Answered step by step

Verified Expert Solution

Question

1 Approved Answer

when Dory's equity consisted of issued capital of $10,000 and retained earnings of $5,000. At the acquisition date, all assets and liabilities of Dory were

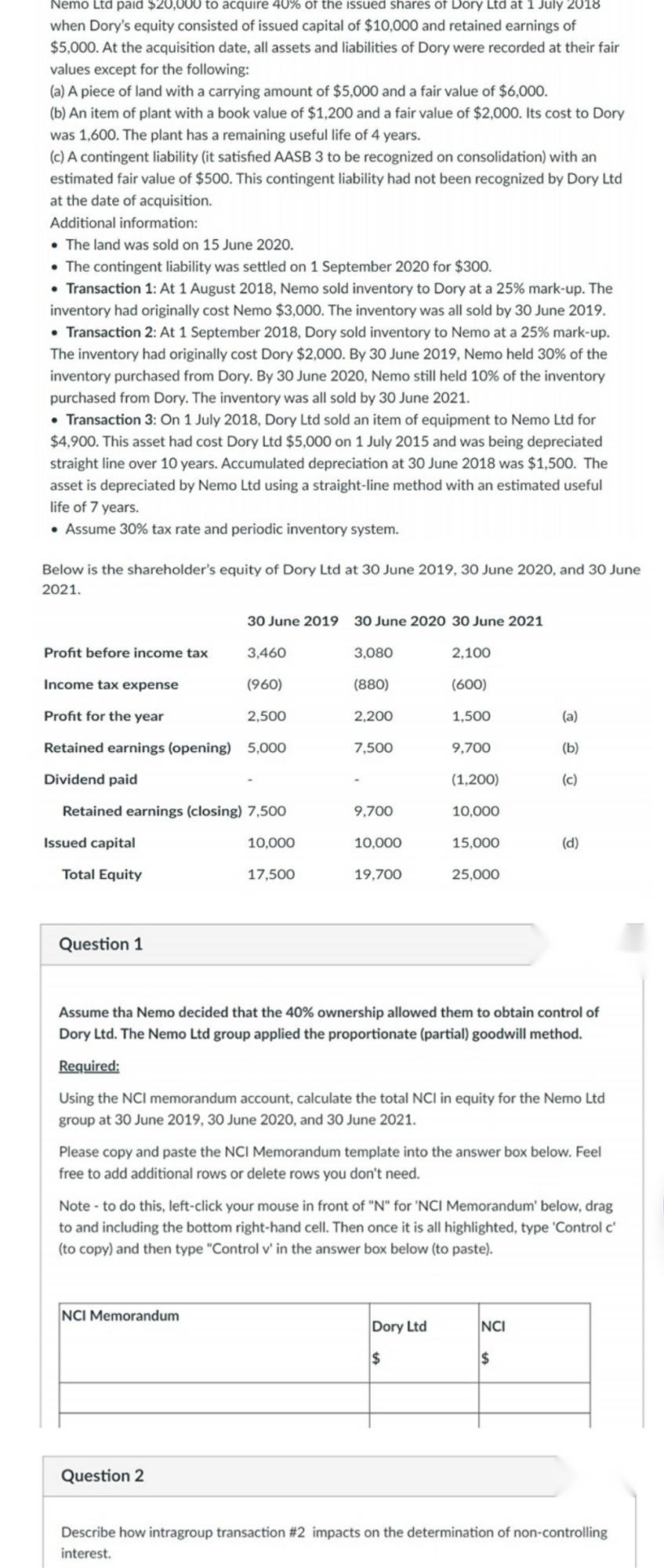

when Dory's equity consisted of issued capital of $10,000 and retained earnings of $5,000. At the acquisition date, all assets and liabilities of Dory were recorded at their fair values except for the following: (a) A piece of land with a carrying amount of $5,000 and a fair value of $6,000. (b) An item of plant with a book value of $1,200 and a fair value of $2,000. Its cost to Dory was 1,600 . The plant has a remaining useful life of 4 years. (c) A contingent liability (it satisfied AASB 3 to be recognized on consolidation) with an estimated fair value of $500. This contingent liability had not been recognized by Dory Ltd at the date of acquisition. Additional information: - The land was sold on 15 June 2020. - The contingent liability was settled on 1 September 2020 for $300. - Transaction 1: At 1 August 2018, Nemo sold inventory to Dory at a 25% mark-up. The inventory had originally cost Nemo $3,000. The inventory was all sold by 30 June 2019. - Transaction 2: At 1 September 2018, Dory sold inventory to Nemo at a 25% mark-up. The inventory had originally cost Dory $2,000. By 30 June 2019 , Nemo held 30% of the inventory purchased from Dory. By 30 June 2020 , Nemo still held 10% of the inventory purchased from Dory. The inventory was all sold by 30 June 2021. - Transaction 3: On 1 July 2018, Dory Ltd sold an item of equipment to Nemo Ltd for $4,900. This asset had cost Dory Ltd $5,000 on 1 July 2015 and was being depreciated straight line over 10 years. Accumulated depreciation at 30 June 2018 was $1,500. The asset is depreciated by Nemo Ltd using a straight-line method with an estimated useful life of 7 years. - Assume 30% tax rate and periodic inventory system. Below is the shareholder's equity of Dory Ltd at 30 June 2019, 30 June 2020, and 30 June 2021. Question 1 Assume tha Nemo decided that the 40% ownership allowed them to obtain control of Dory Ltd. The Nemo Ltd group applied the proportionate (partial) goodwill method. Required: Using the NCl memorandum account, calculate the total NCl in equity for the Nemo Ltd group at 30 June 2019, 30 June 2020, and 30 June 2021. Please copy and paste the NCl Memorandum template into the answer box below. Feel free to add additional rows or delete rows you don't need. Note - to do this, left-click your mouse in front of " N " for ' NCl Memorandum' below, drag to and including the bottom right-hand cell. Then once it is all highlighted, type 'Control c' (to copy) and then type "Control v ' in the answer box below (to paste). Question 2 Describe how intragroup transaction \#2 impacts on the determination of non-controlling interest

when Dory's equity consisted of issued capital of $10,000 and retained earnings of $5,000. At the acquisition date, all assets and liabilities of Dory were recorded at their fair values except for the following: (a) A piece of land with a carrying amount of $5,000 and a fair value of $6,000. (b) An item of plant with a book value of $1,200 and a fair value of $2,000. Its cost to Dory was 1,600 . The plant has a remaining useful life of 4 years. (c) A contingent liability (it satisfied AASB 3 to be recognized on consolidation) with an estimated fair value of $500. This contingent liability had not been recognized by Dory Ltd at the date of acquisition. Additional information: - The land was sold on 15 June 2020. - The contingent liability was settled on 1 September 2020 for $300. - Transaction 1: At 1 August 2018, Nemo sold inventory to Dory at a 25% mark-up. The inventory had originally cost Nemo $3,000. The inventory was all sold by 30 June 2019. - Transaction 2: At 1 September 2018, Dory sold inventory to Nemo at a 25% mark-up. The inventory had originally cost Dory $2,000. By 30 June 2019 , Nemo held 30% of the inventory purchased from Dory. By 30 June 2020 , Nemo still held 10% of the inventory purchased from Dory. The inventory was all sold by 30 June 2021. - Transaction 3: On 1 July 2018, Dory Ltd sold an item of equipment to Nemo Ltd for $4,900. This asset had cost Dory Ltd $5,000 on 1 July 2015 and was being depreciated straight line over 10 years. Accumulated depreciation at 30 June 2018 was $1,500. The asset is depreciated by Nemo Ltd using a straight-line method with an estimated useful life of 7 years. - Assume 30% tax rate and periodic inventory system. Below is the shareholder's equity of Dory Ltd at 30 June 2019, 30 June 2020, and 30 June 2021. Question 1 Assume tha Nemo decided that the 40% ownership allowed them to obtain control of Dory Ltd. The Nemo Ltd group applied the proportionate (partial) goodwill method. Required: Using the NCl memorandum account, calculate the total NCl in equity for the Nemo Ltd group at 30 June 2019, 30 June 2020, and 30 June 2021. Please copy and paste the NCl Memorandum template into the answer box below. Feel free to add additional rows or delete rows you don't need. Note - to do this, left-click your mouse in front of " N " for ' NCl Memorandum' below, drag to and including the bottom right-hand cell. Then once it is all highlighted, type 'Control c' (to copy) and then type "Control v ' in the answer box below (to paste). Question 2 Describe how intragroup transaction \#2 impacts on the determination of non-controlling interest Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started