What was the WACC for Heinz at the start of fiscal year 2010? What were the WACC one year earlier?

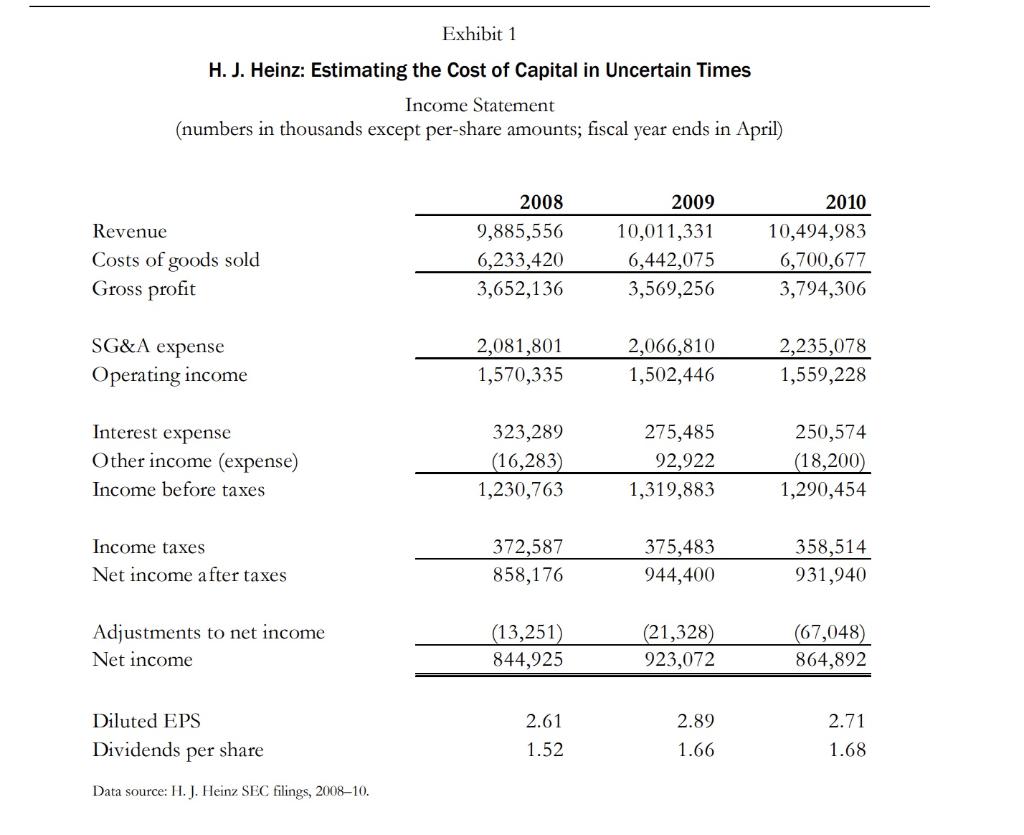

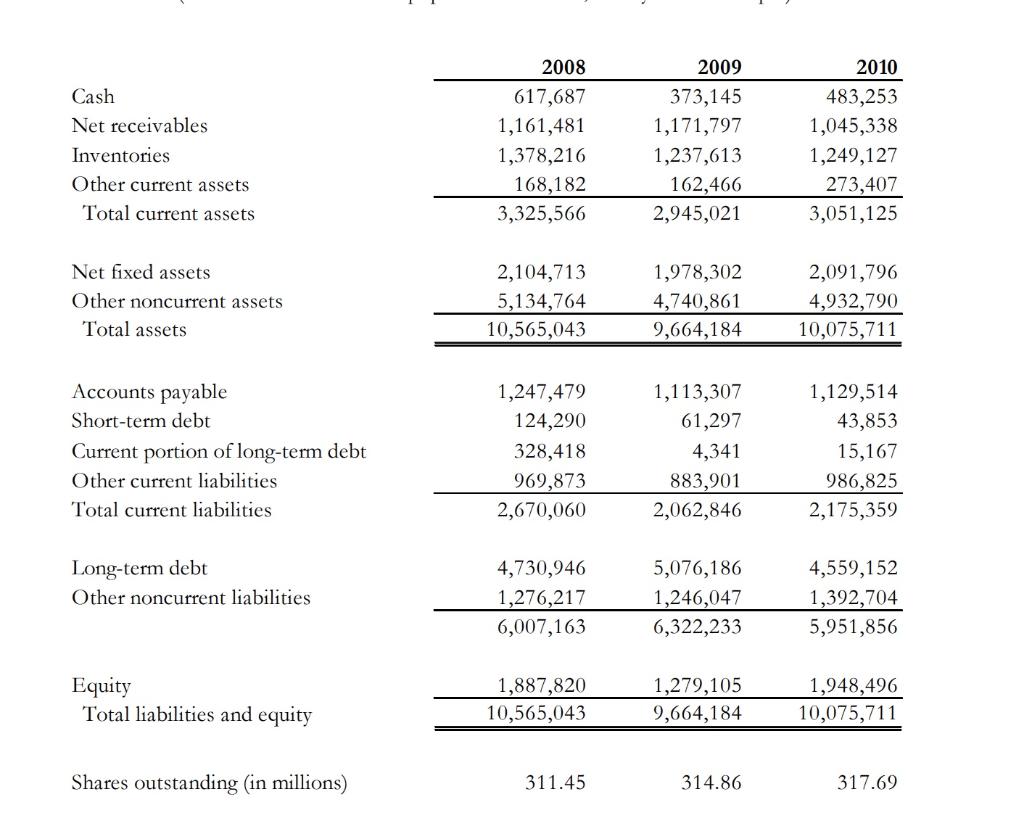

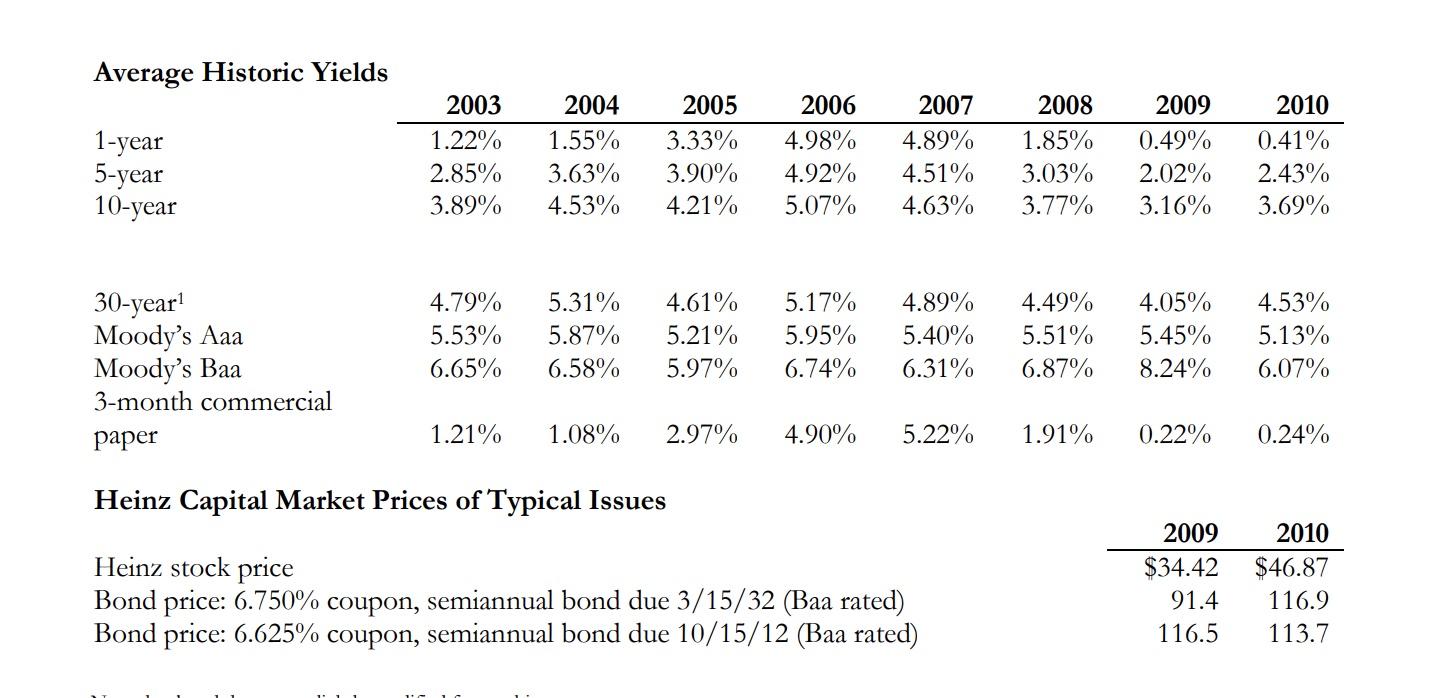

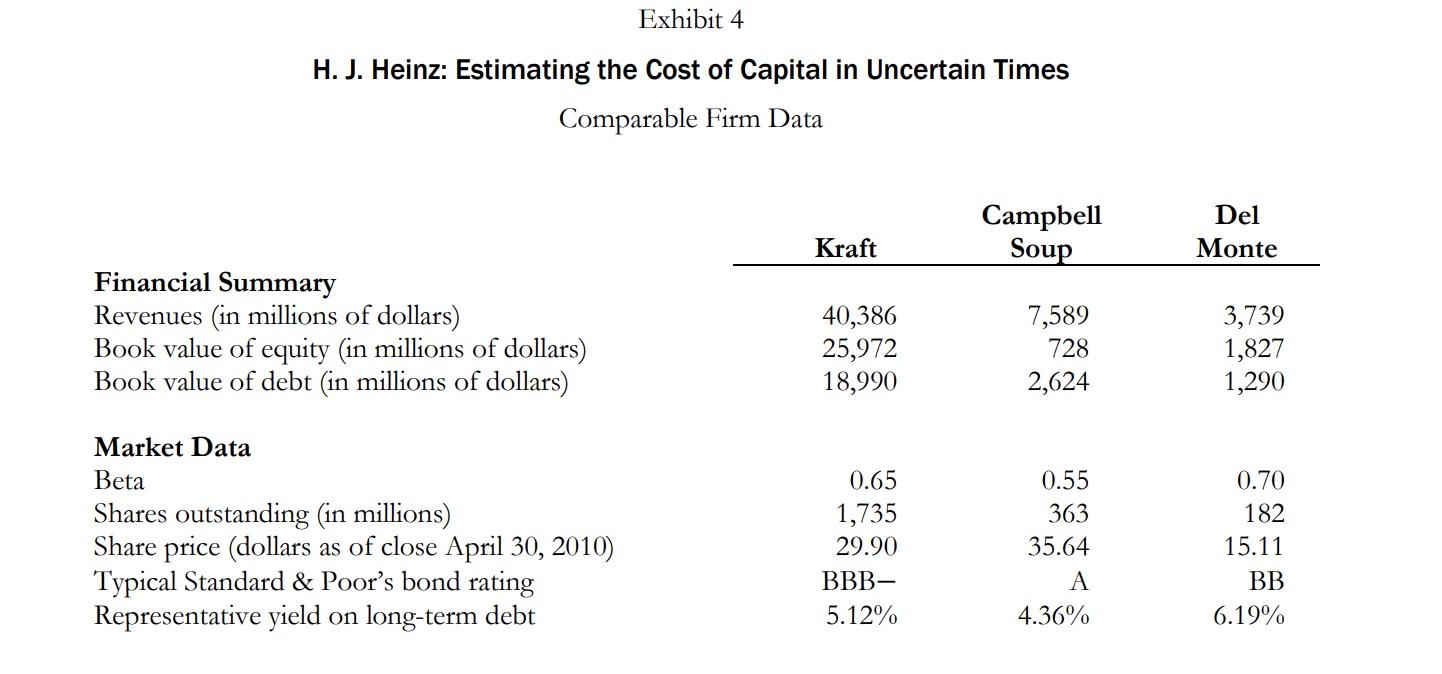

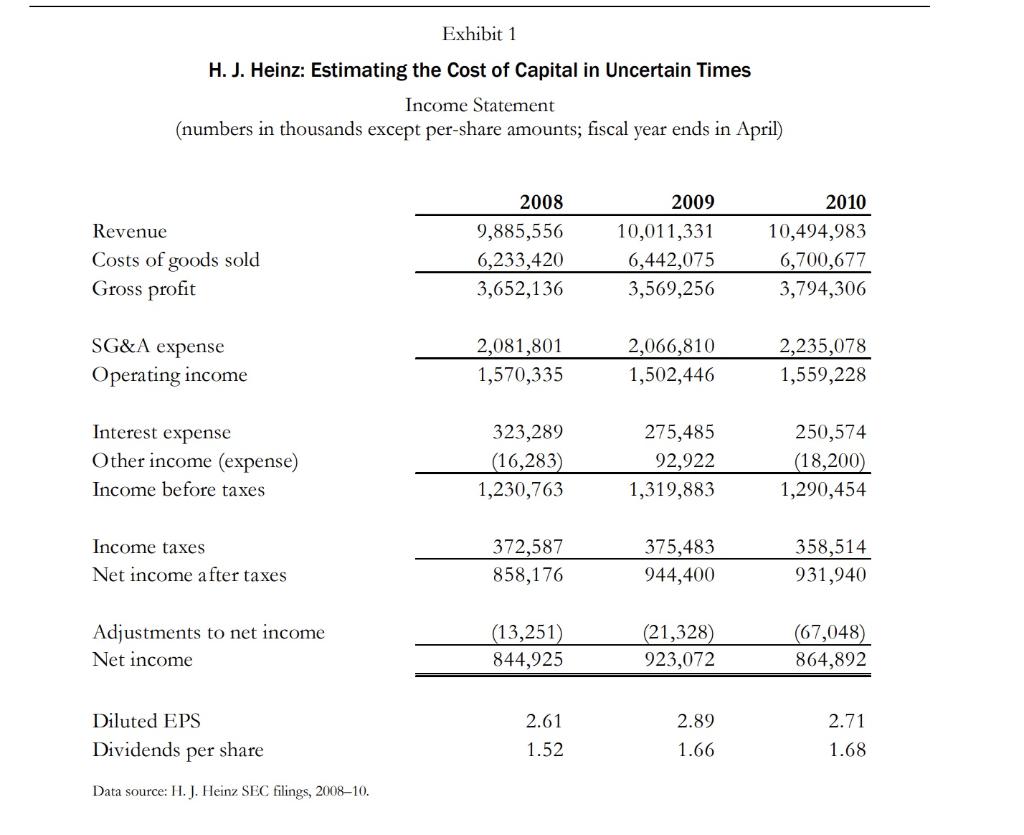

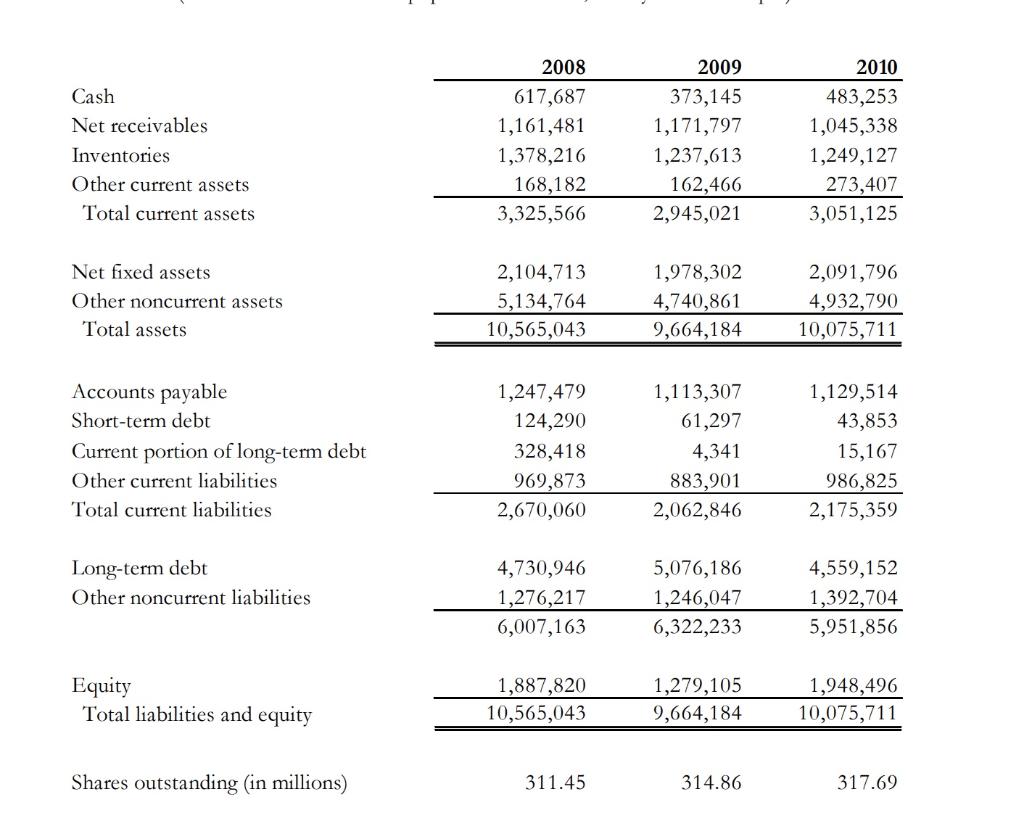

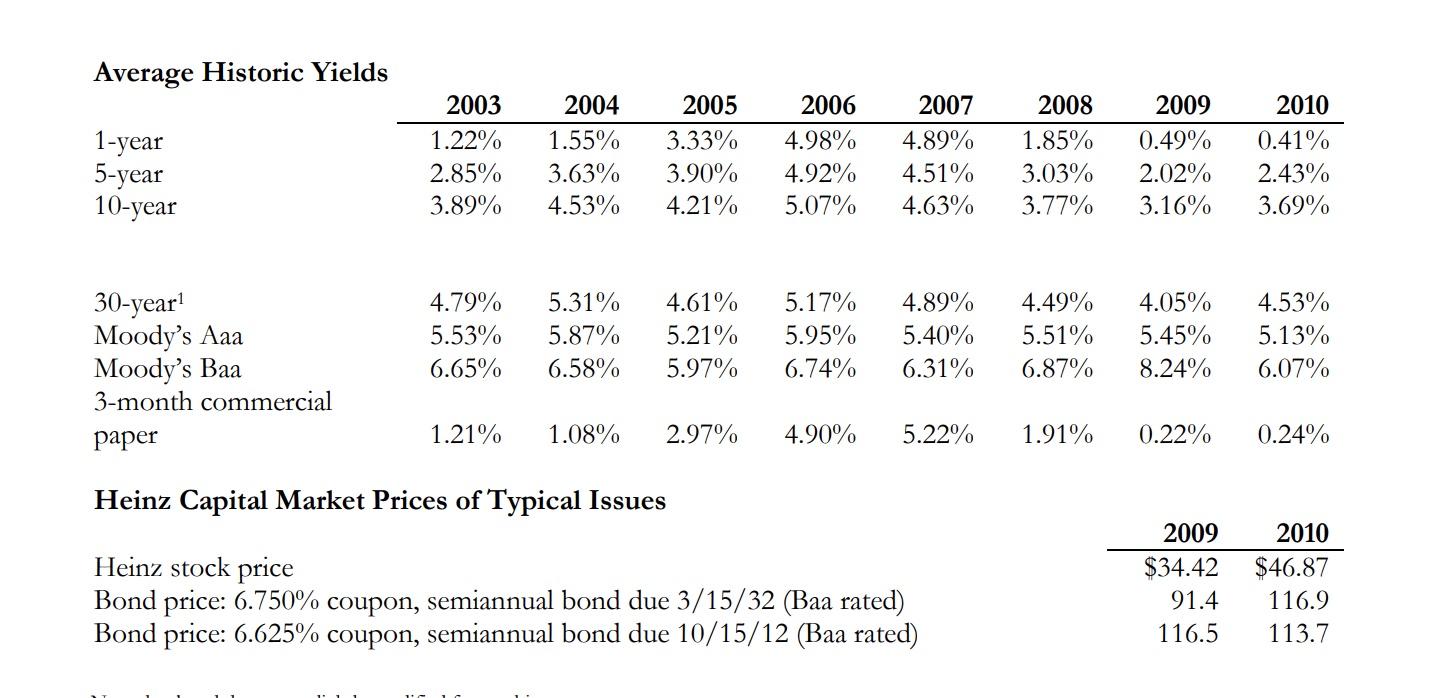

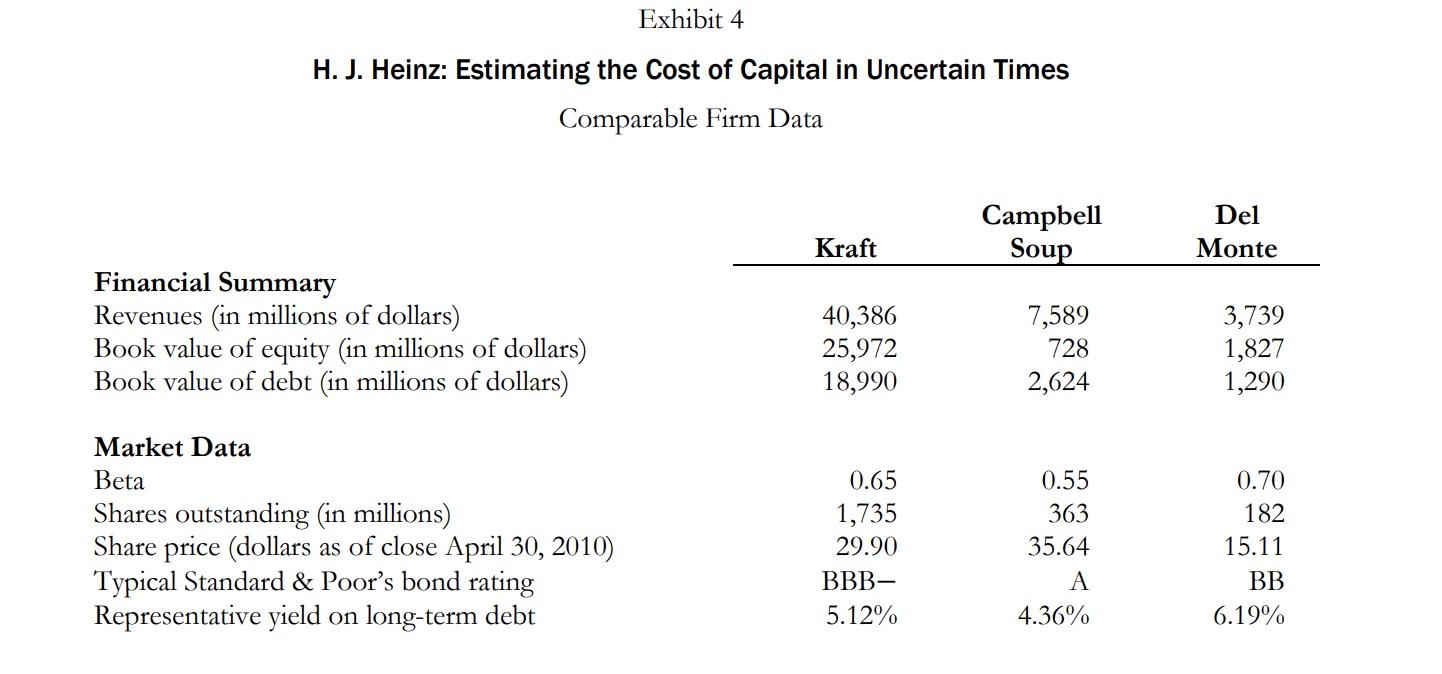

H. J. Heinz: Estimating the Cost of Capital in Uncertain Times Income Statement (numbers in thousands except per-share amounts; fiscal year ends in April) Cash Net receivables Inventories Other current assets Total current assets Net fixed assets Other noncurrent assets Total assets \begin{tabular}{rrr} 2008 & 2009 & 2010 \\ \hline 617,687 & 373,145 & 483,253 \\ 1,161,481 & 1,171,797 & 1,045,338 \\ 1,378,216 & 1,237,613 & 1,249,127 \\ 168,182 & 162,466 & 273,407 \\ \hline 3,325,566 & 2,945,021 & 3,051,125 \\ & & \\ 2,104,713 & 1,978,302 & 2,091,796 \\ 5,134,764 & 4,740,861 & 4,932,790 \\ \hline 10,565,043 & 9,664,184 & 10,075,711 \\ \hline \hline \end{tabular} Accounts payable Short-term debt Current portion of long-term Other current liabilities Total current liabilities Long-term debt Other noncurrent liabilities Equity Total liabilities and equity \begin{tabular}{rrr} 1,887,820 & 1,279,105 & 1,948,496 \\ \hline 10,565,043 & 9,664,184 & 10,075,711 \\ \hline \hline \end{tabular} Shares outstanding (in millions) 311.45314.86 317.69 Average Historic Yields \begin{tabular}{lrrrrrrrr} & 2003 & 2004 & 2005 & 2006 & 2007 & 2008 & 2009 & 2010 \\ \cline { 2 - 8 } 1-year & 1.22% & 1.55% & 3.33% & 4.98% & 4.89% & 1.85% & 0.49% & 0.41% \\ 5-year & 2.85% & 3.63% & 3.90% & 4.92% & 4.51% & 3.03% & 2.02% & 2.43% \\ 10-year & 3.89% & 4.53% & 4.21% & 5.07% & 4.63% & 3.77% & 3.16% & 3.69% \end{tabular} 30-yearMoodysAaaMoodysBaa3-monthcommercialpaper4.79%5.53%6.65%1.21%5.31%5.87%6.58%1.08%4.61%5.21%5.97%2.97%5.17%5.95%6.74%4.90%4.89%5.40%6.31%5.22%4.49%5.51%6.87%1.91%4.05%5.45%8.24%0.22%4.53%5.13%6.07%0.24% Heinz Capital Market Prices of Typical Issues Heinz stock price \begin{tabular}{rr} 2009 & 2010 \\ \hline$34.42 & $46.87 \\ 91.4 & 116.9 \\ 116.5 & 113.7 \end{tabular} H. J. Heinz: Estimating the Cost of Capital in Uncertain Times Comparable Firm Data H. J. Heinz: Estimating the Cost of Capital in Uncertain Times Income Statement (numbers in thousands except per-share amounts; fiscal year ends in April) Cash Net receivables Inventories Other current assets Total current assets Net fixed assets Other noncurrent assets Total assets \begin{tabular}{rrr} 2008 & 2009 & 2010 \\ \hline 617,687 & 373,145 & 483,253 \\ 1,161,481 & 1,171,797 & 1,045,338 \\ 1,378,216 & 1,237,613 & 1,249,127 \\ 168,182 & 162,466 & 273,407 \\ \hline 3,325,566 & 2,945,021 & 3,051,125 \\ & & \\ 2,104,713 & 1,978,302 & 2,091,796 \\ 5,134,764 & 4,740,861 & 4,932,790 \\ \hline 10,565,043 & 9,664,184 & 10,075,711 \\ \hline \hline \end{tabular} Accounts payable Short-term debt Current portion of long-term Other current liabilities Total current liabilities Long-term debt Other noncurrent liabilities Equity Total liabilities and equity \begin{tabular}{rrr} 1,887,820 & 1,279,105 & 1,948,496 \\ \hline 10,565,043 & 9,664,184 & 10,075,711 \\ \hline \hline \end{tabular} Shares outstanding (in millions) 311.45314.86 317.69 Average Historic Yields \begin{tabular}{lrrrrrrrr} & 2003 & 2004 & 2005 & 2006 & 2007 & 2008 & 2009 & 2010 \\ \cline { 2 - 8 } 1-year & 1.22% & 1.55% & 3.33% & 4.98% & 4.89% & 1.85% & 0.49% & 0.41% \\ 5-year & 2.85% & 3.63% & 3.90% & 4.92% & 4.51% & 3.03% & 2.02% & 2.43% \\ 10-year & 3.89% & 4.53% & 4.21% & 5.07% & 4.63% & 3.77% & 3.16% & 3.69% \end{tabular} 30-yearMoodysAaaMoodysBaa3-monthcommercialpaper4.79%5.53%6.65%1.21%5.31%5.87%6.58%1.08%4.61%5.21%5.97%2.97%5.17%5.95%6.74%4.90%4.89%5.40%6.31%5.22%4.49%5.51%6.87%1.91%4.05%5.45%8.24%0.22%4.53%5.13%6.07%0.24% Heinz Capital Market Prices of Typical Issues Heinz stock price \begin{tabular}{rr} 2009 & 2010 \\ \hline$34.42 & $46.87 \\ 91.4 & 116.9 \\ 116.5 & 113.7 \end{tabular} H. J. Heinz: Estimating the Cost of Capital in Uncertain Times Comparable Firm Data