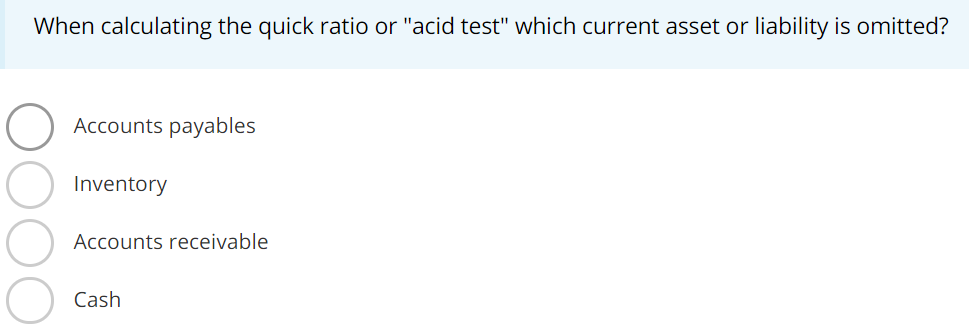

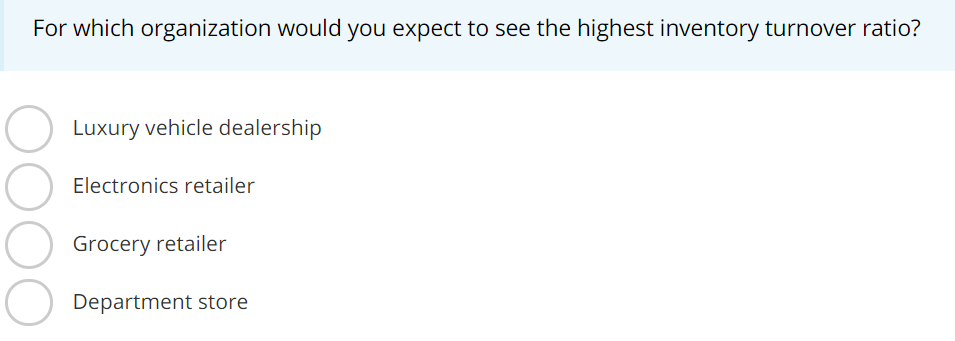

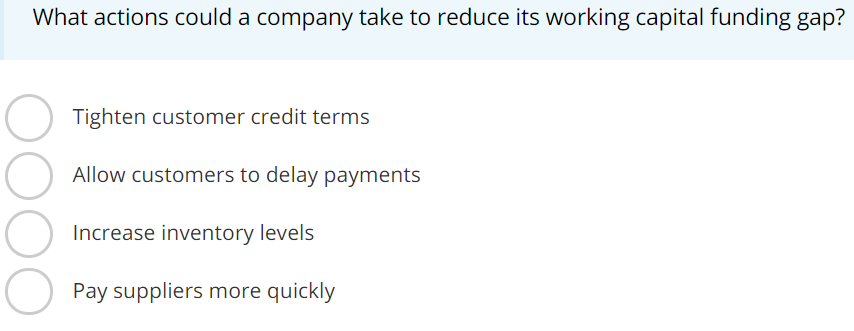

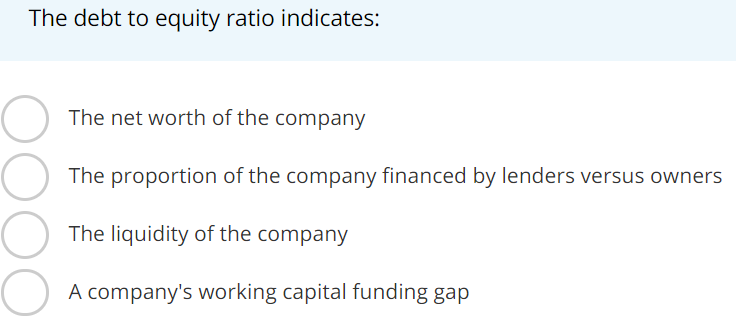

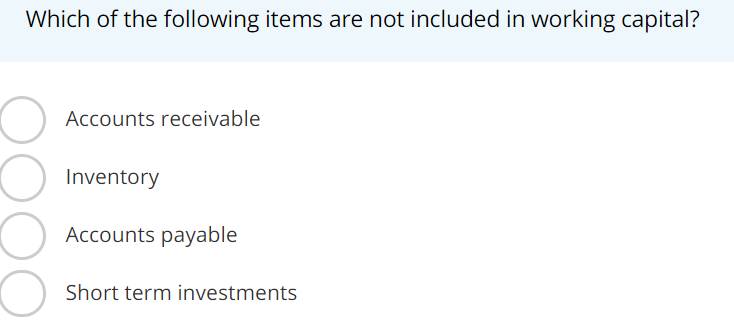

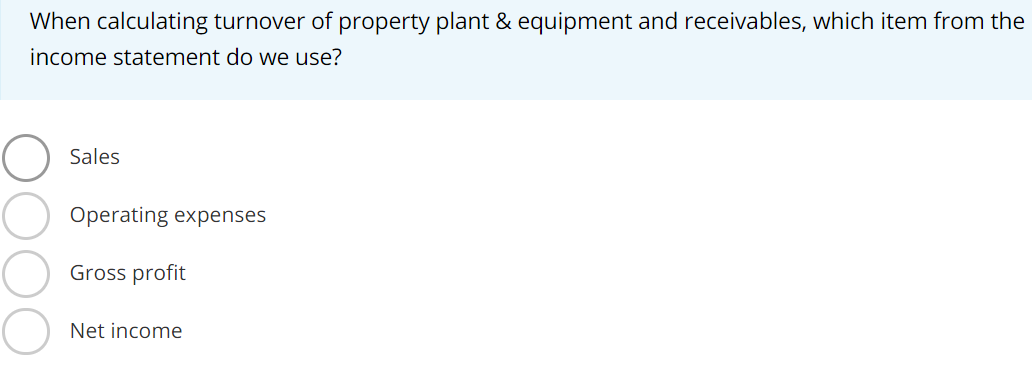

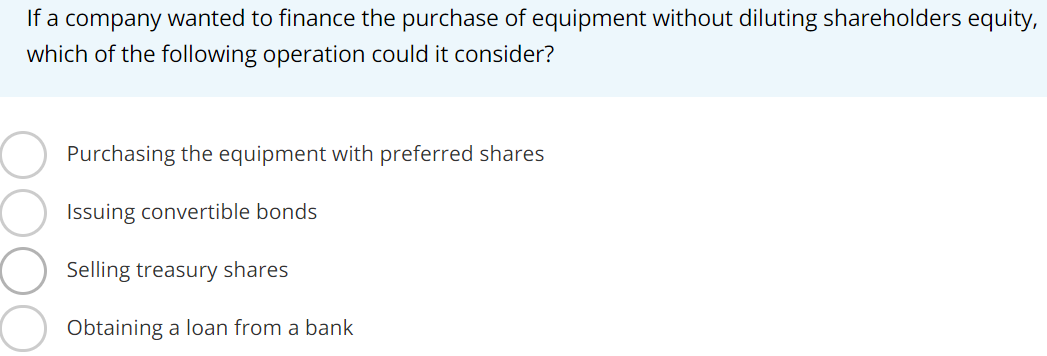

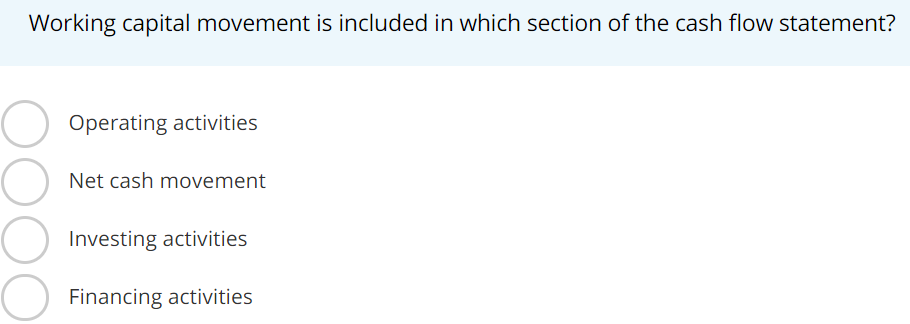

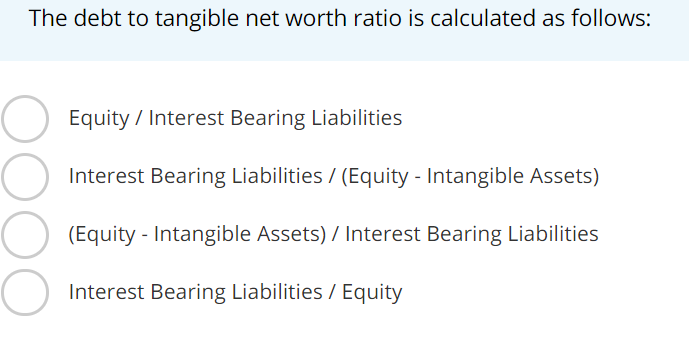

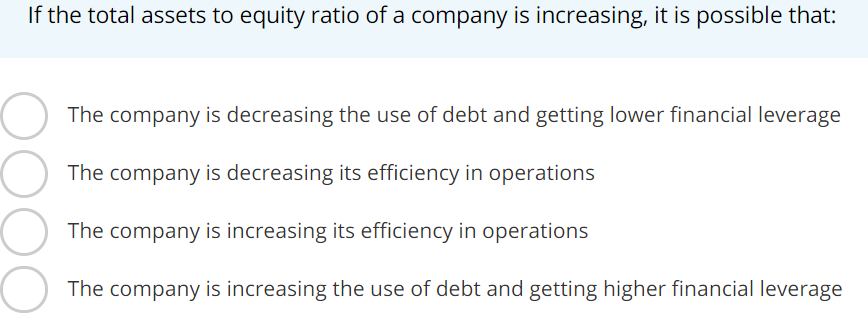

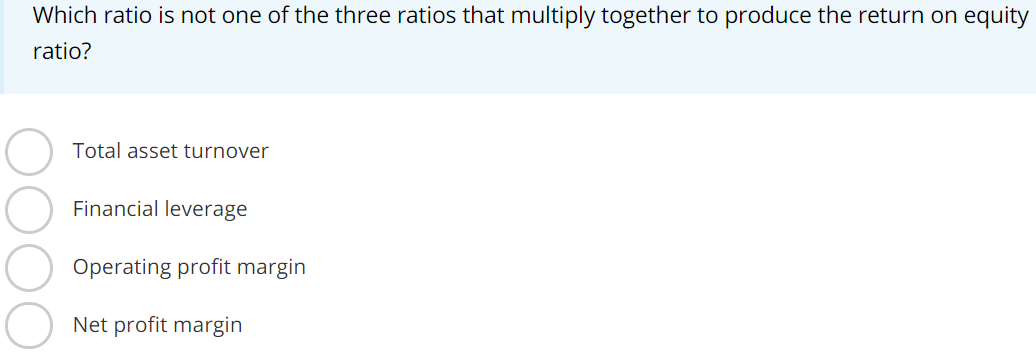

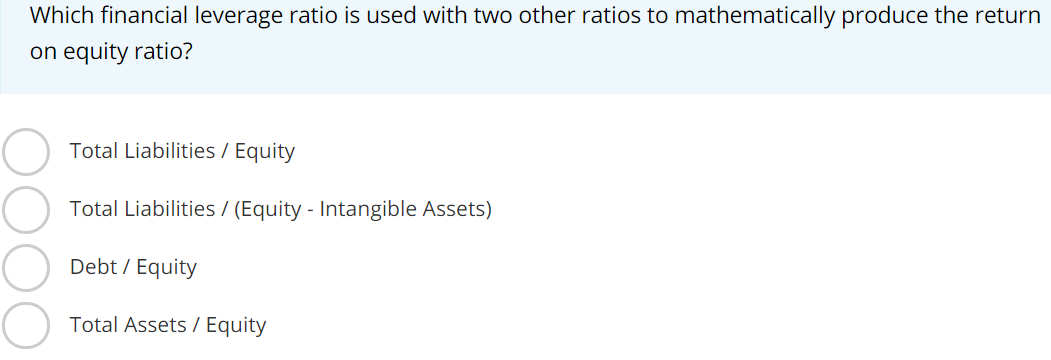

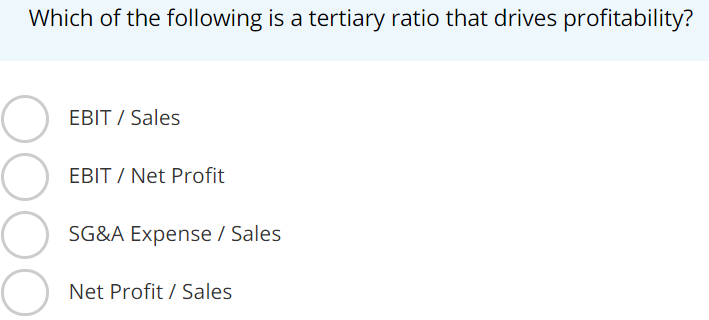

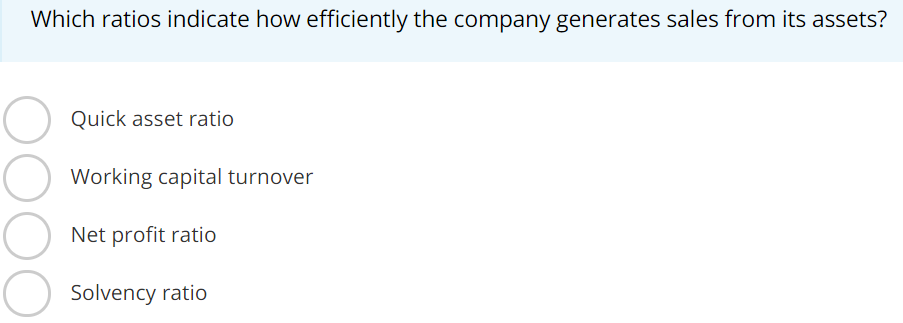

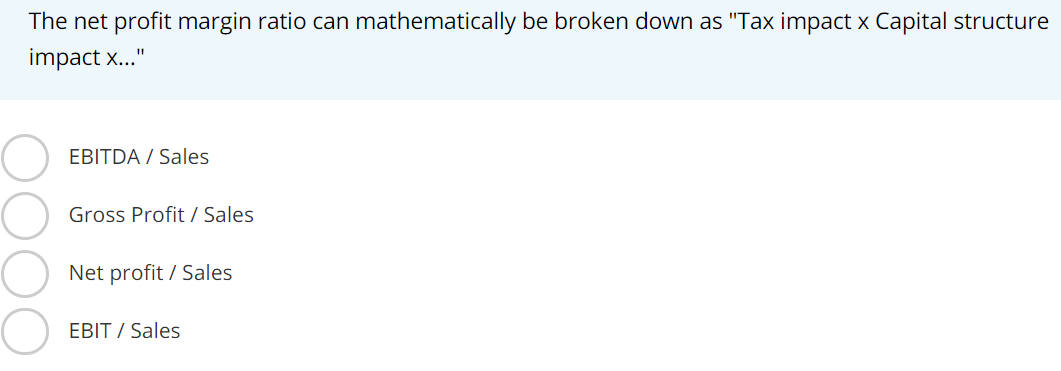

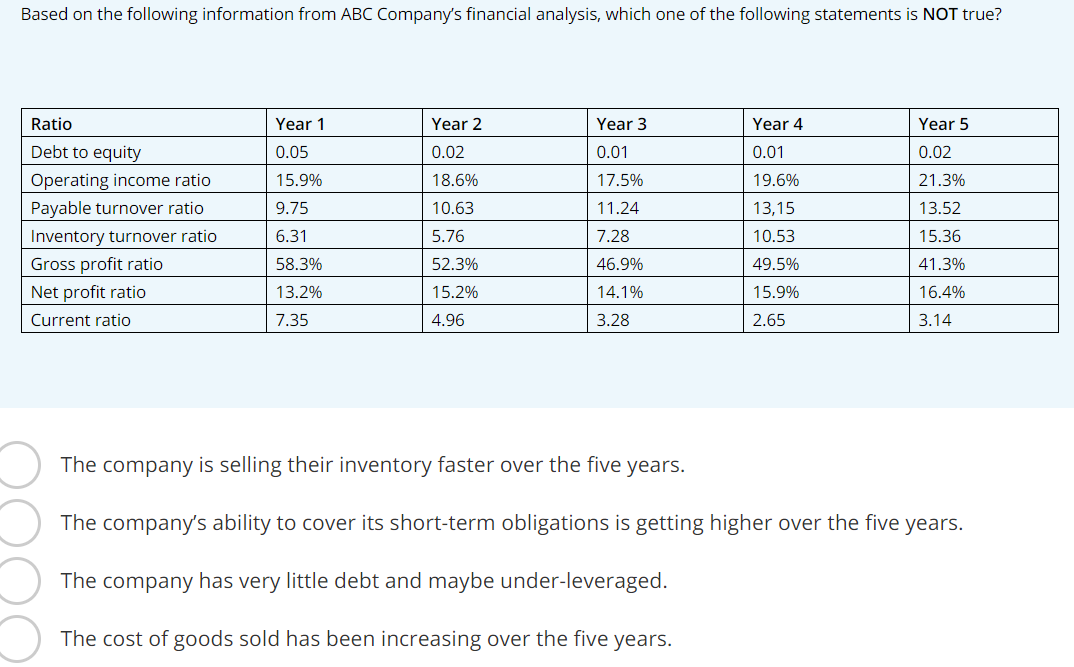

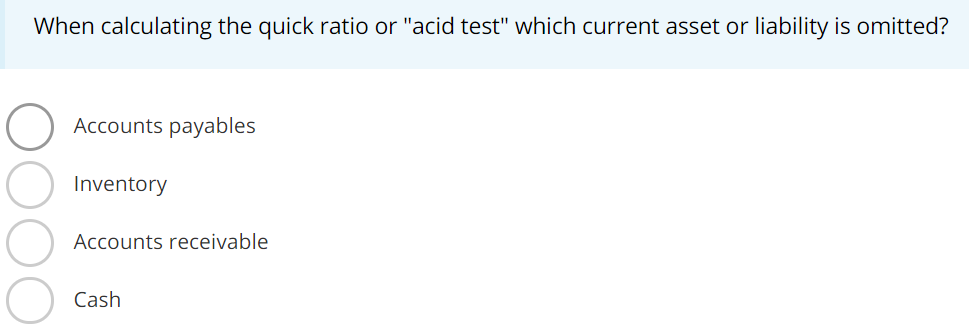

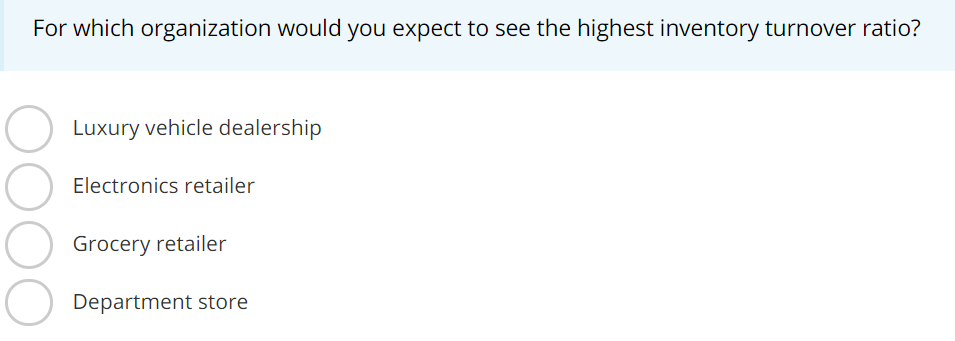

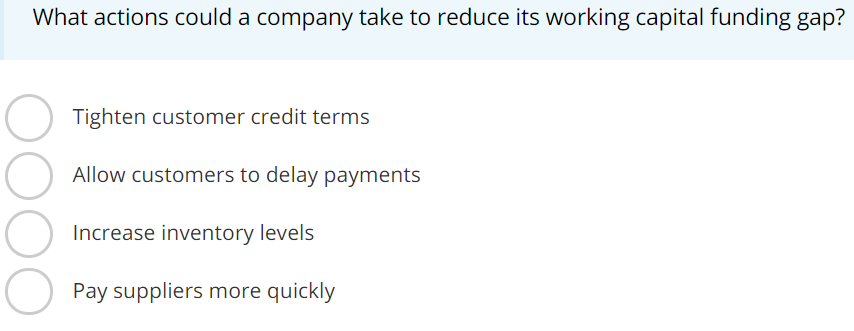

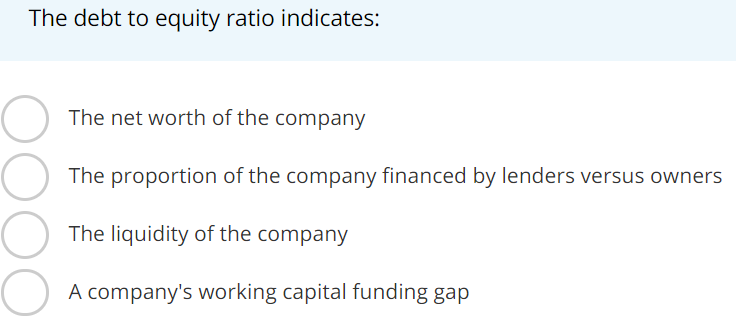

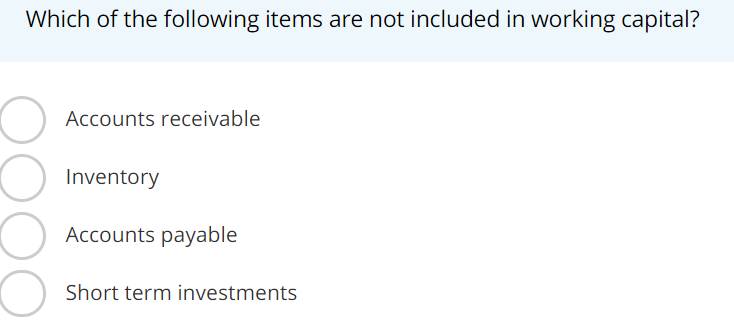

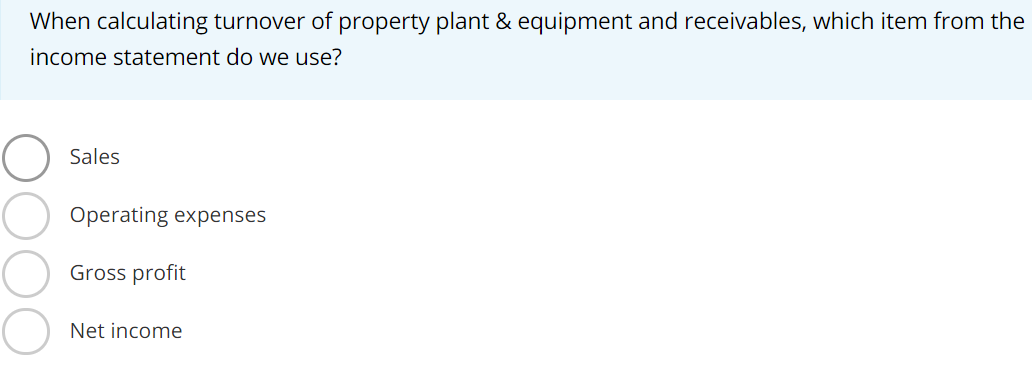

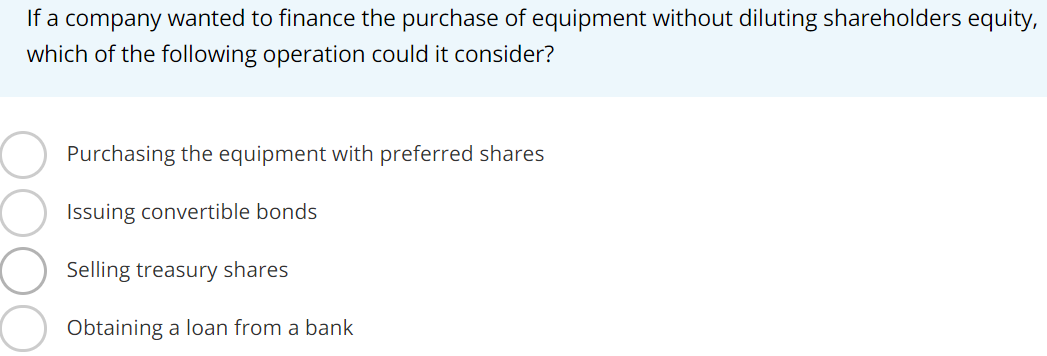

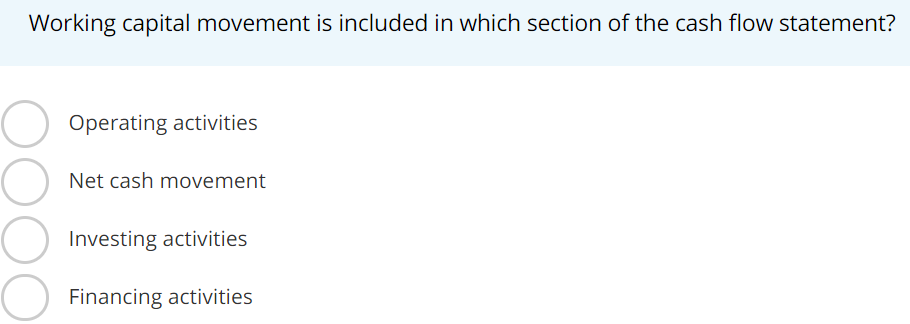

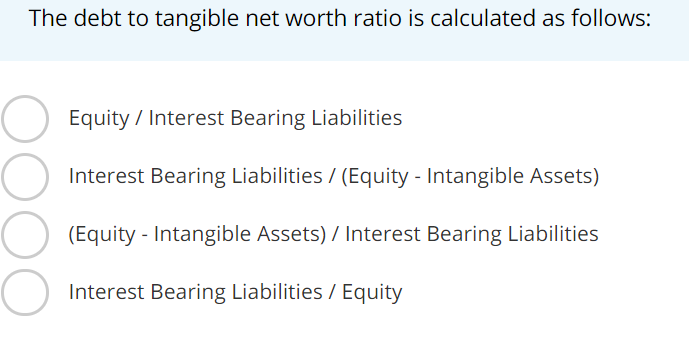

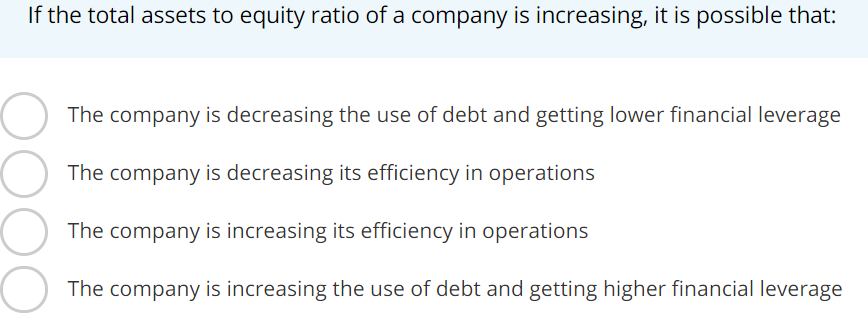

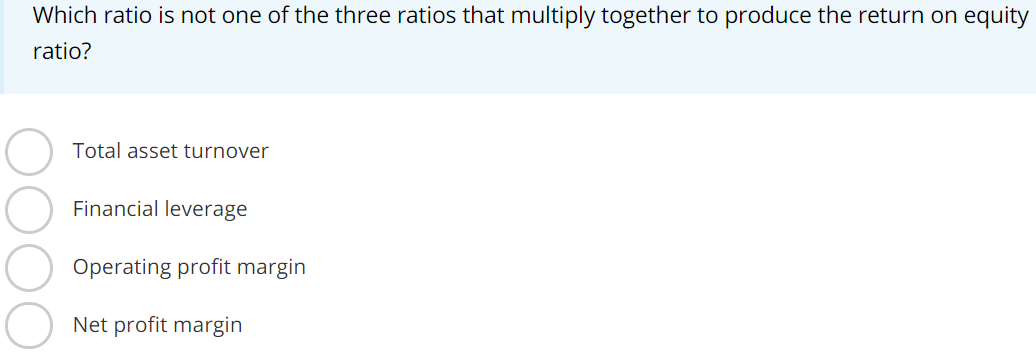

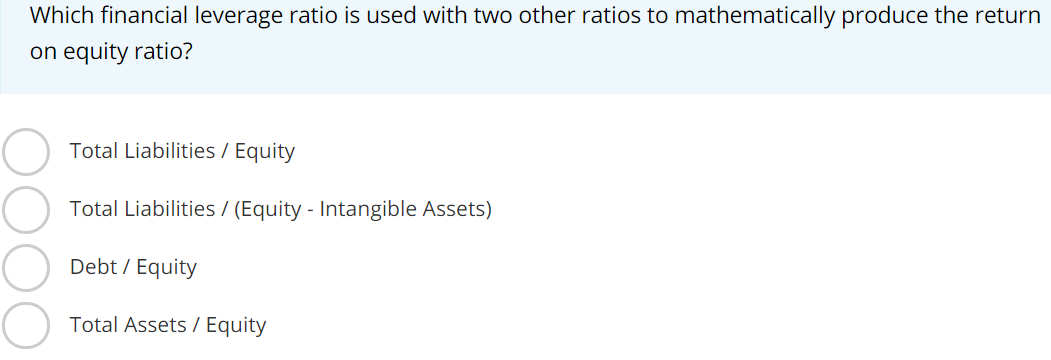

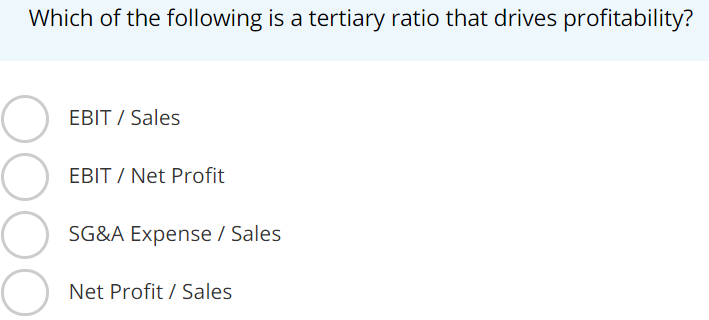

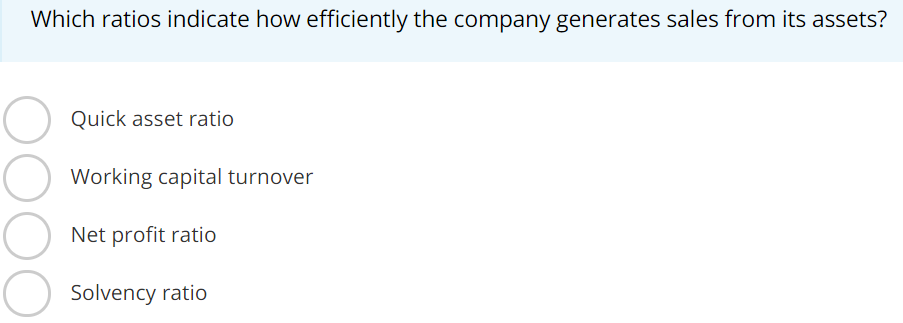

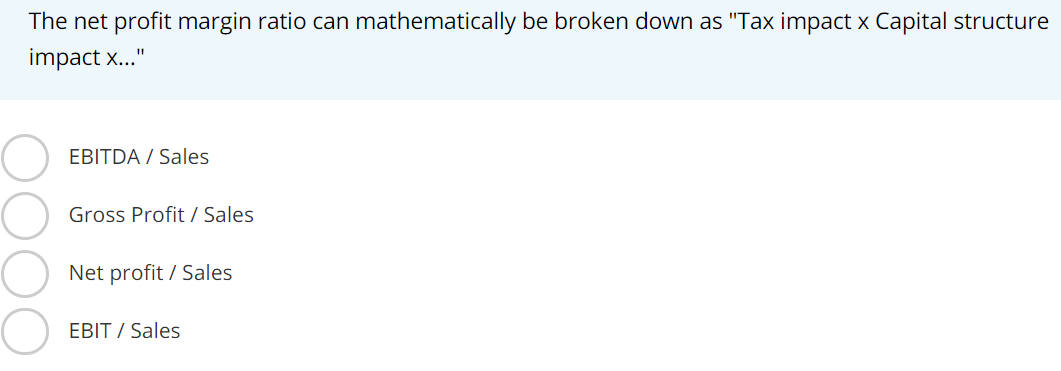

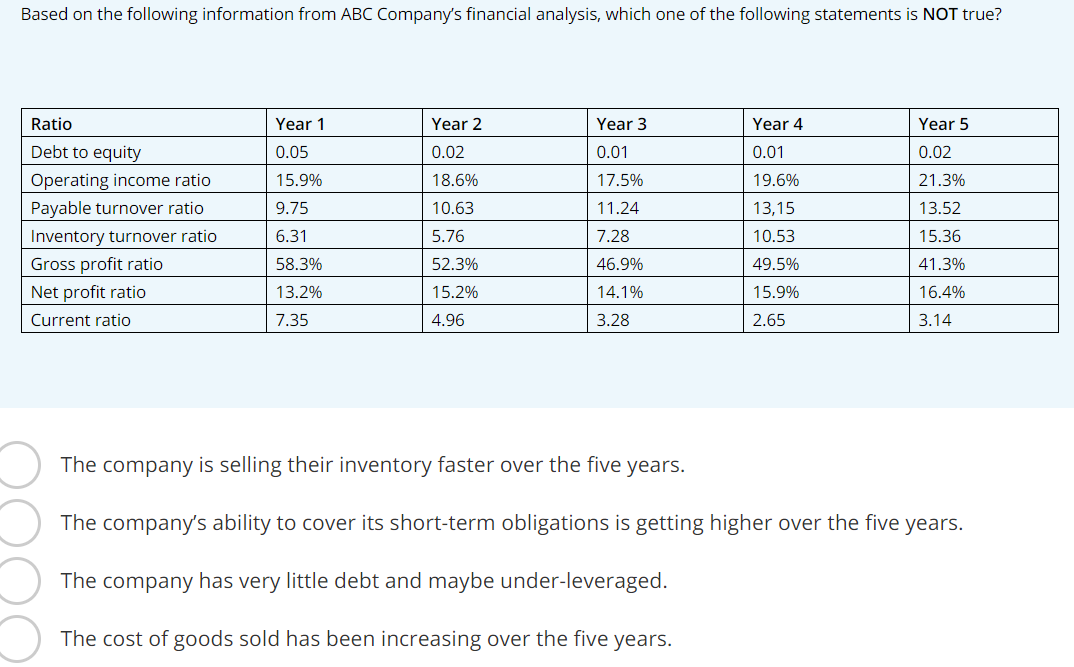

When calculating the quick ratio or "acid test" which current asset or liability is omitted? Accounts payables Inventory Accounts receivable Cash For which organization would you expect to see the highest inventory turnover ratio? Luxury vehicle dealership Electronics retailer Grocery retailer O Department Department store What actions could a company take to reduce its working capital funding gap? Tighten customer credit terms Allow customers to delay payments Increase inventory levels Pay suppliers more quickly The debt to equity ratio indicates: O The net worth of the company The proportion of the company financed by lenders versus owners The liquidity of the company O A company's working capital funding gap Which of the following items are not included in working capital? O Accounts receivable Inventory Accounts payable o Accounts O Short term investments When calculating turnover of property plant & equipment and receivables, which item from the income statement do we use? Sales Operating expenses Gross profit Net income If a company wanted to finance the purchase of equipment without diluting shareholders equity, which of the following operation could it consider? Purchasing the equipment with preferred shares Issuing convertible bonds Selling treasury shares Obtaining a loan from a bank Working capital movement is included in which section of the cash flow statement? Operating activities O Net cash movement Investing activities Financing activities The debt to tangible net worth ratio is calculated as follows: Equity / Interest Bearing Liabilities Interest Bearing Liabilities / (Equity - Intangible Assets) (Equity - Intangible Assets) / Interest Bearing Liabilities O Interest Bearing Liabilities / Equity If the total assets to equity ratio of a company is increasing, it is possible that: The company is decreasing the use of debt and getting lower financial leverage The company is decreasing its efficiency in operations O O (0) The company is increasing its efficiency in operations The company is increasing the use of debt and getting higher financial leverage Which ratio is not one of the three ratios that multiply together to produce the return on equity ratio? Total asset turnover Financial leverage Operating profit margin Net profit margin Which financial leverage ratio is used with two other ratios to mathematically produce the return on equity ratio? Total Liabilities / Equity Total Liabilities/ (Equity - Intangible Assets) Debt / Equity Total Assets / Equity Which of the following is a tertiary ratio that drives profitability? EBIT / Sales EBIT / Net Profit O SG&A Expense / Sales Net Profit / Sales Which ratios indicate how efficiently the company generates sales from its assets? Quick asset ratio Working capital turnover Net profit ratio O O Solvency ratio The net profit margin ratio can mathematically be broken down as "Tax impact x Capital structure impact x..." EBITDA / Sales Gross Profit / Sales Net profit / Sales EBIT / Sales Based on the following information from ABC Company's financial analysis, which one of the following statements is NOT true? Ratio Year 1 Year 2 Year 3 Year 4 Year 5 0.05 0.01 0.01 0.02 0.02 18.6% 17.5% 15.9% 9.75 6.31 10.63 Debt to equity Operating income ratio Payable turnover ratio Inventory turnover ratio Gross profit ratio Net profit ratio Current ratio 11.24 7.28 19.6% 13,15 10.53 49.5% 15.9% 2.65 5.76 52.3% 15.2% 21.3% 13.52 15.36 41.3% 16.4% 58.3% 46.9% 14.1% 13.2% 7.35 4.96 3.28 3.14 The company is selling their inventory faster over the five years. The company's ability to cover its short-term obligations is getting higher over the five years. The company has very little debt and maybe under-leveraged. The cost of goods sold has been increasing over the five years