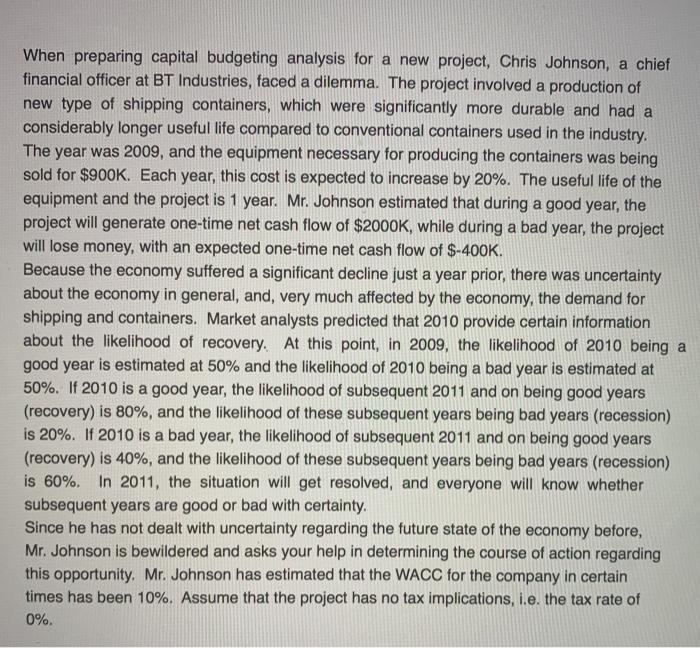

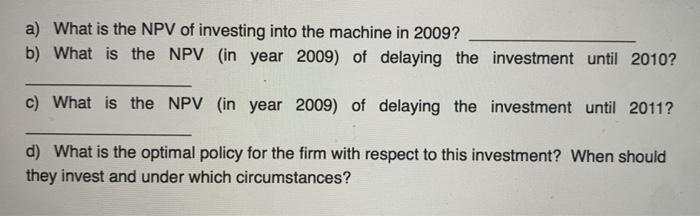

When preparing capital budgeting analysis for a new project, Chris Johnson, a chief financial officer at BT Industries, faced a dilemma. The project involved a production of new type of shipping containers, which were significantly more durable and had a considerably longer useful life compared to conventional containers used in the industry. The year was 2009, and the equipment necessary for producing the containers was being sold for $900K. Each year, this cost is expected to increase by 20%. The useful life of the equipment and the project is 1 year. Mr. Johnson estimated that during a good year, the project will generate one-time net cash flow of $2000K, while during a bad year, the project will lose money, with an expected one-time net cash flow of $-400K. Because the economy suffered a significant decline just a year prior, there was uncertainty about the economy in general, and, very much affected by the economy, the demand for shipping and containers. Market analysts predicted that 2010 provide certain information about the likelihood of recovery. At this point, in 2009, the likelihood of 2010 being a good year is estimated at 50% and the likelihood of 2010 being a bad year is estimated at 50%. If 2010 is a good year, the likelihood of subsequent 2011 and on being good years (recovery) is 80%, and the likelihood of these subsequent years being bad years (recession) is 20%. If 2010 is a bad year, the likelihood of subsequent 2011 and on being good years (recovery) is 40%, and the likelihood of these subsequent years being bad years (recession) is 60%. In 2011, the situation will get resolved, and everyone will know whether subsequent years are good or bad with certainty. Since he has not dealt with uncertainty regarding the future state of the economy before, Mr. Johnson is bewildered and asks your help in determining the course of action regarding this opportunity. Mr. Johnson has estimated that the WACC for the company in certain times has been 10%. Assume that the project has no tax implications, i.e. the tax rate of 0%. a) What is the NPV of investing into the machine in 2009? b) What is the NPV (in year 2009) of delaying the investment until 2010? c) What is the NPV (in year 2009) of delaying the investment until 2011? d) What is the optimal policy for the firm with respect to this investment? When should they invest and under which circumstances? When preparing capital budgeting analysis for a new project, Chris Johnson, a chief financial officer at BT Industries, faced a dilemma. The project involved a production of new type of shipping containers, which were significantly more durable and had a considerably longer useful life compared to conventional containers used in the industry. The year was 2009, and the equipment necessary for producing the containers was being sold for $900K. Each year, this cost is expected to increase by 20%. The useful life of the equipment and the project is 1 year. Mr. Johnson estimated that during a good year, the project will generate one-time net cash flow of $2000K, while during a bad year, the project will lose money, with an expected one-time net cash flow of $-400K. Because the economy suffered a significant decline just a year prior, there was uncertainty about the economy in general, and, very much affected by the economy, the demand for shipping and containers. Market analysts predicted that 2010 provide certain information about the likelihood of recovery. At this point, in 2009, the likelihood of 2010 being a good year is estimated at 50% and the likelihood of 2010 being a bad year is estimated at 50%. If 2010 is a good year, the likelihood of subsequent 2011 and on being good years (recovery) is 80%, and the likelihood of these subsequent years being bad years (recession) is 20%. If 2010 is a bad year, the likelihood of subsequent 2011 and on being good years (recovery) is 40%, and the likelihood of these subsequent years being bad years (recession) is 60%. In 2011, the situation will get resolved, and everyone will know whether subsequent years are good or bad with certainty. Since he has not dealt with uncertainty regarding the future state of the economy before, Mr. Johnson is bewildered and asks your help in determining the course of action regarding this opportunity. Mr. Johnson has estimated that the WACC for the company in certain times has been 10%. Assume that the project has no tax implications, i.e. the tax rate of 0%. a) What is the NPV of investing into the machine in 2009? b) What is the NPV (in year 2009) of delaying the investment until 2010? c) What is the NPV (in year 2009) of delaying the investment until 2011? d) What is the optimal policy for the firm with respect to this investment? When should they invest and under which circumstances