Question

When publicly-traded corporations engage in mergers & acquisitions (M&A), managers present the market with the rationale for the deal and why they expect it

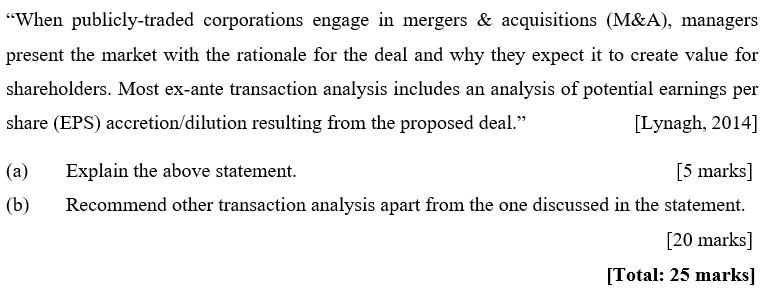

"When publicly-traded corporations engage in mergers & acquisitions (M&A), managers present the market with the rationale for the deal and why they expect it to create value for shareholders. Most ex-ante transaction analysis includes an analysis of potential earnings per share (EPS) accretion/dilution resulting from the proposed deal." [Lynagh, 2014] (a) Explain the above statement. [5 marks] (b) Recommend other transaction analysis apart from the one discussed in the statement. [20 marks] [Total: 25 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a The statement highlights the importance of analyzing potential earnings per share EPS accretion or dilution when publiclytraded corporations engage ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Understanding Business Ethics

Authors: Peter A. Stanwick, Sarah D. Stanwick

3rd Edition

1506303234, 9781506303239

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App