whats the answer

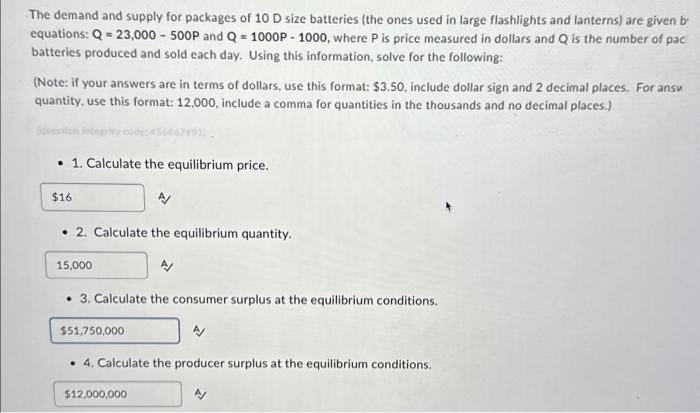

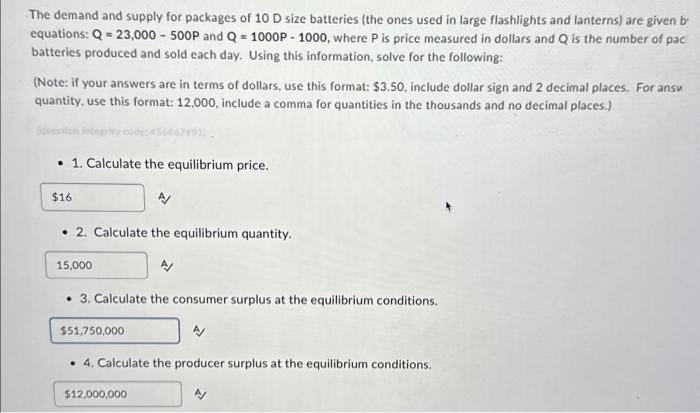

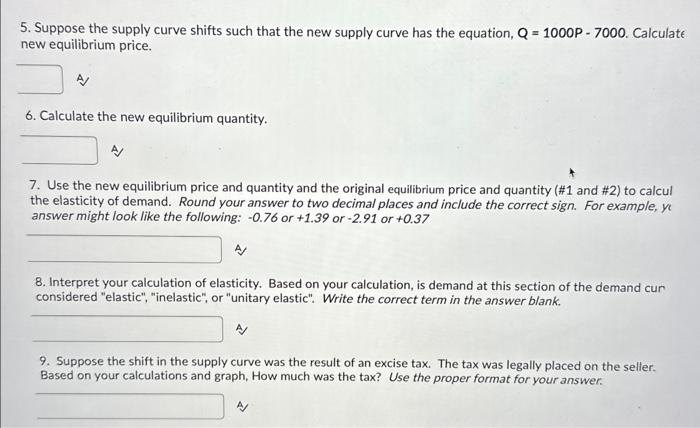

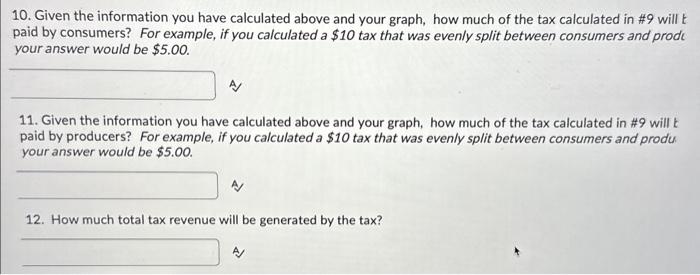

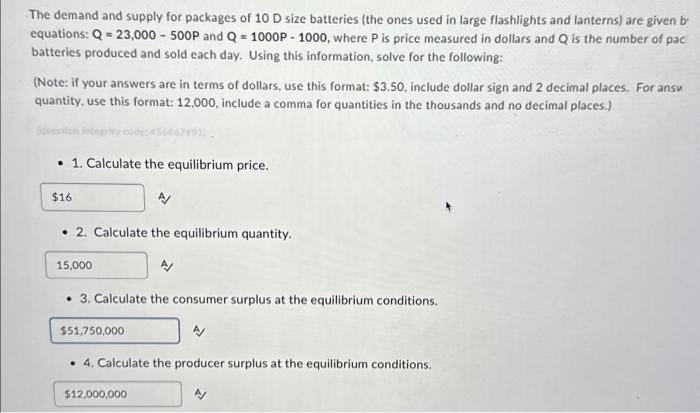

5. Suppose the supply curve shifts such that the new supply curve has the equation, Q=1000P7000. Calculate new equilibrium price. 6. Calculate the new equilibrium quantity. A 7. Use the new equilibrium price and quantity and the original equilibrium price and quantity (\#1 and \#2) to calcul the elasticity of demand. Round your answer to two decimal places and include the correct sign. For example, ye answer might look like the following: -0.76 or +1.39 or -2.91 or +0.37 A 8. Interpret your calculation of elasticity. Based on your calculation, is demand at this section of the demand cur considered "elastic", "inelastic", or "unitary elastic". Write the correct term in the answer blank. A 9. Suppose the shift in the supply curve was the result of an excise tax. The tax was legally placed on the seller. Based on your calculations and graph, How much was the tax? Use the proper format for your answer. The demand and supply for packages of 10D size batteries (the ones used in large flashlights and lanterns) are given b' equations: Q=23,000500P and Q=1000P1000, where P is price measured in dollars and Q is the number of pac batteries produced and sold each day. Using this information, solve for the following: (Note: if your answers are in terms of dollars, use this format: $3.50, include dollar sign and 2 decimal places. For ansh quantity, use this format: 12,000 , include a comma for quantities in the thousands and no decimal places.) - 1. Calculate the equilibrium price. A - 2. Calculate the equilibrium quantity. A - 3. Calculate the consumer surplus at the equilibrium conditions. - 4. Calculate the producer surplus at the equilibrium conditions. 10. Given the information you have calculated above and your graph, how much of the tax calculated in #9 will t paid by consumers? For example, if you calculated a $10 tax that was evenly split between consumers and prodi your answer would be $5.00. A 11. Given the information you have calculated above and your graph, how much of the tax calculated in \#9 will t paid by producers? For example, if you calculated a $10 tax that was evenly split between consumers and produ. your answer would be $5.00. 12. How much total tax revenue will be generated by the tax