Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What requirements must be met for for a transaction to qualify as a 1031 exchange. Will this transaction qualify as a 1031 exchange? What gain

What requirements must be met for for a transaction to qualify as a 1031 exchange. Will this transaction qualify as a 1031 exchange? What gain will be recognized if any? What would the company's basis be?

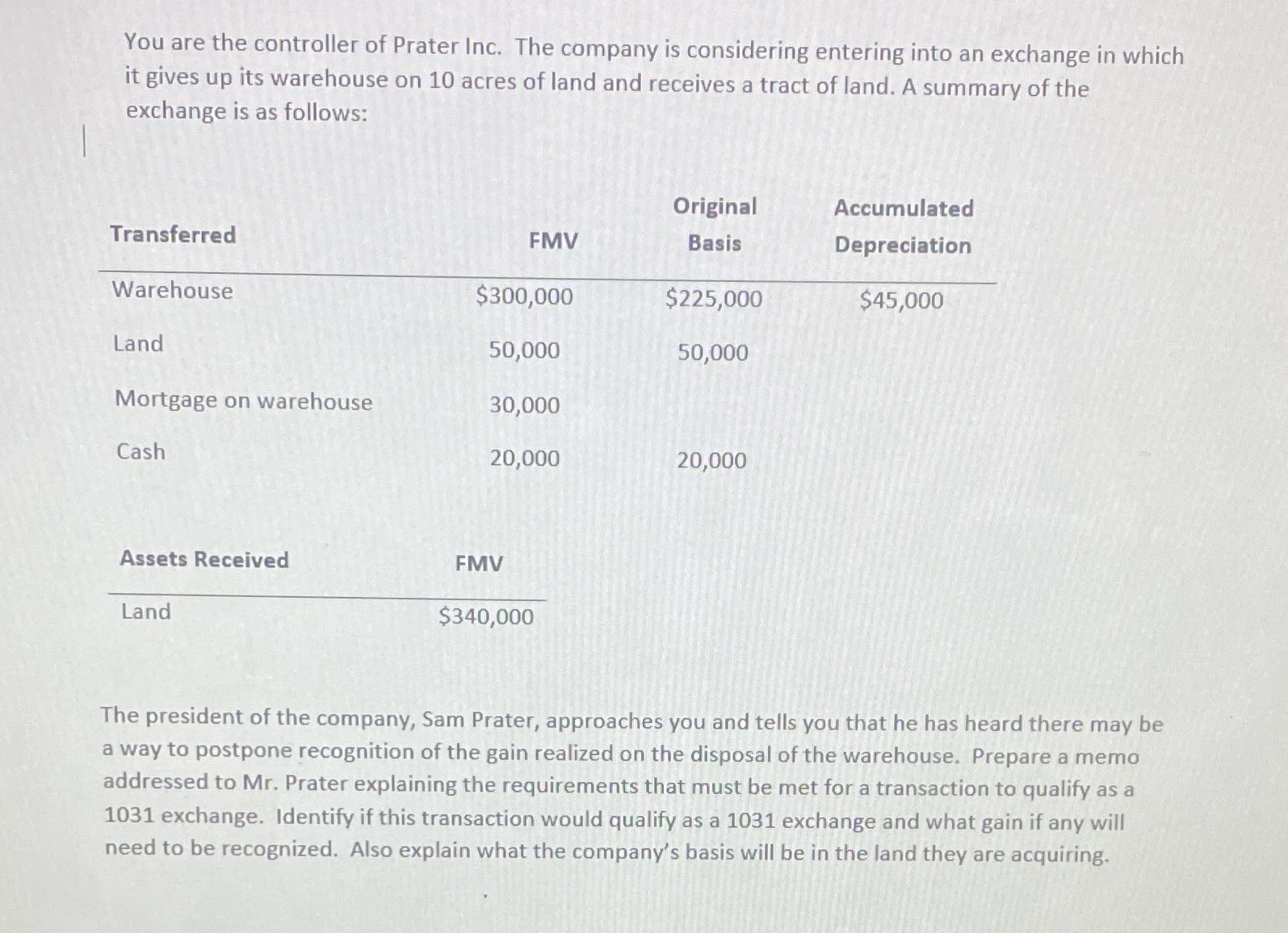

You are the controller of Prater Inc. The company is considering entering into an exchange in which it gives up its warehouse on 10 acres of land and receives a tract of land. A summary of the exchange is as follows: Transferred Warehouse Land Mortgage on warehouse Cash Assets Received Land FMV $300,000 50,000 30,000 20,000 FMV $340,000 Original Basis $225,000 50,000 20,000 Accumulated Depreciation $45,000 The president of the company, Sam Prater, approaches you and tells you that he has heard there may be a way to postpone recognition of the gain realized on the disposal of the warehouse. Prepare a memo addressed to Mr. Prater explaining the requirements that must be met for a transaction to qualify as a 1031 exchange. Identify if this transaction would qualify as a 1031 exchange and what gain if any will need to be recognized. Also explain what the company's basis will be in the land they are acquiring.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started