Answered step by step

Verified Expert Solution

Question

1 Approved Answer

When one country offers a higher interest rate then another country, it is tempting to borrow money in the lower interest rate country currency

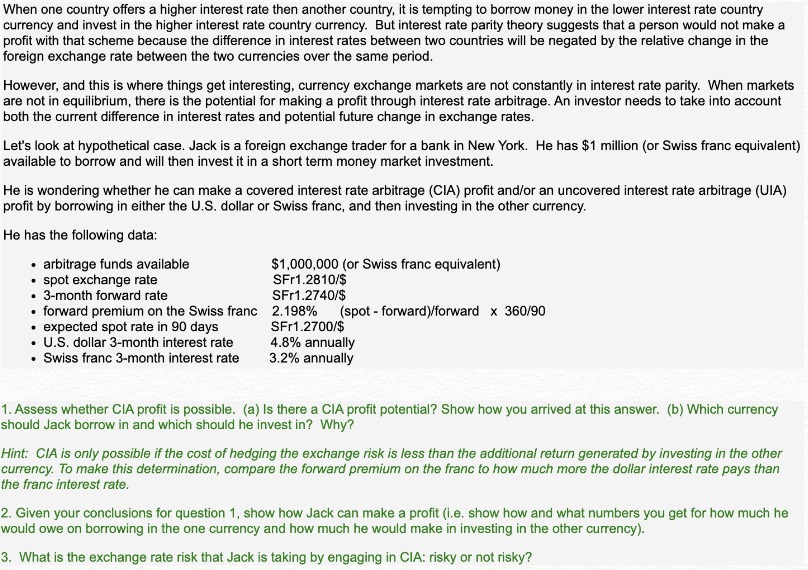

When one country offers a higher interest rate then another country, it is tempting to borrow money in the lower interest rate country currency and invest in the higher interest rate country currency. But interest rate parity theory suggests that a person would not make a profit with that scheme because the difference in interest rates between two countries will be negated by the relative change in the foreign exchange rate between the two currencies over the same period. However, and this is where things get interesting, currency exchange markets are not constantly in interest rate parity. When markets are not in equilibrium, there is the potential for making a profit through interest rate arbitrage. An investor needs to take into account both the current difference in interest rates and potential future change in exchange rates. Let's look at hypothetical case. Jack is a foreign exchange trader for a bank in New York. He has $1 million (or Swiss franc equivalent) available to borrow and will then invest it in a short term money market investment. He is wondering whether he can make a covered interest rate arbitrage (CIA) profit and/or an uncovered interest rate arbitrage (UIA) profit by borrowing in either the U.S. dollar or Swiss franc, and then investing in the other currency. He has the following data: arbitrage funds available spot exchange rate 3-month forward rate forward premium on the Swiss franc expected spot rate in 90 days U.S. dollar 3-month interest rate Swiss franc 3-month interest rate $1,000,000 (or Swiss franc equivalent) SFr1.2810/$ SFr1.2740/$ 2.198% (spot forward)/forward x 360/90 SFr1.2700/$ 4.8% annually 3.2% annually 1. Assess whether CIA profit is possible. (a) Is there a CIA profit potential? Show how you arrived at this answer. (b) Which currency should Jack borrow in and which should he invest in? Why? Hint: CIA is only possible if the cost of hedging the exchange risk is less than the additional return generated by investing in the other currency. To make this determination, compare the forward premium on the franc to how much more the dollar interest rate pays than the franc interest rate. 2. Given your conclusions for question 1, show how Jack can make a profit (i.e. show how and what numbers you get for how much he would owe on borrowing in the one currency and how much he would make in investing in the other currency). 3. What is the exchange rate risk that Jack is taking by engaging in CIA: risky or not risky?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started