Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What would you recomend to settle the conflict here? RIGHTFUL DUES In 1952, singer Peggy Lee entered an agreement with Disney to work on the

What would you recomend to settle the conflict here?

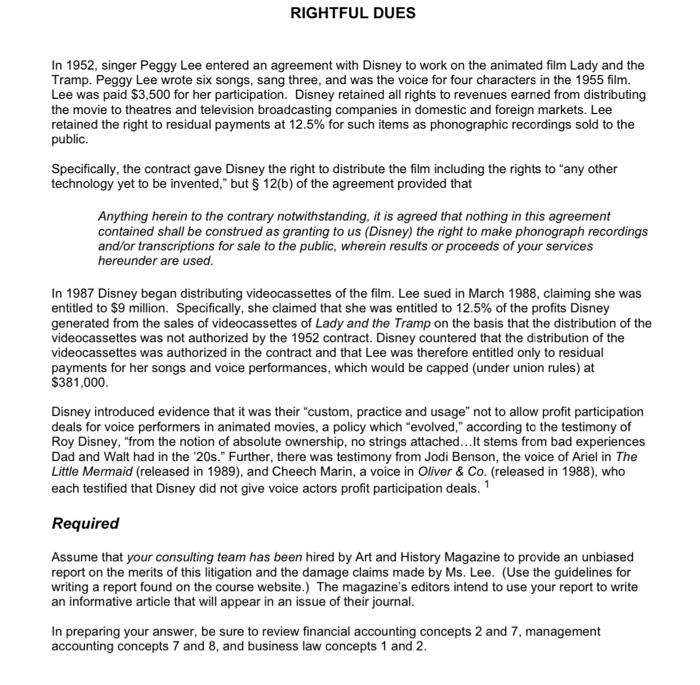

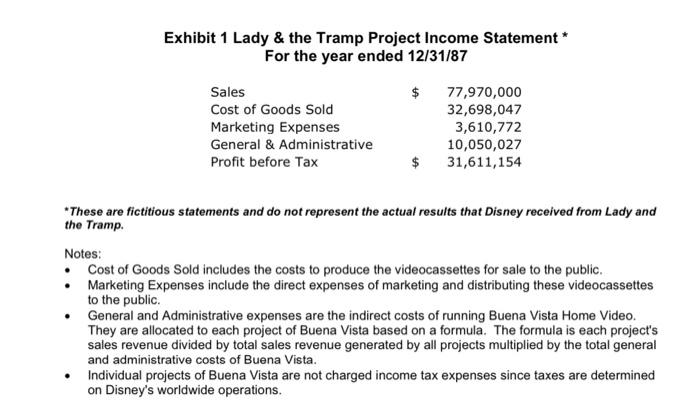

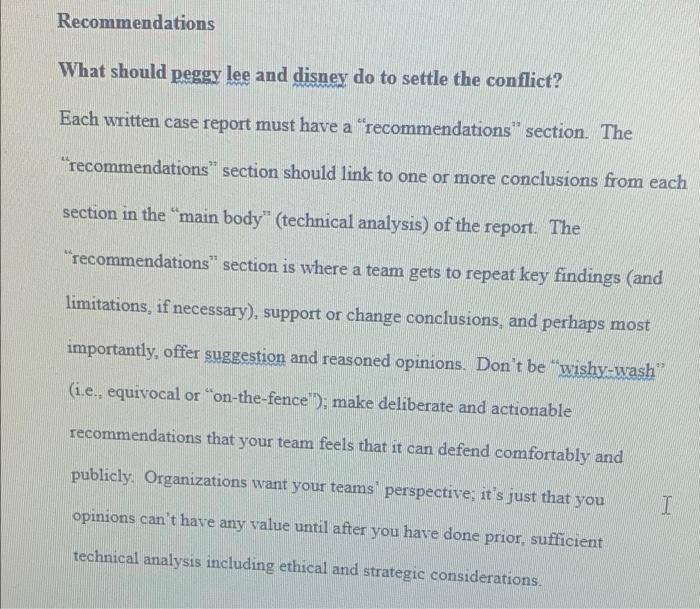

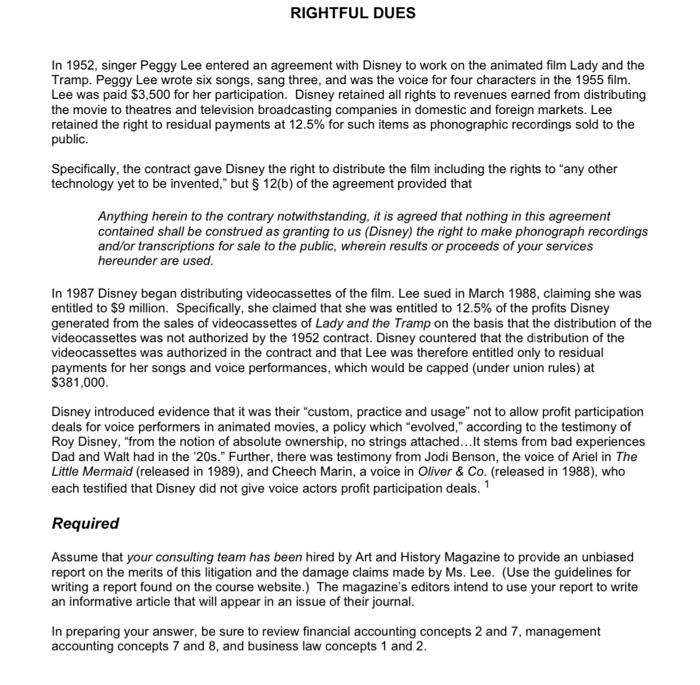

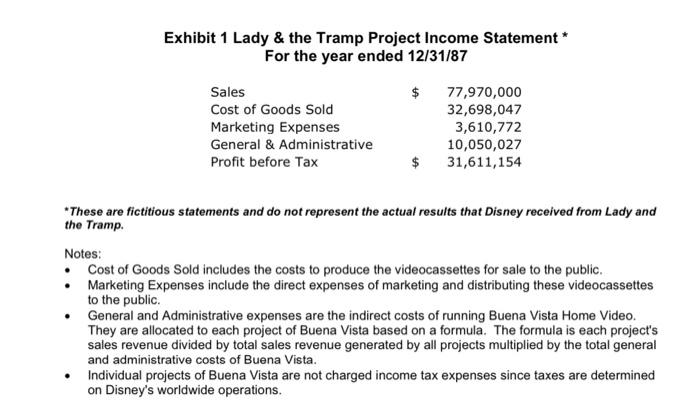

RIGHTFUL DUES In 1952, singer Peggy Lee entered an agreement with Disney to work on the animated film Lady and the Tramp. Peggy Lee wrote six songs, sang three, and was the voice for four characters in the 1955 film. Lee was paid $3,500 for her participation. Disney retained all rights to revenues earned from distributing the movie to theatres and television broadcasting companies in domestic and foreign markets. Lee retained the right to residual payments at 12.5% for such items as phonographic recordings sold to the public. Specifically, the contract gave Disney the right to distribute the film including the rights to any other technology yet to be invented," but $ 12(b) of the agreement provided that Anything herein to the contrary notwithstanding, it is agreed that nothing in this agreement contained shall be construed as granting to us (Disney) the right to make phonograph recordings and/or transcriptions for sale to the public, wherein results or proceeds of your services hereunder are used. In 1987 Disney began distributing videocassettes of the film. Lee sued in March 1988, claiming she was entitled to $9 million. Specifically, she claimed that she was entitled to 12.5% of the profits Disney generated from the sales of videocassettes of Lady and the Tramp on the basis that the distribution of the videocassettes was not authorized by the 1952 contract. Disney countered that the distribution of the videocassettes was authorized in the contract and that Lee was therefore entitled only to residual payments for her songs and voice performances, which would be capped (under union rules) at $381,000. Disney introduced evidence that it was their "custom, practice and usage not to allow profit participation deals for voice performers in animated movies, a policy which evolved," according to the testimony of Roy Disney, "from the notion of absolute ownership, no strings attached...It stems from bad experiences Dad and Walt had in the '20s." Further, there was testimony from Jodi Benson, the voice of Ariel in The Little Mermaid (released in 1989), and Cheech Marin, a voice in Oliver & Co. (released in 1988), who each testified that Disney did not give voice actors profit participation deals. 1 Required Assume that your consulting team has been hired by Art and History Magazine to provide an unbiased report on the merits of this litigation and the damage claims made by Ms. Lee. (Use the guidelines for writing a report found on the course website.) The magazine's editors intend to use your report to write an informative article that will appear in an issue of their journal. In preparing your answer, be sure to review financial accounting concepts 2 and 7, management accounting concepts 7 and 8, and business law concepts 1 and 2. Exhibit 1 Lady & the Tramp Project Income Statement * For the year ended 12/31/87 $ Sales Cost of Goods Sold Marketing Expenses General & Administrative Profit before Tax 77,970,000 32,698,047 3,610,772 10,050,027 31,611,154 *These are fictitious statements and do not represent the actual results that Disney received from Lady and the Tramp. Notes: Cost of Goods Sold includes the costs to produce the videocassettes for sale to the public. Marketing Expenses include the direct expenses of marketing and distributing these videocassettes to the public. General and Administrative expenses are the indirect costs of running Buena Vista Home Video They are allocated to each project of Buena Vista based on a formula. The formula is each project's sales revenue divided by total sales revenue generated by all projects multiplied by the total general and administrative costs of Buena Vista. Individual projects of Buena Vista are not charged income tax expenses since taxes are determined on Disney's worldwide operations. Recommendations What should peggy lee and disney do to settle the conflict? Each written case report must have a recommendations" section. The "recommendations" section should link to one or more conclusions from each section in the main body" (technical analysis) of the report. The "recommendations" section is where a team gets to repeat key findings (and limitations, if necessary), support or change conclusions, and perhaps most importantly, offer suggestion and reasoned opinions. Don't be wishy-wash 39 (i.e., equivocal or on-the-fence")make deliberate and actionable recommendations that your team feels that it can defend comfortably and publicly. Organizations want your teams perspective, it's just that you T I opinions can't have any value until after you have done prior sufficient technical analysis including ethical and strategic considerations. RIGHTFUL DUES In 1952, singer Peggy Lee entered an agreement with Disney to work on the animated film Lady and the Tramp. Peggy Lee wrote six songs, sang three, and was the voice for four characters in the 1955 film. Lee was paid $3,500 for her participation. Disney retained all rights to revenues earned from distributing the movie to theatres and television broadcasting companies in domestic and foreign markets. Lee retained the right to residual payments at 12.5% for such items as phonographic recordings sold to the public. Specifically, the contract gave Disney the right to distribute the film including the rights to any other technology yet to be invented," but $ 12(b) of the agreement provided that Anything herein to the contrary notwithstanding, it is agreed that nothing in this agreement contained shall be construed as granting to us (Disney) the right to make phonograph recordings and/or transcriptions for sale to the public, wherein results or proceeds of your services hereunder are used. In 1987 Disney began distributing videocassettes of the film. Lee sued in March 1988, claiming she was entitled to $9 million. Specifically, she claimed that she was entitled to 12.5% of the profits Disney generated from the sales of videocassettes of Lady and the Tramp on the basis that the distribution of the videocassettes was not authorized by the 1952 contract. Disney countered that the distribution of the videocassettes was authorized in the contract and that Lee was therefore entitled only to residual payments for her songs and voice performances, which would be capped (under union rules) at $381,000. Disney introduced evidence that it was their "custom, practice and usage not to allow profit participation deals for voice performers in animated movies, a policy which evolved," according to the testimony of Roy Disney, "from the notion of absolute ownership, no strings attached...It stems from bad experiences Dad and Walt had in the '20s." Further, there was testimony from Jodi Benson, the voice of Ariel in The Little Mermaid (released in 1989), and Cheech Marin, a voice in Oliver & Co. (released in 1988), who each testified that Disney did not give voice actors profit participation deals. 1 Required Assume that your consulting team has been hired by Art and History Magazine to provide an unbiased report on the merits of this litigation and the damage claims made by Ms. Lee. (Use the guidelines for writing a report found on the course website.) The magazine's editors intend to use your report to write an informative article that will appear in an issue of their journal. In preparing your answer, be sure to review financial accounting concepts 2 and 7, management accounting concepts 7 and 8, and business law concepts 1 and 2. Exhibit 1 Lady & the Tramp Project Income Statement * For the year ended 12/31/87 $ Sales Cost of Goods Sold Marketing Expenses General & Administrative Profit before Tax 77,970,000 32,698,047 3,610,772 10,050,027 31,611,154 *These are fictitious statements and do not represent the actual results that Disney received from Lady and the Tramp. Notes: Cost of Goods Sold includes the costs to produce the videocassettes for sale to the public. Marketing Expenses include the direct expenses of marketing and distributing these videocassettes to the public. General and Administrative expenses are the indirect costs of running Buena Vista Home Video They are allocated to each project of Buena Vista based on a formula. The formula is each project's sales revenue divided by total sales revenue generated by all projects multiplied by the total general and administrative costs of Buena Vista. Individual projects of Buena Vista are not charged income tax expenses since taxes are determined on Disney's worldwide operations. Recommendations What should peggy lee and disney do to settle the conflict? Each written case report must have a recommendations" section. The "recommendations" section should link to one or more conclusions from each section in the main body" (technical analysis) of the report. The "recommendations" section is where a team gets to repeat key findings (and limitations, if necessary), support or change conclusions, and perhaps most importantly, offer suggestion and reasoned opinions. Don't be wishy-wash 39 (i.e., equivocal or on-the-fence")make deliberate and actionable recommendations that your team feels that it can defend comfortably and publicly. Organizations want your teams perspective, it's just that you T I opinions can't have any value until after you have done prior sufficient technical analysis including ethical and strategic considerations

RIGHTFUL DUES In 1952, singer Peggy Lee entered an agreement with Disney to work on the animated film Lady and the Tramp. Peggy Lee wrote six songs, sang three, and was the voice for four characters in the 1955 film. Lee was paid $3,500 for her participation. Disney retained all rights to revenues earned from distributing the movie to theatres and television broadcasting companies in domestic and foreign markets. Lee retained the right to residual payments at 12.5% for such items as phonographic recordings sold to the public. Specifically, the contract gave Disney the right to distribute the film including the rights to any other technology yet to be invented," but $ 12(b) of the agreement provided that Anything herein to the contrary notwithstanding, it is agreed that nothing in this agreement contained shall be construed as granting to us (Disney) the right to make phonograph recordings and/or transcriptions for sale to the public, wherein results or proceeds of your services hereunder are used. In 1987 Disney began distributing videocassettes of the film. Lee sued in March 1988, claiming she was entitled to $9 million. Specifically, she claimed that she was entitled to 12.5% of the profits Disney generated from the sales of videocassettes of Lady and the Tramp on the basis that the distribution of the videocassettes was not authorized by the 1952 contract. Disney countered that the distribution of the videocassettes was authorized in the contract and that Lee was therefore entitled only to residual payments for her songs and voice performances, which would be capped (under union rules) at $381,000. Disney introduced evidence that it was their "custom, practice and usage not to allow profit participation deals for voice performers in animated movies, a policy which evolved," according to the testimony of Roy Disney, "from the notion of absolute ownership, no strings attached...It stems from bad experiences Dad and Walt had in the '20s." Further, there was testimony from Jodi Benson, the voice of Ariel in The Little Mermaid (released in 1989), and Cheech Marin, a voice in Oliver & Co. (released in 1988), who each testified that Disney did not give voice actors profit participation deals. 1 Required Assume that your consulting team has been hired by Art and History Magazine to provide an unbiased report on the merits of this litigation and the damage claims made by Ms. Lee. (Use the guidelines for writing a report found on the course website.) The magazine's editors intend to use your report to write an informative article that will appear in an issue of their journal. In preparing your answer, be sure to review financial accounting concepts 2 and 7, management accounting concepts 7 and 8, and business law concepts 1 and 2. Exhibit 1 Lady & the Tramp Project Income Statement * For the year ended 12/31/87 $ Sales Cost of Goods Sold Marketing Expenses General & Administrative Profit before Tax 77,970,000 32,698,047 3,610,772 10,050,027 31,611,154 *These are fictitious statements and do not represent the actual results that Disney received from Lady and the Tramp. Notes: Cost of Goods Sold includes the costs to produce the videocassettes for sale to the public. Marketing Expenses include the direct expenses of marketing and distributing these videocassettes to the public. General and Administrative expenses are the indirect costs of running Buena Vista Home Video They are allocated to each project of Buena Vista based on a formula. The formula is each project's sales revenue divided by total sales revenue generated by all projects multiplied by the total general and administrative costs of Buena Vista. Individual projects of Buena Vista are not charged income tax expenses since taxes are determined on Disney's worldwide operations. Recommendations What should peggy lee and disney do to settle the conflict? Each written case report must have a recommendations" section. The "recommendations" section should link to one or more conclusions from each section in the main body" (technical analysis) of the report. The "recommendations" section is where a team gets to repeat key findings (and limitations, if necessary), support or change conclusions, and perhaps most importantly, offer suggestion and reasoned opinions. Don't be wishy-wash 39 (i.e., equivocal or on-the-fence")make deliberate and actionable recommendations that your team feels that it can defend comfortably and publicly. Organizations want your teams perspective, it's just that you T I opinions can't have any value until after you have done prior sufficient technical analysis including ethical and strategic considerations. RIGHTFUL DUES In 1952, singer Peggy Lee entered an agreement with Disney to work on the animated film Lady and the Tramp. Peggy Lee wrote six songs, sang three, and was the voice for four characters in the 1955 film. Lee was paid $3,500 for her participation. Disney retained all rights to revenues earned from distributing the movie to theatres and television broadcasting companies in domestic and foreign markets. Lee retained the right to residual payments at 12.5% for such items as phonographic recordings sold to the public. Specifically, the contract gave Disney the right to distribute the film including the rights to any other technology yet to be invented," but $ 12(b) of the agreement provided that Anything herein to the contrary notwithstanding, it is agreed that nothing in this agreement contained shall be construed as granting to us (Disney) the right to make phonograph recordings and/or transcriptions for sale to the public, wherein results or proceeds of your services hereunder are used. In 1987 Disney began distributing videocassettes of the film. Lee sued in March 1988, claiming she was entitled to $9 million. Specifically, she claimed that she was entitled to 12.5% of the profits Disney generated from the sales of videocassettes of Lady and the Tramp on the basis that the distribution of the videocassettes was not authorized by the 1952 contract. Disney countered that the distribution of the videocassettes was authorized in the contract and that Lee was therefore entitled only to residual payments for her songs and voice performances, which would be capped (under union rules) at $381,000. Disney introduced evidence that it was their "custom, practice and usage not to allow profit participation deals for voice performers in animated movies, a policy which evolved," according to the testimony of Roy Disney, "from the notion of absolute ownership, no strings attached...It stems from bad experiences Dad and Walt had in the '20s." Further, there was testimony from Jodi Benson, the voice of Ariel in The Little Mermaid (released in 1989), and Cheech Marin, a voice in Oliver & Co. (released in 1988), who each testified that Disney did not give voice actors profit participation deals. 1 Required Assume that your consulting team has been hired by Art and History Magazine to provide an unbiased report on the merits of this litigation and the damage claims made by Ms. Lee. (Use the guidelines for writing a report found on the course website.) The magazine's editors intend to use your report to write an informative article that will appear in an issue of their journal. In preparing your answer, be sure to review financial accounting concepts 2 and 7, management accounting concepts 7 and 8, and business law concepts 1 and 2. Exhibit 1 Lady & the Tramp Project Income Statement * For the year ended 12/31/87 $ Sales Cost of Goods Sold Marketing Expenses General & Administrative Profit before Tax 77,970,000 32,698,047 3,610,772 10,050,027 31,611,154 *These are fictitious statements and do not represent the actual results that Disney received from Lady and the Tramp. Notes: Cost of Goods Sold includes the costs to produce the videocassettes for sale to the public. Marketing Expenses include the direct expenses of marketing and distributing these videocassettes to the public. General and Administrative expenses are the indirect costs of running Buena Vista Home Video They are allocated to each project of Buena Vista based on a formula. The formula is each project's sales revenue divided by total sales revenue generated by all projects multiplied by the total general and administrative costs of Buena Vista. Individual projects of Buena Vista are not charged income tax expenses since taxes are determined on Disney's worldwide operations. Recommendations What should peggy lee and disney do to settle the conflict? Each written case report must have a recommendations" section. The "recommendations" section should link to one or more conclusions from each section in the main body" (technical analysis) of the report. The "recommendations" section is where a team gets to repeat key findings (and limitations, if necessary), support or change conclusions, and perhaps most importantly, offer suggestion and reasoned opinions. Don't be wishy-wash 39 (i.e., equivocal or on-the-fence")make deliberate and actionable recommendations that your team feels that it can defend comfortably and publicly. Organizations want your teams perspective, it's just that you T I opinions can't have any value until after you have done prior sufficient technical analysis including ethical and strategic considerations

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started