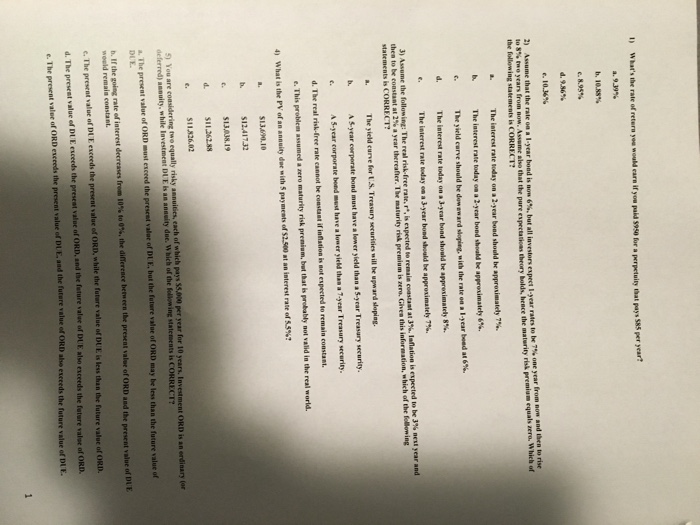

What's the rate of return you would earn if you paid $950 for a perpetuity that pays $85 per year? a. 9.39% b. 10.88% c. 8.95% d. 9.86% e. 10.36% Assume that the rate on a 1- year bond is now 6%, but all investors expect 1- year rates to be 7% one year from now and then to rise to 8% two years from now. Assume also that the pure expectations theory holds, hence the maturity risk premium equals zero. Which of the following statements is CORRECT: a. The interest rate today on a 2-year bond should be approximately 7%. b. The interest rate today on a 2-year bond should be approximately 6%. The yield curve should be downward sloping, with the rate on a 1-year bond at 6%. The interest rate today on a 3-year bond should be approximately 8%. The interest rate today on a 3-year bond should be approximately 7%. Assume the following: The real risk-free rate, r^b, is expected to remake constant at 3%. Inflation is expected to be 3% next year and then to be constant at 2% a year thereafter. the maturity risk premium is zero. Given this information, which of the following statements is CORRECT: a. The yield curse for U.S. treasury securities will be upward sloping. A 5-year corporate bond most have a lower yield than a 5-year Treasury security. A 5-year corporate bond must have a lower yield than a 7-year Treasury security. d. The real risk-free rate cannot be constant if inflation is not expected to remain constant. e. This problem assumed a zero maturity risk premium, but that is probably not valid in the real world. What is the PV of an annuity due with 5 payments of $2, 500 at an interest rate of 55%? a. %13, 690.10 b. $12, 417.32 c. $13, 038.19 d. $11, 262.88 e. $11, 826.02 You are considering two equally risky annuities, each of which pays $5,000 per year for 10 years. Investment ORD is an ordinary (or deferred) annuity, while investment DUE is an annuity due. Which of the following statements is CORRECT? a. The present value of ORD must exceed the present value of DUE, but the future value of ORD may be less than future value of DUE. b. If the going rate of interest decreases from 10% to 0%, the difference between the present value of ORD and the present value of DUE. c. The present value of DUE exceeds the present value of ORD, while the future value of DUE is less than the future value of ORD. d. The present value of DUE exceeds the present value of ORD, and the future value of DUE also exceeds the future value of ORD. e. The present value of ORD exceeds the present value of DUE, and the future value of ORD also exceeds the future value of DUE