- What was AMCs debt ratio on December 31, 2020, compared to December 31, 2019? Did the debt ratio improve or decline for AMC during 2020? Please show the basis of your calculation of the debt ratios and summerize the challenges that AMC faced during 2020 that led to the change in AMCs debt ratio you calculated.

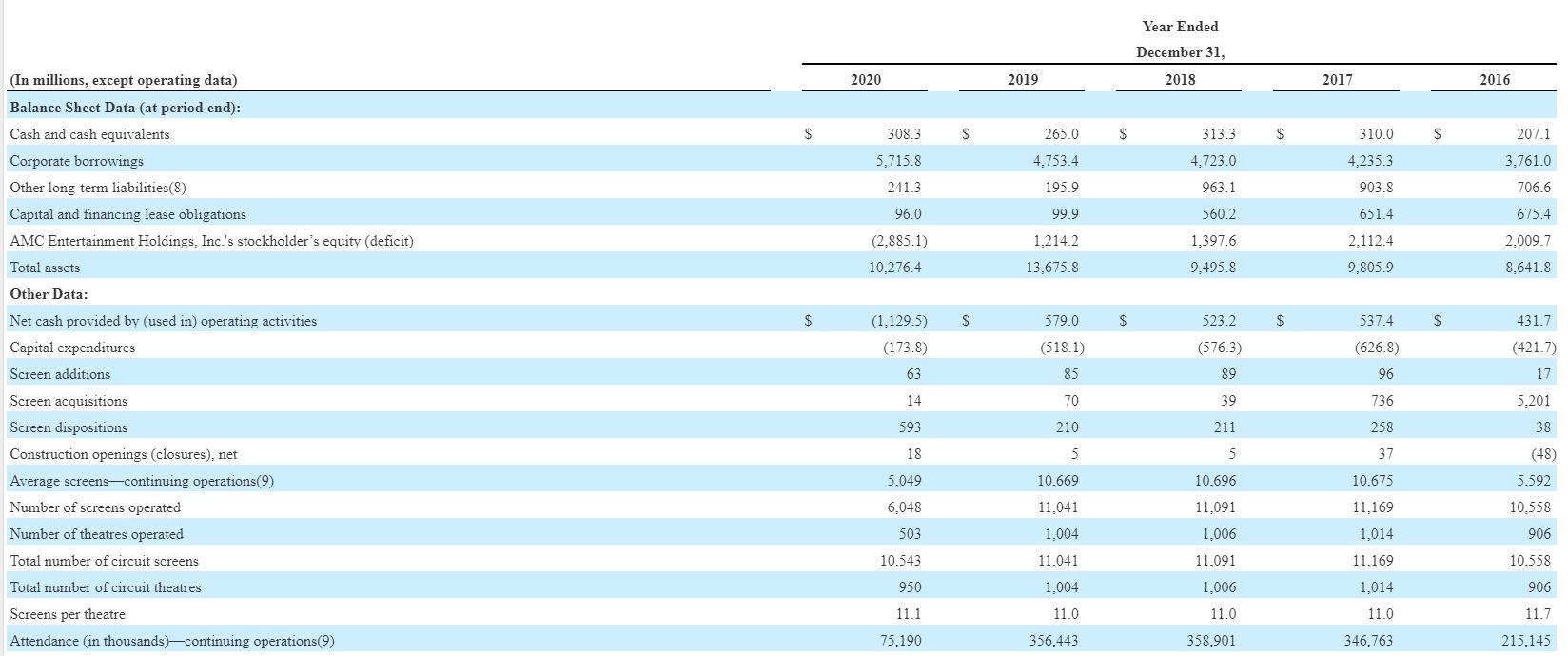

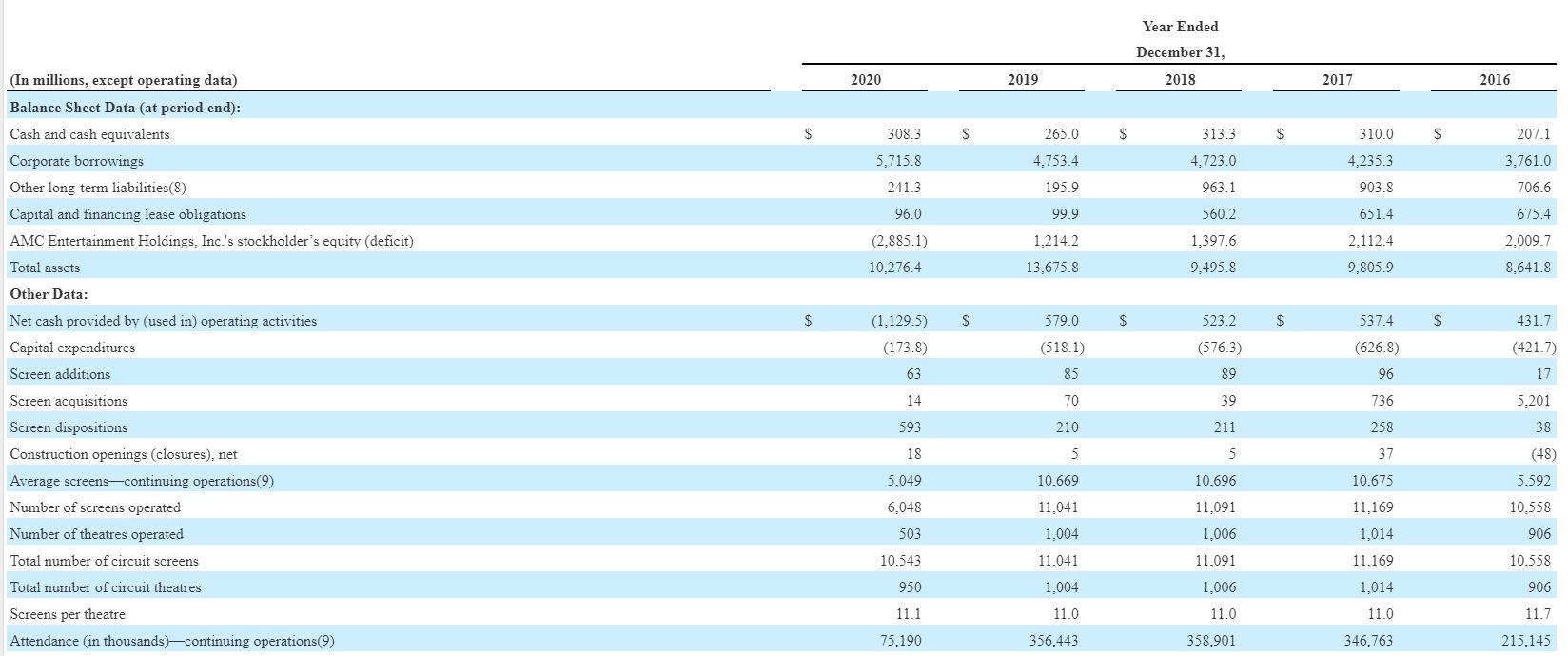

Year Ended December 31, 2018 2020 2019 2017 2016 $ 308.3 S 265.0 $ 313.3 $ 310.0 S 207.1 4.753.4 4.723.0 4,2353 3.761.0 5.715.8 241.3 195.9 963.1 903.8 706.6 96.0 99.9 560.2 651.4 675.4 2.009.7 (2.885.1) 1,397.6 1.214.2 13,675.8 2.112.4 9,805.9 10,276.4 9,495.8 8.641.8 $ S 579.0 $ 523.2 $ 537.4 S 431.7 (1,129.5) (173.8) (576.3) (626.8) (In millions, except operating data) Balance Sheet Data (at period end): Cash and cash equivalents Corporate borrowings Other long-term liabilities(8) Capital and financing lease obligations AMC Entertainment Holdings. Inc.'s stockholder's equity (deficit) Total assets Other Data: Net cash provided by (used in) operating activities Capital expenditures Screen additions Screen acquisitions Screen dispositions Construction openings (closures), net Average screens-continuing operations(9) Number of screens operated Number of theatres operated Total number of circuit screens Total number of circuit theatres Screens per theatre Attendance (in thousands)continuing operations(9) (518.1) 85 (421.7) 17 63 89 96 14 70 39 5.201 736 258 593 210 211 38 18 5 5 37 (48) 5.049 10.669 10,696 10.675 5.592 11,091 11.169 10.558 6,048 503 11,041 1,004 1,014 906 11.041 1,006 11.091 1,006 11.169 10,543 950 10,558 1,004 1,014 906 11.1 11.0 11.0 11.0 11.7 215.145 75,190 356.443 358,901 346,763 Year Ended December 31, 2018 2020 2019 2017 2016 $ 308.3 S 265.0 $ 313.3 $ 310.0 S 207.1 4.753.4 4.723.0 4,2353 3.761.0 5.715.8 241.3 195.9 963.1 903.8 706.6 96.0 99.9 560.2 651.4 675.4 2.009.7 (2.885.1) 1,397.6 1.214.2 13,675.8 2.112.4 9,805.9 10,276.4 9,495.8 8.641.8 $ S 579.0 $ 523.2 $ 537.4 S 431.7 (1,129.5) (173.8) (576.3) (626.8) (In millions, except operating data) Balance Sheet Data (at period end): Cash and cash equivalents Corporate borrowings Other long-term liabilities(8) Capital and financing lease obligations AMC Entertainment Holdings. Inc.'s stockholder's equity (deficit) Total assets Other Data: Net cash provided by (used in) operating activities Capital expenditures Screen additions Screen acquisitions Screen dispositions Construction openings (closures), net Average screens-continuing operations(9) Number of screens operated Number of theatres operated Total number of circuit screens Total number of circuit theatres Screens per theatre Attendance (in thousands)continuing operations(9) (518.1) 85 (421.7) 17 63 89 96 14 70 39 5.201 736 258 593 210 211 38 18 5 5 37 (48) 5.049 10.669 10,696 10.675 5.592 11,091 11.169 10.558 6,048 503 11,041 1,004 1,014 906 11.041 1,006 11.091 1,006 11.169 10,543 950 10,558 1,004 1,014 906 11.1 11.0 11.0 11.0 11.7 215.145 75,190 356.443 358,901 346,763