Answered step by step

Verified Expert Solution

Question

1 Approved Answer

what's missing? Holmes Company reported the following balance sheets at December 31, 20X2 and 20X1: ($ in millions) Cash Accounts receivable Inventory Fixed assets Accumulated

what's missing?

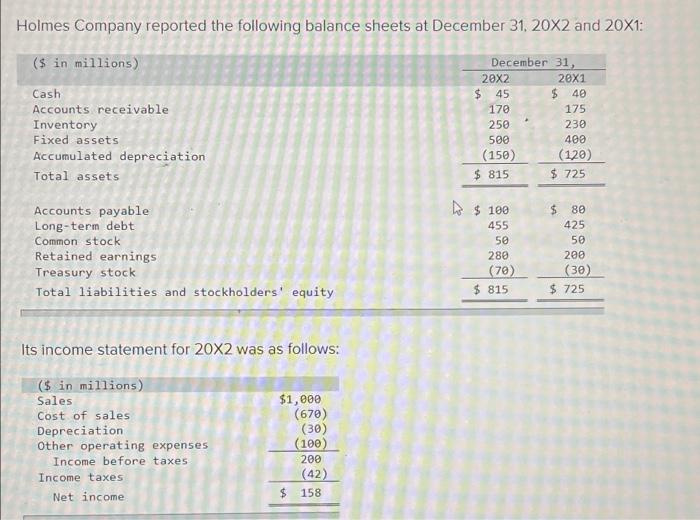

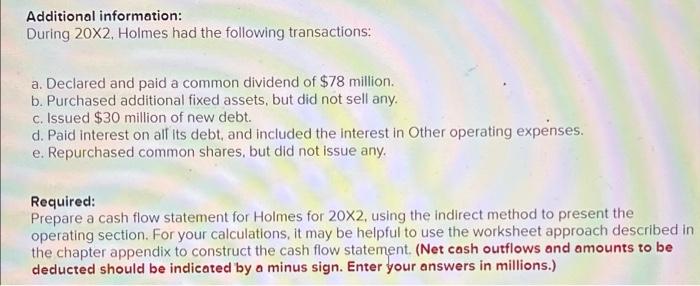

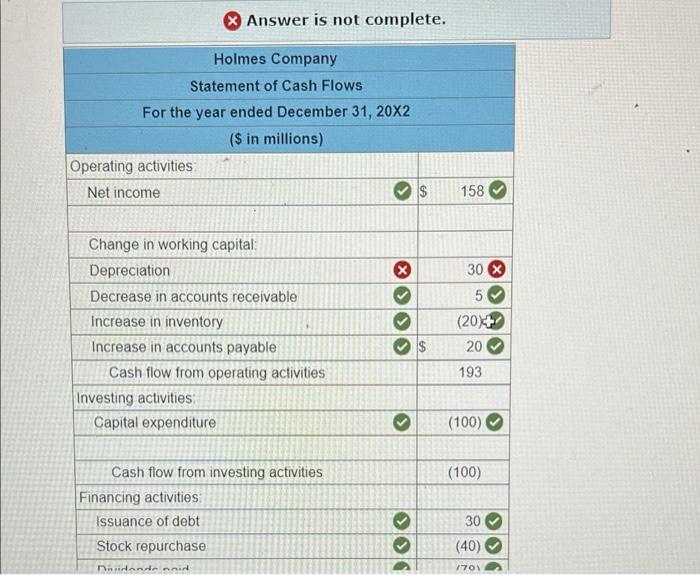

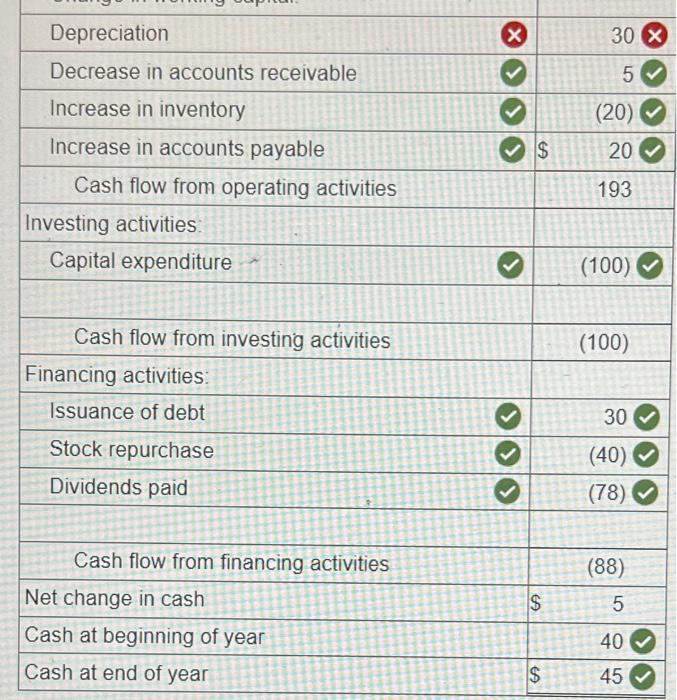

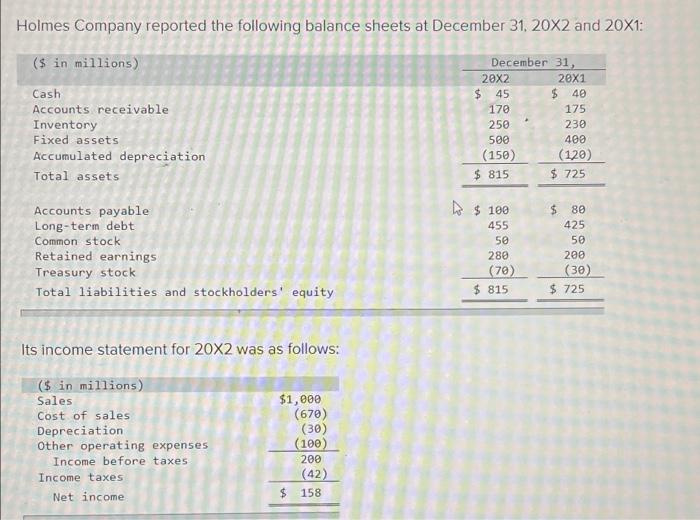

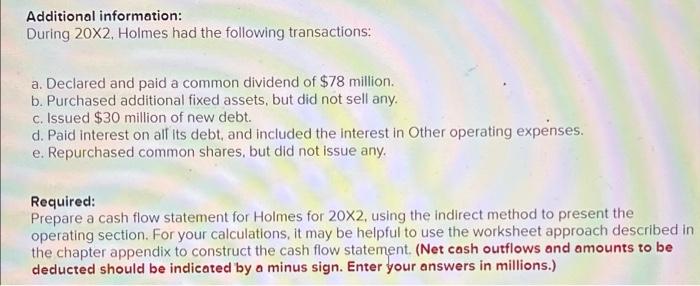

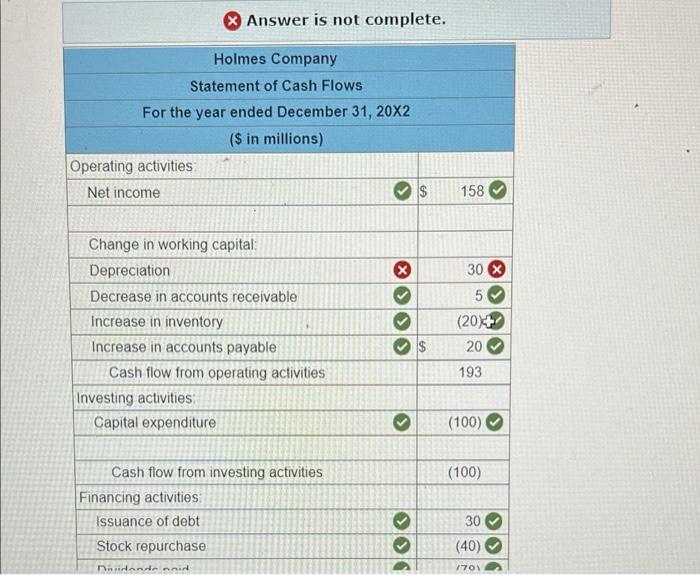

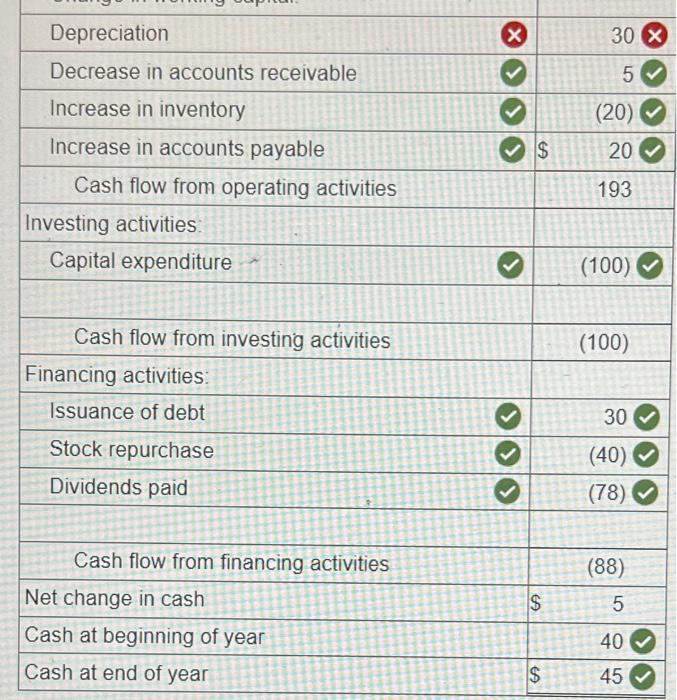

Holmes Company reported the following balance sheets at December 31, 20X2 and 20X1: ($ in millions) Cash Accounts receivable Inventory Fixed assets Accumulated depreciation Total assets December 31, 20X2 20X1 $ 45 $ 40 170 175 250 230 500 400 (150) (120) $ 815 $ 725 $ Accounts payable Long-term debt Common stock Retained earnings Treasury stock Total liabilities and stockholders' equity a $ 100 455 50 280 (70) $ 815 $ 80 425 50 200 (30) $ 725 Its income statement for 20X2 was as follows: ($ in millions) Sales Cost of sales Depreciation Other operating expenses Income before taxes Income taxes Net income $1,000 (670) (30) (100) 200 (42) $ 158 Additional information: During 20X2, Holmes had the following transactions: a. Declared and paid a common dividend of $78 million b. Purchased additional fixed assets, but did not sell any. c. Issued $30 million of new debt. d. Paid interest on all its debt, and included the interest in Other operating expenses. e. Repurchased common shares, but did not issue any. Required: Prepare a cash flow statement for Holmes for 20X2, using the indirect method to present the operating section. For your calculations, it may be helpful to use the worksheet approach described in the chapter appendix to construct the cash flow statement. (Net cash outflows and amounts to be deducted should be indicated by a minus sign. Enter your answers in millions.) Answer is not complete. Holmes Company Statement of Cash Flows For the year ended December 31, 20X2 ($ in millions) Operating activities Net income $ 158 X 30 X X 5 (20+) Change in working capital: Depreciation Decrease in accounts receivable Increase in inventory Increase in accounts payable Cash flow from operating activities Investing activities Capital expenditure 20 193 (100) (100) Cash flow from investing activities Financing activities Issuance of debt Stock repurchase Dandantennid 30 (40) O 1701 x 30 x 5 (20) Depreciation Decrease in accounts receivable Increase in inventory Increase in accounts payable Cash flow from operating activities Investing activities Capital expenditure $ 20 193 (100) (100) Cash flow from investing activities Financing activities: Issuance of debt 30 (40) Stock repurchase Dividends paid (78) (88) $ 5 Cash flow from financing activities Net change in cash Cash at beginning of year Cash at end of year 40 $ 45

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started