Answered step by step

Verified Expert Solution

Question

1 Approved Answer

When Isabelle's parents heard that she was taking a tax class at SDSU, they immediately enlisted her in preparing their 2022 tax return. Isabelle's

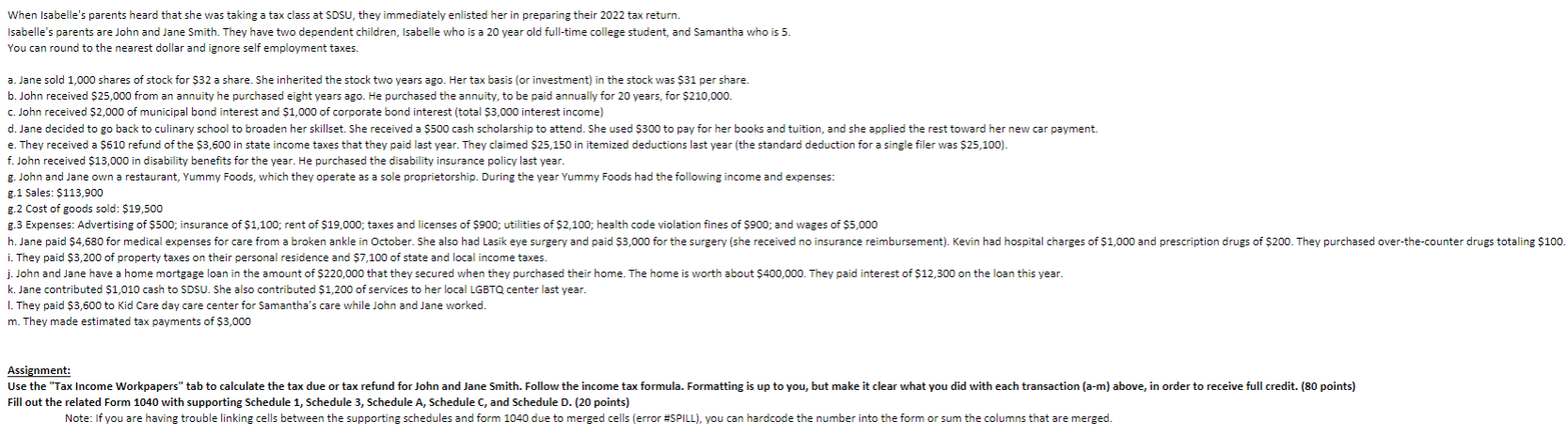

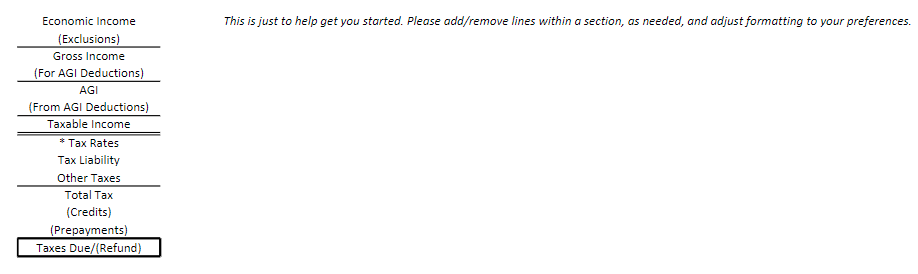

When Isabelle's parents heard that she was taking a tax class at SDSU, they immediately enlisted her in preparing their 2022 tax return. Isabelle's parents are John and Jane Smith. They have two dependent children, Isabelle who is a 20 year old full-time college student, and Samantha who is 5. You can round to the nearest dollar and ignore self employment taxes. a. Jane sold 1,000 shares of stock for $32 a share. She inherited the stock two years ago. Her tax basis (or investment) in the stock was $31 per share. b. John received $25,000 from an annuity he purchased eight years ago. He purchased the annuity, to be paid annually for 20 years, for $210,000. c. John received $2,000 of municipal bond interest and $1,000 of corporate bond interest (total $3,000 interest income) d. Jane decided to go back to culinary school to broaden her skillset. She received a $500 cash scholarship to attend. She used $300 to pay for her books and tuition, and she applied the rest toward her new car payment. e. They received a $610 refund of the $3,600 in state income taxes that they paid last year. They claimed $25,150 in itemized deductions last year (the standard deduction for a single filer was $25,100). f. John received $13,000 in disability benefits for the year. He purchased the disability insurance policy last year. g. John and Jane own a restaurant, Yummy Foods, which they operate as a sole proprietorship. During the year Yummy Foods had the following income and expenses: g.1 Sales: $113,900 g.2 Cost of goods sold: $19,500 g.3 Expenses: Advertising of $500; insurance of $1,100; rent of $19,000; taxes and licenses of $900; utilities of $2,100; health code violation fines of $900; and wages of $5,000 h. Jane paid $4,680 for medical expenses for care from a broken ankle in October. She also had Lasik eye surgery and paid $3,000 for the surgery (she received no insurance reimbursement). Kevin had hospital charges of $1,000 and prescription drugs of $200. They purchased over-the-counter drugs totaling $100. i. They paid $3,200 of property taxes on their personal residence and $7,100 of state and local income taxes. j. John and Jane have a home mortgage loan in the amount of $220,000 that they secured when they purchased their home. The home is worth about $400,000. They paid interest of $12,300 on the loan this year. k. Jane contributed $1,010 cash to SDSU. She also contributed $1,200 of services to her local LGBTQ center last year. I. They paid $3,600 to Kid Care day care center for Samantha's care while John and Jane worked. m. They made estimated tax payments of $3,000 Assignment: Use the "Tax Income Workpapers" tab to calculate the tax due or tax refund for John and Jane Smith. Follow the income tax formula. Formatting is up to you, but make it clear what you did with each transaction (a-m) above, in order to receive full credit. (80 points) Fill out the related Form 1040 with supporting Schedule 1, Schedule 3, Schedule A, Schedule C, and Schedule D. (20 points) Note: If you are having trouble linking cells between the supporting schedules and form 1040 due to merged cells (error # SPILL), you can hardcode the number into the form or sum the columns that are merged. Economic Income (Exclusions) Gross Income (For AGI Deductions) AGI (From AGI Deductions) Taxable Income * Tax Rates Tax Liability Other Taxes Total Tax (Credits) (Prepayments) Taxes Due/(Refund) This is just to help get you started. Please add/remove lines within a section, as needed, and adjust formatting to your preferences.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Tax Income Workpapers a 1000 of capital gain from stock sale 32000 31000 cost basis b 25000 annuity ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started