Answered step by step

Verified Expert Solution

Question

1 Approved Answer

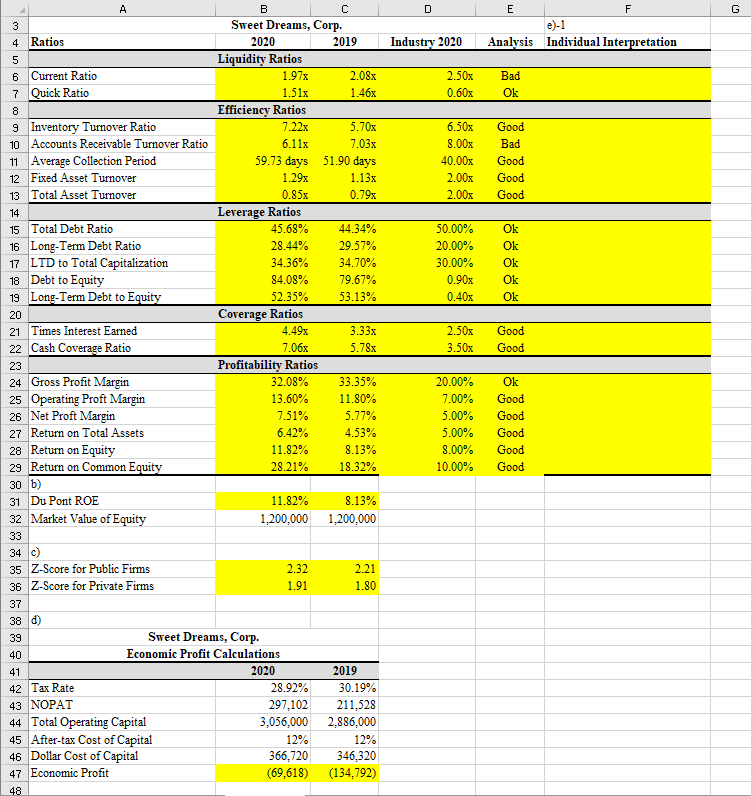

What would be the individual interpretation for each of the ratios? and what is the overall interpretation of the company from this data? D G

What would be the individual interpretation for each of the ratios? and what is the overall interpretation of the company from this data?

D G E F e)-1 Analysis Individual Interpretation Industry 2020 Bad 2.50x 0.60x Ok 6.50x 8.00x 40.00x 2.00x 2.00x Good Bad Good Good Good 50.00% 20.00% 30.00% 0.90x 0.40x Ok Ok Ok Ok Ok 2.50x 3.50x Good Good A B C 3 Sweet Dreams, Corp. 4 Ratios 2020 2019 5 Liquidity Ratios 6 Current Ratio 1.97x 2.08x 7 Quick Ratio 1.51x 1.46x 8 Efficiency Ratios 9 Inventory Turnover Ratio 7.22x 5.70x 10 Accounts Receivable Turnover Ratio 6.11x 7.03x 11 Average Collection Period 59.73 days 51.90 days 12 Fixed Asset Turnover 1.29x 1.13x 13 Total Asset Turnover 0.85x 0.79x 14 Leverage Ratios 15 Total Debt Ratio 45.68% 44.34% 16 Long-Term Debt Ratio 28.44% 29.57% 17 LTD to Total Capitalization 34.36% 34.70% 18 Debt to Equity 84.08% 79.67% 19 Long-Term Debt to Equity 52.35% 53.13% 20 Coverage Ratios 21 Times Interest Earned 4.49x 3.33x 22 Cash Coverage Ratio 7.06x 5.78x 23 Profitability Ratios 24 Gross Profit Margin 32.08% 33.35% 25 Operating Proft Margin 13.60% 11.80% 26 Net Proft Margin 7.51% 5.77% 27 Return on Total Assets 6.42% 4.53% 28 Return on Equity 11.82% 8.13% 29 Return on Common Equity 28.21% 18.32% 30 b) 31 Du Pont ROE 11.82% 8.13% 32 Market Value of Equity 1,200,000 1.200,000 33 34 C) 35 Z-Score for Public Firms 2.32 2.21 36 Z-Score for Private Firms 1.91 1.80 37 38 d) 39 Sweet Dreams, Corp. 40 Economic Profit Calculations 41 2020 2019 42 Tax Rate 28.92% 30.19% 43 NOPAT 297,102 211,528 44 Total Operating Capital 3,056.000 2,886,000 45 After-tax Cost of Capital 12% 12% 46 Dollar Cost of Capital 366,720 346,320 47 Economic Profit (69,618) (134,792) 48 20.00% 7.00% 5.00% 5.00% 8.00% 10.00% Ok Good Good Good Good GoodStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started