Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Wheeler Corp. has invested $750,000 into a project which is now completed and operational. Services provided by the completed project will bring in $100,000

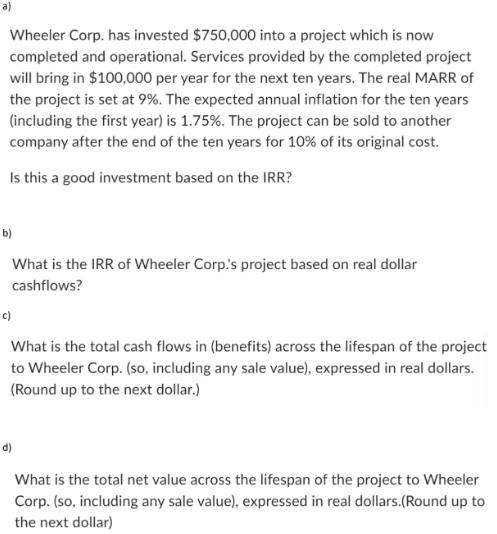

Wheeler Corp. has invested $750,000 into a project which is now completed and operational. Services provided by the completed project will bring in $100,000 per year for the next ten years. The real MARR of the project is set at 9%. The expected annual inflation for the ten years (including the first year) is 1.75%. The project can be sold to another company after the end of the ten years for 10% of its original cost. Is this a good investment based on the IRR? b) What is the IRR of Wheeler Corp's project based on real dollar cashflows? c) What is the total cash flows in (benefits) across the lifespan of the project to Wheeler Corp. (so, including any sale value), expressed in real dollars. (Round up to the next dollar.) d) What is the total net value across the lifespan of the project to Wheeler Corp. (so, including any sale value), expressed in real dollars.(Round up to the next dollar)

Step by Step Solution

★★★★★

3.31 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

a Yes this investment is a good investment based on the IRR The internal rate of return IRR is a mea...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started