Answered step by step

Verified Expert Solution

Question

1 Approved Answer

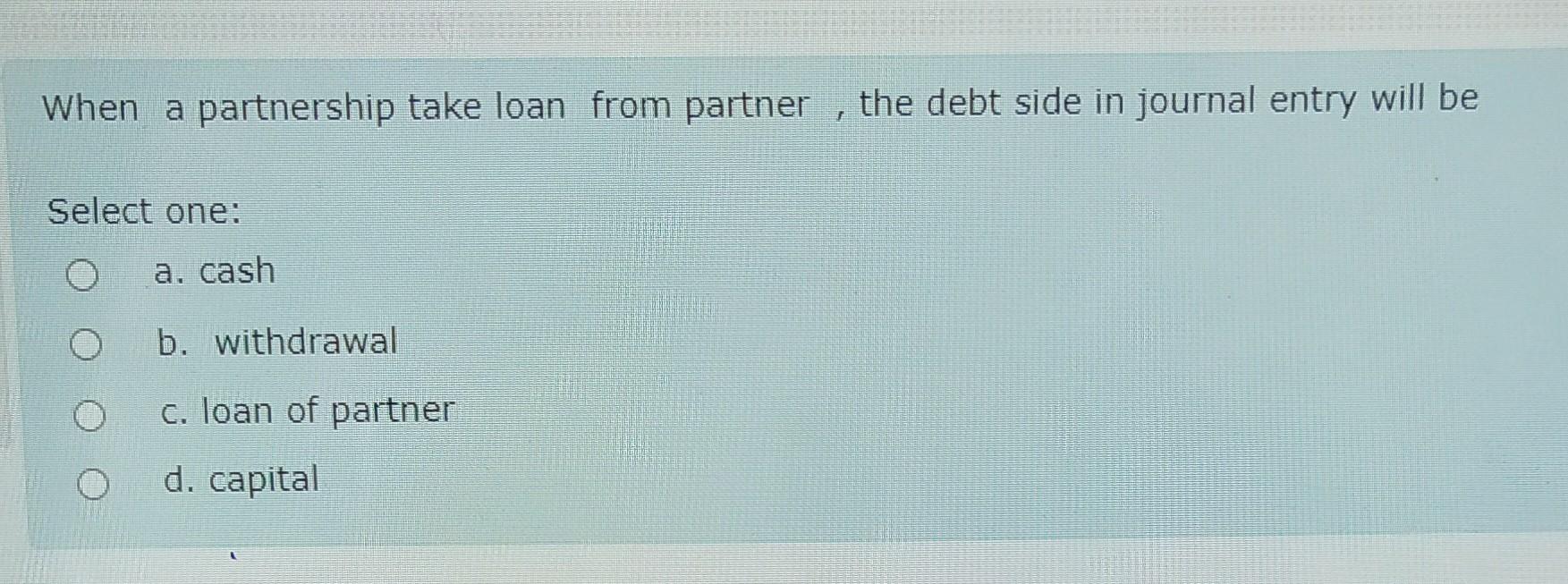

When a partnership take loan from partner , the debt side in journal entry will be Select one: a. cash b. withdrawal c. loan of

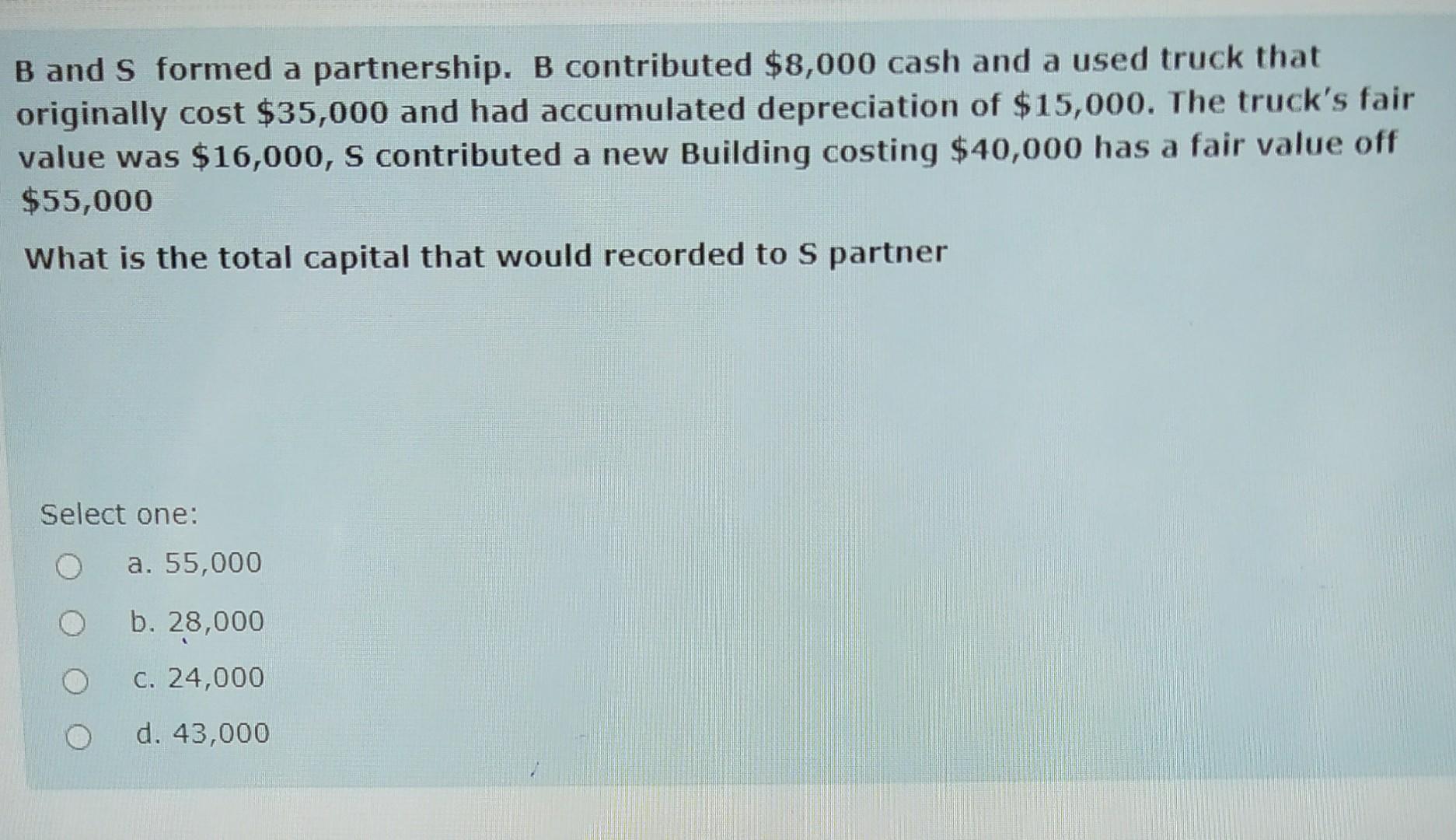

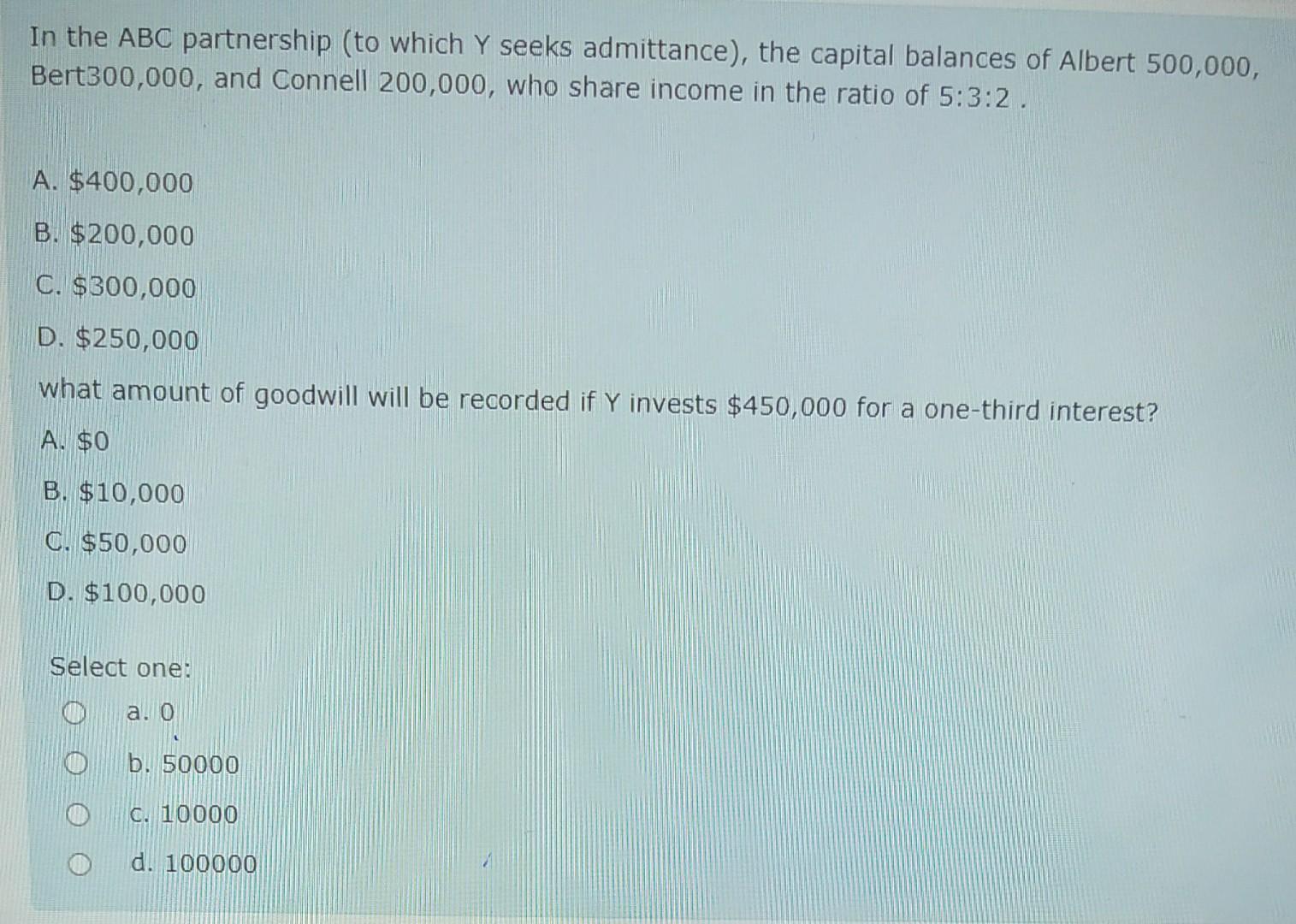

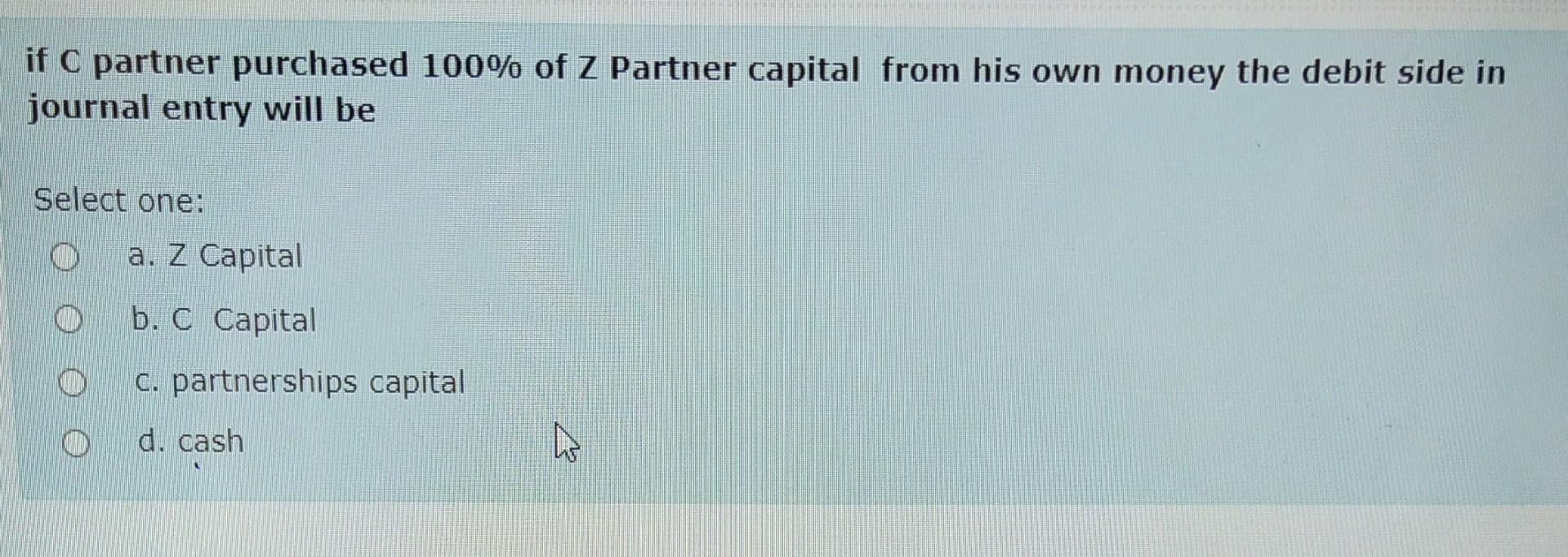

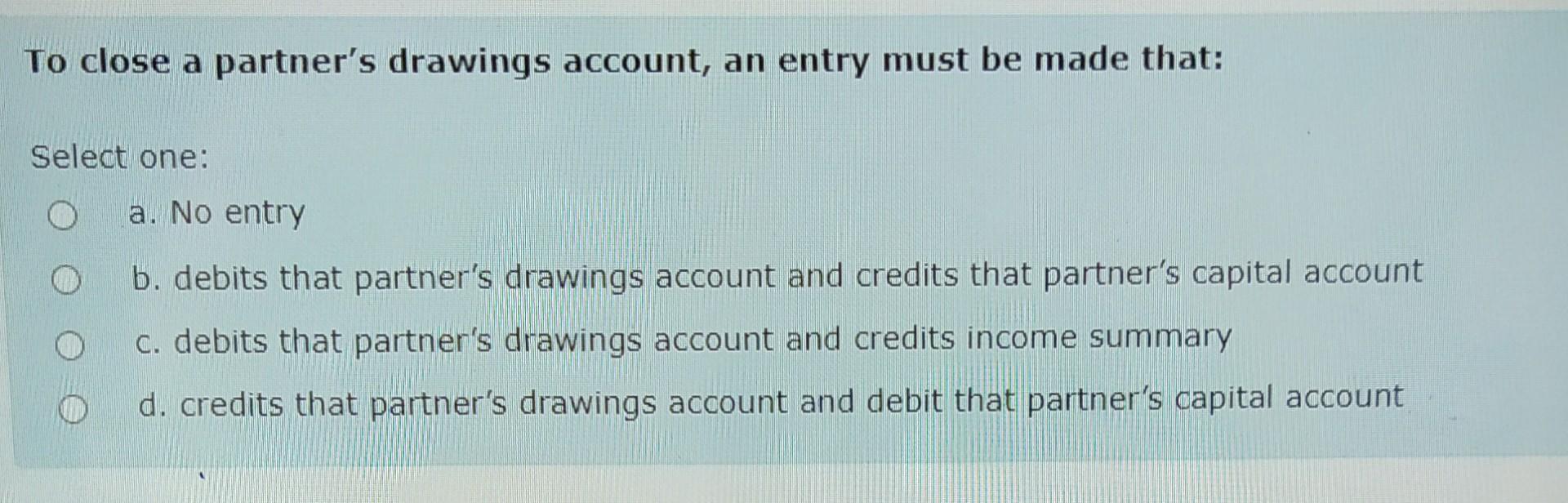

When a partnership take loan from partner , the debt side in journal entry will be Select one: a. cash b. withdrawal c. loan of partner d. capital B and s formed a partnership. B contributed $8,000 cash and a used truck that originally cost $35,000 and had accumulated depreciation of $15,000. The truck's fair value was $ 16,000, S contributed a new Building costing $40,000 has a fair value off $55,000 What is the total capital that would recorded to S partner Select one: a. 55,000 b. 28,000 c. 24,000 d. 43,000 In the ABC partnership (to which Y seeks admittance), the capital balances of Albert 500,000, Bert300,000, and Connell 200,000, who share income in the ratio of 5:3:2. A. $400,000 B. $200,000 C. $300,000 D. $250,000 what amount of goodwill will be recorded if Y invests $450,000 for a one-third interest? A. $0 B. $10,000 C. $50,000 D. $100,000 Select one: a. O b. 50000 c. 10000 d. 100000 if ( partner purchased 100% of Z Partner capital from his own money the debit side in journal entry will be Select one: a. Z Capital b. C Capital c. partnerships capital d. cash D To close a partner's drawings account, an entry must be made that: Select one: a. No entry b. debits that partner's drawings account and credits that partner's capital account C. debits that partner's drawings account and credits income summary d. credits that partner's drawings account and debit that partner's capital account

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started