What would be the Common Size analysis for this question:

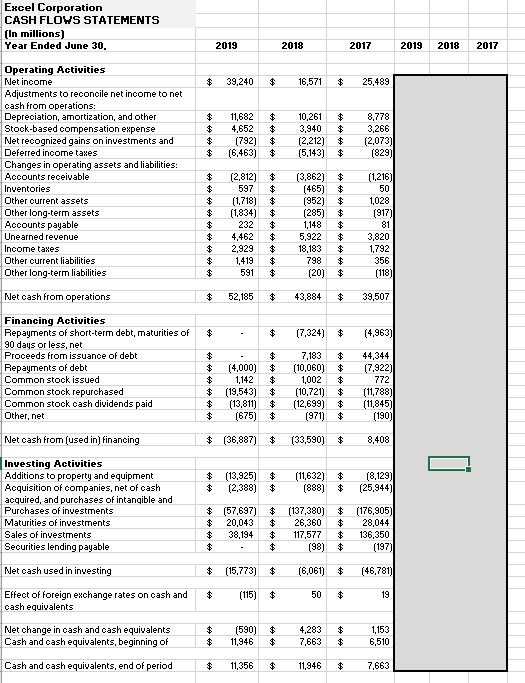

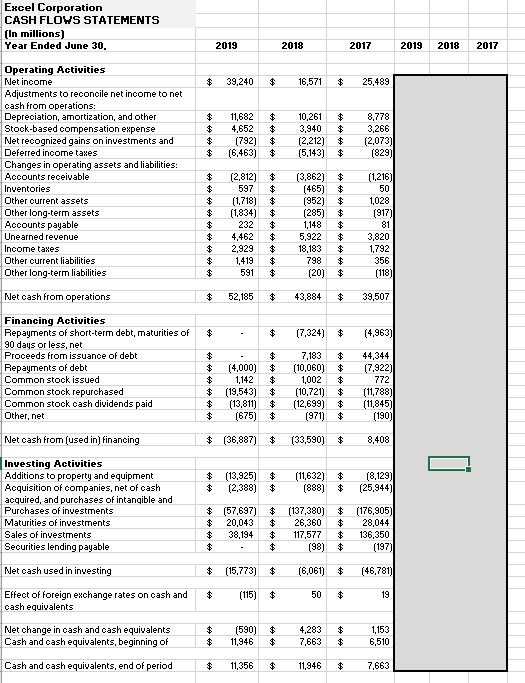

Excel Corporation CASH FLOWS STATEMENTS (In millions) Year Ended June 30, 2019 2018 2017 2019 2018 2017 $ 39,240 $ 16,571 $ 25,489 $ 6446 11,682 4,652 (792) (6,463) $ $ $ $ 10,261 $ 3,940 $ (2.212) $ (5.143) $ 8,778 3,266 (2,073) (829) $ $ Operating Activities Net income Adjustments to reconoile net income to net cash from operations: Depreciation, amortization, and other Stock-based compensation expense Net recognized gains on investments and Deferred income taxes Changes in operating assets and liabilities: Accounts receivable Inventories Other Ourrent assets Other long-term assets Accounts payable Unearned revenue Income taxes Other current liabilities Other long-term liabilities (2.812) 597 (1.718) (1,834) $ $ $ $ $ $ $ $ $ 232 $ $ $ $ $ $ $ $ $ (3.862) (465) (952) (285) 1148 5,922 18,183 798 (20) $ $ $ $ $ $ $ $ $ (1,216) 50 1,028 (917) 81 3,820 1,792 356 (118) 44 44 44 4,462 2,929 1.419 591 LES Net cash from operations $ 52,185 $ 43,884 $ 39,507 $ $ (7,324) $ (4.963) Financing Activities Repayments of short-term debt, maturities of 90 days or less, net Proceeds from issuance of debt Repayments of debt Common stock issued Common stook repurchased Common stock cash dividends paid Other, net $ $ $ $ $ $ 4 4 4 4 4 4 (4,000) 1,142 (19,543) (13,811) (675) $ $ $ $ $ $ 7.183 (10,060) 1,002 (10,721) (12,699) (971) $ $ $ $ $ $ 44,344 (7.922) 772 (11,788) (11,845) (190) Net cash from (used in) Financing $ (36,887) $ (33,590) 8,408 $ $ (13,925) (2,388) $ $ (11,632) $ (888) $ (8,129) (25,944) Investing Activities Additions to property and equipment Acquisition of companies, net of cash acquired, and purchases of intangible and Purchases of investments Maturities of investments Sales of investments Securities lending payable $ (57,697) $ 20,043 $ 38,194 $ $ (137,380) $ 26,360 $ 117,577 $ (98) $ $ $ $ (176,905) 28,044 136,350 (197) $ (15,773) $ (6,061) $ (46,781) Net cash used in investing Effect of foreign exchange rates on cash and cash equivalents $ (115) $ 50 $ 19 Net change in cash and cash equivalents Cash and cash equivalents, beginning of $ $ (590) 11,946 $ $ 4,283 7,663 $ $ 1,153 6,510 Cash and cash equivalents, end of period $ 11,356 $ 11,946 $ 7,663