Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Wheeler Electrical Supplies, Inc. (Wheeler), an accrual basis, calendar year C corporation, has been in the business of manufacturing small electrical components in Texas

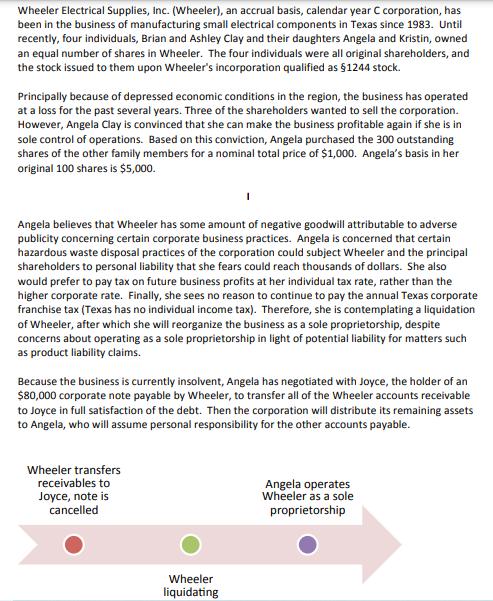

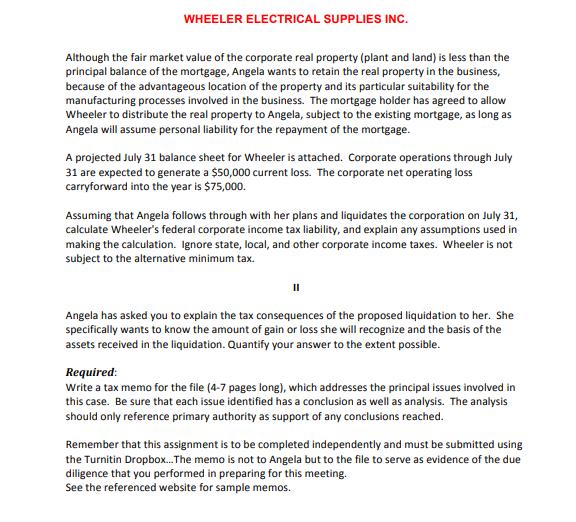

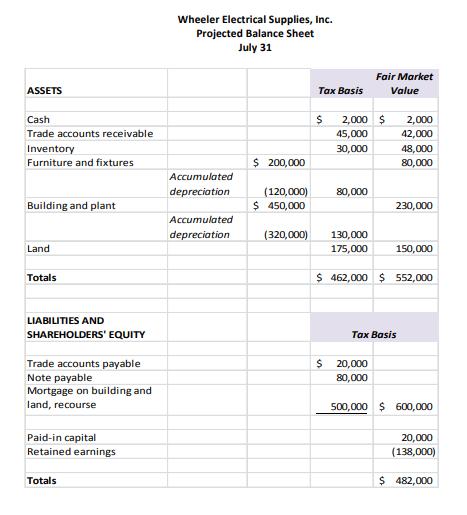

Wheeler Electrical Supplies, Inc. (Wheeler), an accrual basis, calendar year C corporation, has been in the business of manufacturing small electrical components in Texas since 1983. Until recently, four individuals, Brian and Ashley Clay and their daughters Angela and Kristin, owned an equal number of shares in Wheeler. The four individuals were all original shareholders, and the stock issued to them upon Wheeler's incorporation qualified as 1244 stock. Principally because of depressed economic conditions in the region, the business has operated at a loss for the past several years. Three of the shareholders wanted to sell the corporation. However, Angela Clay is convinced that she can make the business profitable again if she is in sole control of operations. Based on this conviction, Angela purchased the 300 outstanding shares of the other family members for a nominal total price of $1,000. Angela's basis in her original 100 shares is $5,000. Angela believes that Wheeler has some amount of negative goodwill attributable to adverse publicity concerning certain corporate business practices. Angela is concerned that certain hazardous waste disposal practices of the corporation could subject Wheeler and the principal shareholders to personal liability that she fears could reach thousands of dollars. She also would prefer to pay tax on future business profits at her individual tax rate, rather than the higher corporate rate. Finally, she sees no reason to continue to pay the annual Texas corporate franchise tax (Texas has no individual income tax). Therefore, she is contemplating a liquidation of Wheeler, after which she will reorganize the business as a sole proprietorship, despite concerns about operating as a sole proprietorship in light of potential liability for matters such as product liability claims. Because the business is currently insolvent, Angela has negotiated with Joyce, the holder of an $80,000 corporate note payable by Wheeler, to transfer all of the Wheeler accounts receivable to Joyce in full satisfaction of the debt. Then the corporation will distribute its remaining assets to Angela, who will assume personal responsibility for the other accounts payable. Wheeler transfers receivables to Joyce, note is cancelled Angela operates Wheeler as a sole proprietorship Wheeler liquidating WHEELER ELECTRICAL SUPPLIES INC. Although the fair market value of the corporate real property (plant and land) is less than the principal balance of the mortgage, Angela wants to retain the real property in the business, because of the advantageous location of the property and its particular suitability for the manufacturing processes involved in the business. The mortgage holder has agreed to allow Wheeler to distribute the real property to Angela, subject to the existing mortgage, as long as Angela will assume personal liability for the repayment of the mortgage. A projected July 31 balance sheet for Wheeler is attached. Corporate operations through July 31 are expected to generate a $50,000 current loss. The corporate net operating loss carryforward into the year is $75,000. Assuming that Angela follows through with her plans and liquidates the corporation on July 31, calculate Wheeler's federal corporate income tax liability, and explain any assumptions used in making the calculation. Ignore state, local, and other corporate income taxes. Wheeler is not subject to the alternative minimum tax. II Angela has asked you to explain the tax consequences of the proposed liquidation to her. She specifically wants to know the amount of gain or loss she will recognize and the basis of the assets received in the liquidation. Quantify your answer to the extent possible. Required: Write a tax memo for the file (4-7 pages long), which addresses the principal issues involved in this case. Be sure that each issue identified has a conclusion as well as analysis. The analysis should only reference primary authority as support of any conclusions reached. Remember that this assignment is to be completed independently and must be submitted using the Turnitin Dropbox... The memo is not to Angela but to the file to serve as evidence of the due diligence that you performed in preparing for this meeting. See the referenced website for sample memos. ASSETS Cash Trade accounts receivable Inventory Furniture and fixtures Building and plant Land Totals LIABILITIES AND SHAREHOLDERS' EQUITY Trade accounts payable Note payable Mortgage on building and land, recourse Paid-in capital Retained earnings Totals Wheeler Electrical Supplies, Inc. Projected Balance Sheet July 31 $ 200,000 (120,000) $ 450,000 (320,000) Accumulated depreciation Accumulated depreciation Tax Basis $ Fair Market Value $ 2,000 $ 2,000 45,000 42,000 30,000 48,000 80,000 80,000 230,000 130,000 175,000 150,000 $ 462,000 $ 552,000 Tax Basis 20,000 80,000 500,000 $ 600,000 20,000 (138,000) $ 482,000

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Tax Memorandum Date 12062015 To Mss Angela From Name of student Subject how to know the amount of gain or loss will recognize and the basis of the assets received in the liquidation Facts Wheeler Elec...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 1 attachment)

629093e15f0a6_25049.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started