what would be quick assets be, it's not 54,750

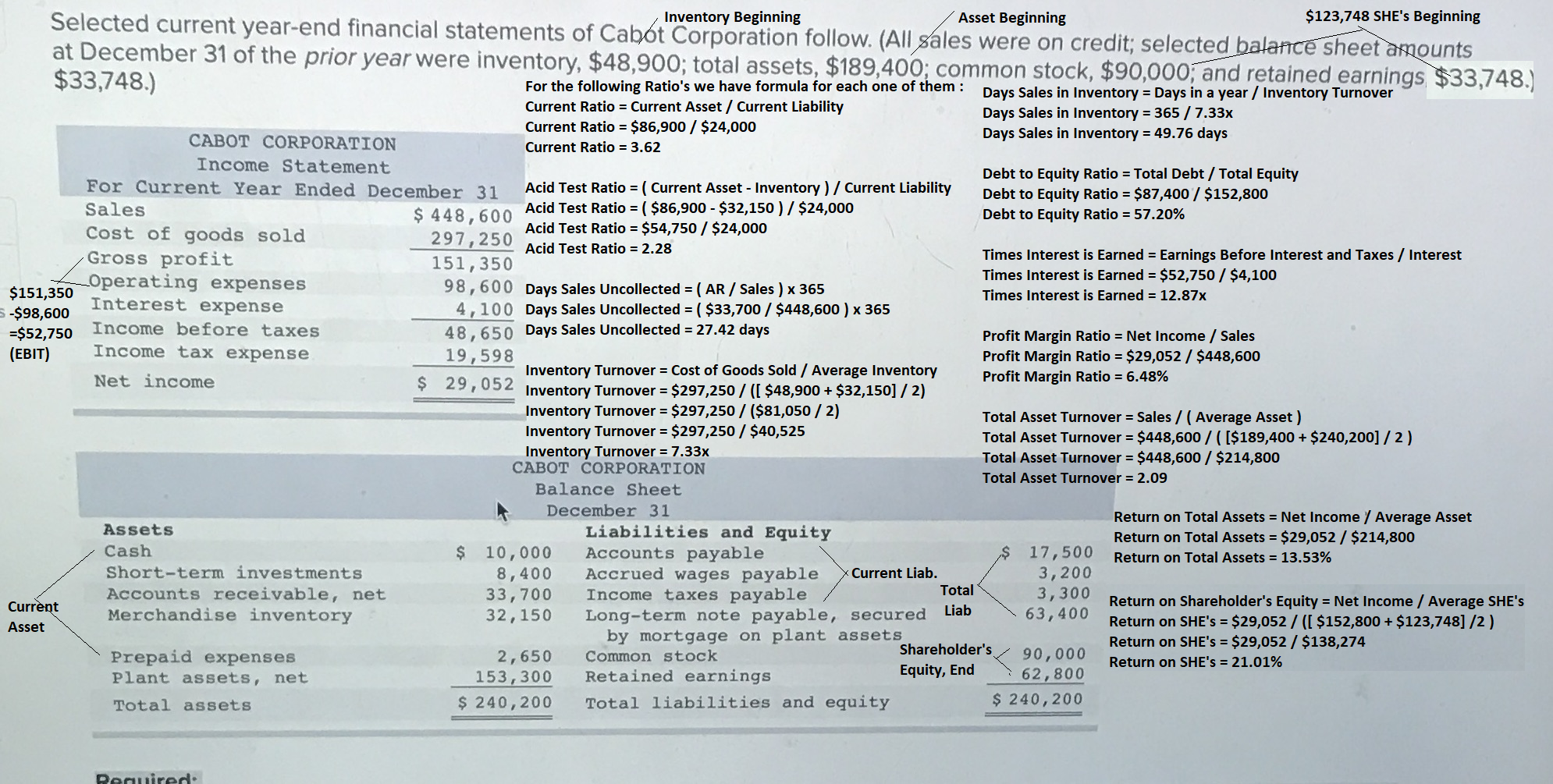

Inventory Beginning Asset Beginning $123,748 SHE's Beginning Selected current year-end financial statements of Cabot Corporation follow. (All sales were on credit; selected balance sheet amounts at December 31 of the prior year were inventory, $48,900; total assets, $189,400; common stock, $90,000; and retained earnings $33,748.) $33,748.) For the following Ratio's we have formula for each one of them : Days Sales in Inventory = Days in a year / Inventory Turnover Current Ratio = Current Asset / Current Liability CABOT CORPORATION Current Ratio = $86,900 / $24,000 Days Sales in Inventory = 365 / 7.33x Current Ratio = 3.62 Days Sales in Inventory = 49.76 days Income Statement For Current Year Ended December 31 Acid Test Ratio = ( Current Asset - Inventory ) / Current Liability Debt to Equity Ratio = Total Debt / Total Equity Sales Debt to Equity Ratio = $87,400 / $152,800 $ 448 , 600 Acid Test Ratio = ( $86,900 - $32,150 ) / $24,000 297, 250 Acid Test Ratio = $54,750 / $24,000 Debt to Equity Ratio = 57.20% Cost of goods sold Gross profit 151, 350 Acid Test Ratio = 2.28 Times Interest is Earned = Earnings Before Interest and Taxes / Interest $151,350 Operating expenses Times Interest is Earned = $52,750 / $4,100 -$98,600 Interest expense 98 , 600 Days Sales Uncollected = ( AR / Sales ) x 365 4, 100 Days Sales Uncollected = ( $33,700 / $448,600 ) x 365 Times Interest is Earned = 12.87x =$52,750 Income before taxes 48, 650 Days Sales Uncollected = 27.42 days Profit Margin Ratio = Net Income / Sales (EBIT) Income tax expense 19, 598 Profit Margin Ratio = $29,052 / $448,600 Net income $ 29, 052 Inventory Turnover = Cost of Goods Sold / Average Inventory Inventory Turnover = $297,250 / ([ $48,900 + $32,150] / 2) Profit Margin Ratio = 6.48% Inventory Turnover = $297,250 / ($81,050 / 2) Inventory Turnover = $297,250 / $40,525 Total Asset Turnover = Sales / ( Average Asset ) Inventory Turnover = 7.33x Total Asset Turnover = $448,600 / ( [$189,400 + $240,200] / 2 ) CABOT CORPORATION Total Asset Turnover = $448,600 / $214,800 Balance Sheet Total Asset Turnover = 2.09 December 31 Assets Liabilities and Equity Return on Total Assets = Net Income / Average Asset Cash $ 10, 000 Accounts payable 17 , 500 Return on Total Assets = $29,052 / $214,800 Return on Total Assets = 13.53% Short-term investments 8 , 400 Accrued wages payable Current Liab. 3, 200 Current Accounts receivable, net 33 , 700 Income taxes payable Total 3, 300 Asset Merchandise inventory 32, 150 Long-term note payable, secured Liab 63, 400 Return on Shareholder's Equity = Net Income / Average SHE's by mortgage on plant assets Return on SHE's = $29,052 / ([ $152,800 + $123,748] /2 ) Prepaid expenses 2, 650 Common stock Shareholder's 153, 300 Equity, End 90 , 000 Return on SHE's = $29,052 / $138,274 Retained earnings 62, 800 Return on SHE's = 21.01% Plant assets, net Total assets $ 240, 200 Total liabilities and equity $ 240, 200