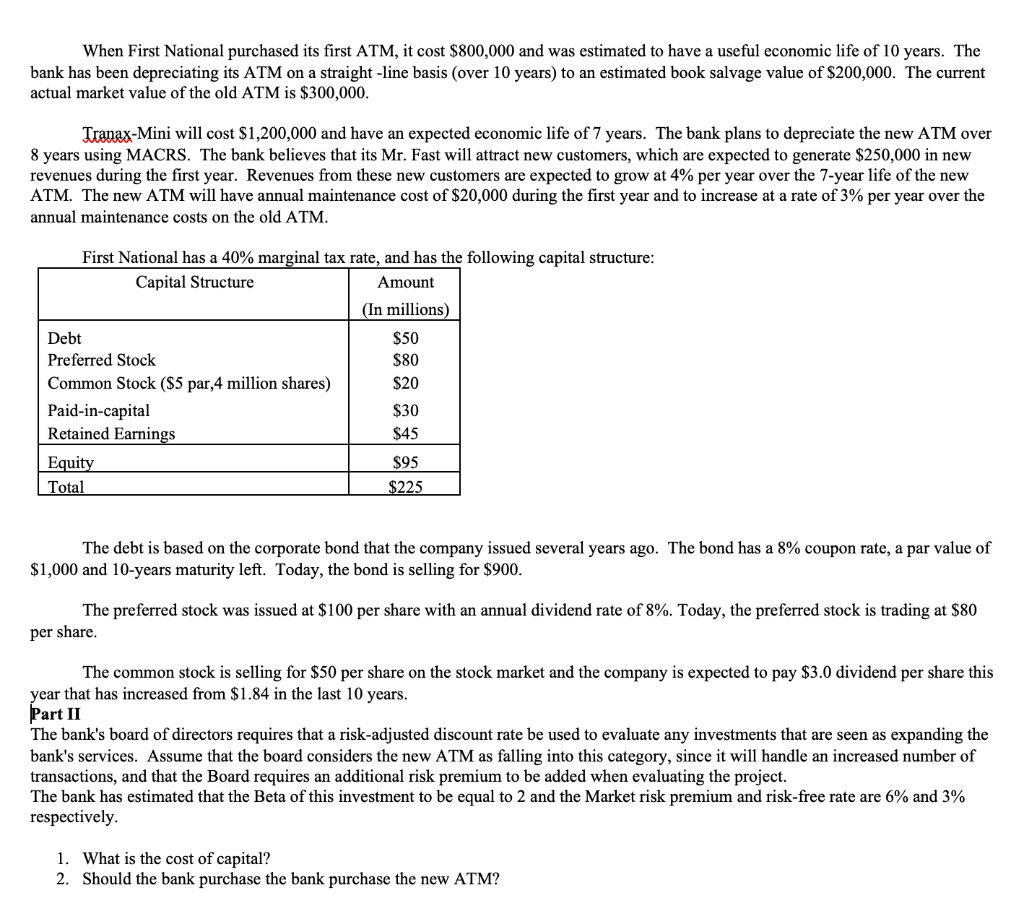

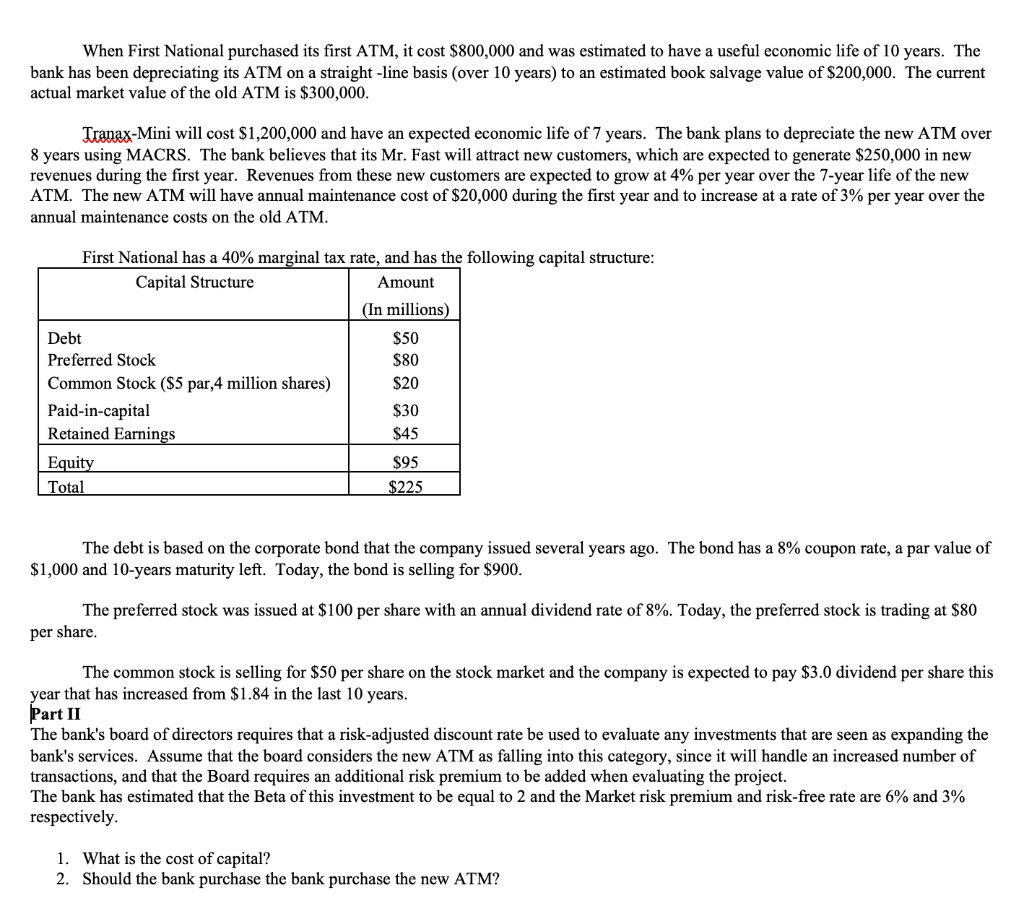

When First National purchased its first ATM, it cost $800,000 and was estimated to have a useful economic life of 10 years. The bank has been depreciating its ATM on a straight-line basis (over 10 years) to an estimated book salvage value of $200,000. The current actual market value of the old ATM is $300,000. Tranax-Mini will cost $1,200,000 and have an expected economic life of 7 years. The bank plans to depreciate the new ATM over 8 years using MACRS. The bank believes that its Mr. Fast will attract new customers, which are expected to generate $250,000 in new revenues during the first year. Revenues from these new customers are expected to grow at 4% per year over the 7-year life of the new ATM. The new ATM will have annual maintenance cost of $20,000 during the first year and to increase at a rate of 3% per year over the annual maintenance costs on the old ATM. First National has a 40% marginal tax rate, and has the following capital structure: Capital Structure Amount (In millions) Debt $50 Preferred Stock $80 Common Stock ($5 par,4 million shares) $20 Paid-in-capital $30 Retained Earnings $45 Equity $95 Total $225 The debt is based on the corporate bond that the company issued several years ago. The bond has a 8% coupon rate, a par value of $1,000 and 10-years maturity left. Today, the bond is selling for $900. The preferred stock was issued at $100 per share with an annual dividend rate of 8%. Today, the preferred stock is trading at $80 per share. The common stock is selling for $50 per share on the stock market and the company is expected to pay $3.0 dividend per share this year that has increased from $1.84 in the last 10 years. Part II The bank's board of directors requires that a risk-adjusted discount rate be used to evaluate any investments that are seen as expanding the bank's services. Assume that the board considers the new ATM as falling into this category, since it will handle an increased number of transactions, and that the Board requires an additional risk premium to be added when evaluating the project. The bank has estimated that the Beta of this investment to be equal to 2 and the Market risk premium and risk-free rate are 6% and 3% respectively. 1. What is the cost of capital? 2. Should the bank purchase the bank purchase the new ATM? When First National purchased its first ATM, it cost $800,000 and was estimated to have a useful economic life of 10 years. The bank has been depreciating its ATM on a straight-line basis (over 10 years) to an estimated book salvage value of $200,000. The current actual market value of the old ATM is $300,000. Tranax-Mini will cost $1,200,000 and have an expected economic life of 7 years. The bank plans to depreciate the new ATM over 8 years using MACRS. The bank believes that its Mr. Fast will attract new customers, which are expected to generate $250,000 in new revenues during the first year. Revenues from these new customers are expected to grow at 4% per year over the 7-year life of the new ATM. The new ATM will have annual maintenance cost of $20,000 during the first year and to increase at a rate of 3% per year over the annual maintenance costs on the old ATM. First National has a 40% marginal tax rate, and has the following capital structure: Capital Structure Amount (In millions) Debt $50 Preferred Stock $80 Common Stock ($5 par,4 million shares) $20 Paid-in-capital $30 Retained Earnings $45 Equity $95 Total $225 The debt is based on the corporate bond that the company issued several years ago. The bond has a 8% coupon rate, a par value of $1,000 and 10-years maturity left. Today, the bond is selling for $900. The preferred stock was issued at $100 per share with an annual dividend rate of 8%. Today, the preferred stock is trading at $80 per share. The common stock is selling for $50 per share on the stock market and the company is expected to pay $3.0 dividend per share this year that has increased from $1.84 in the last 10 years. Part II The bank's board of directors requires that a risk-adjusted discount rate be used to evaluate any investments that are seen as expanding the bank's services. Assume that the board considers the new ATM as falling into this category, since it will handle an increased number of transactions, and that the Board requires an additional risk premium to be added when evaluating the project. The bank has estimated that the Beta of this investment to be equal to 2 and the Market risk premium and risk-free rate are 6% and 3% respectively. 1. What is the cost of capital? 2. Should the bank purchase the bank purchase the new ATM