Answered step by step

Verified Expert Solution

Question

1 Approved Answer

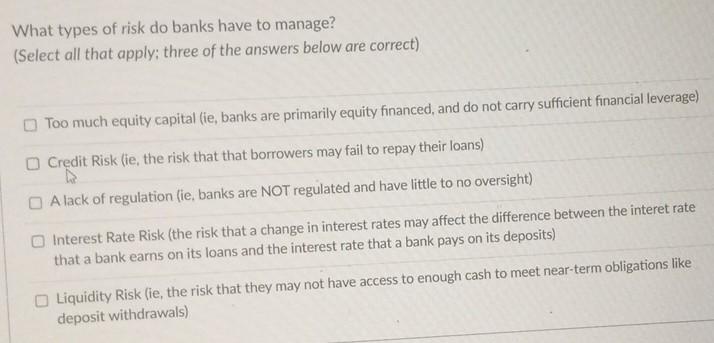

What types of risk do banks have to manage? (Select all that apply; three of the answers below are correct) Too much equity capital (ie,

What types of risk do banks have to manage? (Select all that apply; three of the answers below are correct) Too much equity capital (ie, banks are primarily equity financed, and do not carry sufficient financial leverage) Credit Risk (ie, the risk that that borrowers may fail to repay their loans) A lack of regulation (ie, banks are NOT regulated and have little to no oversight) Interest Rate Risk (the risk that a change in interest rates may affect the difference between the interet rate that a bank earns on its loans and the interest rate that a bank pays on its deposits) Liquidity Risk (ie, the risk that they may not have access to enough cash to meet near-term obligations like deposit withdrawals)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started