Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What: What is the stock you want to talk about? Are you long or short the stock? Why: Your reasons for being long or

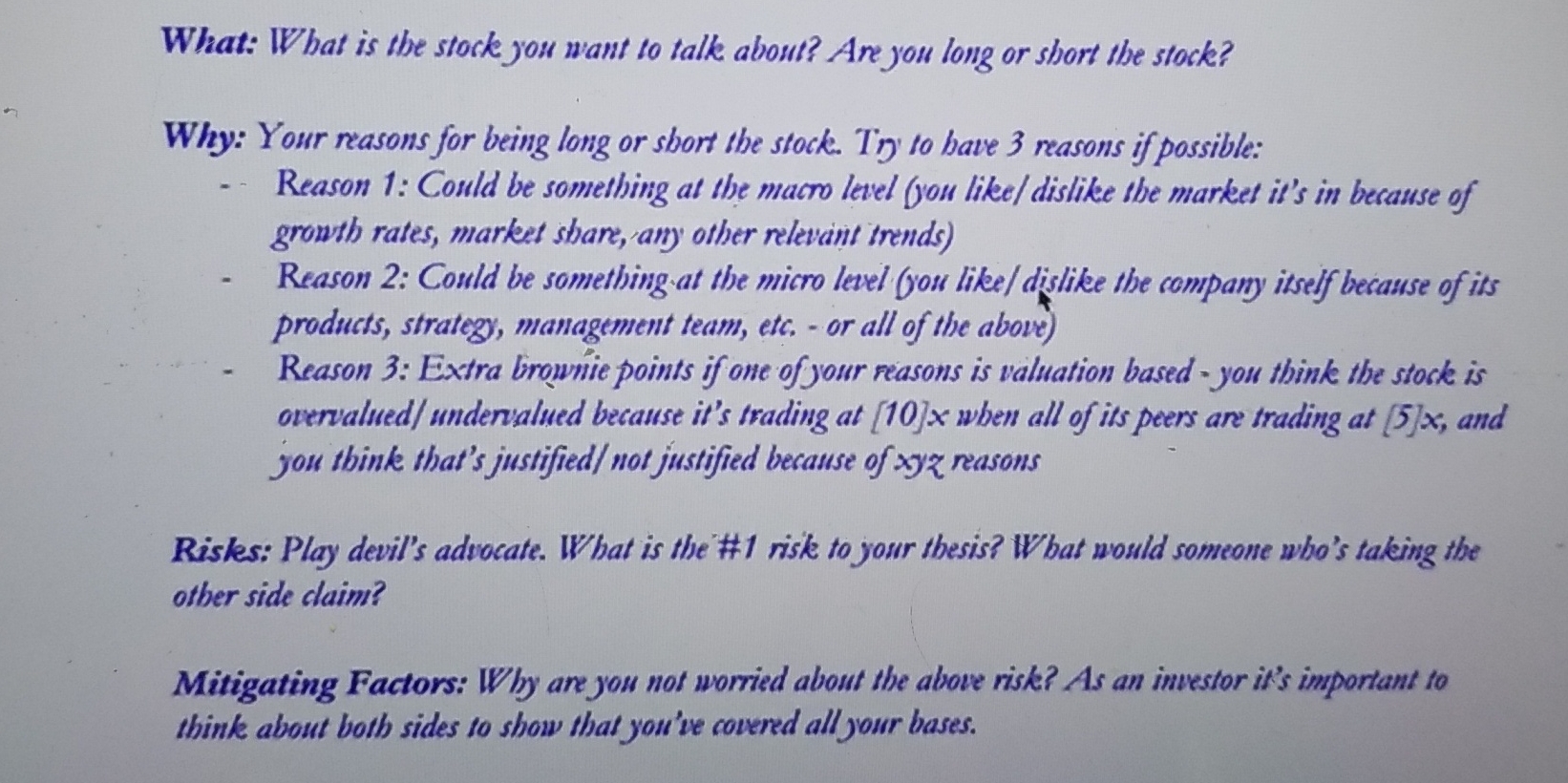

What: What is the stock you want to talk about? Are you long or short the stock? Why: Your reasons for being long or short the stock. Try to have 3 reasons if possible: Reason 1: Could be something at the macro level (you like/dislike the market it's in because of growth rates, market share, any other relevant trends) Reason 2: Could be something at the micro level (you like/dislike the company itself because of its products, strategy, management team, etc. - or all of the above) Reason 3: Extra brownie points if one of your reasons is valuation based-you think the stock is overvalued/undervalued because it's trading at [10]x when all of its peers are trading at [5]x, and you think that's justified/ not justified because of xyz reasons Risks: Play devil's advocate. What is the #1 risk to your thesis? What would someone who's taking the other side claim? Mitigating Factors: Why are you not worried about the above risk? As an investor it's important to think about both sides to show that you've covered all your bases.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started