Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What were the advantages that Waste Management was seeking through this case? Unsupported Changes to the Estimated Useful Lives of Assets From 1988 through 1996,

What were the advantages that Waste Management was seeking through this case?

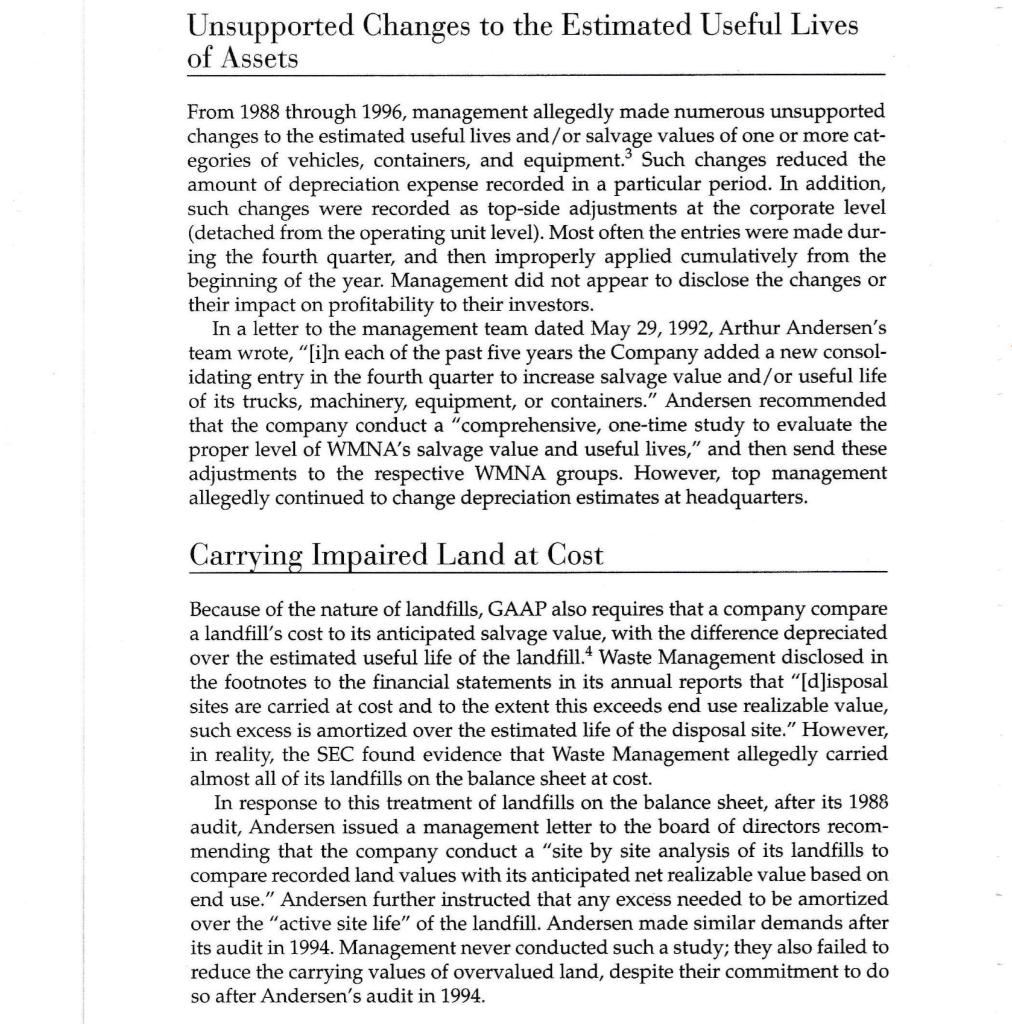

Unsupported Changes to the Estimated Useful Lives of Assets From 1988 through 1996, management allegedly made numerous unsupported changes to the estimated useful lives and/or salvage values of one or more cat- egories of vehicles, containers, and equipment. Such changes reduced the amount of depreciation expense recorded in a particular period. In addition, such changes were recorded as top-side adjustments at the corporate level (detached from the operating unit level). Most often the entries were made dur- ing the fourth quarter, and then improperly applied cumulatively from the beginning of the year. Management did not appear to disclose the changes or their impact on profitability to their investors. In a letter to the management team dated May 29, 1992, Arthur Andersen's team wrote, "[i]n each of the past five years the Company added a new consol- idating entry in the fourth quarter to increase salvage value and/or useful life of its trucks, machinery, equipment, or containers." Andersen recommended that the company conduct a "comprehensive, one-time study to evaluate the proper level of WMNA's salvage value and useful lives," and then send these adjustments to the respective WMNA groups. However, top management allegedly continued to change depreciation estimates at headquarters. Carrying Impaired Land at Cost Because of the nature of landfills, GAAP also requires that a company compare a landfill's cost to its anticipated salvage value, with the difference depreciated over the estimated useful life of the landfill.4 Waste Management disclosed in the footnotes to the financial statements in its annual reports that "[d]isposal sites are carried at cost and to the extent this exceeds end use realizable value, such excess is amortized over the estimated life of the disposal site." However, in reality, the SEC found evidence that Waste Management allegedly carried almost all of its landfills on the balance sheet at cost. In response to this treatment of landfills on the balance sheet, after its 1988 audit, Andersen issued a management letter to the board of directors recom- mending that the company conduct a "site by site analysis of its landfills to compare recorded land values with its anticipated net realizable value based on end use." Andersen further instructed that any excess needed to be amortized over the "active site life" of the landfill. Andersen made similar demands after its audit in 1994. Management never conducted such a study; they also failed to reduce the carrying values of overvalued land, despite their commitment to do so after Andersen's audit in 1994.

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Perhaps the greatest advantage of waste management is keeping the environment fresh and neat These w...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started