Answered step by step

Verified Expert Solution

Question

1 Approved Answer

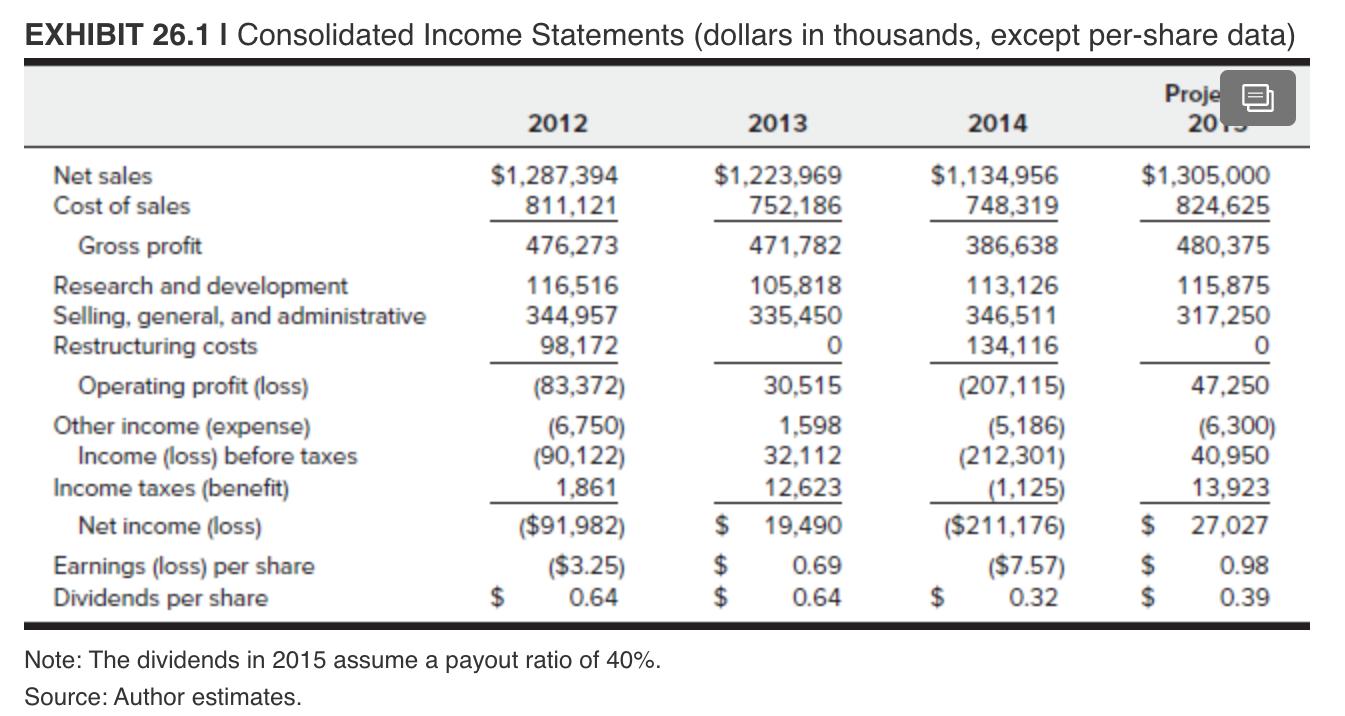

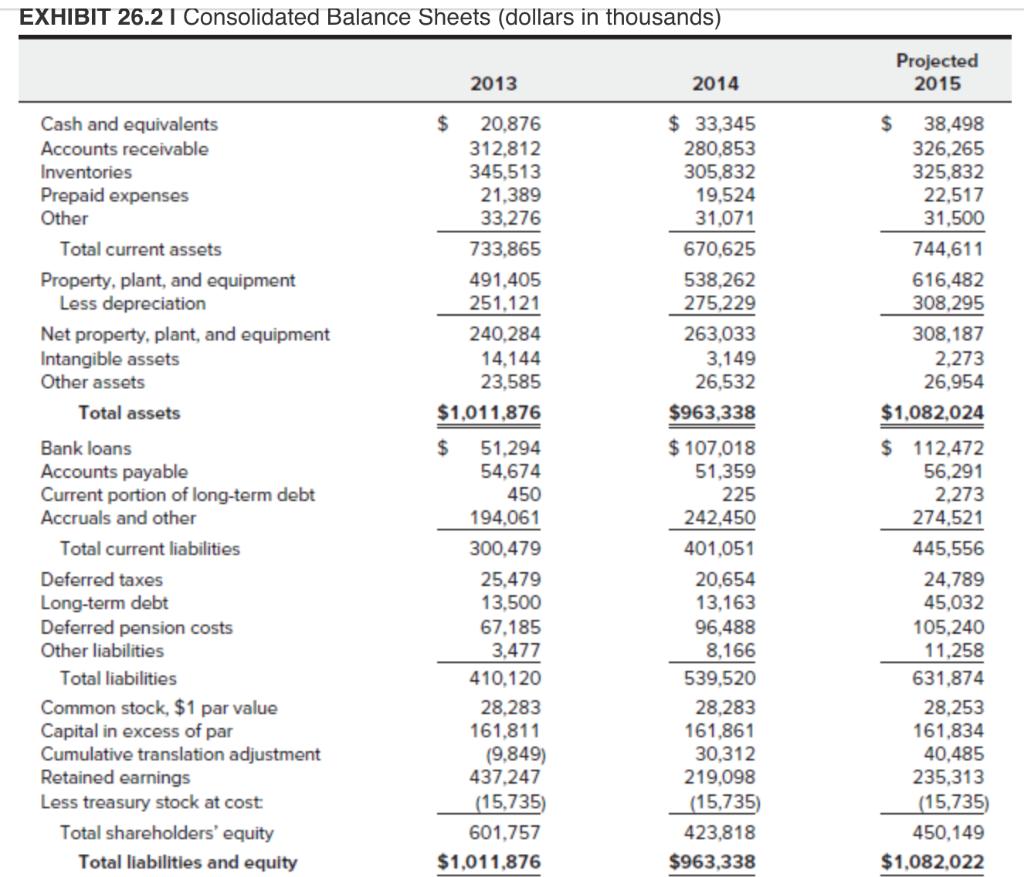

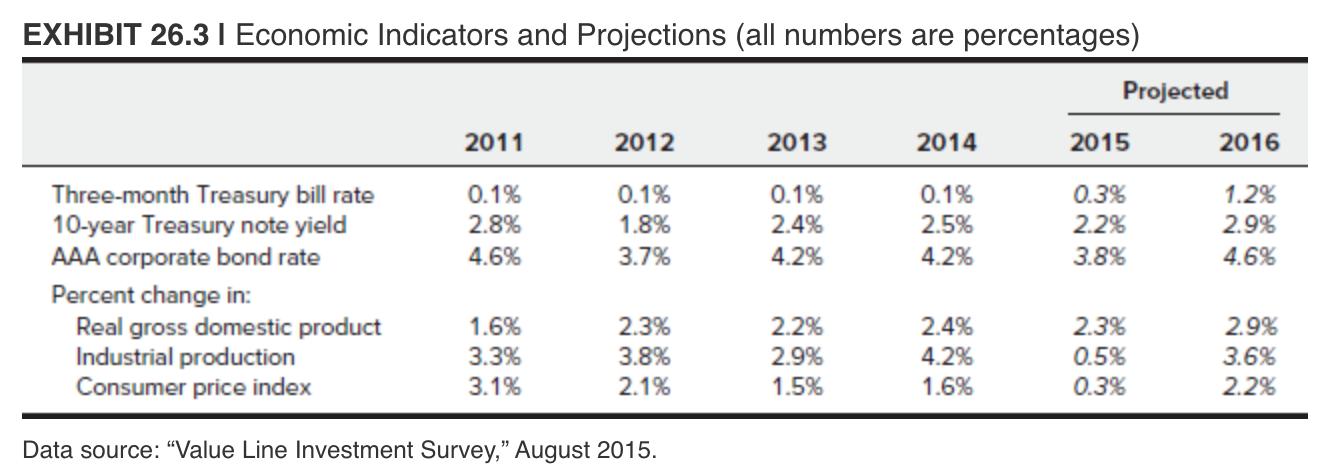

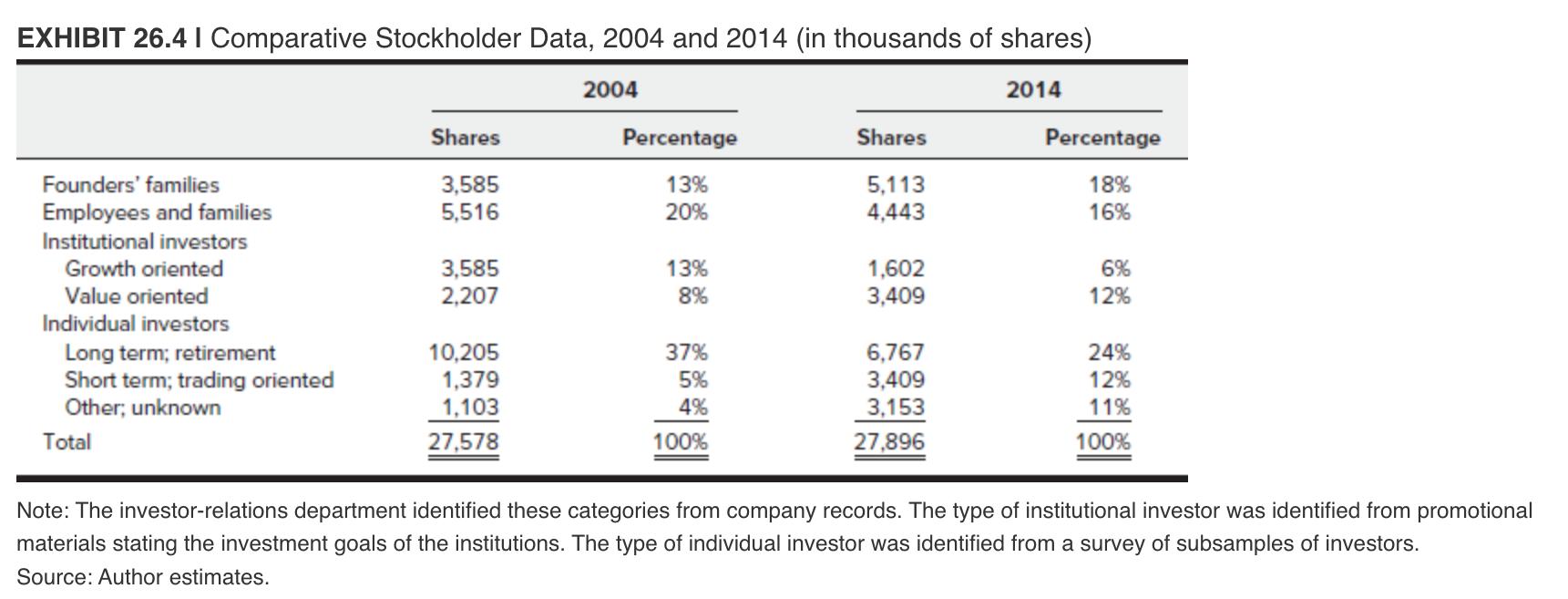

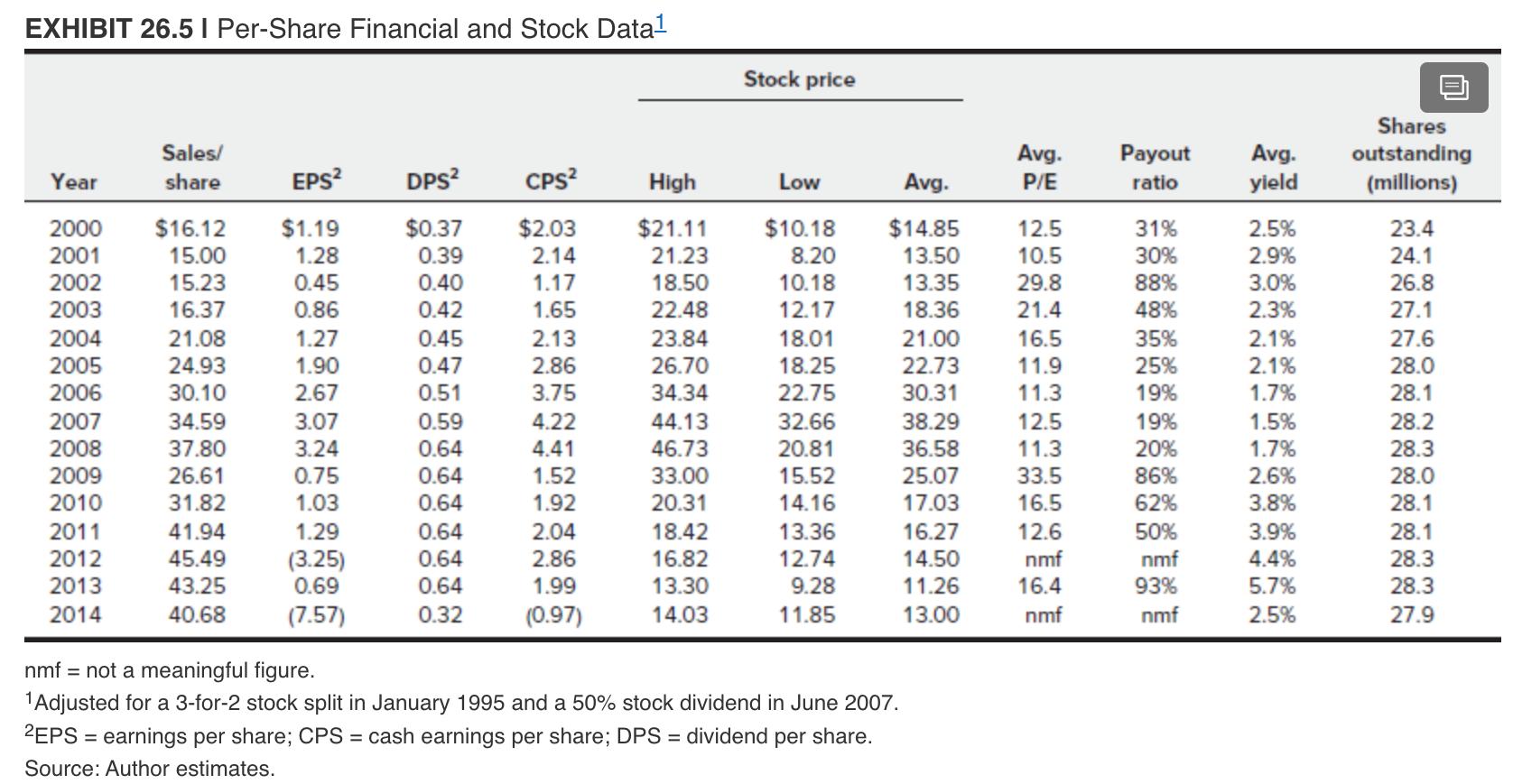

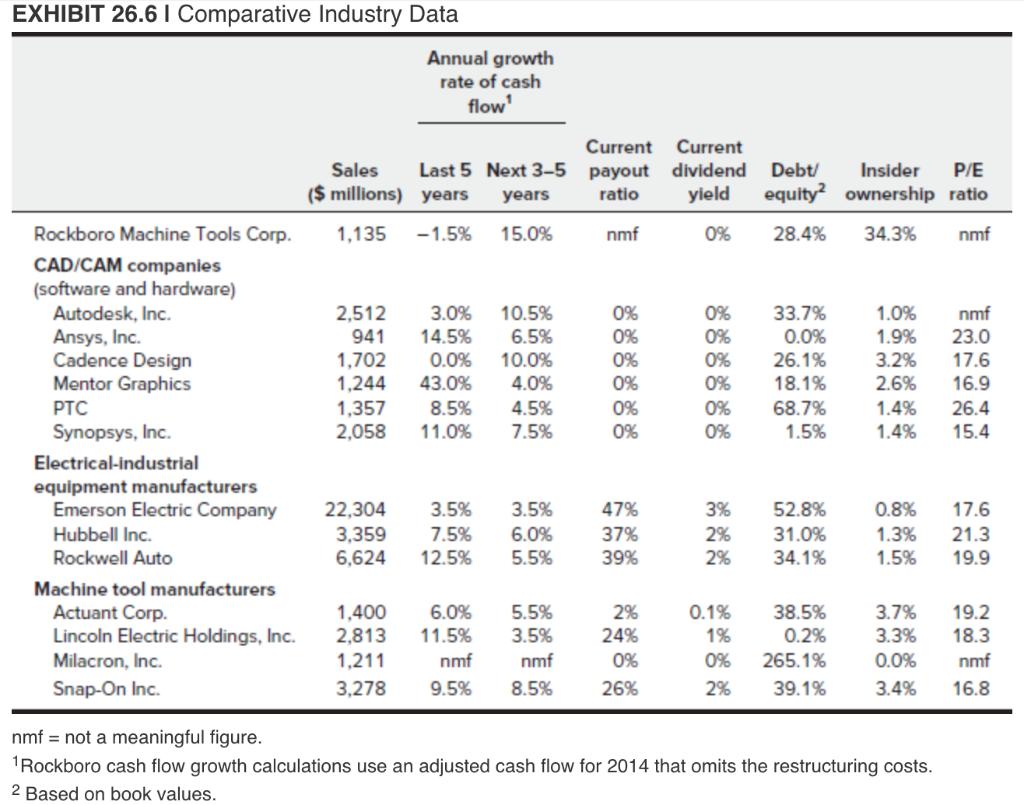

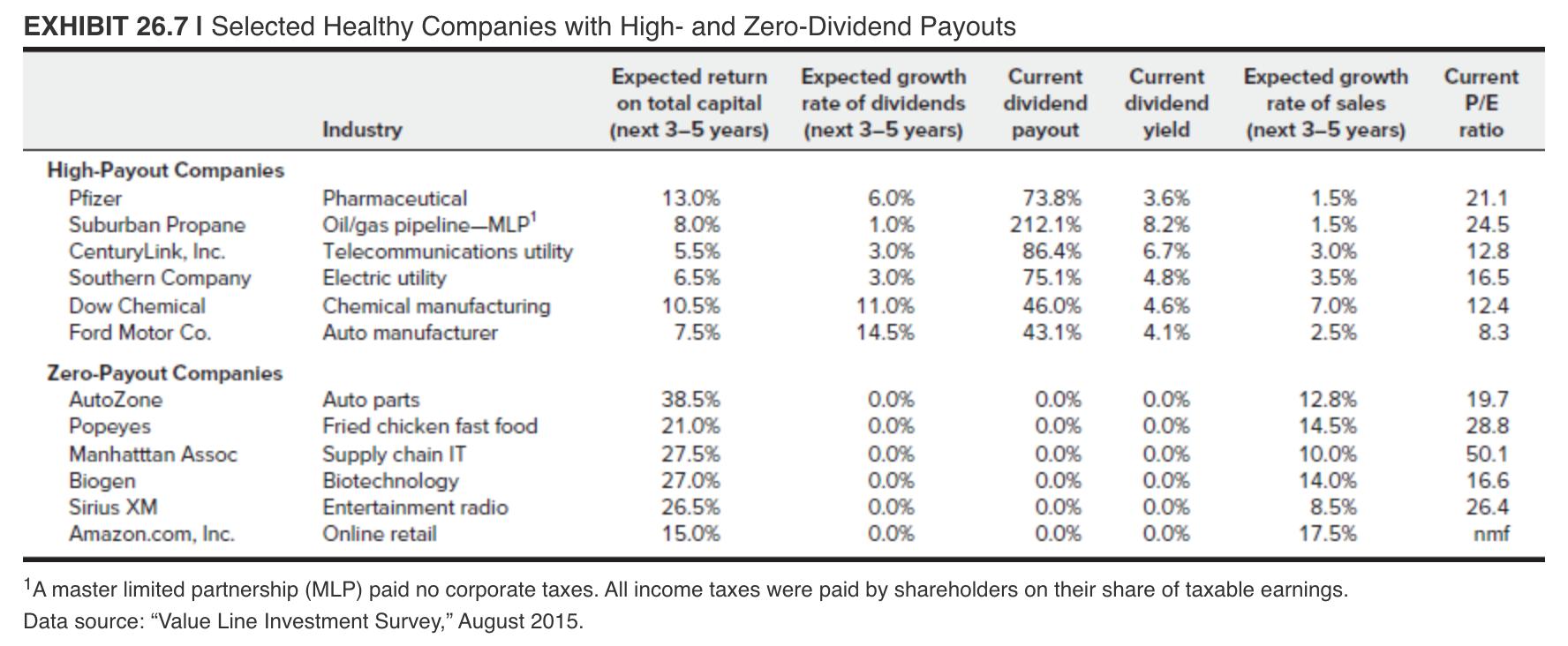

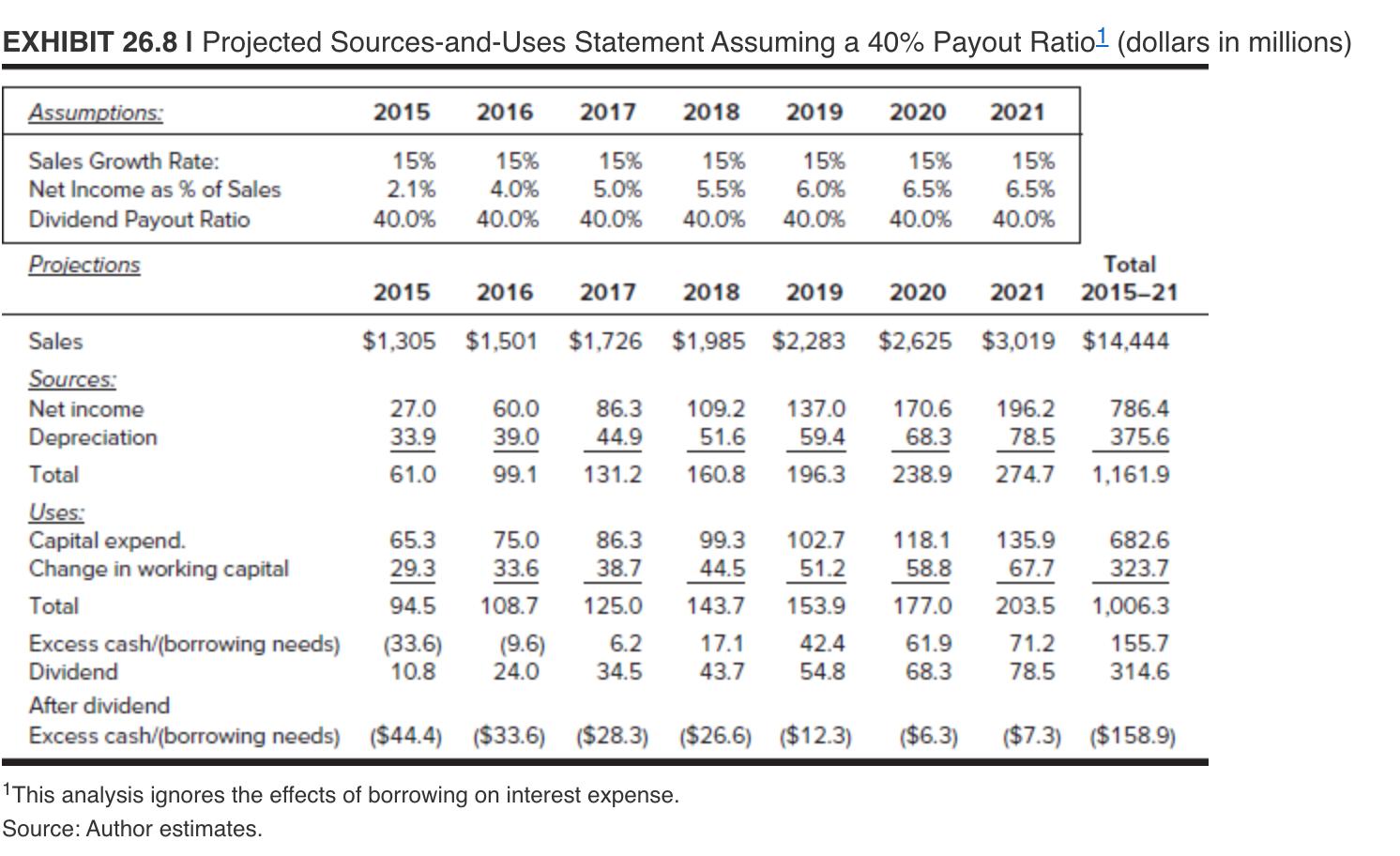

What should Larson recommend? You can use numbers from the case Exhibits 26.1-8 and the analysis above to justify your argument. EXHIBIT 26.1 I Consolidated

What should Larson recommend? You can use numbers from the case Exhibits 26.1-8 and the analysis above to justify your argument.

EXHIBIT 26.1 I Consolidated Income Statements (dollars in thousands, except per-share data) Net sales Cost of sales Gross profit Research and development Selling, general, and administrative Restructuring costs Operating profit (loss) Other income (expense) Income (loss) before taxes Income taxes (benefit) Net income (loss) Earnings (loss) per share Dividends per share 2012 $1,287,394 811,121 476,273 116,516 344,957 98,172 (83,372) (6,750) (90,122) 1,861 ($91,982) ($3.25) 0.64 $ Note: The dividends in 2015 assume a payout ratio of 40%. Source: Author estimates. 2013 $1,223,969 752,186 471,782 105,818 335,450 30,515 1,598 32,112 12,623 $ 19,490 $ $ 0.69 0.64 2014 $1,134,956 748,319 386,638 113,126 346,511 134,116 (207,115) (5,186) (212,301) (1,125) ($211,176) $ ($7.57) 0.32 Proje $ $ 2015 $1,305,000 824,625 480,375 115,875 317,250 0 47,250 (6,300) 40,950 13,923 $ 27,027 0.98 0.39

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Larson should recommend the following based on the analysis and information provided in the case 1 D...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started