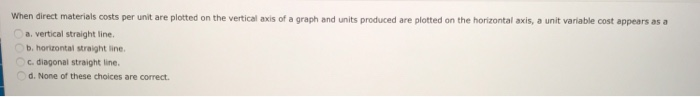

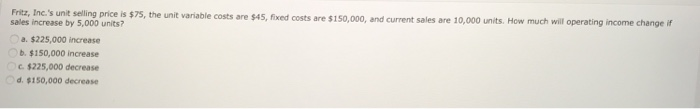

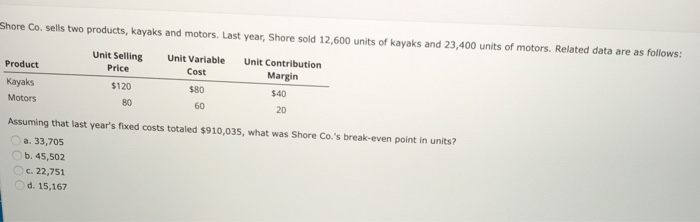

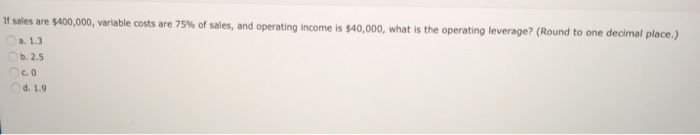

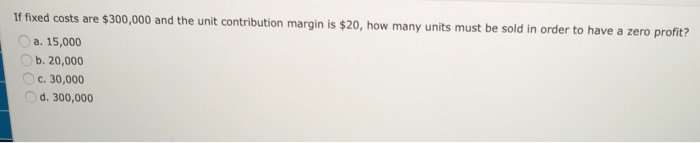

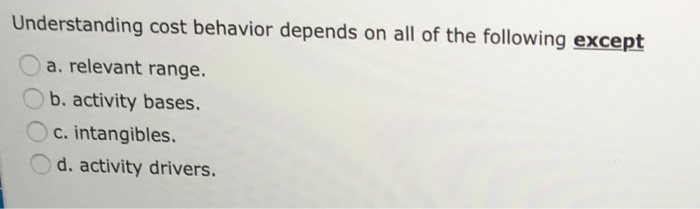

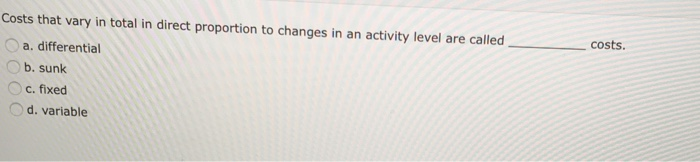

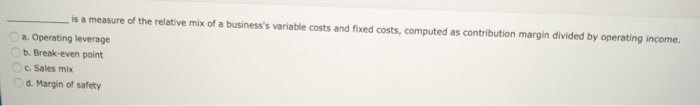

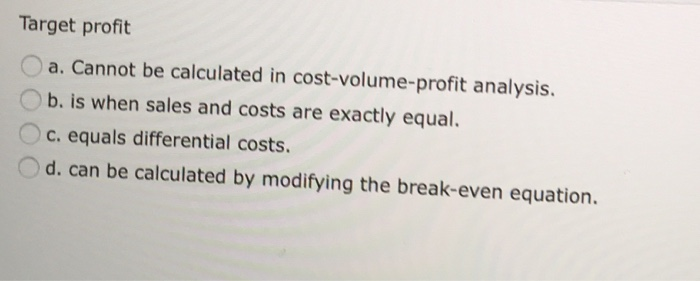

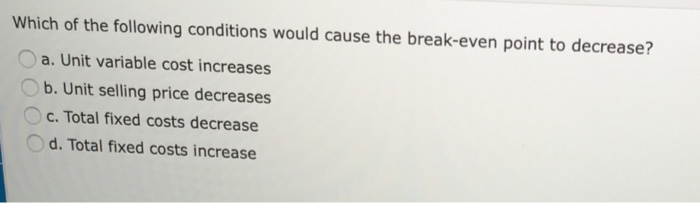

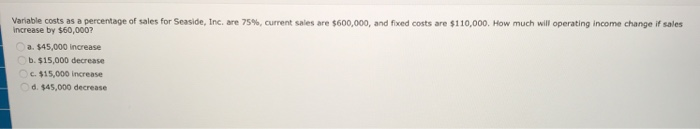

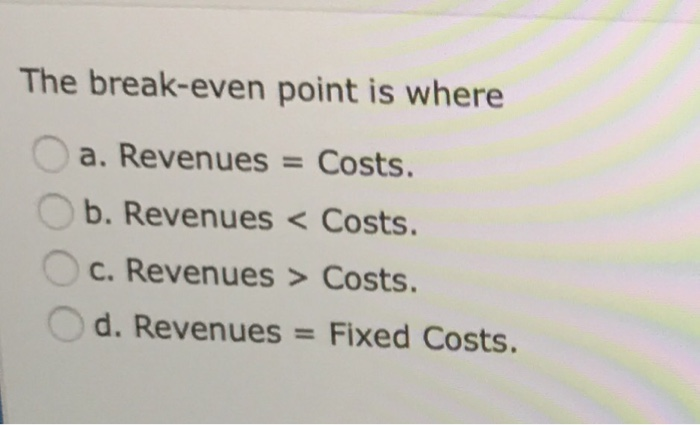

When direct materials costs per unit are plotted on the vertical axis of a graph and units produced are plotted on the horizontal axis, a unit variable cost appears asa a, vertical straight line. b. horizontal straight line c. diagonal straight line d. None of these choices are correct. Fritz, Inc.'s unit selling price is $75, the unit variable costs are $45, fixed costs are $150,000, and current sales are 10,000 units. How much will operating income change if sales increase by 5,000 units? a. $225,000 increase b.$150,000 increase c$225,000 decrease d. $150,000 decrease Shore Co. sells two products, kayaks and motors. Last year, Shore sold 12,600 units of kayaks and 23,400 units of motors. Related data are as follows: Unit Selling Unit Variable Unit Contribution Margin $40 20 Product Kayaks Motors Price $120 80 Cost $80 60 Assuming that last year's fixed costs totaled $910,035, what was Shore Co.'s break-even point in units? a. 33,705 b. 45,502 . 22,751 d. 15,167 If sales are $400,000, variable costs are 75% of sales, and operating income is $40,000, what is the operating leverage? (Round to one decimal place.) a. 1.3 b. 2.5 d. 1.9 If fixed costs are $300,000 and the unit contribution margin is $20, how many units must be sold in order to have a zero profit? a. 15,000 b. 20,000 c.30,000 d. 300,000 Understanding cost behavior depends on all of the following except a. relevant range. b. activity bases. c. intangibles. d, activity drivers. costs. Costs that vary in total in direct proportion to changes in an activity level are called a. differential b. sunk c. fixed d. variable is a measure of the relative mix of a business's variable costs and fixed costs, computed as contribution margin divided by operating income. . Operating leverage b. Break-even point c. Sales mix d. Margin of safety Target profit a. Cannot be calculated in cost-volume-profit analysis. b. is when sales and costs are exactly equal. c. equals differential costs. d. can be calculated by modifying the break-even equation. Which of the following conditions would cause the break-even point to decrease? 0 a. Unit variable cost increases b. Unit selling price decreases c.Total fixed costs decrease d. Total fixed costs increase variable costs as a percentage of sales for Seaside, Inc. are 75%, current sales are $600,000 and foed costs are si 10 000How much w operating income aange rares increase by $60,000? a. $45,000 increase b. $15,000 decrease .$15,000 increase d. $45,000 decrease The break-even point is where a. Revenues- Costs. b. Revenues

Costs. d. Revenues-Fixed Costs