Answered step by step

Verified Expert Solution

Question

1 Approved Answer

When Amazon opened its first brick-and-mortar store in 2015 on the campus of Purdue University in Indiana and then in December announced its first

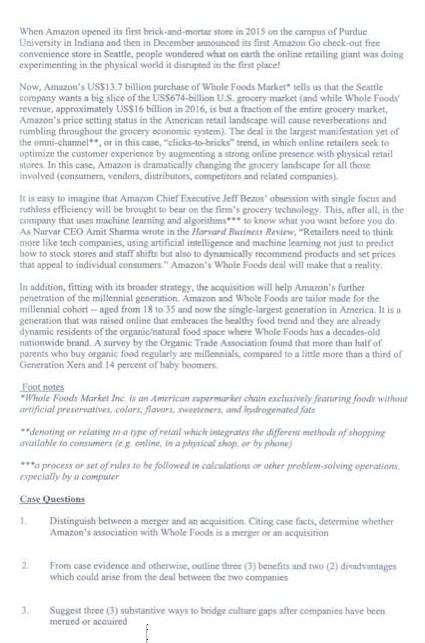

When Amazon opened its first brick-and-mortar store in 2015 on the campus of Purdue University in Indiana and then in December announced its first Amazon Go check-out free convenience store in Seattle, people wondered what on earth the online retailing giant was doing experimenting in the physical world it disrupted in the first place! Now, Amazon's US$13.7 billion purchase of Whole Foods Market" tells us that the Seattle company wants a big slice of the US$674-billion U.S. grocery market (and while Whole Foods revenue, approximately US$16 billion in 2016, is but a fraction of the entire grocery market, Amazon's price setting status in the American retail landscape will cause reverberations and rumbling throughout the grocery economic system). The deal is the largest manifestation yet of the omni-channel**, or in this case, "clicks-to-bricks" trend, in which online retailers seek to optimize the customer experience by augmenting a strong online presence with physical retail stores. In this case, Amazon is dramatically changing the grocery landscape for all those involved (consumers, vendors, distributors, competitors and related companies) It is easy to imagine that Amazon Chief Executive Jeff Bezos obsession with single focus and ruthless efficiency will be brought to bear on the firm's grocery technology. This, after all, is the company that uses machine learning and algorithms to know what you want before you do. As Narvar CEO Amit Sharma wrote in the Harvard Business Review, "Retailers need to think more like tech companies, using artificial intelligence and machine learning not just to predict how to stock stores and staff shifts but also to dynamically recommend products and set prices that appeal to individual consumers" Amazon's Whole Foods deal will make that a reality. In addition, fitting with its broader strategy, the acquisition will help Amazon's further penetration of the millennial generation. Amazon and Whole Foods are tailor made for the millennial cohort-aged from 18 to 35 and now the single-largest generation in America. It is a generation that was raised online that embraces the healthy food trend and they are already dynamic residents of the organic/natural food space where Whole Foods has a decades-old nationwide brand. A survey by the Organic Trade Association found that more than half of parents who buy organic food regularly are millennials, compared to a little more than a third of Generation Xers and 14 percent of baby boomers. Footnotes "Whole Foods Market Inc is an American supermarket chain exclusively featuring foods without artificial preservatives, colors, flavors, sweeteners, and lydrogenated fats **denoting or relating to a type of retail which integrates the different methods of shopping available to consumers (eg online, in a physical shop, or by phone) ***a process or set of rules to be followed in calculations or other problem-solving operations. expecially by a computer Case Questions Distinguish between a merger and an acquisition. Citing case facts, determine whether Amazon's association with Whole Foods is a merger or an acquisition 2 3. From case evidence and otherwise, outline three (3) benefits and two (2) disadvantages which could arise from the deal between the two companies Suggest three (3) substantive ways to bridge culture gaps after companies have been merged or acquired Question 1 Diversification (a) Sketch a labeled diagram showing the five categories of businesses based on level of diversification. Briefly explain each of the five categories (b) Describe how diversified firms can use activity sharing and transfer of core competencies to create value. Question 2 Corporate Governance (a) Explain the agency relationship and managerial opportunism and discuss their strategic implications. (b) Define the three internal corporate governance mechanisms and how they may be used to control and monitor managerial decisions. Question 3 Strategic Alliances (a) Define and explain the concept of strategic alliances and describe the main forms of strategic alliances. Outline three major reasons why some firms will enter into strategic alliances, even with a major competitor. (b) Strategic alliances are not without risks as some alliance partners may act in an opportunistic or deviant way. Discuss three (3) strategies that firms may use to mitigate these risks and enhance value creation.

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Case Questions Differentiate between a merger and an acquisition Citing case facts determine whether Amazons association with Whole Foods is a merger or an acquisition Amazons association with Whole F...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started