Answered step by step

Verified Expert Solution

Question

1 Approved Answer

When Hunter was hired by his company several years ago, he was required to complete Form W-4 Employee's Withholding Allowance Certificate. He followed the

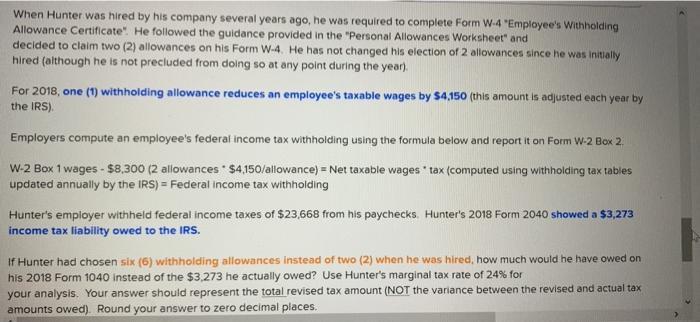

When Hunter was hired by his company several years ago, he was required to complete Form W-4 "Employee's Withholding Allowance Certificate". He followed the guidance provided in the "Personal Allowances Worksheet" and decided to claim two (2) allowances on his Form W-4. He has not changed his election of 2 allowances since he was initially hired (although he is not precluded from doing so at any point during the year). For 2018, one (1) withholding allowance reduces an employee's taxable wages by $4,150 (this amount is adjusted each year by the IRS). Employers compute an employee's federal income tax withholding using the formula below and report it on Form W-2 Box 2. W-2 Box 1 wages - $8,300 (2 allowances $4,150/allowance) = Net taxable wages tax (computed using withholding tax tables updated annually by the IRS) = Federal income tax withholding Hunter's employer withheld federal income taxes of $23,668 from his paychecks. Hunter's 2018 Form 2040 showed a $3,273 income tax liability owed to the IRS. If Hunter had chosen six (6) withholding allowances instead of two (2) when he was hired, how much would he have owed on his 2018 Form 1040 instead of the $3,273 he actually owed? Use Hunter's marginal tax rate of 24% for your analysis. Your answer should represent the total revised tax amount (NOT the variance between the revised and actual tax amounts owed). Round your answer to zero decimal places.

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

If Hunter had chosen six 6 withholding allowances instead of two 2 when he was hired ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started