Question

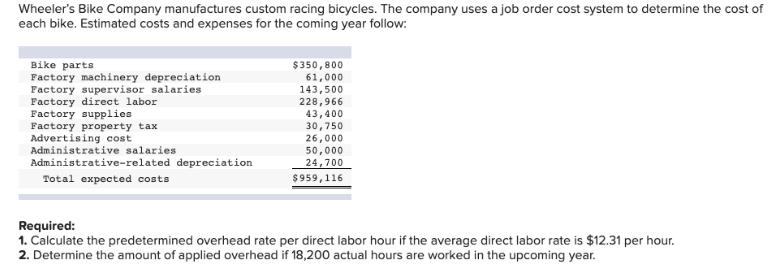

Wheeler's Bike Company manufactures custom racing bicycles. The company uses a job order cost system to determine the cost of each bike. Estimated costs

Wheeler's Bike Company manufactures custom racing bicycles. The company uses a job order cost system to determine the cost of each bike. Estimated costs and expenses for the coming year follow: $350,800 61,000 Bike parts Factory machinery depreciation Factory supervisor salaries Factory direct labor Factory supplies Factory property tax Advertising cost Administrative salaries 143,500 228,966 43,400 30,750 26,000 50,000 24,700 Administrative-related depreciation Total expected costs $959,116 Required: 1. Calculate the predetermined overhead rate per direct labor hour if the average direct labor rate is $12.31 per hour. 2. Determine the amount of applied overhead if 18,200 actual hours are worked in the upcoming year.

Step by Step Solution

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Expected Factory labor cost 228966 Cost per direct labor ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting

Authors: Carl S. Warren, James M. Reeve, Jonathan E. Duchac

22nd Edition

324401841, 978-0-324-6250, 0-324-62509-X, 978-0324401844

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App