Answered step by step

Verified Expert Solution

Question

1 Approved Answer

When analyzing a company's valuation using financial ratios, which statement accurately describes the use of P/E (Price-to-Earnings), P/B (Price-to-Book), and ( mathrm{P} / mathrm{S} )

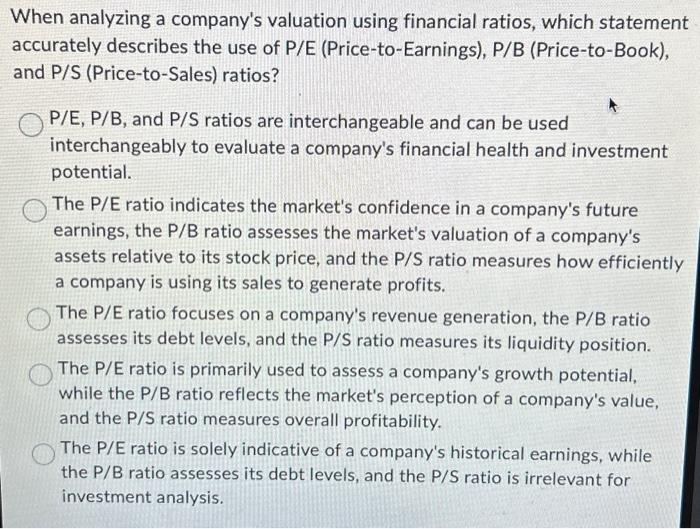

When analyzing a company's valuation using financial ratios, which statement accurately describes the use of P/E (Price-to-Earnings), P/B (Price-to-Book), and ( mathrm{P} / mathrm{S} ) (Price-to-Sales) ratios? ( P / E, P / B ), and ( P / S ) ratios are interchangeable and can be used interchangeably to evaluate a company's financial health and investment potential. The ( mathrm{P} / mathrm{E} ) ratio indicates the market's confidence in a company's future earnings, the ( mathrm{P} / mathrm{B} ) ratio assesses the market's valuation of a company's assets relative to its stock price, and the ( P / S ) ratio measures how efficiently a company is using its sales to generate profits. The ( mathrm{P} ) /E ratio focuses on a company's revenue generation, the ( mathrm{P} / mathrm{B} ) ratio assesses its debt levels, and the ( mathrm{P} / mathrm{S} ) ratio measures its liquidity position. The P/E ratio is primarily used to assess a company's growth potential, while the ( P / B ) ratio reflects the market's perception of a company's value, and the ( mathrm{P} / mathrm{S} ) ratio measures overall profitability. The ( P / E ) ratio is solely indicative of a company's historical earnings, while the ( mathrm{P} / mathrm{B} ) ratio assesses its debt levels, and the ( mathrm{P} / mathrm{S} ) ratio is irrelevant for investment analysis.

When analyzing a company's valuation using financial ratios, which statement accurately describes the use of P/E (Price-to-Earnings), P/B (Price-to-Book), and P/S (Price-to-Sales) ratios? P/E, P/B, and P/S ratios are interchangeable and can be used interchangeably to evaluate a company's financial health and investment potential. The P/E ratio indicates the market's confidence in a company's future earnings, the P/B ratio assesses the market's valuation of a company's assets relative to its stock price, and the P/S ratio measures how efficiently a company is using its sales to generate profits. The P/E ratio focuses on a company's revenue generation, the P/B ratio assesses its debt levels, and the P/S ratio measures its liquidity position. The P/E ratio is primarily used to assess a company's growth potential, while the P/B ratio reflects the market's perception of a company's value, and the P/S ratio measures overall profitability. The P/E ratio is solely indicative of a company's historical earnings, while the P/B ratio assesses its debt levels, and the P/S ratio is irrelevant for investment analysis.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started