Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Whatchamacallit Sports ( A ) . Whatchamacallit Sports ( Whatchamacallit ) is considering bidding to sell $ 1 1 7 , 0 0 0 of

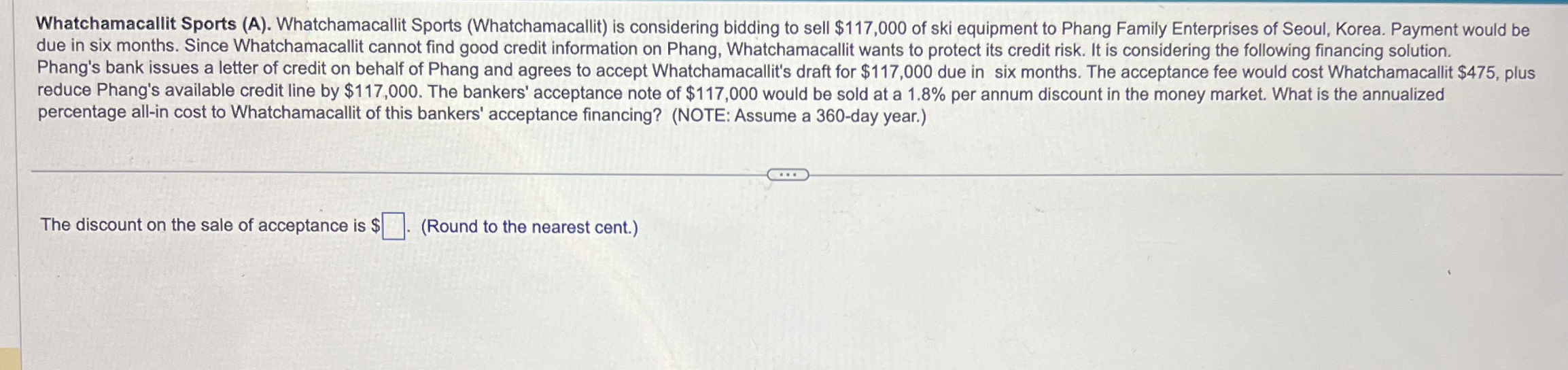

Whatchamacallit Sports A Whatchamacallit Sports Whatchamacallit is considering bidding to sell $ of ski equipment to Phang Family Enterprises of Seoul, Korea. Payment would be due in six months. Since Whatchamacallit cannot find good credit information on Phang, Whatchamacallit wants to protect its credit risk. It is considering the following financing solution. Phang's bank issues a letter of credit on behalf of Phang and agrees to accept Whatchamacallit's draft for $ due in six months. The acceptance fee would cost Whatchamacallit $ plus reduce Phang's available credit line by $ The bankers' acceptance note of $ would be sold at a per annum discount in the money market. What is the annualized percentage allin cost to Whatchamacallit of this bankers' acceptance financing? NOTE: Assume a day year.

The discount on the sale of acceptance is $ Round to the nearest cent.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started