Question: WHATCOM HELPING HAND AGENCY, INC. SUMMARIZED TRANSACTIONS FOR YEAR ENDING JUNE 30, 20X4 (1) A public spirited citizen donated rent free office space to

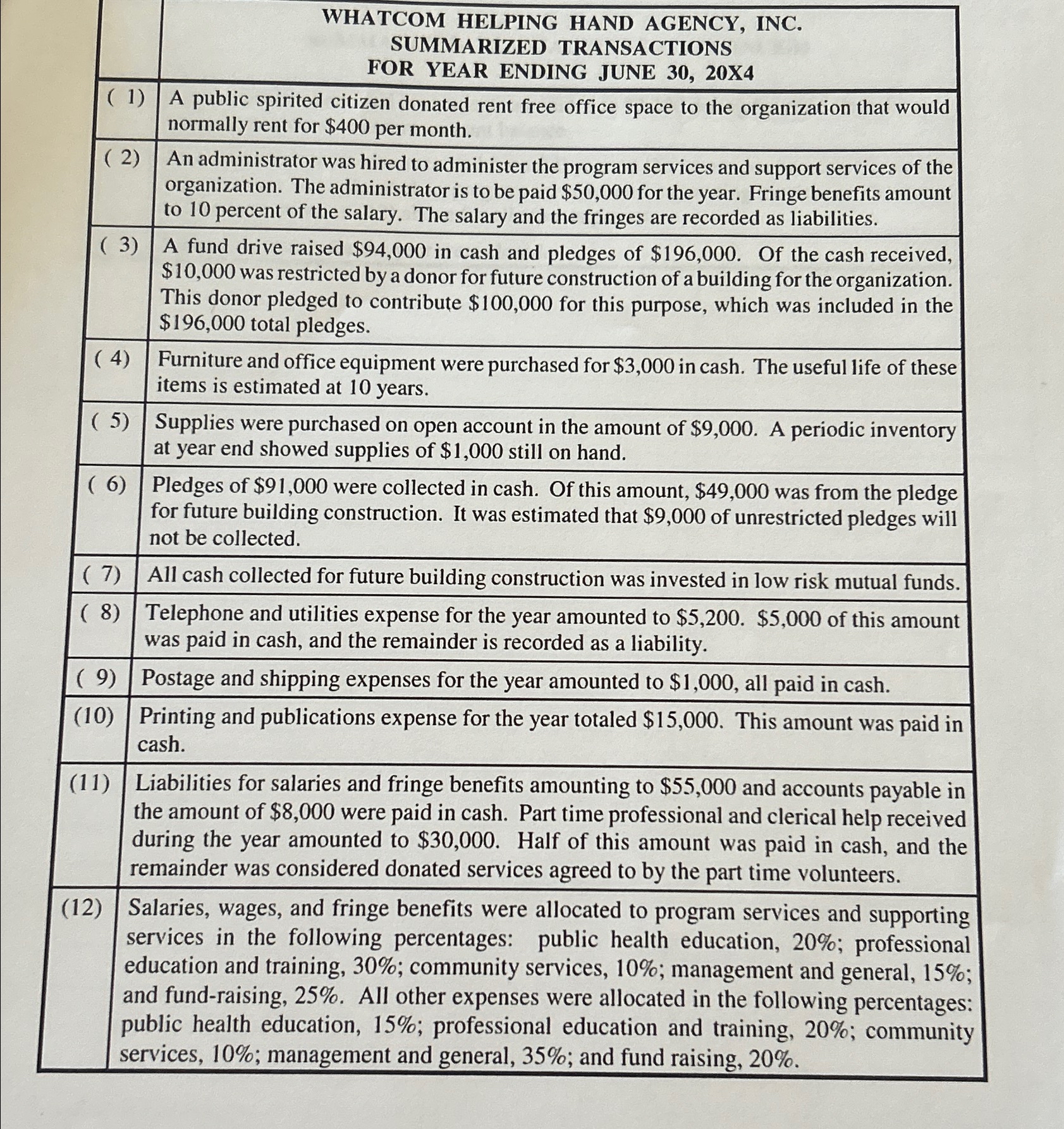

WHATCOM HELPING HAND AGENCY, INC. SUMMARIZED TRANSACTIONS FOR YEAR ENDING JUNE 30, 20X4 (1) A public spirited citizen donated rent free office space to the organization that would normally rent for $400 per month. (2) An administrator was hired to administer the program services and support services of the organization. The administrator is to be paid $50,000 for the year. Fringe benefits amount to 10 percent of the salary. The salary and the fringes are recorded as liabilities. (3) A fund drive raised $94,000 in cash and pledges of $196,000. Of the cash received, $10,000 was restricted by a donor for future construction of a building for the organization. This donor pledged to contribute $100,000 for this purpose, which was included in the $196,000 total pledges. (4) Furniture and office equipment were purchased for $3,000 in cash. The useful life of these items is estimated at 10 years. (5) Supplies were purchased on open account in the amount of $9,000. A periodic inventory at year end showed supplies of $1,000 still on hand. (6) Pledges of $91,000 were collected in cash. Of this amount, $49,000 was from the pledge for future building construction. It was estimated that $9,000 of unrestricted pledges will not be collected. (7) All cash collected for future building construction was invested in low risk mutual funds. (8) Telephone and utilities expense for the year amounted to $5,200. $5,000 of this amount was paid in cash, and the remainder is recorded as a liability. (9) Postage and shipping expenses for the year amounted to $1,000, all paid in cash. (10) Printing and publications expense for the year totaled $15,000. This amount was paid in cash. (11) Liabilities for salaries and fringe benefits amounting to $55,000 and accounts payable in the amount of $8,000 were paid in cash. Part time professional and clerical help received during the year amounted to $30,000. Half of this amount was paid in cash, and the remainder was considered donated services agreed to by the part time volunteers. (12) Salaries, wages, and fringe benefits were allocated to program services and supporting services in the following percentages: public health education, 20%; professional education and training, 30%; community services, 10%; management and general, 15%; and fund-raising, 25%. All other expenses were allocated in the following percentages: public health education, 15%; professional education and training, 20%; community services, 10%; management and general, 35%; and fund raising, 20%.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts