Answered step by step

Verified Expert Solution

Question

1 Approved Answer

what would go these be recorded on a journal entry book ? it doesnt seem like it would fit the format of the book? 1.

what would go these be recorded on a journal entry book ?

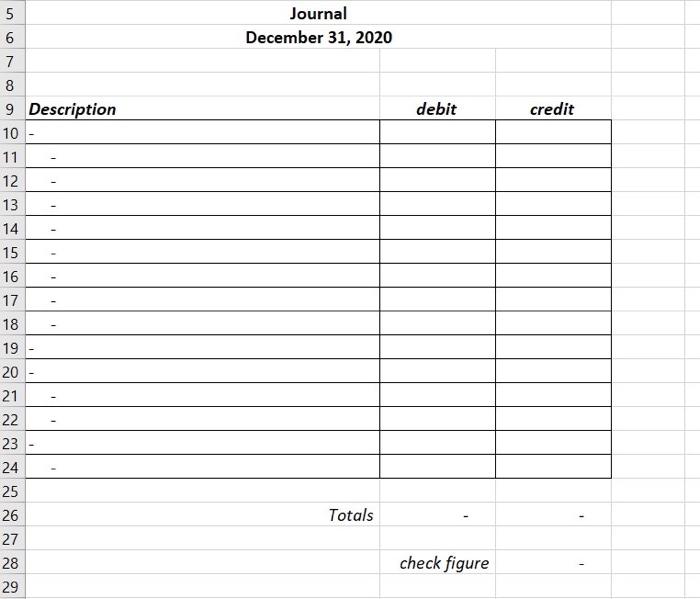

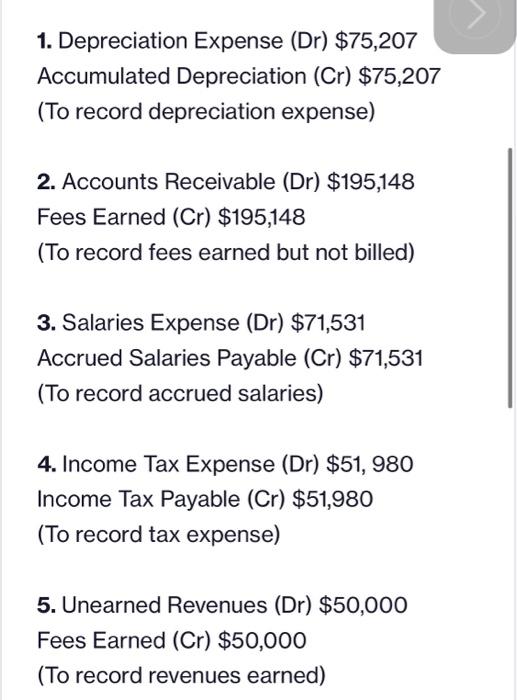

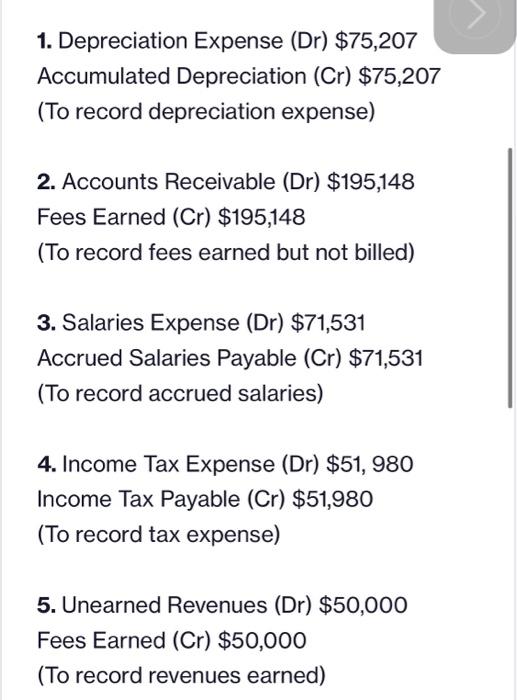

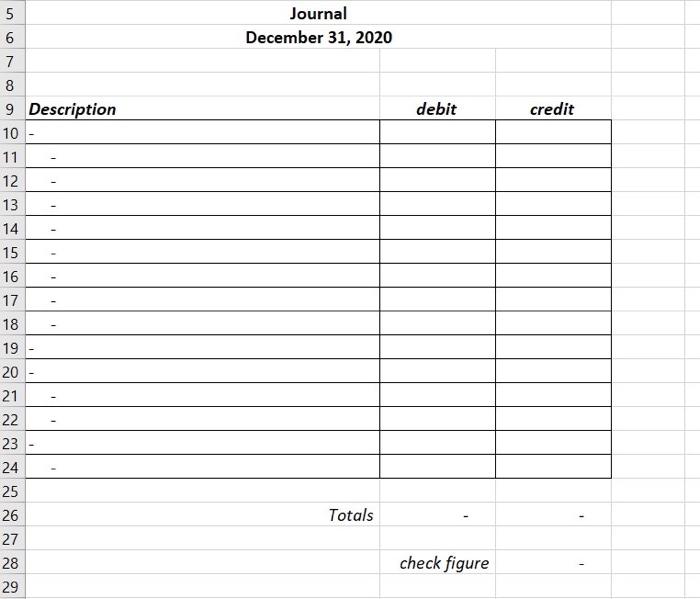

1. Depreciation Expense (Dr) $75,207 Accumulated Depreciation (Cr) $75,207 (To record depreciation expense) 2. Accounts Receivable (Dr) $195,148 Fees Earned (Cr) $195,148 (To record fees earned but not billed) 3. Salaries Expense (Dr) $71,531 Accrued Salaries Payable (Cr) $71,531 (To record accrued salaries) 4. Income Tax Expense (Dr) $51, 980 Income Tax Payable (Cr) $51,980 (To record tax expense) 5. Unearned Revenues (Dr) $50,000 Fees Earned (Cr) $50,000 (To record revenues earned) un Journal December 31, 2020 7 8 5 6 7 8 9 Description 10 11 12 13 debit credit 2. 14 15 16 17 18 19 20 21 22 23 24 25 26 Totals 27 28 29 check figure it doesnt seem like it would fit the format of the book?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started