Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What should your Accounting Firm do about the $350,000 of forklift trucks which were expensed by the Corporate Controller? Bob, of course, tells you

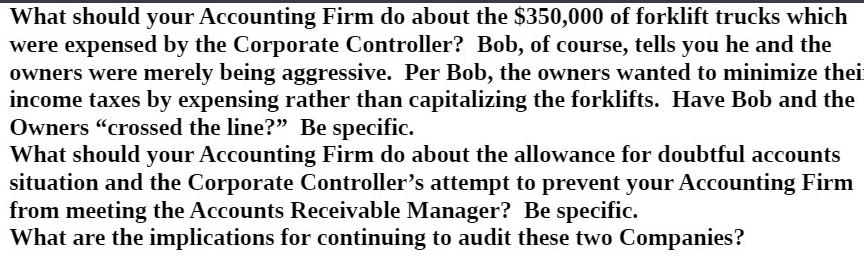

What should your Accounting Firm do about the $350,000 of forklift trucks which were expensed by the Corporate Controller? Bob, of course, tells you he and the owners were merely being aggressive. Per Bob, the owners wanted to minimize thei income taxes by expensing rather than capitalizing the forklifts. Have Bob and the Owners "crossed the line?" Be specific. What should your Accounting Firm do about the allowance for doubtful accounts situation and the Corporate Controller's attempt to prevent your Accounting Firm from meeting the Accounts Receivable Manager? Be specific. What are the implications for continuing to audit these two Companies?

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Regarding the forklift trucks if they meet the capitalization criteria set by Generally Accepted Accounting Principles GAAP they should have been capi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started