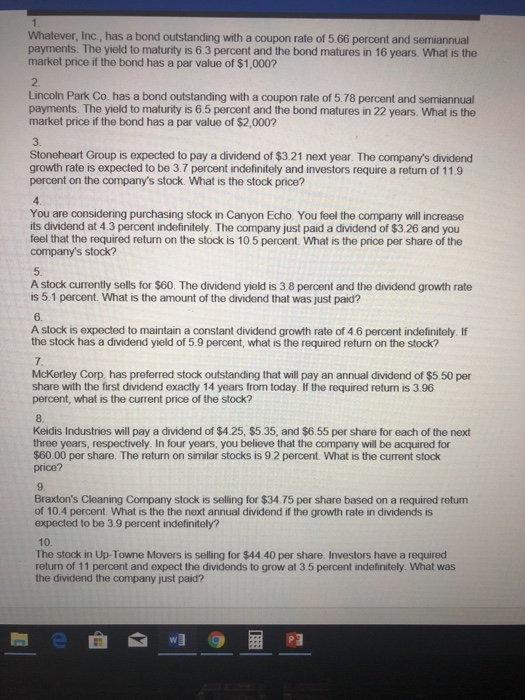

Whatever, Inc., has a bond outstanding with a coupon rate of 5.66 percent and semiannual payments. The yield to maturity is 6.3 percent and the bond matures in 16 years. What is the market price if the bond has a par value of $1,000? 2. Lincoln Park Co. has a bond outstanding with a coupon rate of 5.78 percent and semiannual payments. The yield to maturity is 6.5 percent and the bond matures in 22 years. What is the market price if the bond has a par value of $2,000 3. Stoneheart Group is expected to pay a dividend of $3.21 next year. The company's dividend growth rate is expected to be 3.7 percent indefinitely and investors require a returm of 11.9 percent on the company's stock. What is the stock price? You are considering purchasing stock in Canyon Echo You feel the company will increase its dividend at 4.3 percent indefinitely. The company just paid a dividend of $3.26 and you feel that the required return on the stock is 10.5 percent. What is the price per share of the company's stock? A stock currently sells for $60. The dividend yield is 38 percent and the dividend growth rate is 5.1 percent. What is the amount of the dividend that was just paid? 6. A stock is expected to maintain a constant dividend growth rate of 4.6 percent indefinitely. If the stock has a dividend yield of 5.9 percent, what is the required return on the stock? McKerley Corp, has preferred stock outstanding that will pay an annual dividend of $5.50 per share with the first dividend exactly 14 years from today. If the required return is 3.96 percent, what is the current price of the stock? 8. Keidis Industries will pay a dividend of $4.25, $5.35, and $6.55 per share for each of the next three years, respectively. In four years, you believe that the company will be acquired for $60.00 per share. The return on similar stocks is 9.2 percent. What is the curent stock price? 9. Braxton's Cleaning Company stock is selling for $34.75 per share based on a required return of 10.4 percent. What is the the next annual dividend if the growth rate in dividends is expected to be 3.9 percent indefinitely? 10. The stock in Up-Towne Movers is selling for $44.40 per share. Investors have a required return of 11 percent and expect the dividends to grow at 3.5 percent indefinitely. What was the dividend the company just paid