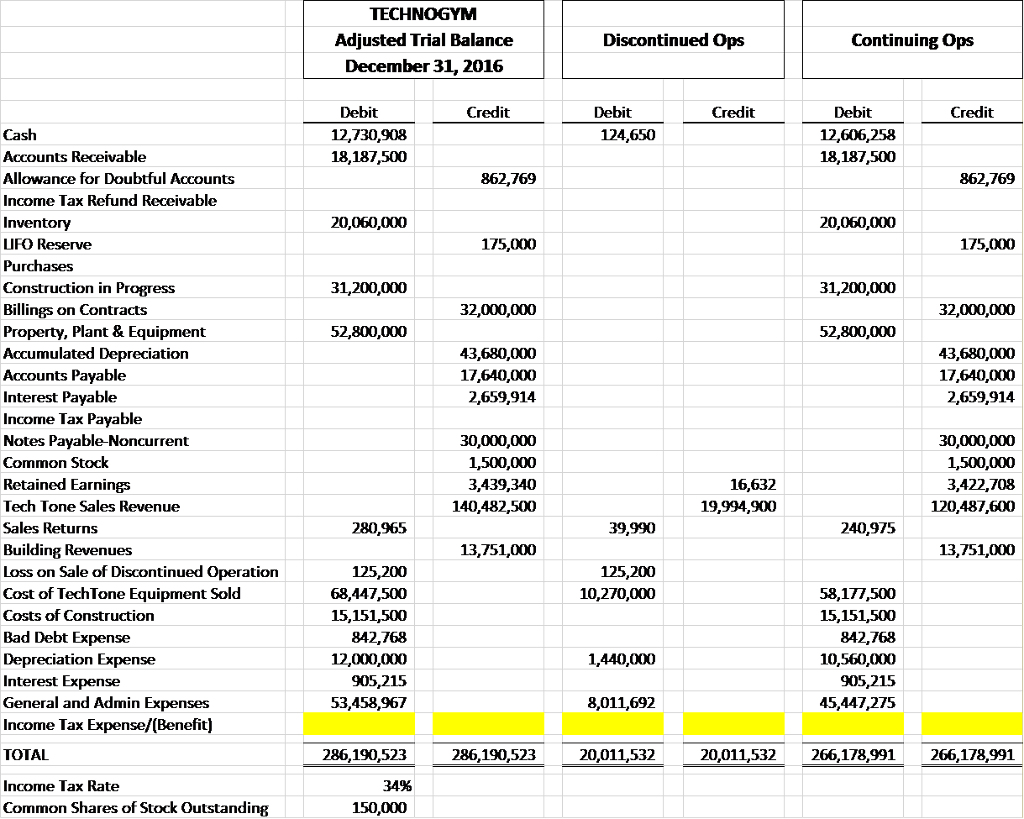

TECHNOGYM Adjusted Trial Balance December 31, 2016 Discontinued Ops Continuing Ops Credit Credit Credit it 12,730,908 18,187,500 it 12,606,258 18,187,500 124,650 Cash Accounts Receivable Allowance for Doubtful Accounts Income Tax Refund Receivable Inventory LIFO Reserve Purchases Construction in Progress Billings on Contracts Property, Plant & Equipment Accumulated Depreciation Accounts Payable Interest Payable Income Tax Payable Notes Payable-Noncurrent Common Stock Retained Earnings Tech Tone Sales Revenue Sales Returns Building Revenues Loss on Sale of Discontinued Operation Cost of TechTone Equipment Sold Costs of Construction Bad Debt Expense Depreciation Expense Interest Expense General and Admin Expenses Income Tax Expense/(Benefit] TOTAL 862,769 862,769 20,060,000 20,060,000 175,000 175,000 31,200,000 31,200,000 32,000,000 52,800,000 52,800,000 43,680,000 17,640,000 2,659,914 43,680,000 17,640,000 2,659,914 30,000,000 1,500,000 3,439,340 140,482,500 30,000,000 16,632 19,994,900 3,422,708 120,487,600 280,965 39,990 240,975 13,751,000 13,751,000 125,200 68,447,500 15,151,500 842,768 12,000,000 905,215 53,458,967 125,200 10,270,000 58,177,500 15,151,500 842,768 10,560,000 905,215 45,447,275 1,440,000 8,011,692 20,011,532 -U,01i,532 20,011,532 266,178,991-2 266,178,991 0,150,32 = Income Tax Rate 34% Common Shares of Stock Outstanding 150,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started