Question

What variables (i.e., interest rates, inflation, unemployment, and so forth) impact PepsiCo financial decision and strategic objectives. Scenario: You have been hired by a prominent

What variables (i.e., interest rates, inflation, unemployment, and so forth) impact PepsiCo financial decision and strategic objectives. Scenario:

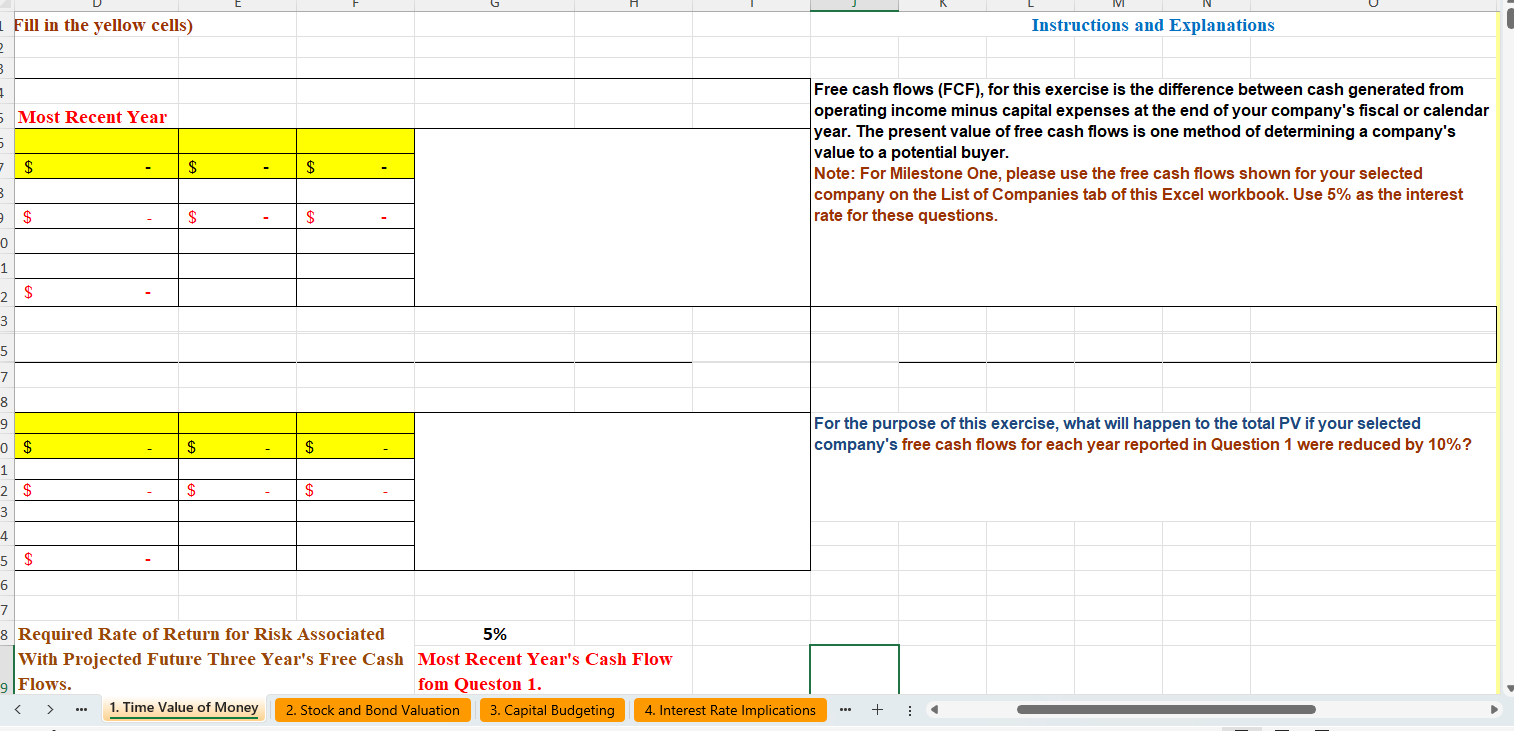

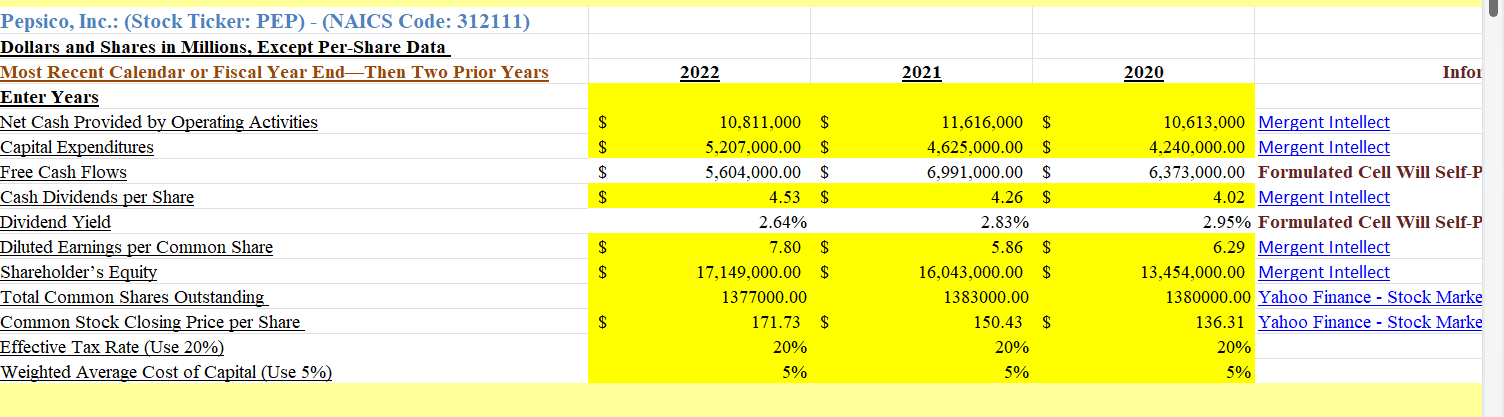

You have been hired by a prominent financial consulting firm known for its expertise in providing data-driven insights to corporations seeking to make informed investment decisions. Your firm has a reputation for delivering accurate financial analyses that aid companies in identifying profitable investment opportunities. Prompt Calculate time value of money figures and use the results to support your explanations of the present and future value of your selected company. Complete your calculations on the Time Value of Money tab in the Spreadsheet. Specifically, the following critical elements must be addressed: Time Value of Money Spreadsheet, calculate the following time value of money figures: Calculate the present value of your selected company based on the given interest rate and free cash flows for the latest three fiscal or calendar year-end values you entered into your selected company in the Spreadsheet. Suppose the risk of your selected company were to change. This change is based on an unanticipated decrease of 10% annually in the free cash flows during the latest three fiscal or calendar year-end values you entered into the Final Project Student Spreadsheet. Recalculate the present value of the company. Suppose that a potential buyer has offered to buy your selected company in three years. Your selected company has projected that the free cash flows will increase by 3% annually over the next three years. Based on the initial present value you calculated above in A1, and the projected free cash flow increases mentioned above, what is a reasonable amount for the potential buyer to pay for your selected company three years into the future? Note that the potential buyer has a required rate of return (discount rate) of 9% to account for the uncertainty that your selected company's potential 3% annual increases in free cash flows over the next three years does not occur. Enter your answer and justify your reasoning in the Microsoft Word document. What are the implications of the change in present value based on risk? In other words, what does the change mean to your selected company, and how would you, as a financial manager, interpret it? Based on the present value of your selected company that you calculated, and being mindful of the need to effectively balance portfolio risk with return, what recommendation would you make about purchasing the company as an investment at that future price?. In your written analysis, support your claims by using appropriate references and citations using proper APA style where required. reference for PepsiCo Financial #: Pepsico, Inc.: (Stock Ticker: PEP) - (NAICS Code: 312111) Dollars and Shares in Millions, Except Per-Share Data Most Recent Calendar or Fiscal Year End?Then Two Prior Years 2022 2021 2020 Information Location Enter Years Net Cash Provided by Operating Activities $10,811,000 $11,616,000 $10,613,000 Mergent Intellect Capital Expenditures $5,207,000.00 $4,625,000.00 $4,240,000.00 Mergent Intellect Free Cash Flows $5,604,000.00 $6,991,000.00 $6,373,000.00 Formulated Cell Will Self-Populate (Do Not Change) Cash Dividends per Share $4.53 $4.26 $4.02 Mergent Intellect Dividend Yield 2.64% 2.83% 2.95% Formulated Cell Will Self-Populate (Do Not Change) Diluted Earnings per Common Share $7.80 $5.86 $6.29 Mergent Intellect Shareholder's Equity $17,149,000.00 $16,043,000.00 $13,454,000.00 Mergent Intellect Total Common Shares Outstanding 1377000.00 1383000.00 1380000.00 Yahoo Finance - Stock Market Live, Quotes, Business & Finance News Enter stock ticker symbol - Click Financials - Click Balance Sheet - Bottom line is Ordinary Shares Outstanding Common Stock Closing Price per Share $171.73 $150.43 $136.31 Yahoo Finance - Stock Market Live, Quotes, Business & Finance News Enter stock ticker symbol - Search - Historical Data - Chart - 5 Years - Use Calendar Year or Fiscal Year End Date Effective Tax Rate (Use 20%) 20% 20% 20% Weighted Average Cost of Capital (Use 5%) 5% 5% 5% provide each questions and create charts, for question 1) Free cash flows (FCF), for this exercise is the difference between cash generated from operating income minus capital expenses at the end of your company's fiscal or calendar year. The present value of free cash flows is one method of determining a company's value to a potential buyer. Note: For Milestone One, please use the free cash flows shown for your selected company on the List of Companies tab of this Excel workbook. Use 5% as the interest rate for these questions. 2) For the purpose of this exercise, what will happen to the total PV if your selected company's free cash flows for each year reported in Question 1 were reduced by 10%? 3) Your selected company is projecting that free cash flows for the next three (3) years will increase by 3% annually. Using the Most Recent Year's free cash flows from Question 1 above, increase each of the future free cash flows by 3% (will self-populate in the yellow highlighted cells). As there is a chance that these increases may not occur as projected, a buyer who may be willing to purchase the company before the increases occur, will account for this risk by using a required rate of return of 9%. What price would the potential buyer be willing to pay based upon the known free cash flows and the future projected free cash flows?

Fill in the yellow cells) 2 3 5 Most Recent Year $ Instructions and Explanations Free cash flows (FCF), for this exercise is the difference between cash generated from operating income minus capital expenses at the end of your company's fiscal or calendar year. The present value of free cash flows is one method of determining a company's value to a potential buyer. Note: For Milestone One, please use the free cash flows shown for your selected company on the List of Companies tab of this Excel workbook. Use 5% as the interest rate for these questions. 5 7 $ $ B 9 $ $ $ 0 1 3 5 8 9 0 $ $ $ 1 $ 2 $ 3 4 5 $ 6 For the purpose of this exercise, what will happen to the total PV if your selected company's free cash flows for each year reported in Question 1 were reduced by 10%? 7 8 Required Rate of Return for Risk Associated With Projected Future Three Year's Free Cash 9 Flows. 5% Most Recent Year's Cash Flow fom Queston 1. < > ... 1. Time Value of Money 2. Stock and Bond Valuation 3. Capital Budgeting 4. Interest Rate Implications + :

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To analyze the impact of various variables on PepsiCos financial decisions and strategic objectives we can consider the following factors 1 Interest R...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started