Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What should be our financing plan if the acquisition is made? The Atlantic Corporation's staff then surveyed the existing U.S. linerboard mills and rated selling

What should be our financing plan if the acquisition is made?

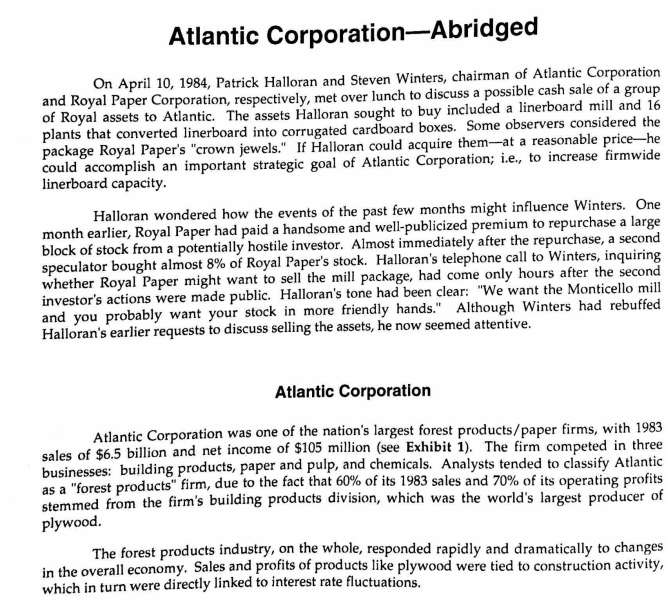

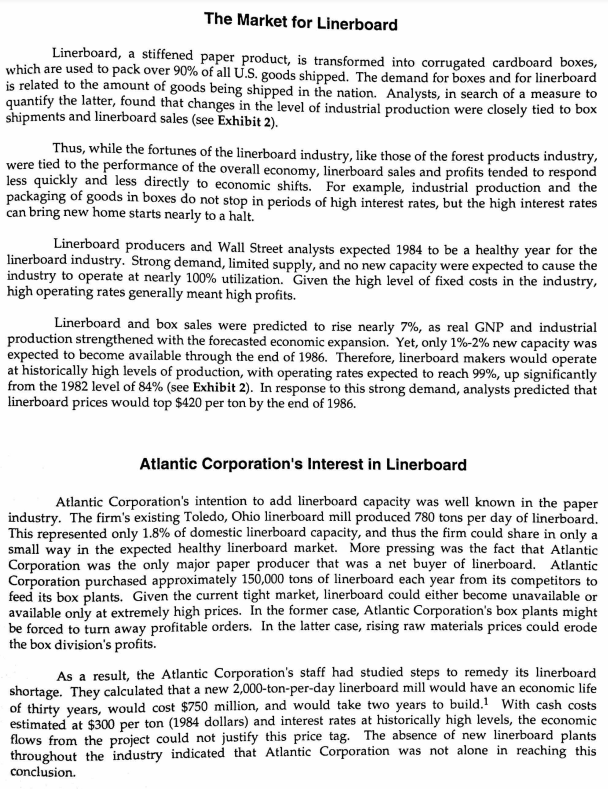

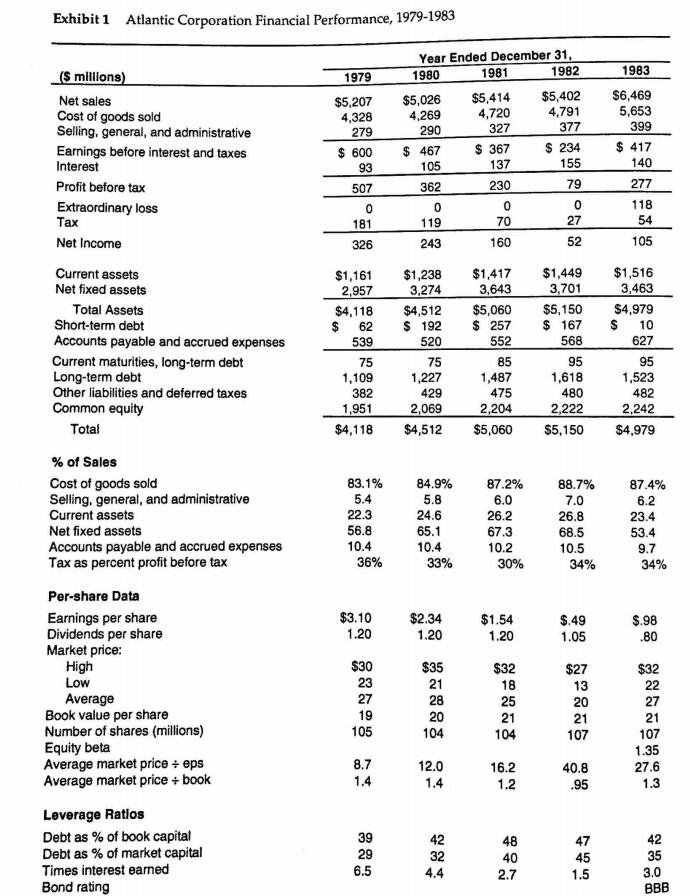

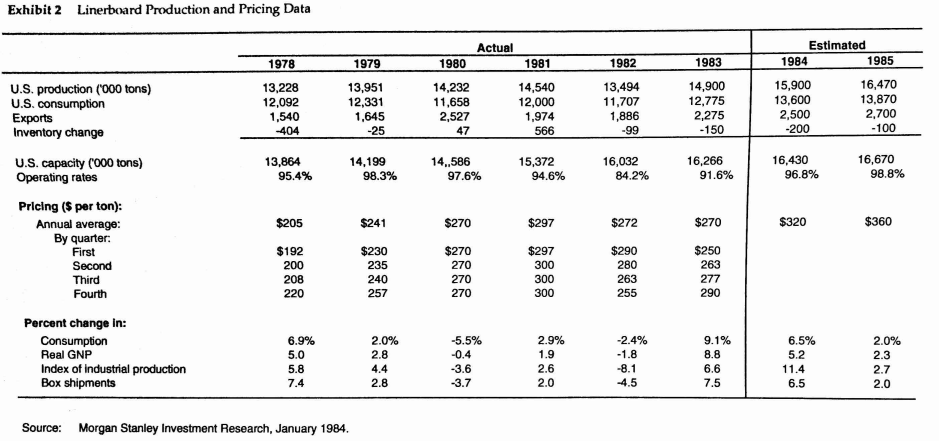

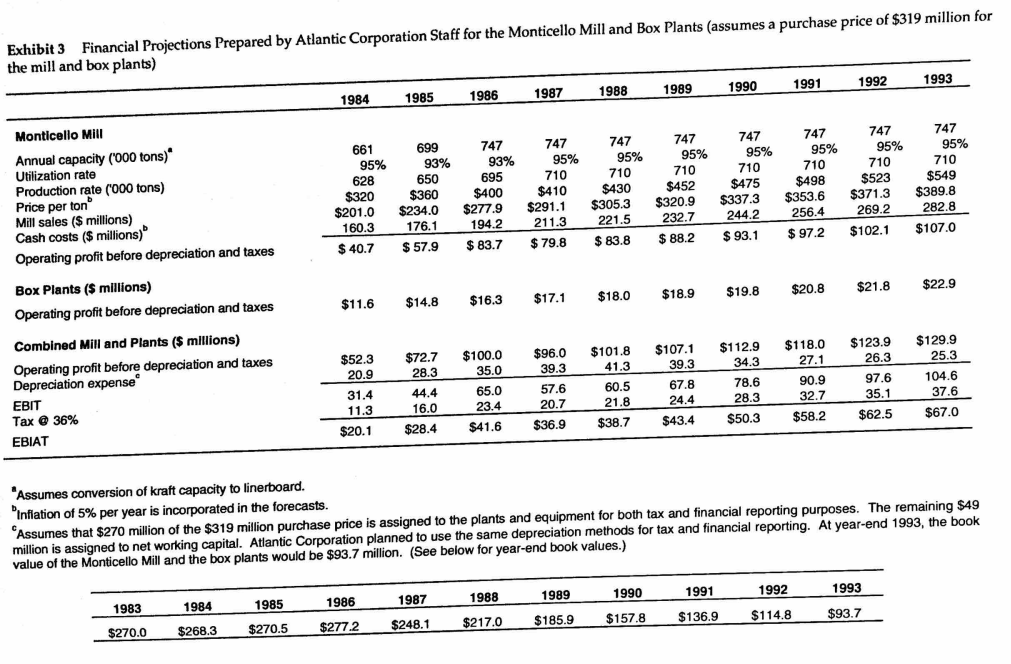

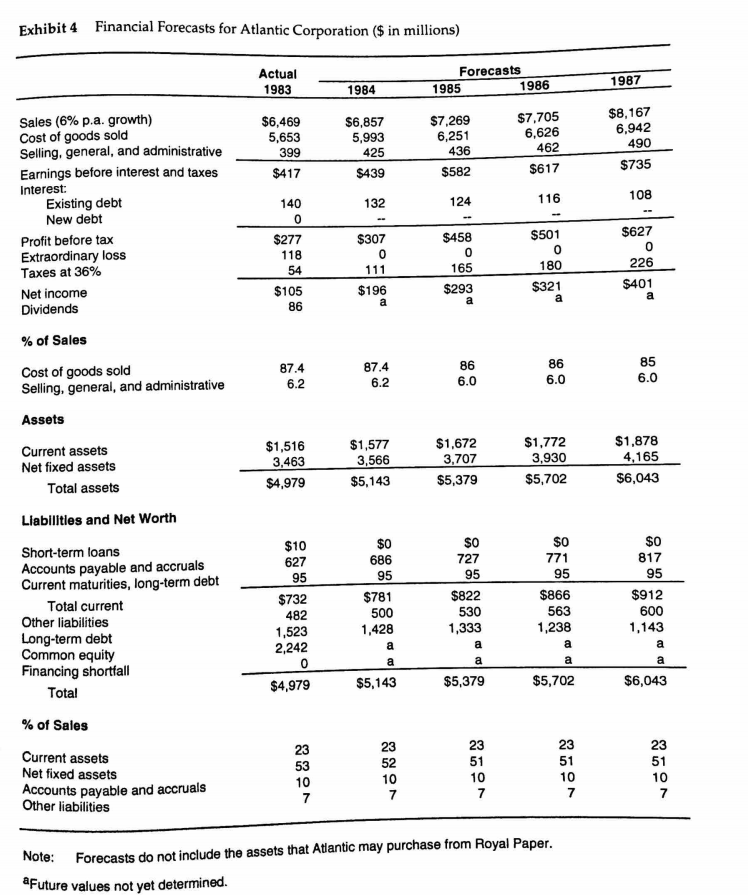

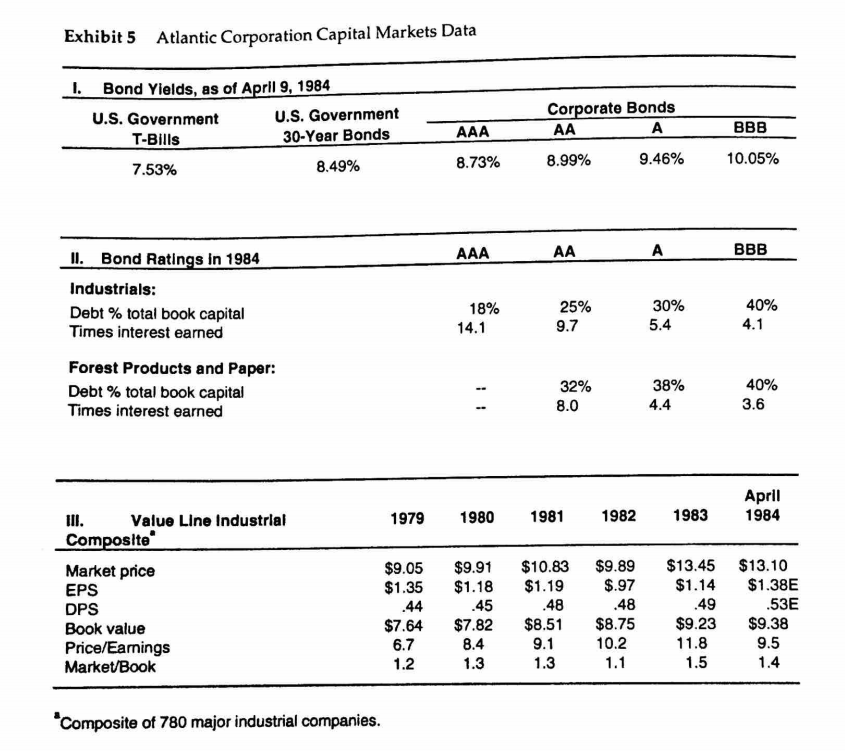

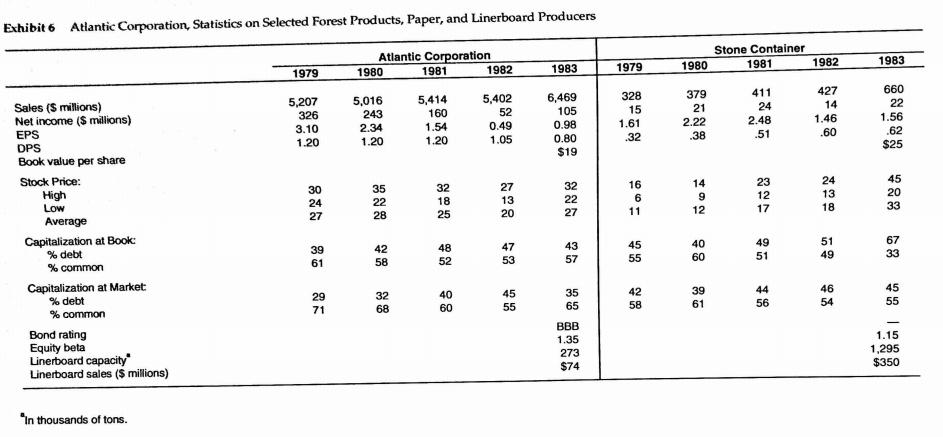

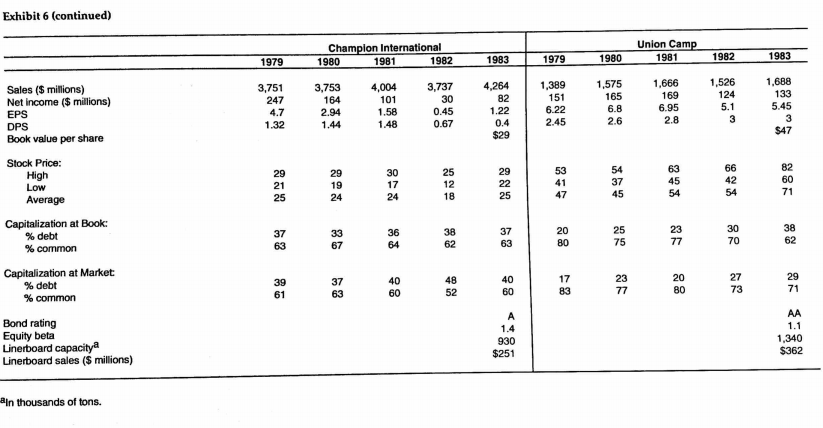

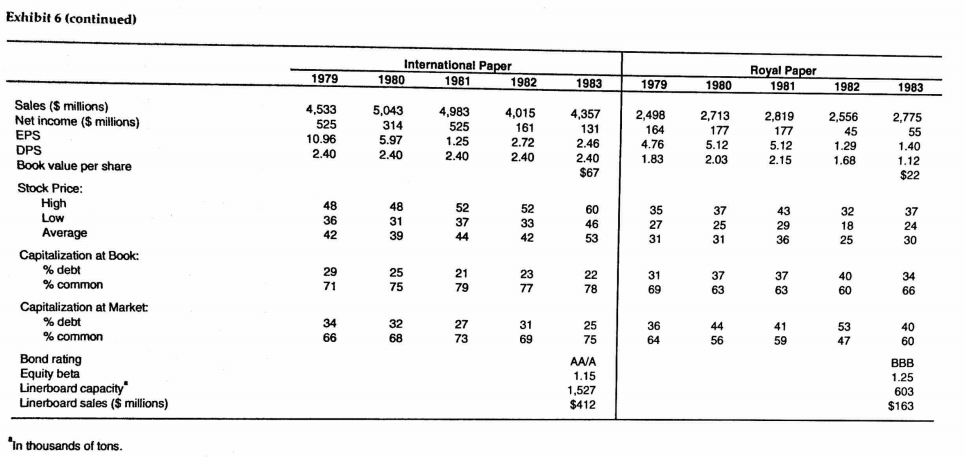

The Atlantic Corporation's staff then surveyed the existing U.S. linerboard mills and rated selling their mills. None was interested, each A, B, or C, depending on their capacities, ages, etc. Halloran called the owners of the 11 "A" rated mills, testing whether they had any interest in incl uding Winters, whose Monticello mill was ranked as the fourth best in the country In late 1983, Halloran became aware that the Continental Group, Inc. was interested in selline a package including three of its linerboard mills, with a combined capacity of over 1.1 mlion tons per year (or 3,143 daily tons), or over four times Atlantic Corporation's existing capacity. Halloran submitted a bid for the mills, but Stone Container Corporation's bid was chosen. Stone Container's product line consisted almost exclusi Container's chairman and CEO, summarized the deal: vely of linerboard and box products. Roger Stone, Stone "The three mills were purchased for around $120,000 per daily ton, excluding working capital and without assigning any value to the corrugated box plants included in the deal. This represents only about 30% of the cost of building new capacity, which if started today, could probably not be brought in for less than %375,000/daily ton three years later." This would be a total replacement cost of $1.4 billion for the three mlls, while the 20 converting (box) plants could hav replacement value of $200 mon. The Royal Paper Package: Mill, Box Plants, and Timberland The assets Halloran sought to buy from Winters comprised an integrated system in Royal Paper's paper operations. (1) The Monticello, Mississippi mill Completed in 1968, the $121 million "state-of-the-art" mill produced both linerboard and kraft paper. (Kraft paper is used to manufacture grocery bags.) In December 1983, Winters announced a "master plan to modernize the Monticello Mill," which called for Royal to spend $70-$80 million over 20-22 months to convert all of the mill's kraft capacity to linerboard capacity. This move would increase the mill's linerboard capacity from 661,000 tons annually to 747,000 tons per year (or 2,134 daily tons) that would be purchased from Royal Paper a part of the transaction. Part of the output would be transformed into corrugated boxes in the 16 box plants. The rest of the mill's output would be used by Atlantic Corporation's own box plants. As of April 1984, the conversion process had not yet started. (2) Corrugated box plants Box plants w high cost of shipping. Royal Paper's 16 corrugated box plants were almost ideally suited f combination with Atlantic's plants. Atlantic's box plants were located in the West, South, and Midwest; while the Royal Paper plants were in the South, Midwest, and East. Together, the box plants would cover most major U.S. markets. ere generally located near end users due to the relatively 3 shows estimates prepared by Atlantic's staff for both the Monticello mill and the 1 6 Exhibit forecasts are based on capital expenditures totaling $140.8 million to efficiency in the box plants corrugated box plants. The convert all of the mill's kraft capacity to linerboard capacity, to improve and to maintain the facilities (see Table A). It was anticipated that the mill and the box plants would have a 15-year economic life (through 1998), at which ti to maintain the operation by investing in new capacity to replace the mill and box plants. No salvage value was expected to be obtained at the end of their lives me management would decide whether or not The Atlantic Corporation's staff then surveyed the existing U.S. linerboard mills and rated selling their mills. None was interested, each A, B, or C, depending on their capacities, ages, etc. Halloran called the owners of the 11 "A" rated mills, testing whether they had any interest in incl uding Winters, whose Monticello mill was ranked as the fourth best in the country In late 1983, Halloran became aware that the Continental Group, Inc. was interested in selline a package including three of its linerboard mills, with a combined capacity of over 1.1 mlion tons per year (or 3,143 daily tons), or over four times Atlantic Corporation's existing capacity. Halloran submitted a bid for the mills, but Stone Container Corporation's bid was chosen. Stone Container's product line consisted almost exclusi Container's chairman and CEO, summarized the deal: vely of linerboard and box products. Roger Stone, Stone "The three mills were purchased for around $120,000 per daily ton, excluding working capital and without assigning any value to the corrugated box plants included in the deal. This represents only about 30% of the cost of building new capacity, which if started today, could probably not be brought in for less than %375,000/daily ton three years later." This would be a total replacement cost of $1.4 billion for the three mlls, while the 20 converting (box) plants could hav replacement value of $200 mon. The Royal Paper Package: Mill, Box Plants, and Timberland The assets Halloran sought to buy from Winters comprised an integrated system in Royal Paper's paper operations. (1) The Monticello, Mississippi mill Completed in 1968, the $121 million "state-of-the-art" mill produced both linerboard and kraft paper. (Kraft paper is used to manufacture grocery bags.) In December 1983, Winters announced a "master plan to modernize the Monticello Mill," which called for Royal to spend $70-$80 million over 20-22 months to convert all of the mill's kraft capacity to linerboard capacity. This move would increase the mill's linerboard capacity from 661,000 tons annually to 747,000 tons per year (or 2,134 daily tons) that would be purchased from Royal Paper a part of the transaction. Part of the output would be transformed into corrugated boxes in the 16 box plants. The rest of the mill's output would be used by Atlantic Corporation's own box plants. As of April 1984, the conversion process had not yet started. (2) Corrugated box plants Box plants w high cost of shipping. Royal Paper's 16 corrugated box plants were almost ideally suited f combination with Atlantic's plants. Atlantic's box plants were located in the West, South, and Midwest; while the Royal Paper plants were in the South, Midwest, and East. Together, the box plants would cover most major U.S. markets. ere generally located near end users due to the relatively 3 shows estimates prepared by Atlantic's staff for both the Monticello mill and the 1 6 Exhibit forecasts are based on capital expenditures totaling $140.8 million to efficiency in the box plants corrugated box plants. The convert all of the mill's kraft capacity to linerboard capacity, to improve and to maintain the facilities (see Table A). It was anticipated that the mill and the box plants would have a 15-year economic life (through 1998), at which ti to maintain the operation by investing in new capacity to replace the mill and box plants. No salvage value was expected to be obtained at the end of their lives me management would decide whether or notStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started