Question

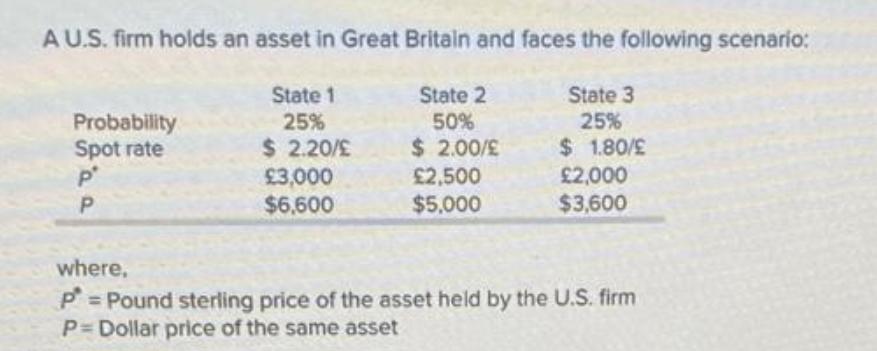

What would be an effective hedge ? A U.S. firm holds an asset in Great Britain and faces the following scenario: Probability Spot rate State

What would be an effective hedge ?

What would be an effective hedge ?

A U.S. firm holds an asset in Great Britain and faces the following scenario: Probability Spot rate State 1 25% $ 2.20/ State 2 50% $ 2.00/ State 3 25% $ 1.80/E P' 3,000 2,500 2,000 P $6,600 $5,000 $3,600 where, P=Pound sterling price of the asset held by the U.S. firm P=Dollar price of the same asset

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Understanding Cross Cultural Management

Authors: Marie Joelle Browaeys, Roger Price

3rd Edition

1292015896, 978-1292015897

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App