Answered step by step

Verified Expert Solution

Question

1 Approved Answer

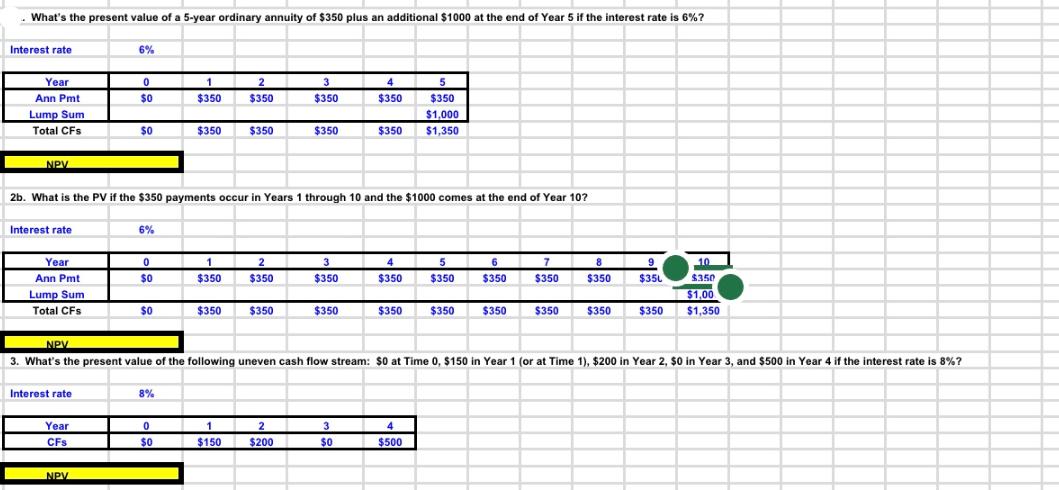

What's the present value of a 5-year ordinary annuity of $350 plus an additional $1000 at the end of Year 5 if the interest

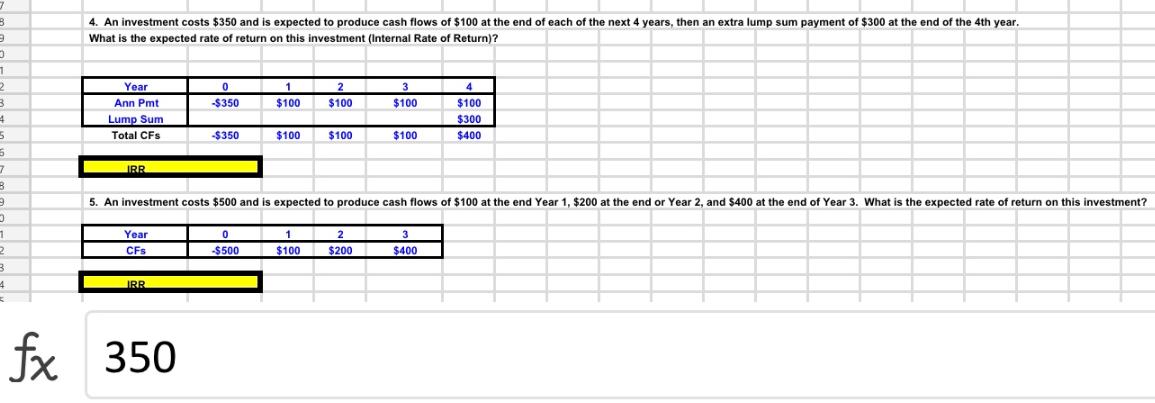

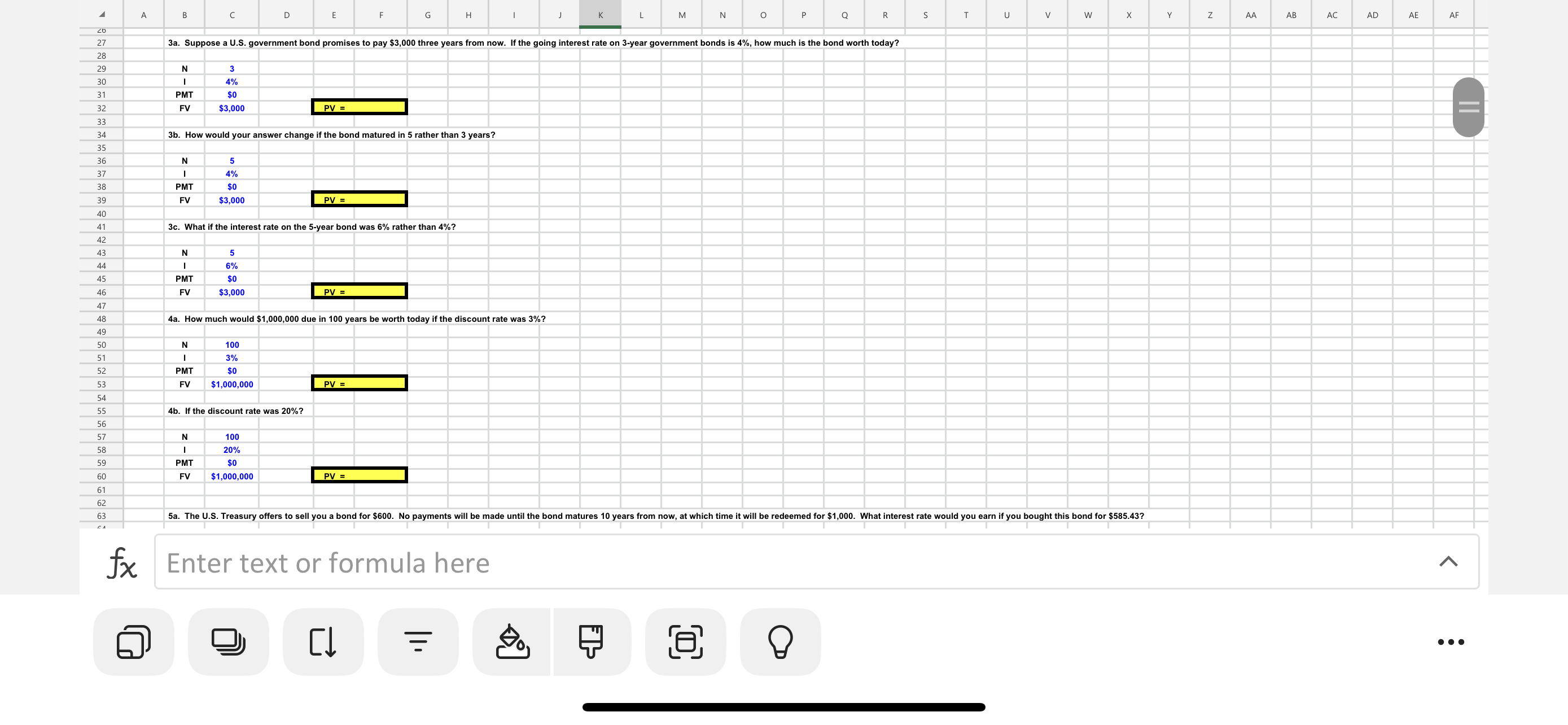

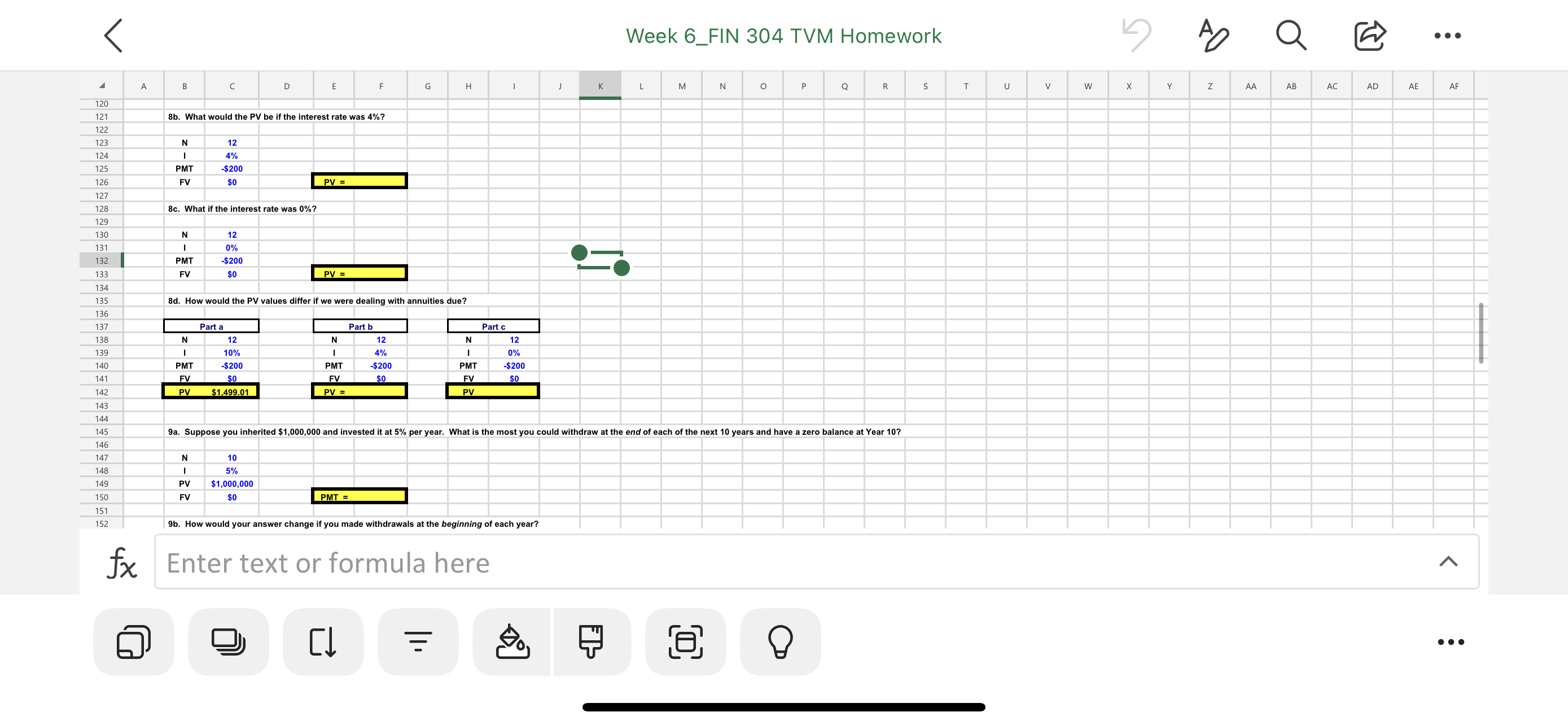

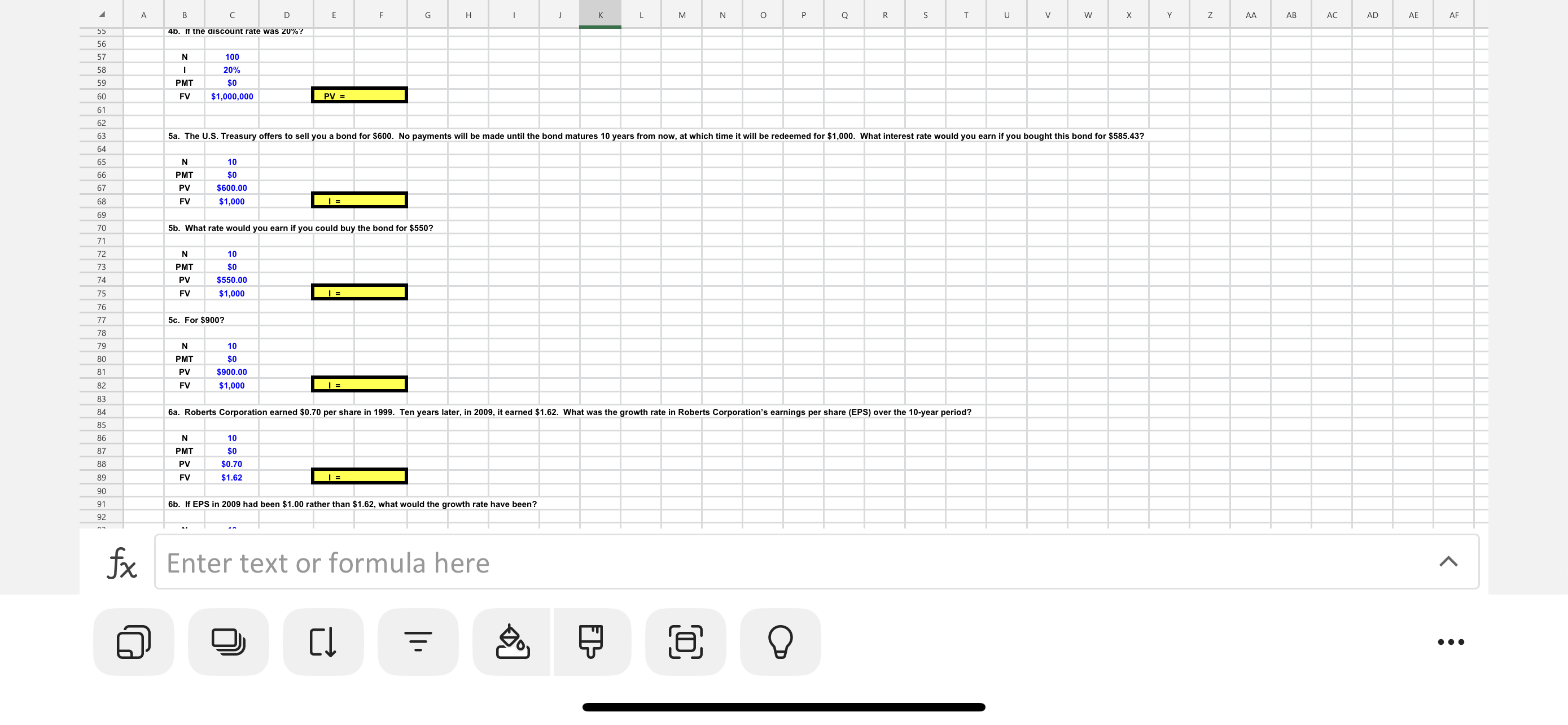

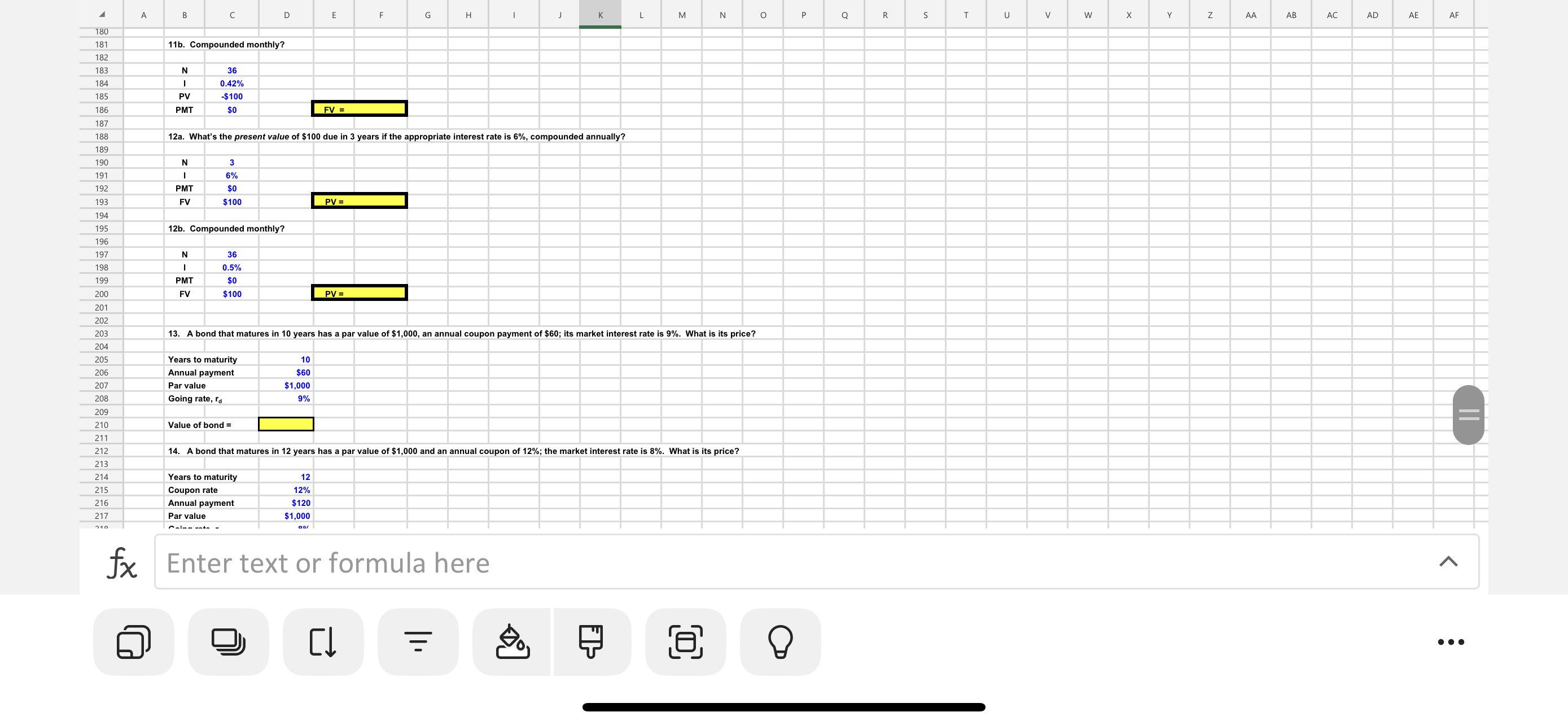

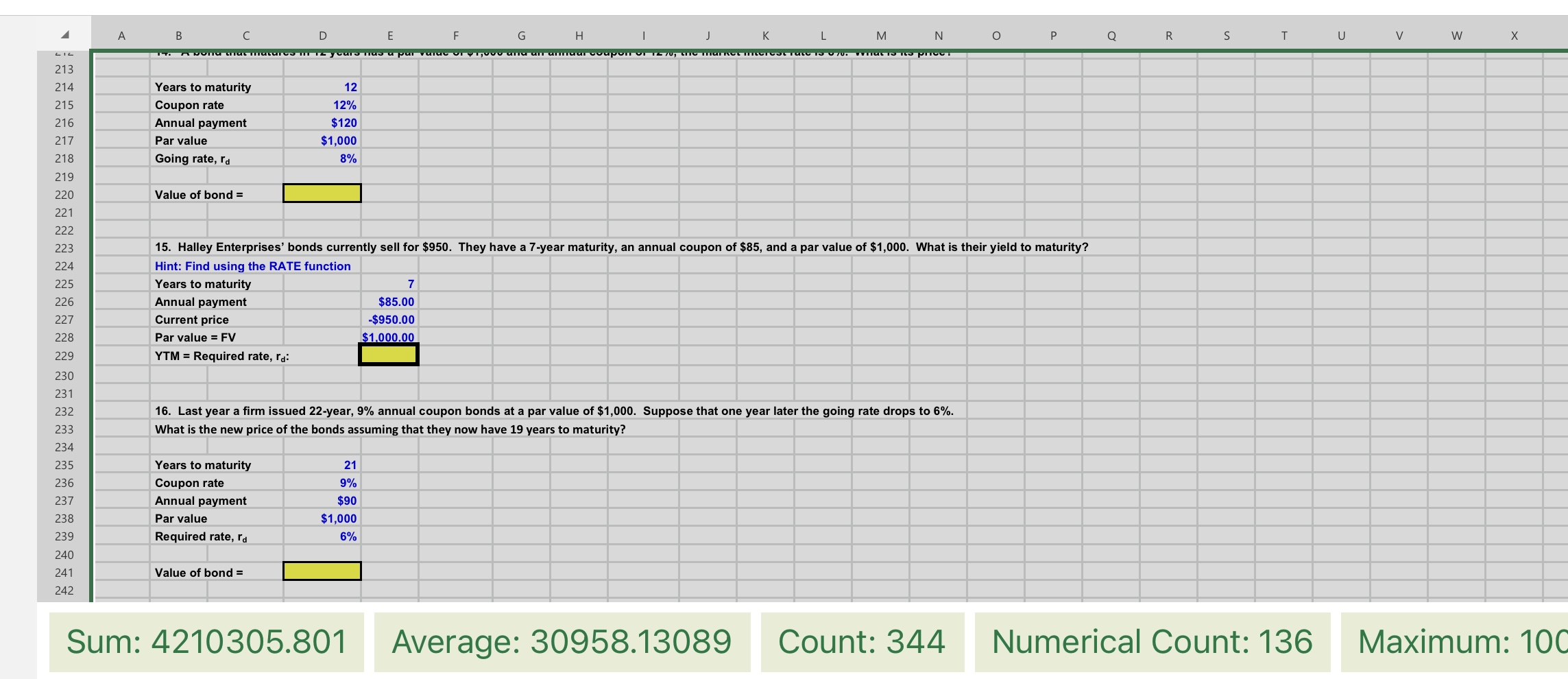

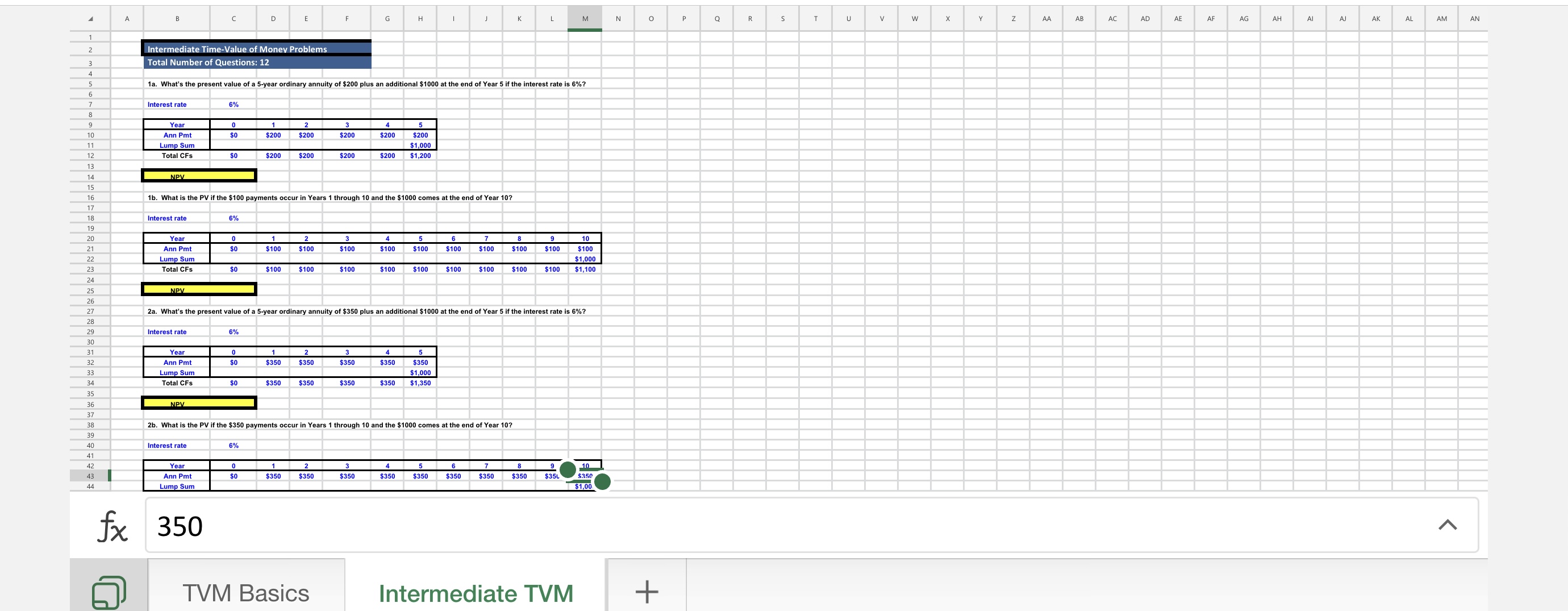

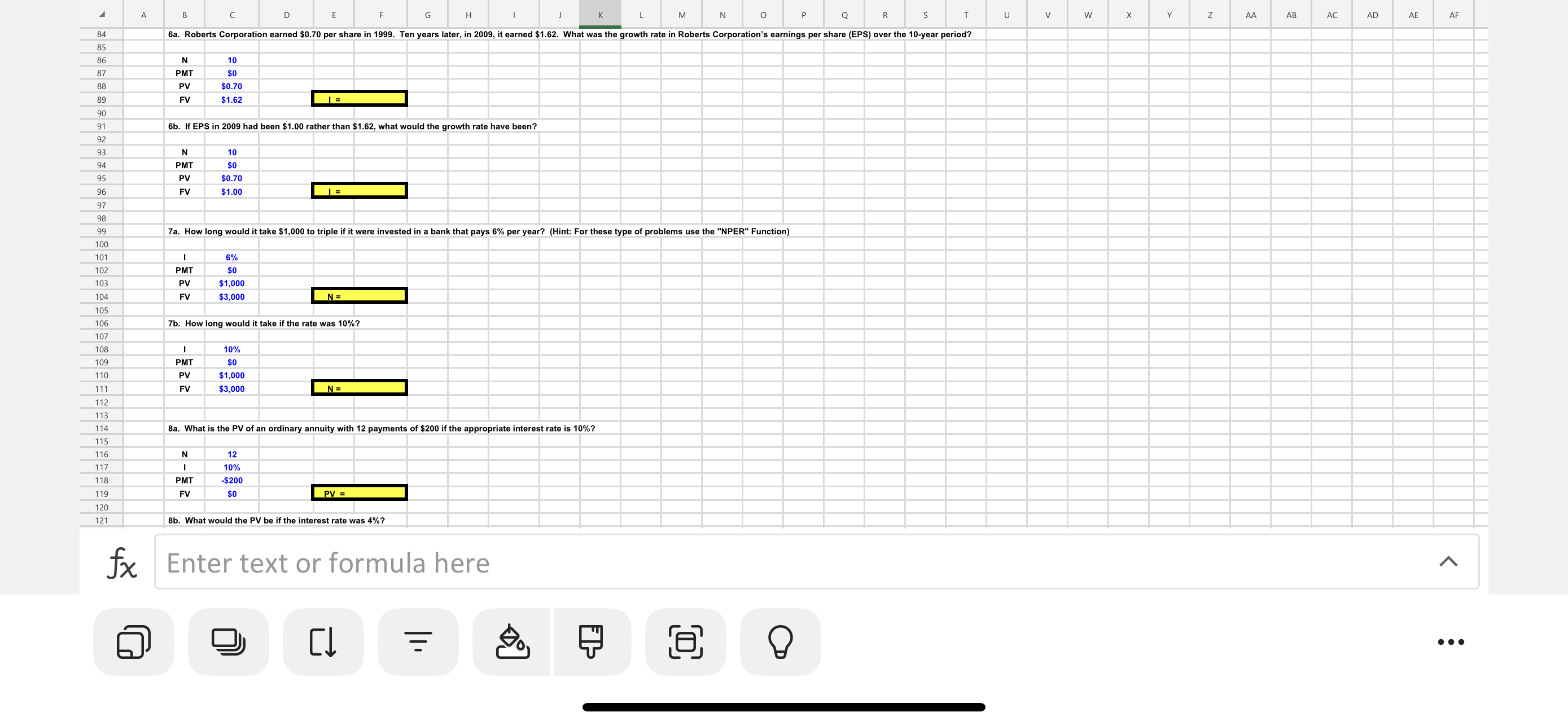

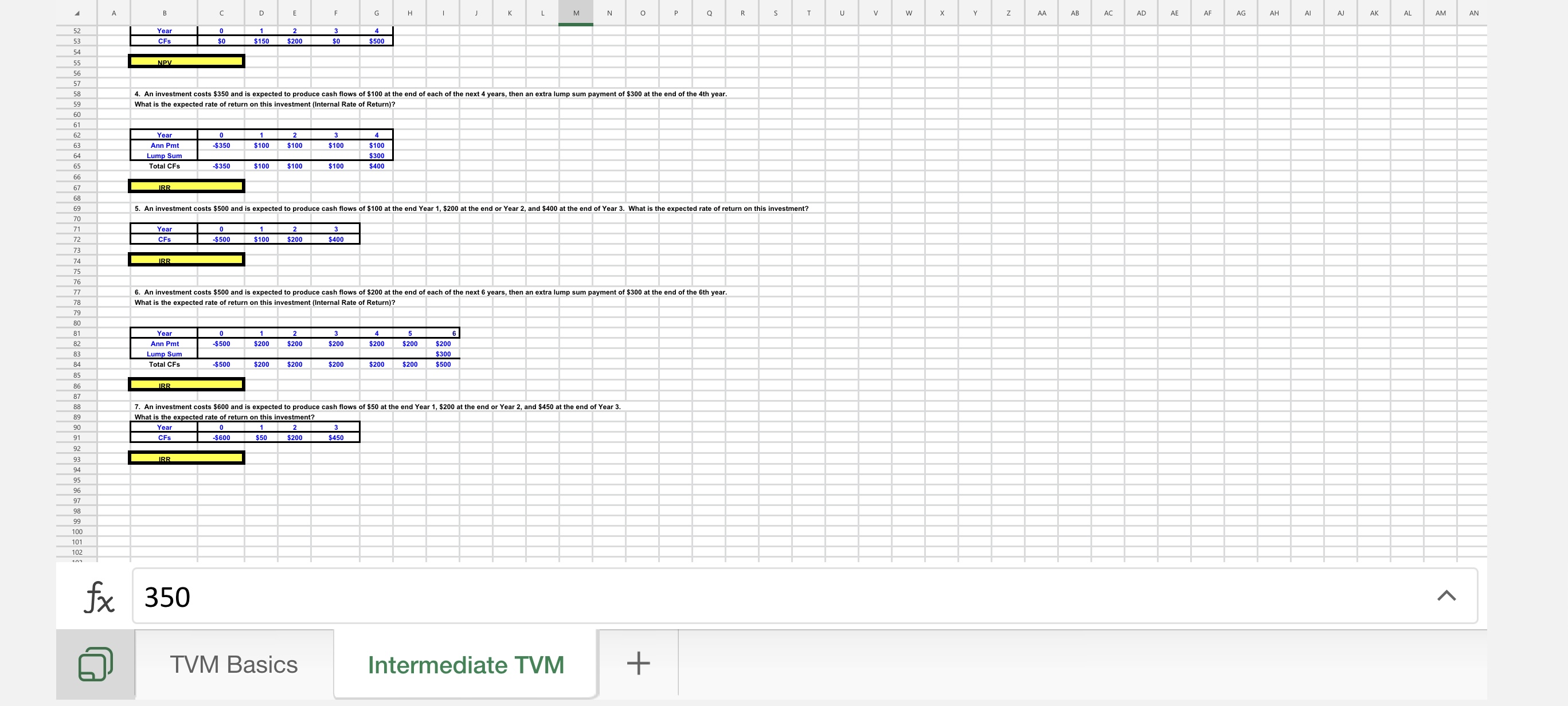

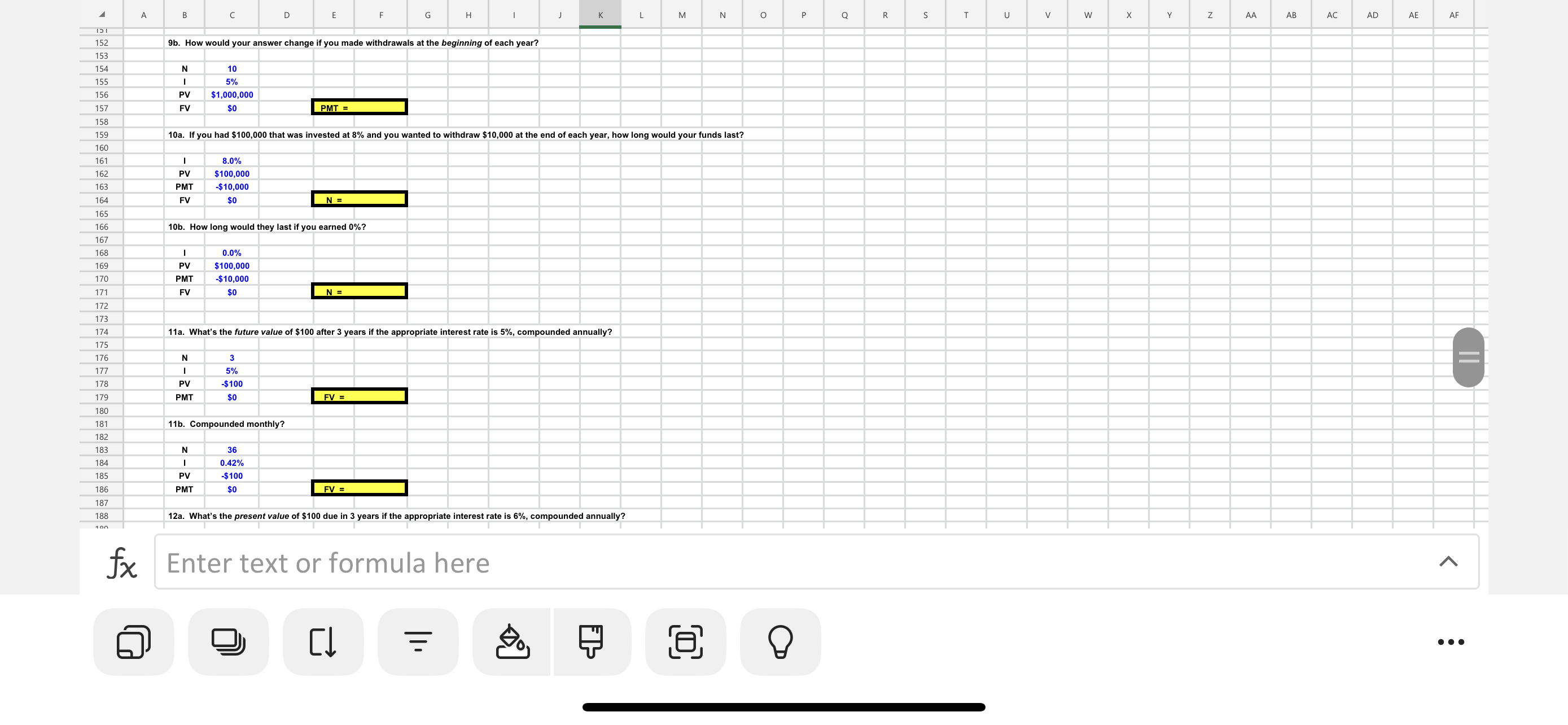

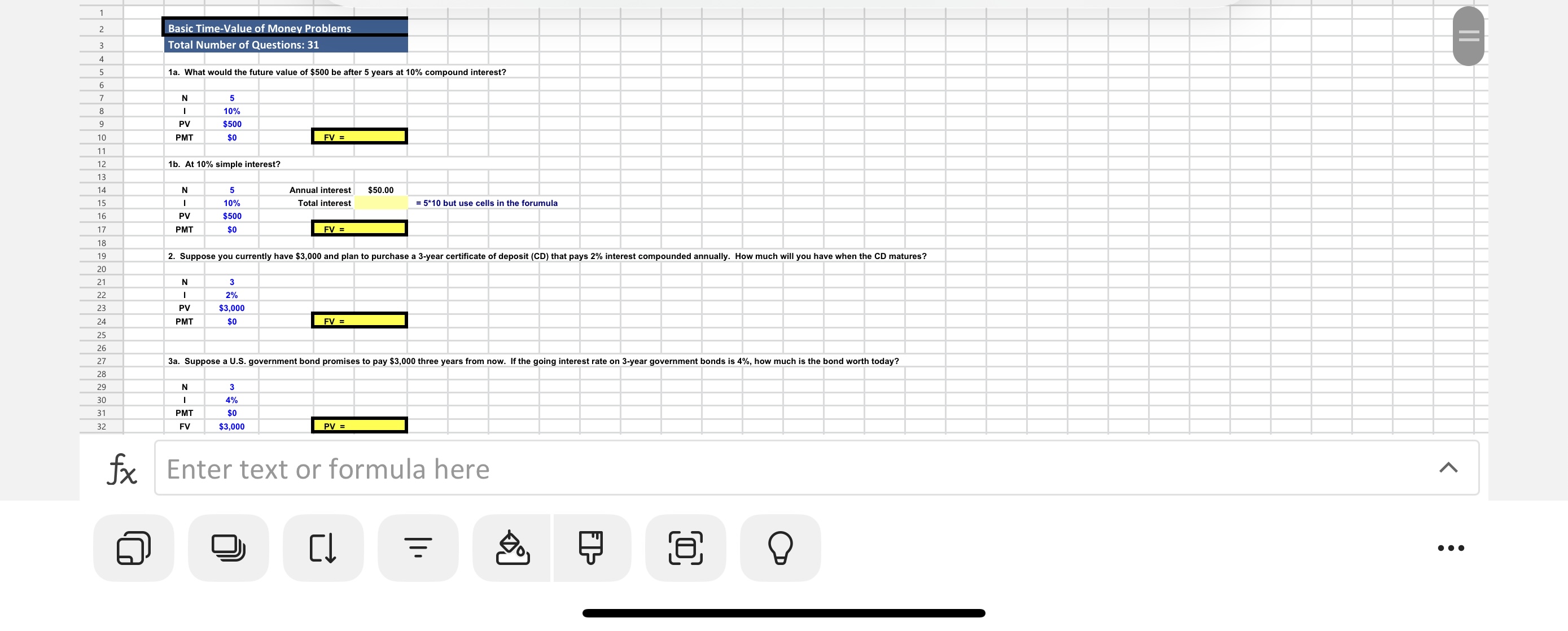

What's the present value of a 5-year ordinary annuity of $350 plus an additional $1000 at the end of Year 5 if the interest rate is 6%? Interest rate Year Ann Pmt Lump Sum Total CFs NPV Interest rate Year Ann Pmt Lump Sum Total CFs Interest rate 6% Year CFS 0 $0 NPV $0 6% 0 $0 $0 2b. What is the PV if the $350 payments occur in Years 1 through 10 and the $1000 comes at the end of Year 10? 1 $350 8% $350 0 $0 1 $350 $350 2 $350 $350 1 $150 2 $350 $350 3 $350 $350 2 $200 3 $350 $350 4 $350 $350 3 $0 5 $350 $1,000 $1,350 4 5 $350 $350 NPV 3. What's the present value of the following uneven cash flow stream: $0 at Time 0, $150 in Year 1 (or at Time 1), $200 in Year 2, $0 in Year 3, and $500 in Year 4 if the interest rate is 8%? 6 $350 4 $500 7 $350 8 $350 $350 $350 $350 $350 $350 9 $35L $350 10 $350 $1,00 $1,350 7 B 3 O 1 2 3 4 5 5 7 B 9 D 1 2 3 4 < 4. An investment costs $350 and is expected to produce cash flows of $100 at the end of each of the next 4 years, then an extra lump sum payment of $300 at the end of the 4th year. What is the expected rate of return on this investment (Internal Rate of Return)? Year Ann Pmt Lump Sum Total CFs IRR Year CFs IRR 0 -$350 fx 350 -$350 1 $100 $100 0 -$500 $100 $100 5. An investment costs $500 and is expected to produce cash flows of $100 at the end Year 1, $200 at the end or Year 2, and $400 at the end of Year 3. What is the expected rate of return on this investment? 1 $100 $100 2 $200 $100 4 $100 3 $400 $300 $400 20 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 CA A fx B N I PMT FV N I PMT FV U N I PMT FV 3 4% $0 $3,000 N I PMT FV 5 4% $0 $3,000 D 3b. How would your answer change if the bond matured in 5 rather than years? 5 6% $0 $3,000 E 100 3% $0 $1,000,000 3c. What if the interest rate on the 5-year bond was 6% rather than 4%? PV = 4b. If the discount rate was 20%? N 100 I 20% PMT $0 FV $1,000,000 3a. Suppose a U.S. government bond promises to pay $3,000 three years from now. If the going interest rate on 3-year government bonds is 4%, how much is the bond worth today? PV = PV = F 4a. How much would $1,000,000 due in 100 years be worth today if the discount rate was 3%? G PV = PV = H C I Enter text or formula here J K L M N O P Q R S T U V 5a. The U.S. Treasury offers to sell you a bond for $600. No payments will be made until the bond matures 10 years from now, at which time it will be redeemed for $1,000. What interest rate would you earn if you bought this bond for $585.43? W X Y N AA AB AC AD AE AF < || : 120 121 122 123 124 125 126 127 128 129 130 131 132 133 134 135 136 137 138 139 140 141 142 143 144 145 146 147 148 149 150 151 152 A B N I PMT FV N I PMT FV 8b. What would the PV be if the interest rate was 4%? 8c. What if the interest rate was 0%? N -: PMT FV PV 12 4% -$200 $0 N I PV FV 12 0% -$200 $0 D Part a E 12 10% -$200 $0 $1,499.01 8d. How would the PV values differ if we were dealing with annuities due? PV = PV = N I PMT FV PV = F Part b PMT= G 12 4% -$200 $0 H N I PMT FV PV Part c I 12 0% -$200 $0 fx Enter text or formula here C 9b. How would your answer change if you made withdrawals at the beginning of each year? K Week 6_FIN 304 TVM Homework L M N 9a. Suppose you inherited $1,000,000 and invested it at 5% per year. What is the most you could withdraw at the end of each of the next 10 years and have a zero balance at Year 10? 10 5% $1,000,000 $0 O O 8 ! P Q R S T U V W 2 X > < A Z AA Q AB AC AD AE AF < : 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 fx A m B 4b. It the discount rate was 20%? N I PMT FV N PMT PV FV N PMT PV FV 100 20% $0 $1,000,000 N PMT PV FV 10 $0 $600.00 $1,000 5c. For $900? N PMT PV FV 10 $0 $550.00 $1,000 D 5b. What rate would you earn if you could buy the bond for $550? 10 $0 $900.00 $1,000 E PV = 10 $0 $0.70 $1.62 = | = TI | = G H C I 5a. The U.S. Treasury offers to sell you a bond for $600. No payments will be made until the bond matures 10 years from now, at which time it will be redeemed for $1,000. What interest rate would you earn if you bought this bond for $585.43? 6b. If EPS in 2009 had been $1.00 rather than $1.62, what would the growth rate have been? Enter text or formula here J K L M N O 6a. Roberts Corporation earned $0.70 per share in 1999. Ten years later, in 2009, it earned $1.62. What was the growth rate in Roberts Corporation's earnings per share (EPS) over the 10-year period? O P 5 ! Q R S T U > W X Y N AA AB AC AD AE AF < : 180 181 182 183 184 185 186 187 188 189 190 191 192 193 194 195 196 197 198 199 200 201 202 203 204 205 206 207 208 209 210 211 212 213 214 215 216 217 310 A B N I PV PMT 11b. Compounded monthly? N I PMT FV 36 0.42% -$100 $0 N I PMT FV 3 6% $0 $100 12b. Compounded monthly? 36 0.5% $0 $100 D Years to maturity Annual payment Par value Going rate, ra 12a. What's the present value of $100 due in 3 years if the appropriate interest rate is 6%, compounded annually? Value of bond = Years to maturity Coupon rate Annual payment Par value 10 $60 $1,000 9% E FV = 12 12% $120 $1,000 00/ PV = F PV = G H I 13. A bond that matures in 10 years has a par value of $1,000, an annual coupon payment of $60; its market interest rate is 9%. What is its price? J K fx Enter text or formula here C L 14. A bond that matures in 12 years has a par value of $1,000 and an annual coupon of 12%; the market interest rate is 8%. What is its price? M N O O 6 ! P Q R S T U < W X Y N AA AB AC AD AE AF < || : 213 214 215 216 217 218 219 220 221 222 223 224 225 226 227 228 229 230 231 232 233 234 235 236 237 238 239 240 241 242 A D E F G K M N And that matures in is yours has a par value of $1,000 and an annual coupon 01 1270, the market Forest Tate to 070 What To Be prevT B Years to maturity Coupon rate Annual payment Par value Going rate, rd Value of bond = Annual payment Current price Par value = FV YTM = Required rate, ra: 15. Halley Enterprises' bonds currently sell for $950. They have a 7-year maturity, an annual coupon of $85, and a par value of $1,000. What is their yield to maturity? Hint: Find using the RATE function Years to maturity 12 12% $120 $1,000 8% Years to maturity Coupon rate Annual payment Par value Required rate, rd Value of bond = 16. Last year a firm issued 22-year, 9% annual coupon bonds at a par value of $1,000. Suppose that one year later the going rate drops to 6%. What is the new price of the bonds assuming that they now have 19 years to maturity? 21 9% $90 $1,000 6% H 7 $85.00 -$950.00 $1,000.00 Sum: 4210305.801 Average: 30958.13089 Count: 344 Q R S T Numerical Count: 136 U W X Maximum: 100 1 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 A fx B Interest rate Intermediate Time-Value of Money Problems Total Number of Questions: 12 Year Ann Pmt Lump Sum Total CFs NPV Interest rate Year Ann Pmt Lump Sum Total CFs NPV Interest rate Year Ann Pmt Lump Sum Total CFs 1a. What's the present value of a 5-year ordinary annuity of $200 plus an additional $1000 at the end of Year 5 if the interest rate is 6%? NPV Interest rate 6% Year Ann Pmt Lump Sum 0 $0 350 $0 6% 0 $0 $0 6% D 0 $0 1b. What is the PV if the $100 payments occur in Years 1 through 10 and the $1000 comes at the end of Year 10? $0 1 $200 6% $200 0 $0 1 $100 E $100 1 $350 2 $200 $200 1 $350 2 $100 $100 2 $350 $350 $350 F 3 $200 2 $350 $200 TVM Basics 3 $100 $100 G 3 $350 $350 4 $200 $200 3 $350 2a. What's the present value of a 5-year ordinary annuity of $350 plus an additional $1000 at the end of Year 5 if the interest rate is 6%? 4 $100 $100 H 4 $350 $350 5 $200 $1,000 $1,200 4 $350 5 $100 $100 2b. What is the PV if the $350 payments occur in Years 1 through 10 and the $1000 comes at the end of Year 10? I 5 $350 $1,000 $1,350 6 $100 5 $350 J $100 6 $350 7 8 $100 $100 $100 K $100 7 $350 L 8 $350 9 $100 $100 M 9 $350 Intermediate TVM 10 $100 $1,000 $1,100 10 $350 $1,00 N O + P Q R S T U V W X Y AA AB AC AD AE AF AG AH Al AJ AK AL AM AN 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 116 117 118 120 121 fx A B S 6a. Roberts Corporation earned $0.70 per share in 1999. Ten years later, in 2009, it earned $1.62. What was the growth rate in Roberts Corporation's earnings per share (EPS) over the 10-year period? N PMT PV FV N PMT PV FV I PMT PV FV 10 $0 $0.70 $1.62 I PMT PV FV 10 $0 $0.70 $1.00 N I PMT D 6b. If EPS in 2009 had been $1.00 rather than $1.62, what would the growth rate have been? 6% $0 $1,000 $3,000 E 10% $0 $1,000 $3,000 | = 7b. How long would it take if the rate was 10%? 12 10% -$200 $0 = N = N= F 7a. How long would it take $1,000 to triple if it were invested in a bank that pays 6% per year? (Hint: For these type of problems use the "NPER" Function) PV = G H 8a. What is the PV of an ordinary annuity with 12 payments of $200 if the appropriate interest rate is 10%? 8b. What would the PV be if the interest rate was 4%? C I Enter text or formula here J K L M N O O 6 ! P Q R T U < W X Y N AA AB AC AD AE AF < : 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 A B Year CFs NPV Year Ann Pmt Lump Sum Total CFs IRR Year CFs IRR Year Ann Pmt Lump Sum Total CFs IRR 0 $0 IRR 0 -$350 fx 350 -$350 0 -$500 D 1 $150 0 -$500 -$500 E 4. An investment costs $350 and is expected to produce cash flows of $100 at the end of each of the next 4 years, then an extra lump sum payment of $300 at the end of the 4th year. What the expected rate of return on this investment (Internal Rate of Return)? 1 2 $100 $100 2 $200 $100 $100 1 $100 1 $200 $200 $200 F 2 $200 3 $0 $200 3 $100 TVM Basics $100 5. An investment costs $500 and is expected to produce cash flows of $100 at the end Year 1, $200 at the end or Year 2, and $400 at the end of Year 3. What is the expected rate of return on this investment? 3 $400 G 3 $200 4 $500 6. An investment costs $500 and is expected to produce cash flows of $200 at the end of each of the next 6 years, then an extra lump sum payment of $300 at the end of the 6th year. What is the expected rate of return on this investment (Internal Rate of Return)? $200 4 $100 $300 $400 3 $450 H 4 $200 $200 I 5 $200 J $200 K L $200 $300 $500 M 7. An investment costs $600 and is expected to produce cash flows of $50 at the end Year 1, $200 at the end or Year 2, and $450 at the end of Year 3. What is the expected rate of return on this investment? 0 2 Year CFs 1 $50 -$600 $200 N O Intermediate TVM P Q + R S T U V W X Y Z AA AB AC AD AE AF AG AH Al AJ AK AL AM AN 151 152 153 154 155 156 157 158 159 160 161 162 163 164 165 166 167 168 169 170 171 172 173 174 175 176 177 178 179 180 181 182 183 184 185 186 187 188 100 A B N I PV FV I PV PMT FV I PV PMT FV 9b. How would your answer change if you made withdrawals at the beginning of each year? N I PV PMT N I 10 5% PV $1,000,000 $0 2 10b. How long would they last if you earned 0%? PMT 8.0% $100,000 -$10,000 $0 D 0.0% $100,000 -$10,000 $0 11b. Compounded monthly? E 10a. If you had $100,000 that was invested at 8% and you wanted to withdraw $10,000 at the end of each year, how long would your funds last? 3 5% -$100 $0 PMT= 36 0.42% -$100 $0 N = 11a. What's the future value of $100 after 3 years if the appropriate interest rate is 5%, compounded annually? N = F G FV = H FV = I J K fx Enter text or formula here C 12a. What's the present value of $100 due in 3 years if the appropriate interest rate is 6%, compounded annually? L M N O O 5 ! P Q R S T U V W X Y N AA AB AC AD AE AF < || : 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 Basic Time-Value of Money Problems Total Number of Questions: 31 1a. What would the future value of $500 be after 5 years at 10% compound interest? N I PV PMT 1b. At 10% simple interest? N I PV PMT 5 10% $500 $0 N I PV PMT 5 10% $500 $0 N I PMT FV 3 2% $3,000 $0 FV = Annual interest Total interest 2. Suppose you currently have $3,000 and plan to purchase a 3-year certificate of deposit (CD) that pays 2% interest compounded annually. How much will you have when the CD matures? 3 4% $0 $3,000 FV = FV = $50.00 3a. Suppose a U.S. government bond promises to pay $3,000 three years from now. If the going interest rate on 3-year government bonds is 4%, how much is the bond worth today? = 5*10 but use cells in the forumula PV = fx Enter text or formula here 9 C == 8 ! || :

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started