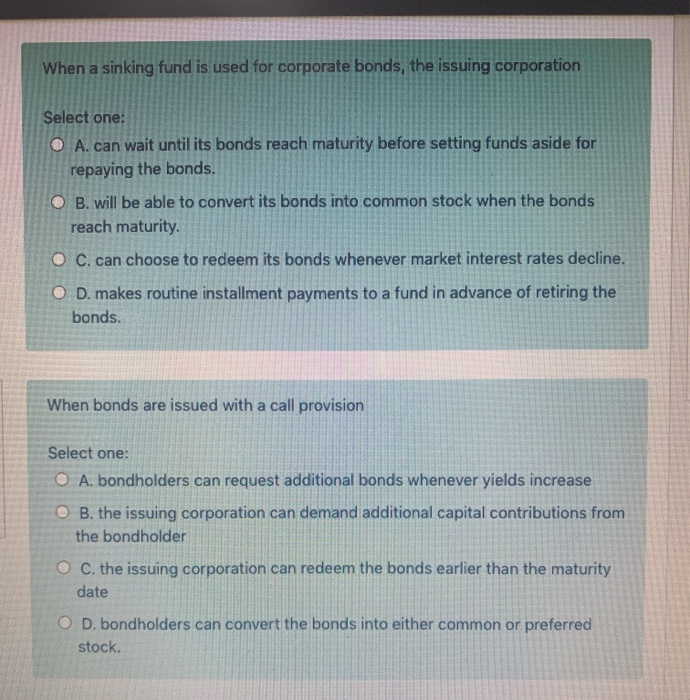

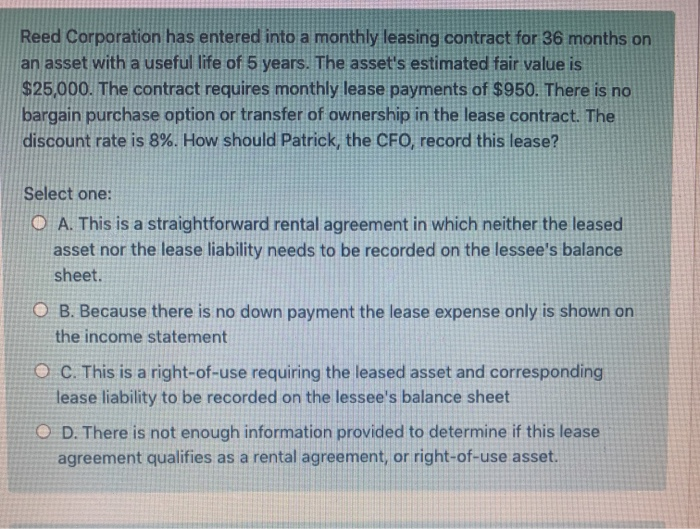

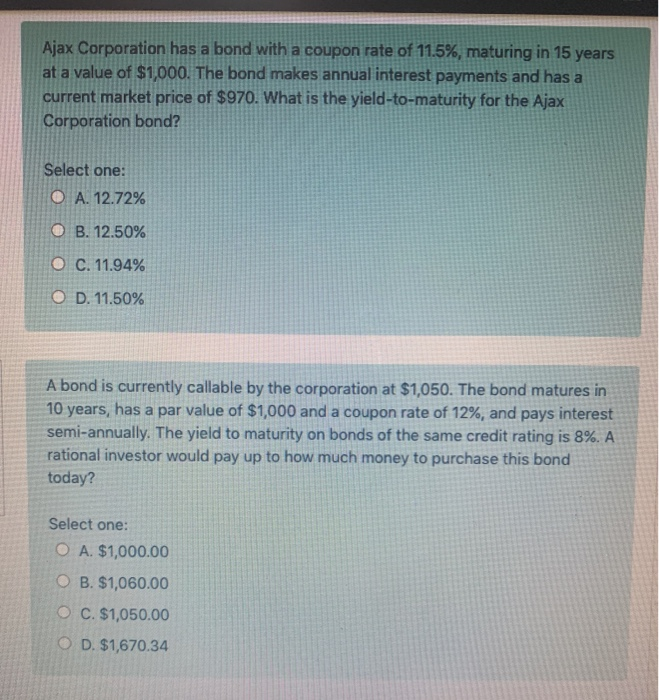

When a sinking fund is used for corporate bonds, the issuing corporation Select one: O A. can wait until its bonds reach maturity before setting funds aside for repaying the bonds. O B. will be able to convert its bonds into common stock when the bonds reach maturity. O C. can choose to redeem its bonds whenever market interest rates decline. O D. makes routine installment payments to a fund in advance of retiring the bonds. When bonds are issued with a call provision Select one: O A. bondholders can request additional bonds whenever yields increase O B. the issuing corporation can demand additional capital contributions from the bondholder O C. the issuing corporation can redeem the bonds earlier than the maturity date OD. bondholders can convert the bonds into either common or preferred stock. Reed Corporation has entered into a monthly leasing contract for 36 months on an asset with a useful life of 5 years. The asset's estimated fair value is $25,000. The contract requires monthly lease payments of $950. There is no bargain purchase option or transfer of ownership in the lease contract. The discount rate is 8%. How should Patrick, the CFO, record this lease? Select one: O A. This is a straightforward rental agreement in which neither the leased asset nor the lease liability needs to be recorded on the lessee's balance sheet. O B. Because there is no down payment the lease expense only is shown on the income statement O C. This is a right-of-use requiring the leased asset and corresponding lease liability to be recorded on the lessee's balance sheet O D. There is not enough information provided to determine if this lease agreement qualifies as a rental agreement, or right-of-use asset. Ajax Corporation has a bond with a coupon rate of 11.5%, maturing in 15 years at a value of $1,000. The bond makes annual interest payments and has a current market price of $970. What is the yield-to-maturity for the Ajax Corporation bond? Select one: O A. 12.72% O B. 12.50% O C. 11.94% O D. 11.50% A bond is currently callable by the corporation at $1,050. The bond matures in 10 years, has a par value of $1,000 and a coupon rate of 12%, and pays interest semi-annually. The yield to maturity on bonds of the same credit rating is 8%. A rational investor would pay up to how much money to purchase this bond today? Select one: O A. $1,000.00 O B. $1,060.00 O C. $1,050.00 O D. $1,670.34