Answered step by step

Verified Expert Solution

Question

1 Approved Answer

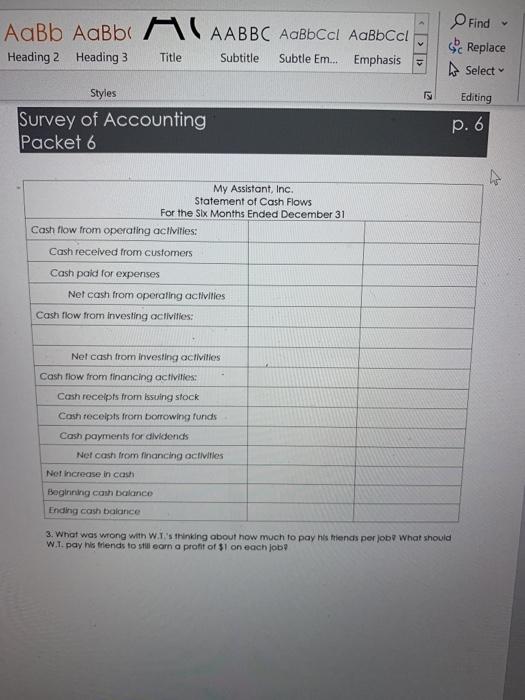

In August, W.1. decided his goal of a $500 cash balance was a bit too conservative. After all, he'd like to be able to

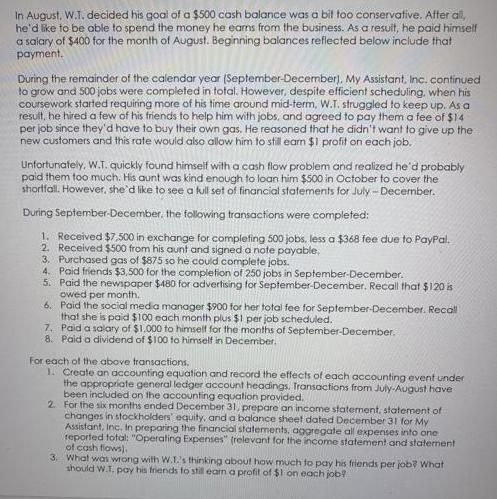

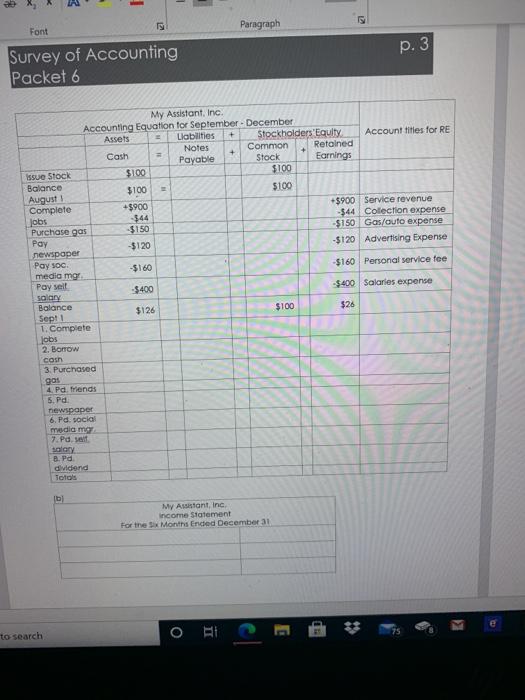

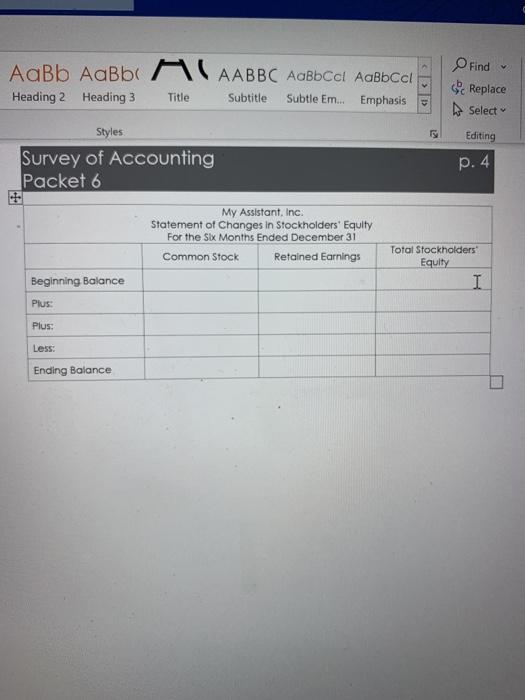

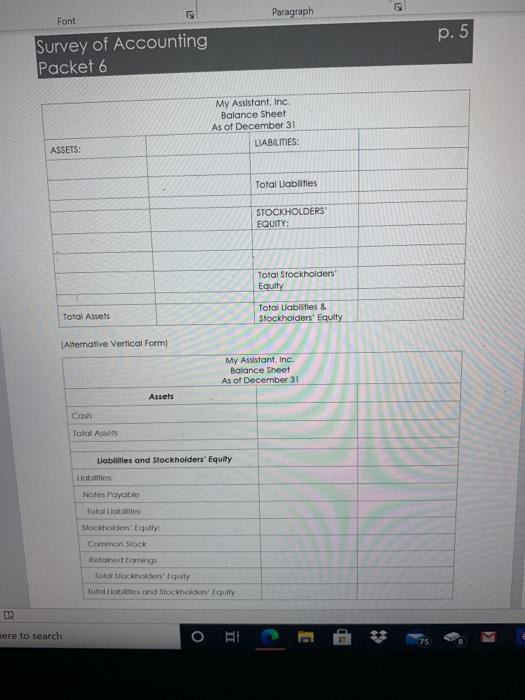

In August, W.1. decided his goal of a $500 cash balance was a bit too conservative. After all, he'd like to be able to spend the money he earns from the business. As a result, he paid himself a salary of $400 for the month of August. Beginning balances reflected below include that payment. During the remainder of the calendar year (September-December). My Assistant, Inc. continued to grow and 500 jobs were completed in total. However, despite efficient scheduling, when his coursework started requiring more of his time around mid-term, W.T. struggled to keep up. As a result, he hired a few of his friends to help him with jobs, and agreed to pay them a fee of $14 per job since they'd have to buy their own gas. He reasoned that he didn't want to give up the new customers and this rate would also allow him to still earn $1 profit on each job. Unfortunately, W.T. quickly found himself with a cash flow problem and realized he'd probably paid them too much. His aunt was kind enough to loan him $500 in October to cover the shortfall. However, she'd like to see a full set of financial statements for July-December. During September-December, the following transactions were completed: 1. Received $7,500 in exchange for completing 500 jobs. less a $368 fee due to PayPal. 2. Received $500 from his aunt and signed a note payable, 3. Purchased gas of $875 so he could complete jobs. 4. Paid friends $3,500 for the completion of 250 jobs in September-December. 5. Paid the newspaper $480 for advertising for September-December. Recall that $120 is owed per month. 6. Paid the social media manager $900 for her total fee for September-December. Recall that she is paid $100 each month plus $1 per job scheduled. 7. Paid a salary of $1,000 to himself for the months of September-December. 8. Paid a dividend of $100 to himself in December. For each of the above transactions. 1. Create an accounting equation and record the effects of each accounting event under the appropriate general ledger account headings. Transactions from July-August have been included on the accounting equation provided. 2. For the six months ended December 31, prepare an income statement, statement of changes in stockholders' equity, and a balance sheet dated December 31 for My Assistant, Inc. In preparing the financial statements, aggregate all expenses into one reported total: "Operating Expenses" (relevant for the income statement and statement of cash flows). 3. What was wrong with W.1.'s thinking about how much to pay his friends per job? What should W.T. pay his friends to still eam a profit of $1 on each job! Font Survey of Accounting Packet 6 Issue Stock Balance August 1 Complete Jobs Purchase gas Pay newspaper Pay soc. media mgr. Pay self salary Balance My Assistant, Inc. Accounting Equation for September-December. Assets Llabilities = + Cash Sept 1 1. Complete jobs 2. Borrow to search cosh 3. Purchased gas 4. Pd. friends 5. Pd. newspaper 6. Pd. social media mar 7.Pd. self salary 8. Pd. dividend Totals [b] $100 $100 +$900 -$44 -$150 -$120 -$160 -$400 $126 T = Notes Payable Paragraph + O II Stockholders'Equity Common Stock $100 $100 My Assistant, Inc. income Statement For the Six Months Ended December 31, $100 C Retained Earnings 12 p. 3 Account titles for RE +$900 Service revenue -$44 Collection expense -$150 Gas/auto expense -$120 Advertising Expense -$160 Personal service fee -$400 Salaries expense $26 AaBb AaBb AABBC AaBbCcl AaBbCcl Heading 2 Heading 3 Subtitle Subtle Em... Emphasis P Styles Survey of Accounting Packet 6 Beginning Balance Plus: Title Plus: Less: Ending Balance My Assistant, Inc. Statement of Changes in Stockholders' Equity For the Six Months Ended December 31 Common Stock Retained Earnings F O Find Replace Select Editing p. 4 Total Stockholders Equity V I DO Font Survey of Accounting Packet 6 ASSETS: Total Assets (Alternative Vertical Form) ere to search Cash Total Assets Liabilities: 5 Assets Notes Payable Total Liabilities Liabilities and Stockholders' Equity My Assistant, Inc. Balance Sheet As of December 31 LIABILITIES: O Stockholders' Equity Common Stock Retained Eamings Total Stockhokden Equity Total Liabanes and Stockholders Equity Paragraph Hi Total Liabilities STOCKHOLDERS' EQUITY: My Assistant, Inc. Balance Sheet As of December 31 Total Stockholders' Equity Total Ulabilities & Stockholders' Equity # S p. 5 AaBb AaBb AABBC AaBbCcl AaBbCcl Heading 2 Heading 3 Subtitle Subtle Em... Emphasis Title Styles Survey of Accounting Packet 6 My Assistant, Inc. Statement of Cash Flows For the Six Months Ended December 31 Cash flow from operating activities: Cash received from customers Cash paid for expenses Net cash from operating activities Cash flow from investing activities: Net cash from investing activities Cash flow from financing activities: Cash receipts from issuing stock Cash receipts from borrowing funds Cash payments for dividends Net increase in cash Beginning cash balance Ending cash balance i Net cash from financing activities Ty O Find 3. What was wrong with W.T.'s thinking about how much to pay his friends per job? What should W.T. pay his friends to still earn a profit of $1 on each job? Replace Select Editing p. 6

Step by Step Solution

★★★★★

3.56 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Let me provide some sample values and show the journal entries for eac...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started