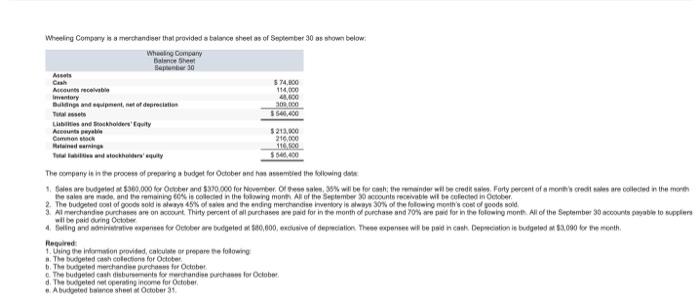

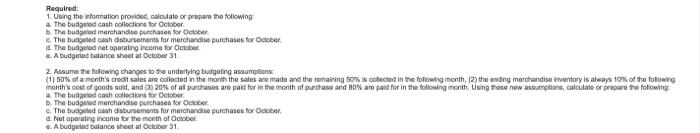

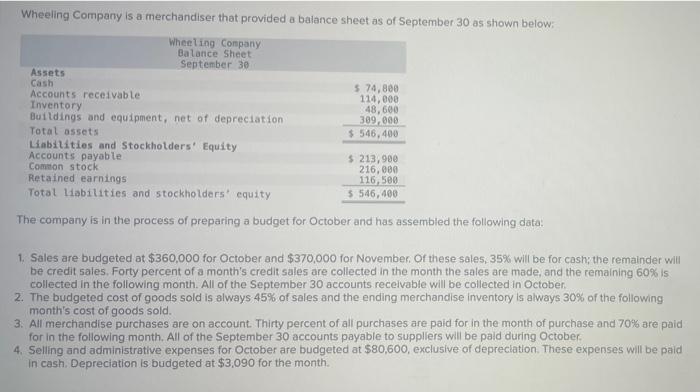

Wheeling Company is a merchandiser that provided a balance sheet as of September 30 as shown below Wher Company Balance Sheet 114.000 Story . Cash $74.600 McGreco Bullingen of desire 1000 To $546,00 Lisandroholder Equity Apie $213.000 Common och 216.000 Remedlem HO To and other The company in se procese of preparing a budget for October and has noted the following di stos are budgeted $300,000 to October and $370.000 for November 10, 35% will be femhithe remainder will be credite Forty percent of a morte credit sies are collected in the more the same made and to remaining of is collected in the following month. All of the Stomber 30 counts receivable wil be colected in October 2. The budgeted cont of goods sold in 48% and the ende merchandienvidory is always 30% of the following mons com goods world 3. Al merchandise purchase ant on account Thirty percent of all purchase repaid for in the month of purchase and 70% e paid for in the folowo monts. All of the September 38 accounts payable to suppliers will be paid ring October Sering ord hoministrive experies for Oekber are buipolod o. 560,000 ordutive of depicinions. These expenses will be pod nemt Decision in budglad 83.000 bar to menth Ding the informon provided, cause of prepare the following The budgeted ce colections for October 6. The burgutod merandue purchases for October d. The buigelede operating income for October boosted puth for October A budgeted twice sheer October 31 Required: 1. Using the information provided, calculate or prepare the following: a The budgeted cash collections for October The budget marchandise purchases for October c. The budgeted cash disbursements for merchandise purchases for October The budgeted net operating income for October e. A budgetod balance sheet at October 31 2. Assume the following changes to the underlying budgeting assumption (1) 50% of a a month's credit sales are collected in the month the sales are made and the remaining 50% scofected in the following month, (2) the ending marchandise mnentory is always 10% of the following months.cost of goods sold, and 20% of all purchases are paid for in the month of purchase and are paid for in the following month. Using these new assumption, calculate or prepare the flowing The budged cash collection for Cober The budgeted merchandise purchases for October c. The budgeted cash disbursements for merchandise purchases for October d. Net operating income for the month of October e. A budgeted balance sheet al October 31 Wheeling Company is a merchandiser that provided a balance sheet as of September 30 as shown below: Wheeling Company Balance Sheet September 30 Assets Cash $ 74,800 Accounts receivable 114,000 Inventory 48,600 Buildings and equipment, net of depreciation 309,000 Total assets $546,400 Liabilities and Stockholders' Equity Accounts payable $ 213,900 Common stock 216,000 Retained earnings 116,500 Total Habilities and stockholders' equity 5.546,400 The company is in the process of preparing a budget for October and has assembled the following data: 1. Sales are budgeted at $360,000 for October and $370,000 for November. Of these sales, 35% will be for cash: the remainder will be credit sales. Forty percent of a month's credit sales are collected in the month the sales are made, and the remaining 60% is collected in the following month. All of the September 30 accounts receivable will be collected in October 2. The budgeted cost of goods sold is always 45% of sales and the ending merchandise inventory is always 30% of the following month's cost of goods sold. 3. All merchandise purchases are on account. Thirty percent of all purchases are paid for in the month of purchase and 70% are paid for in the following month. All of the September 30 accounts payable to suppliers will be paid during October 4. Selling and administrative expenses for October are budgeted at $80,600, exclusive of depreciation. These expenses will be paid in cash. Depreciation is budgeted at $3,090 for the month Required: 1. Using the information provided, calculate or prepare the following: a. The budgeted cash collections for October b. The budgeted merchandise purchases for October c. The budgeted cash disbursements for merchandise purchases for October d. The budgeted net operating income for October e. A budgeted balance sheet at October 31, 2. Assume the following changes to the underlying budgeting assumptions: (1) 50% of a month's credit sales are collected in the month the sales are made and the remaining 50% is collected in the following month, (2) the ending merchandise inventory is always 10% of the following month's cost of goods sold, and (3) 20% of all purchases are paid for in the month of purchase and 80% are paid for in the following month. Using these new assumptions, calculate or prepare the following: a. The budgeted cash collections for October. b. The budgeted merchandise purchases for October C. The budgeted cash disbursements for merchandise purchases for October d. Net operating income for the month of October e. A budgeted balance sheet at October 31