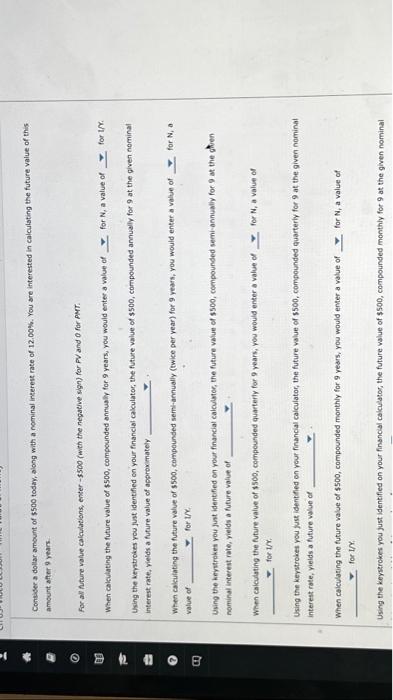

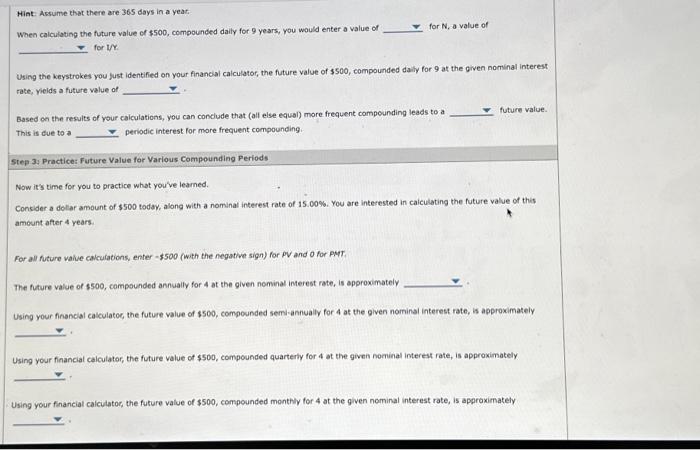

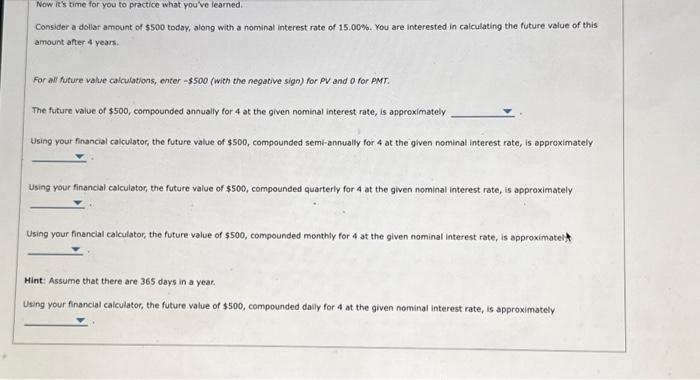

When calculatiog the future value of $500, compounded daily for 9 years, you would enter a value of for N, a value of for t. Using the keystrokes you Just identified on your financial calculator, the future value of $500, compounded dally for 9 at the given nominal interest rate, yields a future value of Based on the results of your calculations, you can conclude that (all else equal) more frequent compounding leads to a future value. This is cue to a periodic interest for more frequent compounding. Step 34. Practice: Future Value for Various Compounding Periods Now it's time for you to practice what you've learned. Consider a dollar amount of $500 today, along with a nominal interest rate of 15.00%. You are interested in caiculating the future value of this amount after 4 years. For all future value calcufations, enter $500 (with the negative sign) for pV and o for Pht. The future value of 5500 , compounded annually for 4 at the given nominal interest rate, is approximately Using your finandal calculatoc, the future value of $500, compounded semi-annualiy for 4 at the given nominal interest rate, is approximately Using your financial calculator, the future value of $500, compounded quarterly for 4 ot the given nominal interest rate, is approximately Using your financial calculator, the future value of $500, compounded montrily for 4 at the given nominal interest rate, is approximately Consider a dollar amount of $500 today, along with a nominal interest rate of 15.00%. You are interested in calculating the future value of this amount after 4 years. For all future value calculations, enter -3500 (with the negative sign) for PV and o for PMT. The future value of $500, compounded annually for 4 at the given nominal interest rate, is approximately Using your financial calculator, the future value of $500, compounded semi-annually for 4 at the given nominal interest rate, is approximately Using your financial calculator, the future value of $500, compounded quarterly for 4 at the given nominal interest rate, is approximately Using your financial calculator, the future value of $500, compounded monthly for 4 at the given nominal interest rate, is approximatel $ Hint: Assume that there are 365 days in a yeat. Using your financial calculator, the future value of $500, compounded daily for 4 at the given nominal interest rate, is approximately Consicer a dollar amount of $500 todary, along with a nominal interest rate of 12.00%. You are interested in calculating the future value of this amount after 9 years. For all future value calculations, enter -5500 (with the negaeve sign) for PV and 0 for PMT. Using the verstrokes you fust identified on your financial cakulator, the futute value of $500, compounded annualy for 9 at the given neminal interest rate, vields a future value of approximately When calculating the future value of 500, compounded seml-annually (twice per vear) for 9 years, you would enter a value of for N, a value of for 1/x. Using the kevatrokes you Junt identified on vour financiat calculater, the future value of $500, compounded semi-annually for 9 at the ghen nominal interest rate, yields a future value of When calculating the future value of $500, compounded quarterfy for 9 years, vow would enter a value of for N, a value of fer 1/%. Using the kevstrokes you just identeled on vour financial calculator, the future value of $500, compounded guarterly for 9 at the given nominal interest rate, yields a huture value of When calculasing the future value of $500, compounded monthly for 9 years, you would enter a value of for N, a value of for 1/x. Using the keystrokes you just identified on your financial calculator, the future value of $500, compounded monthly for 9 at the given nominal