Answered step by step

Verified Expert Solution

Question

1 Approved Answer

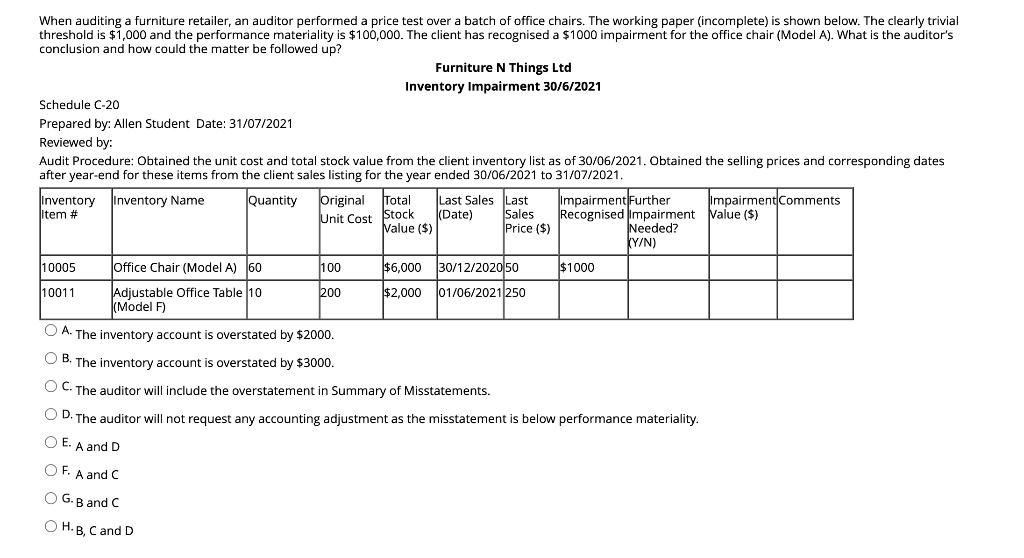

When auditing a furniture retailer, an auditor performed a price test over batch of office chairs. The working paper (incomplete) is shown below. The

When auditing a furniture retailer, an auditor performed a price test over batch of office chairs. The working paper (incomplete) is shown below. The clearly trivial threshold is $1,000 and the performance materiality is $100,000. The client has recognised a $1000 impairment for the office chair (Model A). What is the auditor's conclusion and how could the matter be followed up? Schedule C-20 Prepared by: Allen Student Date: 31/07/2021 Reviewed by: Audit Procedure: Obtained the unit cost and total stock value from the client inventory list as of 30/06/2021. Obtained the selling prices and corresponding dates after year-end for these items from the client sales listing for the year ended 30/06/2021 to 31/07/2021. Inventory Name Quantity Inventory Item # Furniture N Things Ltd Inventory Impairment 30/6/2021 10005 10011 Original Total Unit Cost Stock Value ($) Office Chair (Model A) 60 Adjustable Office Table 10 (Model F) A. The inventory account is overstated by $2000. OB. The inventory account is overstated by $3000. OC. The auditor will include the overstatement in Summary of Misstatements. 100 200 Last Sales Last (Date) $6,000 $2,000 Sales Price ($) 30/12/2020 50 01/06/2021 250 Impairment Further Recognised Impairment Needed? KY/N) $1000 OD. The auditor will not request any accounting adjustment as the misstatement is below performance materiality. OE. A and D OF. A and C OG. B and C OH. B, C and D Impairment Comments Value ($)

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

The client has recognized a 1000 impairment for the office chair Model A The clearly trivial threshold is 1000 and the performance materiality is 1000...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started